"The longer climate deniers keep up this charade, the more expensive things will get," said the JEC chair.

The remnants of buildings in Chimney Rock, North Carolina are captured on December 14, 2024, months after Hurricane Helene devastated the area.

(Photo: Peter Zay/Anadolu via Getty Images)

Jessica Corbett

Dec 16, 2024

COMMON DREAMS

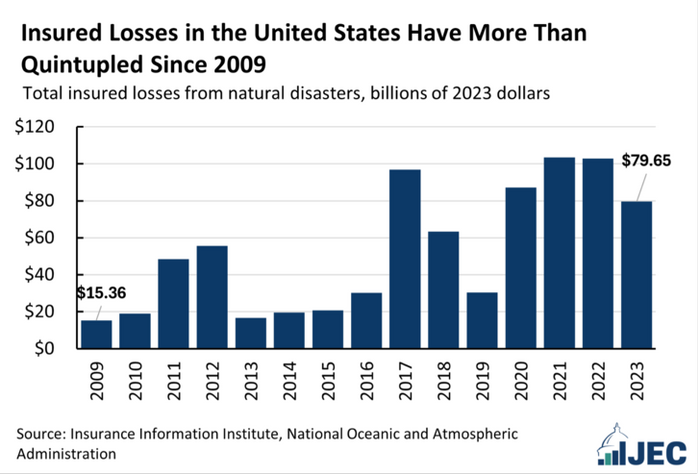

After at least two dozen U.S. disasters with losses exceeding $1 billion during a year that is on track to be the hottest on record, a congressional committee on Monday released a report detailing how the fossil fuel-driven climate emergency poses a "significant threat" to the country's housing and insurance markets.

"Climate-exacerbated disasters, such as wildfires, hurricanes, floods, drought, and excessive heat, are increasing risk and causing damage to homes across the country," states the report from Democrats on the Joint Economic Committee (JEC). "Last year, roughly 70% of Americans reported that their community experienced an extreme weather event."

"In the 1980s, the United States experienced an average of one billion-dollar disaster (adjusted for inflation) every four months; now, these significant disasters occur approximately every three weeks," the document continues. "2023 was the worst year for home insurers since 2000, with losses reaching $15.2 billion—more than twice the losses reported in 2022."

"Rising premiums and this issue of uninsurability could seriously disrupt the housing market and stress state-operated insurance programs, public services, and disaster relief."

The insurance industry is already responding to that stress. The publication highlights that "insurers are pulling out of some states with substantial wildfire or hurricane risk—like California, Arizona, Florida, and North Carolina—leaving some areas 'uninsurable,'" and "in many regions, even if the homeowner can get insurance, the policy covers less than the actual physical climate risks (for example, rising sea levels or more intense wildfires) that their home faces, leaving them 'underinsured.'"

JEC Democratic staff found that last year, "the average U.S. homeowners' insurance rate rose over 11%," and from 2011-21, it soared 44%. Researchers also documented state-by-state jumps for 2020-23. For increases, Florida was the highest ($1,272), followed by Louisiana ($986), the District of Columbia ($971), Colorado ($892), Massachusetts ($855), and Nebraska ($849).

The highest premiums for 2023 were in Florida ($3,547), Nebraska ($3,055), Oklahoma ($2,990), Massachusetts ($2,980), Colorado ($2,972), Hawaii ($2,958), D.C. ($2,867), Louisana ($2,793), Rhode Island ($2,792), and Mississippi ($2,787).

The report ties the rising premiums to "surging" prices for repairs, reinsurers also hiking rates, insurance litigation issues, and rate caps in some states pushing higher costs off to states that regulate the industry less. While JEC Democrats focused on the United States, as Common Dreamsreported last week, the climate threat to the insurance industry is a global problem.

"Rising premiums and this issue of uninsurability could seriously disrupt the housing market and stress state-operated insurance programs, public services, and disaster relief," the new report warns. "Given this rising threat, innovations in climate mitigation and adaptation, insurance options, and disaster relief are essential for protecting Americans and their finances."

The publication points out that "a previous JEC report on climate financial risks discussed other potential solutions like parametric insurance (a supplemental insurance plan that can pay homeowners faster), community-based catastrophe insurance that incentivizes community-level resilience efforts, and attempts to use risk-pooling, data, and AI to better price risk."

The new document also promotes the Wildfire Insurance Coverage Study Act, introduced by JEC Chair Sen. Martin Heinrich (D-N.M.) "to address these data needs and study wildfire risk, insurance, and mitigation to help Americans make more informed decisions about the risks to their homes," and the Shelter Act, which "would create a new tax credit, allowing taxpayers to deduct 25% of disaster mitigation expenditures."

The report further recommends improvements to several Federal Emergency Management Agency (FEMA) programs, including:Expanding the flagship pre-disaster mitigation grant funding available through FEMA's Building Resilient Infrastructure and Communities (BRIC) program beyond the nearly $3 billion it received in the Bipartisan Infrastructure Law (BIL) to meet growing demand (only 22 states received funding in FY23; although, applications were received from all 50).

