The hidden link between corporate greed and inflation

Don’t fall for the fear mongering about inflation. The real culprit here is corporate power.

Inflation! Inflation! Everyone’s talking about it, but ignoring one of its biggest causes: corporate concentration.

Now, prices are undeniably rising. In response, the Fed is about to slow the economy — even though we’re still 2 million jobs short of where we were before the pandemic, and millions of American workers won’t get the raises they deserve.

Meanwhile, Republicans haven’t wasted any time hammering Biden and Democratic lawmakers about inflation.

Don’t fall for their fear mongering.

Everybody’s ignoring the deeper structural reason for price increases: the concentration of the American economy into the hands of a few corporate giants with the power to raise prices.

If the market were actually competitive, corporations would keep their prices as low as possible as they competed for customers.

Even if some of their costs increased, they would do everything they could to avoid passing them on to consumers in the form of higher prices, for fear of losing business to competitors.

But that’s the opposite of what we’re seeing. Corporations are raising prices even as they rake in record profits. Corporate profit margins hit record highs last year. You see, these corporations have so much market power they can raise prices with impunity.

So the underlying problem isn’t inflation per se. It’s a lack of competition. Corporations are using the excuse of inflation to raise prices and make fatter profits.

Take the energy sector.

Only a few entities have access to the land and pipelines that control the oil and gas powering most of the world. They took a hit during the pandemic as most people stayed home. But they are more than making up for it now, limiting supply and ratcheting up prices.

Or look at consumer goods.

In April 2021, Procter & Gamble raised prices on staples like diapers and toilet paper, citing increased costs in raw materials and transportation. But P&G has been making huge profits. After some of its price increases went into effect, it reported an almost 25% profit margin.

Looking to buy your diapers elsewhere? Good luck. The market is dominated by P&G and Kimberly-Clark, which—NOT entirely coincidentally—raised its prices at the same time.

Another example: in April 2021, PepsiCo raised prices, blaming higher costs for ingredients, freight, and labor. It then recorded $3 billion in operating profits through September. How did it get away with this without losing customers?

Pepsi has only one major competitor, Coca-Cola, which promptly raised its own prices. Coca-Cola recorded $10 billion in revenues in the third quarter of 2021, up 16% from the previous year.

Food prices are soaring, but half of that is from meat, which costs 15% more than last year. There are only four major meat processing companies in America, which are all raising their prices and enjoying record profits.

Get the picture?

The underlying problem is not inflation. It’s corporate power. Since the 1980s, when the U.S. government all but abandoned antitrust enforcement, two-thirds of all American industries have become more concentrated.

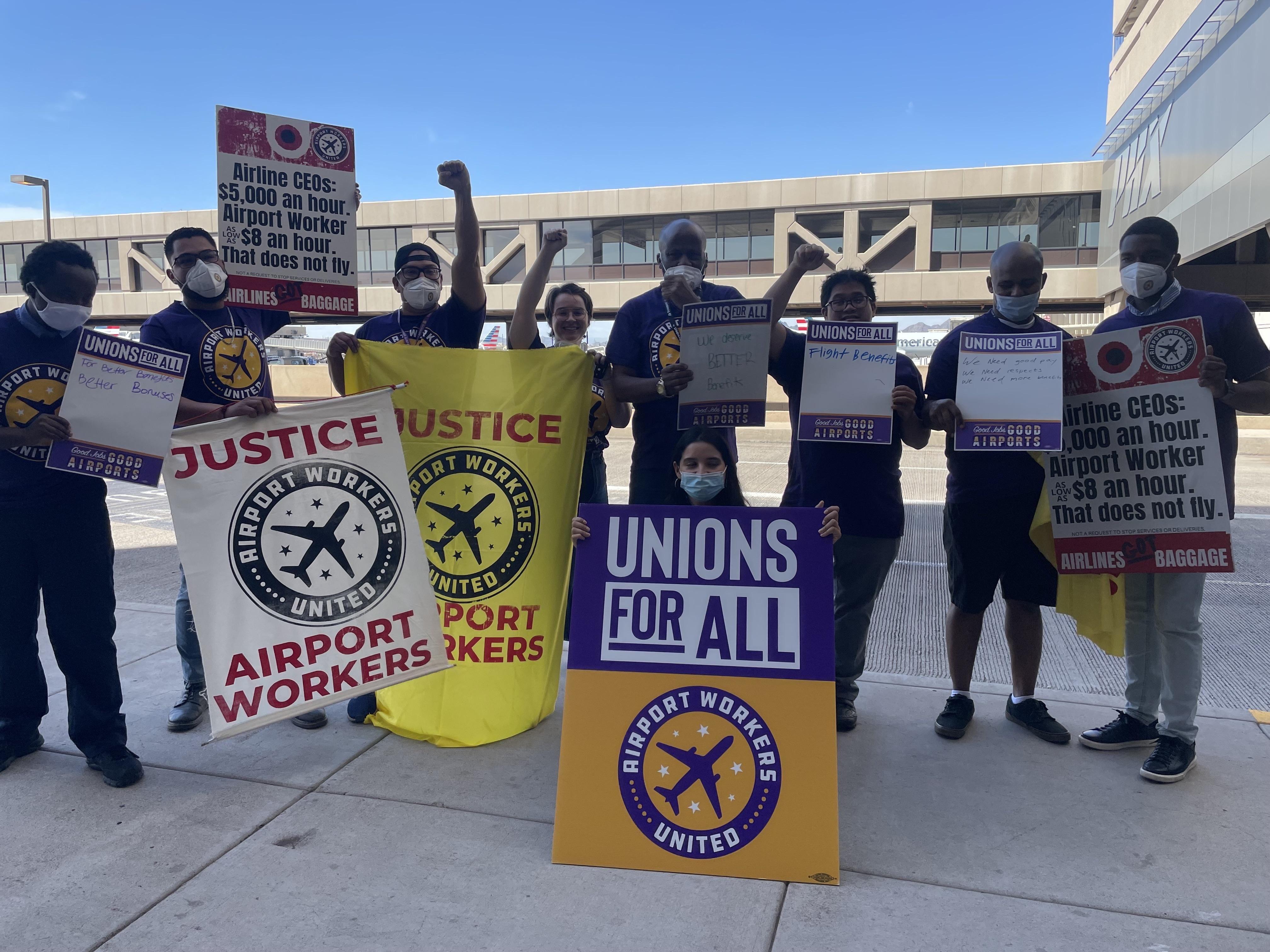

Most are now dominated by a handful of corporations that coordinate prices and production. This is true of: banks, broadband, pharmaceutical companies, airlines, meatpackers, and yes, soda.

Corporations in all these industries could easily absorb higher costs — including long overdue wage increases — without passing them on to consumers in the form of higher prices. But they aren’t.

Instead, they’re using their massive profits to line the pockets of major investors and executives — while both consumers and workers get shafted.

How can this structural problem be fixed? Fighting corporate concentration with more aggressive antitrust enforcement. And imposing a windfall profits tax on profitable corporations that are using this period of rising costs to gouge consumers.

So don’t fall for the fear mongering about inflation. The real culprit here is corporate