Wages need 'big-time' catch-up in Canada as inflation rages: BMO

, BNN Bloomberg

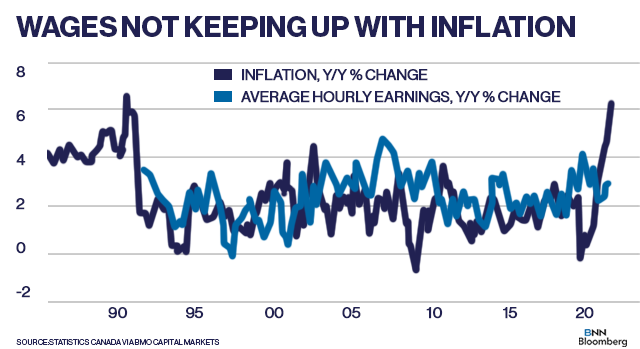

The disconnect between wage growth and inflation is being put under the microscope by the chief economist of BMO Capital Markets.

In a short note to clients, Doug Porter pointed out that wages are only rising around three to 3.5 per cent year-over-year, less than half the rate of Canada’s “steaming” (in Porter’s words) cost of living after Statistics Canada’s consumer price index surged 6.7 per cent year-over-year in April. He described the gap between those two metrics as “simply unsustainable,” particularly given Canada’s tight labour market.

“Either inflation will need to moderate, and soon, or else wages are poised to play catch-up, big-time,” Porter wrote.

“With commodity prices still frothy, supply chains still struggling, and home prices still raging, we don’t expect any quick relief for inflation.”

Porter is one of many Bay Street voices sounding the alarm on inflation that’s racing further and further away from the Bank of Canada’s target range of one to three per cent.

Scotiabank Head of Capital Markets Economics Derek Holt said on Wednesday he thinks there’s a “solid case” for the Bank of Canada to hike as much as full point “in one shot.”

Rising inflation is making us poorer.

APRIL 21, 2022

Wages across all industries have failed to keep pace with inflation, which hit a three-decade high last month.

In March, inflation climbed to 6.7 per cent year over year thanks to the pandemic, supply-chain struggles, and the war in Ukraine.

During the same period, average hourly wages rose 3.4 per cent, just half the rate of inflation, according to the latest data from Statistics Canada. Meanwhile, the cost of certain necessary goods is way up — groceries climbed 8.7 per cent. Gas rose a whopping 39.8 per cent.

Experts call the ratio between prices and wages purchasing power. That power diminishes as the gap grows, which is what is happening now.

Simply put, you’re making less money.

“Workers need a three per cent increase right now to make up for the losses, which is unlikely to happen,” said David Macdonald, senior economist with the Canadian Center for Policy Alternatives.

Instead, he said, workers will likely take a temporary pay cut, in essence, as inflation soars for the next few months as wages fall behind. “It will be difficult to recoup this three per cent difference.”

Some industries are keeping wages up with inflation better than others.

Information and IT workers are seeing consistent wage gains, Macdonald said. Supervisors and wholesale trade workers are also getting salary increases. This includes producers and retailers managing supply chain issues, which have become an ever-present challenge requiring more time and greater resources.

Food and beverage manufacturing also saw an upswing in wages as in-person dining decreased and stacking products in grocery stores became more frequent and necessary to help with higher demand from consumers, Macdonald said.

And real estate agents saw “huge wage gains” with the high cost of housing. Macdonald expects they will continue to do well moving forward.

On the flip side, employees manufacturing durable items such as automobiles saw little in wage increases.

Public sector workers, which include education and health care professionals, also saw "very low wage gains" and likely won't see a substantial wage increase in the near future.

“With the new inflation numbers, now 75 per cent of workers are seeing real wage losses because of how much inflation has gone up,” Macdonald said.

Douglas Porter, chief economist and managing director of BMO Financial Group, said almost every industry will see wages go up at this point, some more than others. “It's reasonable to expect a pretty comprehensive broad based upward pressure on wages.”

He called the sizable gap between wage increase and inflation “highly unusual.”

"It's especially unusual given how tight the labor market is when you look at the low unemployment rate and the number of job vacancies," he said. “Ether inflation is going to run away rapidly or wages will rise rapidly. That gap between prices and wages can't be sustained for long.” If it does, people will be unable to afford everyday goods and the cost of living will be unattainable.

Porter said sectors with high vacancy rates will face the biggest pressure to increase wages. These include the accommodation and food services sectors, which have a 7.5 per cent vacancy rate, and health care and social assistance jobs which have 6.4 per cent vacancy.

“Wherever there is a high vacancy rate there will be increased wage pressures to attract more workers and for retention,” he said.

