'We went too far, too fast': Chancellor scrambles to 'stabilise' economy - with Trussonomics junked

16 October 2022

Liz Truss's so-called 'Trussonomics' vision for the UK finances appears doomed after the Chancellor halted her tax-cutting agenda - while she seeks to stay in power despite an increasingly shaky-looking premiership.

New Chancellor Jeremy Hunt, brought in to replace the sacked Kwasi Kwarteng and to restore credibility to Downing Street, spent Saturday effectively trashing the mini-budget and the set of policies that brought Ms Truss to power.

Amid warnings of "difficult decisions" to come over the next two weeks, Mr Hunt and Ms Truss will meet in her Chequers residence on Sunday as tax rises and spending cuts loom on the horizon.

The Chancellor, who spent Saturday also meeting with Treasury officials, insisted that he and the Prime Minister were a "team" as he said that his priority was "growth underpinned by stability".

"The drive on growing the economy is right - it means more people can get good jobs, new businesses can thrive and we can secure world class public services. But we went too far, too fast," he said.

Earlier, he told broadcasters: "Spending will not rise by as much as people would like and all Government departments are going to have to find more efficiencies than they were planning to."

"And some taxes will not be cut as quickly as people want. Some taxes will go up. So it's going to be difficult."

As Mr Hunt begins his job of putting together a fresh budget for October 31 one possible plan, as reported in the Sunday Times, would be to delay his predecessor's aim of reducing the basic rate of income tax by a year as part of a wider package designed to calm the financial markets.

Earlier, Governor of the Bank of England Andrew Bailey said he spoke to Mr Hunt on Friday after his appointment as he warned that interest rates may have to be raised higher than initially expected to tackle inflation.

Speaking from Washington, he said the pair had a "meeting of minds" on the issue of "fiscal sustainability" as he noted the fact the Office of Budget Responsibility is now "very much back in the picture".

US President Joe Biden also appeared to join in the criticism of Ms Truss's plan, telling reporters: "I wasn't the only one that thought it was a mistake" and calling the outcome "predictable".

Asked about her original economic strategy, he added that while he disagreed with her plan, it was up to the British people.

Mr Biden also dismissed concerns about the strength of the dollar: "The problem is the lack of economic growth and sound policy in other countries."

Questions still hang over the Government about whether it would be able to win enough support from a divided party for a series of painful decisions on tax and spending that have already prompted memories of the austerity era under David Cameron and George Osborne.

In a media blitz over the weekend, both Mr Hunt and Ms Truss tried to win over their own party and voters to the new Downing Street regime.

After completing several interviews on Saturday, the new chancellor will later appear on BBC One's Sunday with Laura Kuenssberg.

Ms Truss, who used a piece in The Sun newspaper to admit that sacking her friend and ideological soulmate Mr Kwarteng had been a "wrench", said: "We cannot pave the way to a low-tax, high-growth economy without maintaining the confidence of the markets in our commitment to sound money."

Mr Hunt, writing in the Telegraph, said that the Government was "changing course".

So far, his appointment has failed to dampen speculation of an imminent coup against Ms Truss.

Rishi Sunak, the defeated leadership contender and former chancellor, as well as Defence Secretary Ben Wallace, have been among the names flagged as potential replacements.

Sir Geoffrey Clifton-Brown told LBC on Saturday that for Ms Truss it all hinges on how the markets receive the fiscal plan at the end of the month.

While he said he believes Mr Hunt could steady the ship, he warned that if "it doesn't manage to satisfy the markets and satisfy everybody else and the economy is still in chaos then I think we would be in a very difficult situation".

Elsewhere, there was speculation that including the Ministry of Defence in any round of spending cuts could spark a clash with Mr Wallace.

A defence source said he will hold Ms Truss to the pledges made.

Ms Truss promised to increase defence spending to 3% of GDP by 2030 in the wake of the war in Ukraine.

The Prime Minister nonetheless still has her defenders within the party.

Former culture minister Nadine Dorries, a loyal follower of Boris Johnson, wrote in the Daily Express: "The sad truth is that those scheming to eject the Prime Minister from Downing Street are the same plotters who conspired to get rid of Boris. They will not rest until they have anointed their own chosen leader in power."

The Labour Party, looking on as it enjoys a mammoth lead in the polls, said that there were "no historical precedents" for the crisis the Truss administration had plunged the country into.

In a speech in Barnsley, Sir Keir Starmer referenced former party leader Neil Kinnock's famous 1985 attack on the left-wing Militant group in Liverpool as he pointed to the "grotesque chaos of a Tory Prime Minister handing out redundancy notices to her own Chancellor".

Sir Charles Bean: Rising interest rates not merely a 'global phenomenon'

Oct 16, 2022

Sir Charles Bean, a former deputy governor at the Bank of England, today admitted that rising interest rates are a result of British economic decisions. Speaking to Sophy Ridge, Sir Charles said it is "disingenuous" to say the UK's economic issues are down to a "global phenomenon". Keep up with all the latest reaction and analysis in the Sky News Politics Hub: https://trib.al/ecixuwi

15 October 2022

By Asher McShane@ashermcs

Liz Truss is continuing to cling to power as Tories turn on her after announcing a humiliating tax u-turn and sacking Kwasi Kwarteng as Chancellor.

The Prime Minister ditched a major chunk of her mini-budget in an extraordinary gamble to stay in power, saying at an eight-minute press conference on Friday that the plan would raise £18 billion pounds per year.

Ms Truss forced her friend Kwasi Kwarteng out of office and U-turned on her commitment to drop the planned rise in corporation tax from 19% to 25%, a central plank of her leadership campaign.