Making it easier for states to apply for FEMA's Hazard Mitigation Grant Program, which gives funds to states hit by a disaster that they can use to protect against future damage. The Biden-Harris administration recently streamlined the program's application process.

Enacting a National Disaster Safety Board (similar to the National Transportation Safety Board), which would provide data-informed recommendations to help communities become more resilient to disasters.

Expanding the Community Wildfire Defense Program, created by the BIL.

The JEC publication comes as the country prepares for President-elect Donald Trump to take office next month after running a campaign backed by billionaires and fossil fuel executives and pledging to "drill, baby, drill," which would increase planet-heating pollution as scientists warn of the need for cutting emissions. Republicans will also have control of both chambers of Congress.

Heinrich on Monday called out the GOP for its climate record, saying that "Republicans have denied that climate change is real for over 40 years, and as a result, homeowners are seeing their insurance costs rise."

"Homeowners in New Mexico have seen their premiums increase by $400 over the last three years because of Republicans' refusal to act," he added, citing the 2020-2023 data. "The longer climate deniers keep up this charade, the more expensive things will get."

"This study mirrors the Biden administration's entire four-year approach to advancing a clean energy future: weak and half-hearted," one advocate said.

A liquefied natural gas (LNG) tanker operates near a Venture Global export facility in Louisiana.

(Photo: Getty Images)

Olivia Rosane

Dec 17, 2024

COMMON DREAMS

Approving more liquefied natural gas exports would raise domestic energy prices, increase the pollution burden placed on local communities, and exacerbate the climate crisis, the Biden administration concluded in a long-awaited report released Tuesday.

However, the Department of Energy (DOE) stopped short of denying any pending or future approvals, passing the buck to the administration of President-elect Donald Trump, who has vocally supported the LNG boom.

"This study mirrors the Biden administration's entire four-year approach to advancing a clean energy future: weak and half-hearted," Food & Water Watch policy director Jim Walsh said in a statement. "Liquid natural gas exports systematically poison the most vulnerable frontline communities, pollute our air and water, and drive up domestic energy prices. We cannot continue to be victimized by the profit-driven agenda of fossil fuel corporations. President Biden must listen to the warnings of his own government by banning further LNG exports and rejecting pending LNG permits before he leaves office."

"DOE's long-awaited environmental and economic analyses demonstrate what environmental justice and frontline communities have been saying for years—liquefied natural gas export facilities are not in the public interest."

U.S. LNG exports have tripled in the last five years, making the country the leading gas exporter in the world. At the same time, the latest climate research has shown that—due to methane leaks across the LNG life cycle—the so-called "bridge fuel" is in fact worse for the climate than coal.

Following pressure from climate and environmental justice advocates, the Biden administration in January announced a pause on approving LNG exports to non-Free Trade Agreement countries while the DOE updated the studies it uses to determine whether or not gas exports are in the public interest, as Congress has authorized it to do under the Natural Gas Act.

Those updated studies were released Tuesday, along with a statement from Energy Secretary Jennifer Granholm. Climate, consumer, and frontline advocates welcomed the findings themselves, which they said were largely consistent with their warnings and experience.

"DOE's long-awaited environmental and economic analyses demonstrate what environmental justice and frontline communities have been saying for years—liquefied natural gas export facilities are not in the public interest," Leslie Fields, the chief federal officer at WE ACT for Environmental Justice, said in a statement. "Not only do these projects compound public health and safety harms to communities, especially in the Gulf and for communities of color, but they also exacerbate the climate crisis and raise energy prices here at home."

Jamie Henn, the director of Fossil Free Media, said on social media that Granholm's statement was "even stronger than I expected."

In it, Granholm emphasized five key findings from the updated studies:LNG exports are booming, with the quantities already approved being sufficient to meet global demand for decades in 4 out of 5 scenarios.

Increasing exports would boost the profits of export facility owners and generate jobs in the industry, but would raise gas prices for domestic industry and consumers overall. Within the U.S., "unfettered exports" would raise prices by more than 30% and add "well over" $100 to the average yearly household energy bill by 2050.

LNG export facilities are concentrated in communities already exposed to fossil fuel industry pollution, with methane, volatile organic compounds, particulate matter, nitrogen oxides, and other contaminates raising mortality rates.

Increased LNG exports would contribute to the climate crisis: They are more likely to supplant renewables than coal and add to global emissions in every scenario the DOE examined.

Regulators should consider where LNG exports will be shipped. Demand in Europe is falling, while China is currently the leading importer and projected to remain so through 2050.

"Today's study makes clear that all pending export applications must be denied as being inconsistent with the public interest, and should result in a reassessment of existing exports to determine compatibility with the public interest," Tyson Slocum, director of Public Citizen's Energy Program, said in a statement. "Using LNG exports to provide energy abundance for China at the expense of higher utility bills for working Americans is not in the public interest."

