Corporate Income Tax Collections Rise When They are

Not Voluntary

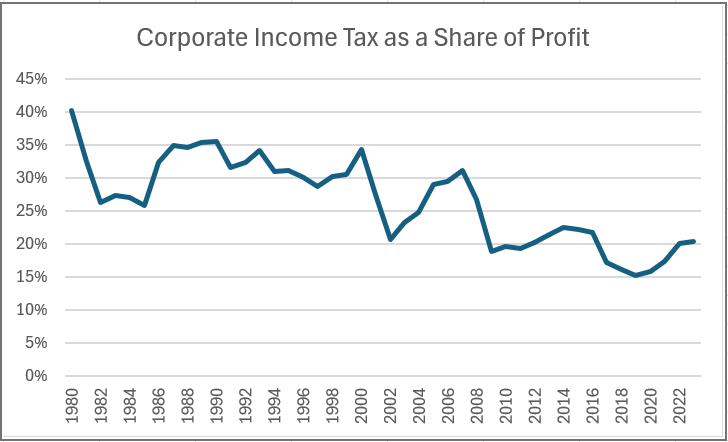

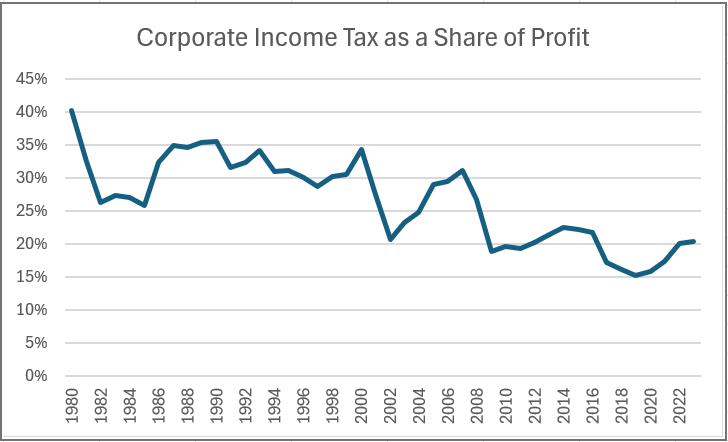

However, there was a turnaround in tax collections under Biden. The tax share rose to 17.4 percent in 2021, and then increased further to 20.1 percent in 2022 and 20.4 percent in 2023.

This was a striking reversal. In 2023 alone it implied an increase in corporate tax collections of more than $150 billion. This is roughly double the sum at stake with the expanded child tax credit.

While there were some tweaks to the tax code, none of them would plausibly raise this sort of revenue. The most obvious change was that the Biden administration took enforcement seriously.

Under Trump, there was not much interest in policing tax filings. The Republicans called I.R.S. efforts to enforce the tax code “harassment.” The Biden administration expected that large corporations would pay the taxes they owe just like the rest of us do. It appears its enforcement efforts made a real difference.

This is an important point to keep in mind as we look at changes in the tax code proposed by Trump and the Republicans in Congress. They have openly pledged to weaken I.R.S. enforcement efforts. The result is that tax collections are likely to fall by considerably more than a simple calculation based on changes in tax rates. After all, most people, and especially most rich people, will not pay taxes if they don’t have to. And Donald Trump and the Republicans have pretty much said that rich people shouldn’t have to pay taxes, so it’s a safe bet that many rich people, and their corporations, will choose not to.

This first appeared on Dean Baker’s Beat the Press blog.

Dean Baker is the senior economist at the Center for Economic and Policy Research in Washington, DC.

Dean Baker

December 13, 2024

Big Pink, Portland, Oregon. Photo: Jeffrey St. Clair.

As Donald Trump prepares to embark on another round of MAGA tax cuts it is worth a quick review of the corporate side of the last one, and the Biden administration’s efforts to reverse the revenue loss. One of the unheralded successes of the Biden administration was increasing corporate income tax collections as a share of profits.