Ms Truss did not address the criticism of the government after the turmoil unleashed by the mini Budget at the end of last month - and did not respond to a question from ITV asking if she would apologise.

The Prime Minister only answered four questions before walking out, in a tetchy performance on Friday afternoon.

This morning Lord Gavin Barwell, Theresa May's former chief of staff, told LBC the "national interest would be best served" if Truss resigned.

"The polls are so bleak I don’t think Tory MPs are going to give her much more time to turn this round," he said.

One former Cabinet minister said the PM had been "robotic" and made the situation worse for herself.

"What an absolutely shambles. She's got to go. After eight minutes... 'I'm going to walk off, I don't have to take this sh**,'" the MP told MailOnline.

"She has burned the house down and she is the chief firefighter. She is now going to be running the country on policies that she trashed completely in the leadership contest... why isn't she joining Kwasi under the bus?"

Another senior minister told the i paper: "It’s over, I imagine.”

A former minister added: "Credibility can be retained to some extent under a new leader but not this one."

It comes amid reports that Tory MPs are planning to outs the PM in favour of Rishi Sunak and Penny Mordaunt.

Several rebels are actively considering demanding a resignation within days.

However, loyalists have warned that another leadership switch could trigger an election before Christmas and mean the Tories are forced out of power.

Read more: Liz Truss 'will resign this afternoon or be gone within the next two weeks', says Andrew Marr

Ms Truss sacked her Chancellor Kwasi Kwarteng earlier on Friday with Jeremy Hunt installed in his place. Mr Hunt arrived at Downing Street for a meeting with Ms Truss on Friday afternoon at about 4.15pm.

She told the press conference: "It is clear that parts of our mini-budget went further and faster than markets were expecting. So the way we are delivering our mission right now has to change.

"We need to act now to reassure the markets of our fiscal discipline.

"I have therefore decided to keep the increase in corporation tax that was planned by the previous government.

Read more: Jeremy Hunt appointed Chancellor after Kwasi Kwarteng sacked

"This will raise £18 billion per year. It will act as a down payment on our full medium-term fiscal plan which will be accompanied by a forecast from the independent [Office for Budget Responsibility].

"We will do whatever is necessary to ensure debt is falling as a share of the economy in the medium term.

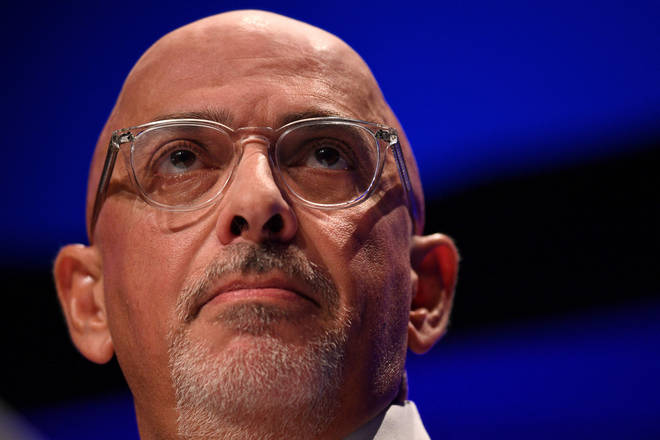

Kwasi Kwarteng. Picture: Getty

Kwasi Kwarteng. Picture: GettyThe embattled Ms Truss said the UK would "get through this storm".

She added: "I want to be honest, this is difficult, but we will get through this storm. And we will deliver the strong and sustained growth that can transform the prosperity of our country for generations to come."

Mr Kwarteng was fired on Friday after just 38 days in the job.

Ms Truss said: "I met the former chancellor earlier today. I was incredibly sorry to lose him.

"He is a great friend and he shares my vision to set this country on the path to growth.

She called Mr Hunt "one of the most experienced and widely respected Government ministers and parliamentarians, adding that he "shares my convictions and my ambitions for our country."

The u-turn came after a government minister said just on Friday morning that there were no plans to change tack on corporation tax.

Trade minister Greg Hands said that there were "absolutely no plans to change anything", speaking to LBC's Nick Ferrari on Friday morning. He also said that Mr Kwarteng was secure in his position, echoing comments made by the former Chancellor himself the day before.

Opposition parties criticised Ms Truss after the press conference, with Labour saying the government needed to scrap its economic plan altogether.

Shadow Chancellor Rachel Reeves told LBC: "There's still much in the budget from just three weeks ago that is causing concerns in financial markets, and so much has already been done, with people’s mortgage rates higher and people worrying about their pensions as well.

"So instead of just another Conservative chancellor in this year alone, what we need now is a Labour government, which would prioritise economic stability."

Liberal Democrat leader Sir Ed Davey told LBC: "If the British people were brought into this conversation, she'd go now."

Some Conservatives rallied behind Ms Truss in the wake of the press conference, with close ally Therese Coffey tweeting: "The PM is right to act now to ensure our country's economic stability - key for families and businesses - and reassure the markets of our fiscal discipline, especially in light of the worsening global economic conditions with Putin's illegal invasion of Ukraine."

Former Chancellor Nadhim Zahawi said: "It's time to get Britain moving. We are determined to grow the economy, eliminate the covid backlog and protect people from Putin's energy warfare."

The corporation tax climbdown is just the latest in a series of u-turns performed by Ms Truss' government in its few weeks in office.

The government has also rowed back on cutting the 45p top rate of income tax, as well as a policy of not giving out "handouts" to help people with higher energy bills by introducing a massive support package.