More than three-quarters of Canadians support a tax on the very wealthy

Christo Aivalis / November 17, 2020 CANADIAN DIMENSION

Illustration by Canadian Dimension

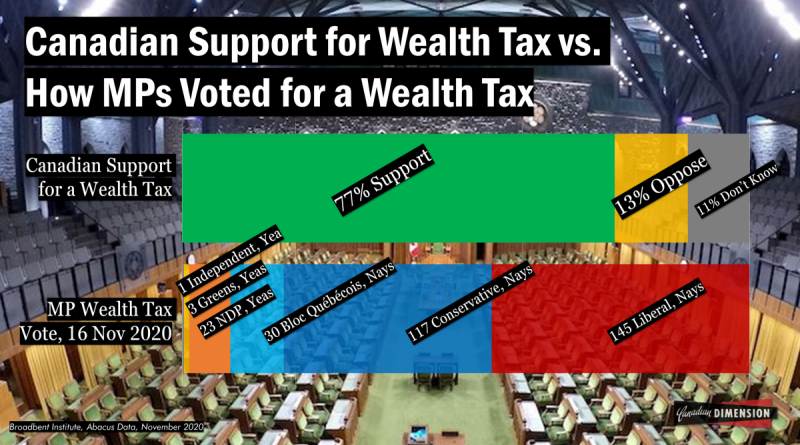

Yesterday was an indictment of Canadian politics. The Liberal Party, Conservative Party, and Bloc Québécois united to oppose a New Democratic Party motion which would have created a one percent tax on an individual’s wealth over $20 million. It would have also provided for an excess profits tax aimed at those who have enriched themselves while millions of Canadians suffer during the COVID-19 pandemic. These three parties (the Greens voted in favour) all opposed this common-sense motion even though the vast majority of Canadians support taxing billionaires and multi-millionaires on their obscene wealth.

As noted by NDP leader Jagmeet Singh and MPs like Peter Julian, Canada is a society riddled with inequality, and while the coronavirus did not create such disparity between the rich and the rest, it has exacerbated it. As Singh put it:

To pay for the programs, the help that people need… it should not be families, and people, and workers, and small businesses who have struggled… It should be those who have profited off the pandemic, it should be the ultra-wealthy that contribute their fair share.

Indeed, the most wealthy and powerful Canadians have gotten richer during the pandemic, even as regular people face poverty and uncertainty. It is a given that, if we want to build a better Canada out of the ashes of this crisis—and if we want to address glaring omissions in our social safety net like pharmacare and dental care—then asking the very wealthiest to pay their fair share is a logical starting point. And nearly all Canadians agree with this approach.

As noted in recent polling, 76 percent of Canadians support the NDP’s one percent wealth tax plan, with a near majority (48 percent) strongly supporting it. More impressively, however, is how support is universally strong across party lines. Unsurprisingly, 91 percent of NDP voters support such a plan, but so do 70 percent of Conservatives (in fact, only 17 percent of Conservative voters actively oppose it). With every party giving at least two-thirds majority support to the idea of taxing wealth, why is it that not a single MP from Canada’s three biggest caucuses stood with the NDP on the motion? Why would the Liberals, Conservatives, and Bloc brazenly disregard the will of their supporters?

Put simply, it is because those parties do not exist to reflect the will of the population, nor even their own base, but rather the interests of the rich, wealthy, and well-connected. Even going back to the days following the 2019 federal election, Abacus Data polled Canadians about policies the Liberals might implement with the support of the NDP alone (given that those two parties form a majority of the seats in the current minority parliament). What they found was not only a similar (77 percent) level of support for a wealth tax and closing tax loopholes, but majority support for the entirety of the NDP’s key platform pieces. Policies like electoral reform had a slim majority of support (54 percent), while eliminating student loan interest, building 500,000 affordable housing units, dental care, pharmacare, and a Green New Deal had support ranging from 64 to 78 percent. For all but one of these policies, Conservative supporters also gave majority support

The @NDP proposed a new tax on the super rich and pandemic profiteers like Amazon and Walmart.

292 of the people’s representatives voted against it. https://t.co/RhaVfSKejK— simon black (@_SimonBlack) November 16, 2020

Clearly, the Liberals and Conservatives—the only two parties to ever form government at the federal level—require the support of regular Canadians to rule and wield power. But once in power, the will of those regular Canadians goes by the wayside more often than not. There are many reasons for this. One is the nature of our first-past-the-post system, which can give near autocratic levels of power to one political party for five years with as little as 35 to 40 percent of the vote. This system also breeds negative voting, where the vast majority of Liberal and Conservative voters are actually voting to prevent something rather than achieve it, according to a recent Angus Reid survey of the 2019 election. This means that while these parties upon victory claim a broad mandate to implement their platform, in reality their power is derived from a popular revulsion to the other principal party. In many ways, Canadians are trapped by this state of affairs.

But even under a proportional system where the NDP and Greens would have a bigger say within Parliament, it is still possible that the Liberals and Conservatives would hold a majority of seats and votes between them, even if reduced in both counts. Canadians must realize that whatever the promises of these parties during elections to represent hardworking middle class families, they govern on behalf of the richest Canadians, and the most powerful multinational corporations.

It should be said in closing that, if anything, the NDP’s wealth and excess tax proposals are too modest. While the one percent tax starts at a lower level of wealth than that proposed by Senators Bernie Sanders and Elizabeth Warren in the United States, their provisions raise the wealth tax gradually on the uber wealthy who hold hundreds of millions and billions of dollars. Sanders’ wealth tax, for example, would tax all wealth above $1 billion at a minimum of five percent. Sanders, along with Senators Ed Markey and Kirsten Gillibrand, also released a 60 percent excess profits proposal that is more detailed than the one tabled by the NDP. The point here is that the NDP plan was already a compromise designed to work with the neoliberal capitalist parties on a basis that would have ironclad support from the voters of those parties. And they still rejected it.

Canadians like to pride themselves on having a government that is progressive and responsive to their needs. But as long as 90 percent of Parliament votes against policies supported by 76 percent of Canadians, that can’t be the case. There are no shortcuts: if Canadians want a government that taxes the rich—who have profited handsomely while many suffer—to pay for the basic necessities all Canadians deserve, they must lend their vote to parties that will deliver. That will never happen under a Conservative or Liberal government, or with the Bloc holding a substantial amount of Quebec seats.

Christo Aivalis is political writer and commentator with a PhD in History. His work has appeared in the Washington Post, Globe and Mail, Maclean’s, and Passage. He can be found daily on YouTube.