Bloomberg News | November 12, 2021 |

Stock image.

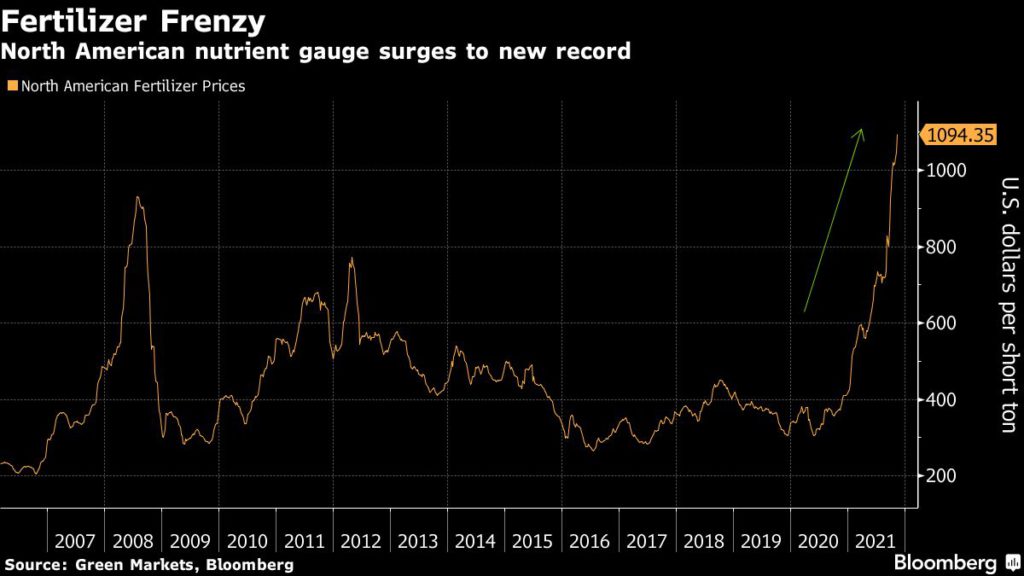

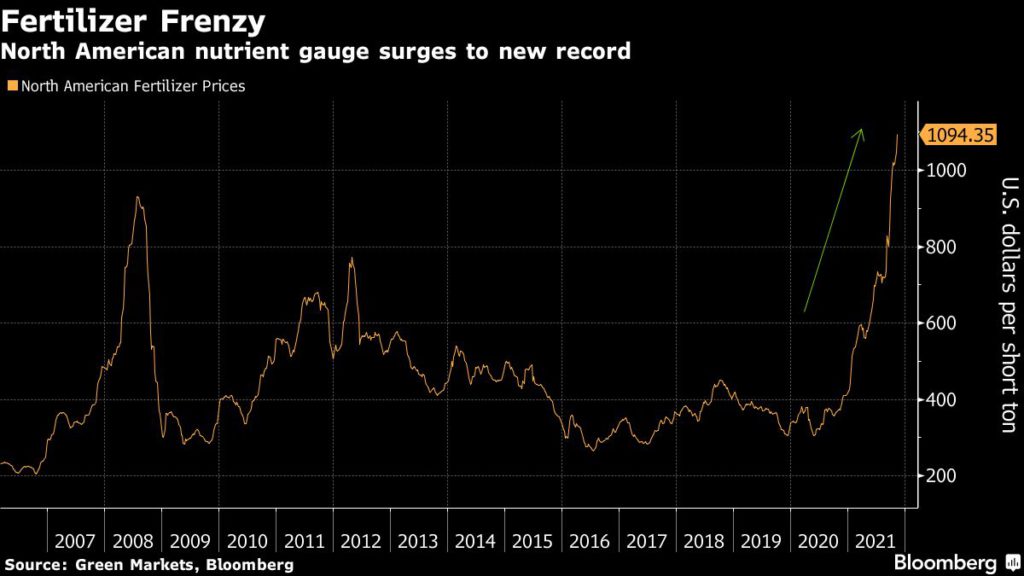

Fertilizer prices keep soaring to unprecedented heights, signaling escalating costs for farmers and consumers around the world.

The Green Markets North American Fertilizer Price Index rose 4.4% to $1,094.35 per short ton on Friday, surpassing a record set a week earlier. Prices for New Orleans urea, a popular nitrogen fertilizer, jumped 8.3% to $812 per short ton as major producer CF Industries Holdings Inc. warned of continued shortages.

Crop-nutrient prices have been soaring as an energy pinch in Europe makes natural gas, the main feedstock for most nitrogen fertilizer, more costly. China and Russia are restricting nutrient exports to ensure sufficient domestic supplies. U.S. consumers already are seeing the steepest inflation since 1990

.

The U.S. is a major importer of farm nutrients, sourcing 20% of its urea and 40% of its ammonium nitrate from Russia alone.

Crop markets from grains to coffee are getting a boost from the fertilizer rally as traders brace for potential supply shortages, with the surging input costs threatening to curb yields across the board.

As fertilizer and other input costs rise, Bloomberg’s Green Markets anticipates American farmers next year will switch 2.5 million acres from corn to soybeans, which is less fertilizer-intensive.

“Warning signs on demand are growing as farmers are unable or unwilling to absorb ammonia’s 65% increase in value since September,” Green Markets analyst Alexis Maxwell said in a note.

(By Elizabeth Elkin)

The U.S. is a major importer of farm nutrients, sourcing 20% of its urea and 40% of its ammonium nitrate from Russia alone.

Crop markets from grains to coffee are getting a boost from the fertilizer rally as traders brace for potential supply shortages, with the surging input costs threatening to curb yields across the board.

As fertilizer and other input costs rise, Bloomberg’s Green Markets anticipates American farmers next year will switch 2.5 million acres from corn to soybeans, which is less fertilizer-intensive.

“Warning signs on demand are growing as farmers are unable or unwilling to absorb ammonia’s 65% increase in value since September,” Green Markets analyst Alexis Maxwell said in a note.

(By Elizabeth Elkin)

BELARUS HOLDS A MONOPOLY ON 'RUSSIAN' POTASH WHICH IS WHY IT HAS NOT BEEN SANCTIONED OVER IT LEAVING IT FREE TO SUPPLY THE WORLD MARKET

No comments:

Post a Comment