Most of the focus on taxes at the moment is on the individual income tax, since these cuts are the ones that expire in 2026. However, Trump has also talked of another round of corporate tax cuts. The 2017 tax cut reduced the corporate tax rate from 35 percent to 21 percent. Since very few companies were paying anything close to 35 percent of their profits in taxes (due to various loopholes), the cut was sold partly on the idea that we would lower rates but eliminate the loopholes and thereby collect roughly the same amount in taxes.

It makes good sense from almost any angle to have the actual tax rate be close to the nominal rate set in law. There is no point in having companies waste large amounts of resources in gaming the tax code; we should want the tax rate to be close to what we actually collect. (If we really want to eliminate tax gaming, we could make returns to shareholders, dividends and capital gains, the basis for the corporate income tax.) Since tax collections were already around 21 percent of corporate profits, there would be little downside if we made the tax rate 21 percent, and actually collected something close to that amount.

Not surprisingly, it didn’t work out that way. Corporate income tax as a share of corporate profits fell from 21.8 percent in 2016 to 16.1 percent in 2018 and just 15.3 percent in 2019, as shown below. (These data are from NIPA Table 1.10, Line 16 divided by Line 15.) This drop continued a long decline in the share of corporate profits paid in taxes from more than 30 percent in the 1980s and 1990s.

December 13, 2024

Big Pink, Portland, Oregon. Photo: Jeffrey St. Clair.

As Donald Trump prepares to embark on another round of MAGA tax cuts it is worth a quick review of the corporate side of the last one, and the Biden administration’s efforts to reverse the revenue loss. One of the unheralded successes of the Biden administration was increasing corporate income tax collections as a share of profits.

Most of the focus on taxes at the moment is on the individual income tax, since these cuts are the ones that expire in 2026. However, Trump has also talked of another round of corporate tax cuts. The 2017 tax cut reduced the corporate tax rate from 35 percent to 21 percent. Since very few companies were paying anything close to 35 percent of their profits in taxes (due to various loopholes), the cut was sold partly on the idea that we would lower rates but eliminate the loopholes and thereby collect roughly the same amount in taxes.

It makes good sense from almost any angle to have the actual tax rate be close to the nominal rate set in law. There is no point in having companies waste large amounts of resources in gaming the tax code; we should want the tax rate to be close to what we actually collect. (If we really want to eliminate tax gaming, we could make returns to shareholders, dividends and capital gains, the basis for the corporate income tax.) Since tax collections were already around 21 percent of corporate profits, there would be little downside if we made the tax rate 21 percent, and actually collected something close to that amount.

Not surprisingly, it didn’t work out that way. Corporate income tax as a share of corporate profits fell from 21.8 percent in 2016 to 16.1 percent in 2018 and just 15.3 percent in 2019, as shown below. (These data are from NIPA Table 1.10, Line 16 divided by Line 15.) This drop continued a long decline in the share of corporate profits paid in taxes from more than 30 percent in the 1980s and 1990s.

However, there was a turnaround in tax collections under Biden. The tax share rose to 17.4 percent in 2021, and then increased further to 20.1 percent in 2022 and 20.4 percent in 2023.

This was a striking reversal. In 2023 alone it implied an increase in corporate tax collections of more than $150 billion. This is roughly double the sum at stake with the expanded child tax credit.

While there were some tweaks to the tax code, none of them would plausibly raise this sort of revenue. The most obvious change was that the Biden administration took enforcement seriously.

Under Trump, there was not much interest in policing tax filings. The Republicans called I.R.S. efforts to enforce the tax code “harassment.” The Biden administration expected that large corporations would pay the taxes they owe just like the rest of us do. It appears its enforcement efforts made a real difference.

This is an important point to keep in mind as we look at changes in the tax code proposed by Trump and the Republicans in Congress. They have openly pledged to weaken I.R.S. enforcement efforts. The result is that tax collections are likely to fall by considerably more than a simple calculation based on changes in tax rates. After all, most people, and especially most rich people, will not pay taxes if they don’t have to. And Donald Trump and the Republicans have pretty much said that rich people shouldn’t have to pay taxes, so it’s a safe bet that many rich people, and their corporations, will choose not to.

This first appeared on Dean Baker’s Beat the Press blog.

Dean Baker is the senior economist at the Center for Economic and Policy Research in Washington, DC.

No comments:

Post a Comment