Granholm stated clearly that "the effect of increased energy prices for domestic consumers combined with the negative impacts to local communities and the climate will continue to grow as exports increase."

Yet she also said the Biden administration would not act on the findings of the updated studies due to the timing of their release: The report's publication now triggers a 60-day comment period, and the inauguration is only a little more than a month away.

"Given that the comment period for the study will continue into the next administration—and that there are a limited number of applications that are concurrently ready for the DOE 'public interest' review—decisions about the future of LNG export levels will necessarily be made by future administrations," she said. "Our hope is that we can now assess the future of natural gas exports based on the facts and ensure authorizations are reviewed in a manner that truly advances the public interest of all the American people."

While the purpose of the DOE's updated studies had never been to deny or approve exports—rather to inform those decisions—advocates have been pushing the Biden administration to act on its findings. In particular, frontline Gulf groups are concerned about Calcasieu Pass 2 and Commonwealth LNG, two pending export facilities that are currently subject to supplemental environmental impact statements by the Federal Energy Regulatory Commission due to concerns about their local impacts.

"We were hoping that this study would be released and with this study would come the denial of permits for these projects," frontline leader Roishetta Ozane of the Vessel Project of Louisiana said in a press briefing.

"It'll be hard for the Trump administration to completely ignore the finding that exports drive up costs for consumers. That's political dynamite."

Several groups responded to the study with renewed calls for permit denials.

"This study confirms that Donald Trump's plans to supercharge LNG exports will come at the expense of consumers and the climate," said Friends of the Earth senior energy campaigner Raena Garcia. "We cannot afford to prop up an industry that continues to threaten our people and the planet for profit. Over the next few weeks, it is not too late for the Biden administration to curb the deadly LNG export boom."

Walsh of Food & Water Watch said: "Secretary Granholm's admission that continuing LNG exports will drive up costs and harm vulnerable communities is a sad reflection on what we have been saying for the last decade. It is time for this administration to start matching its rhetoric with action, and reject new LNG exports while it still can."

But Henn told Common Dreams that this might be a losing battle.

"The administration has indicated it wants to follow the regular process and not jump ahead and deny permits before they leave office, only to have Trump reapprove them," Henn said. "We disagree and think denials would send a strong political signal and potentially strengthen legal challenges. It's unlikely we'll sway them with so little time left, but we're going to try."

Still, campaigners emphasized that the DOE's findings will strengthen the case of any community or group opposing LNG exports going forward.

"This report will serve as a tool for us in fighting against these projects," Ozane said.

This remains the case despite the Trump administration's pro-fossil fuel stance and history of running roughshod over rules and regulations.

"Trump will of course try and ignore the study, but it gives us new political, legal, and diplomatic arguments," Henn told Common Dreams. "Politically, it'll be hard for the Trump administration to completely ignore the finding that exports drive up costs for consumers. That's political dynamite. Legally, if Trump just ignores the findings of this report and rushes approval, that opens the door for challenges."

Natural Resources Defense Council senior attorney Gillian Giannetti pointed out in a press briefing that "because these studies are in the public record, the failure to properly consider them and their relevance would be unlawful under the Administrative Procedure Act."

Slocum of Public Citizen said that groups like his have legal intervention status and can ask a court to review any Trump decision.

"Any court is going to want to know—what does the administrative record say?" he noted. "And this report greatly strengthens the case that requested LNG exports are not consistent with the public interest. So a court can toss out a Trump admin approval."

"These studies show clearly that LNG exports are in gas executives' best interest and nobody else's."

Henn added that the findings could slow the LNG buildout both diplomatically and economically.

"Diplomatically, the climate data in this report makes it less likely that our allies, all of whom have signed the Paris agreement, will be as interested in importing dirty U.S. gas," he told Common Dreams.

"Finally," he concluded, "this report will cause tremors on Wall Street. This report and Secretary Granholm's strongly worded letter indicate that future Democratic administrations won't likely support new export facilities. Since these are long-term investment decisions, that uncertainty will slow down financing for new projects."

The report also undermines Trump's economic argument that more fossil fuel production is better for everyone, revealing it instead for another giveaway to the wealthy.

"Despite claims from the incoming Trump administration that it wants to lower prices, the truth is they are putting billionaire fossil fuel donors ahead of everyday Americans," Greenpeace USA deputy climate program director John Noël said in a statement. "The record is crystal clear: Increasing LNG exports will drive up costs for domestic businesses and consumers. Full stop. Any further investment in LNG will only exacerbate the cost-of-living crisis, while enriching gas industry CEOs who don't have to experience the fallout of living near an export terminal."

Lauren Parker, an attorney at the Center for Biological Diversity's Climate Law Institute, agreed, saying, "These studies show clearly that LNG exports are in gas executives' best interest and nobody else's."

Parker concluded, "If Trump wants to drive up dangerous gas exports, he's going to have to answer for causing more deadly storms, condemning the Rice's whale to extinction, and socking consumers with higher costs."