Anil Verma, a retired professor of industrial relations at the Rotman School of Management, expects the travel, food and hospitality sectors — which are having difficulties hiring — will pass the cost of increased wages on to consumers.

Bea Bruske, president of the Canadian Labor Congress, expects employees and unions across all industries will press for improved wages.

“At the end of the day workers can organize. There's more strength in numbers to negotiate collective agreements," she said.

Many workers have expired collective agreements that are now being negotiated, especially in the public sector, Bruske said.

Jim Stanford, director of the Center for Future of Work, said few collective agreements have a cost of living adjustment, meaning wages don't automatically change to offset inflation.

While employees will ask for higher wages, Stanford isn't optimistic employers will give the three per cent needed.

Look at public service workers in Ontario, for example. They have a pay cap of one per cent for three years, under Bill 124, and will find it legally challenging to ask for higher salaries, he said.

For some, it might be easier to negotiate a higher salary at a new job than to get a raise from an existing employer.

Perhaps with that in mind, some employers are being proactive in light of the latest data.

At Ascend Fundraising Solutions, a software company that helps charities raise money, CEO Daniel Lewis announced a cross-board five per cent bonus for employees the day before the latest inflation numbers were released.

“It's not an act of retention. It's just the right thing to do,” Lewis said.

Clarrie Feinstein is a Toronto-based staff reporter for the Star. Reach Clarrie via email: clarriefeinstein@torstar.ca

Rosa Saba is a Toronto-based business reporter for the Star. Follow her on Twitter: @rosajsaba

Eyeing a raise as inflation soars?

It’s a great time to ask, experts say

By Craig Lord Global News

Posted April 20, 2022

Soaring inflation amid a tight job market could mean good news for Canadian workers hoping to bring home a little bit more to cover the surging cost of living, according to career experts.

Statistics Canada reported Wednesday that the annual rate of inflation hit a whopping 6.7 per cent in March, setting a new 31-year high, while the country’s labour market is at its lowest point on record, dropping to 5.3 per cent last month.

Experts say this has created a perfect window for anyone eyeing a bump in compensation to offset the rising cost of living.

“There’s probably never been a better time to ask for a raise,” says Michael French, national director at recruitment agency Robert Half.

Sarah Vermunt, career coach and founder of Careergasm, echoed French. She tells Global News the current economic conditions are a “rare opportunity” where job seekers and those feeling underpaid have a chance to boost their salaries.

“It’s actually a great time to ask for a raise because your company very likely wants to keep you in this job market. So you have a little more power than you usually do if you’re looking for a raise right now,” she says.

READ MORE: Bank of Canada interest rate hike: How it connects to inflation, job market

A recent survey from Robert Half shows employees are feeling the heat from inflation and might be well aware of their bargaining power.

Of the more than 500 Canadian workers surveyed in early March, half said they plan to ask for a raise this year.

Of those respondents, 31 per cent said adjusting for the higher cost of living was their top reason for wanting a boost, followed by accounting for additional responsibility (18 per cent) and reflecting current market rates (16 per cent).

A survey from accounting firm MNP earlier this week illustrated how hard inflation is hitting Canadians’ wallets.

Some 31 per cent of respondents to that poll said they already don’t make enough to cover their bills and debt payments.

But with the ongoing labour crunch, Canadian employers also have to devote closer attention to how much they’re paying.

A separate Robert Half survey showed 69 per cent of companies are experiencing “pay compression” — longer-tenured employees seeing their salaries look closer to those of new hires as market rates rise.

French says giving an employee a raise, rather than letting them slip away and having to hire a replacement, can be a time and money saver for companies.

“If you’re not keeping up with the market or in many cases, leading the market, you have people leaving you and the most expensive thing you can do is have turnover during COVID,” he says.

But how should you go about asking for that raise? Here are the top tips and biggest mistakes to avoid when looking for a pay bump.

How much money should I ask for?

Before launching into any conversations about compensation, it’s important to know where market rates for similar roles are, Vermunt says.

“Given the job market now, it’s probably higher than it was a year ago. So that’s important to research,” she says.

Websites such as Indeed, Glassdoor and Robert Half itself all have salary trackers that will show you where the industry has set the bar for your position.

When should I ask for a raise?

Vermunt says one of the biggest mistakes people make when they’ve been wanting a raise for a while is to ask when they’re already at their wits’ end.

“Going into the conversation in an overly emotional state is a recipe for disaster. Do not do that. Wait until you have a moment to have a planned conversation,” she says.

Set a meeting in advance for a downtime during the week, Verument recommends. Call it something informal like “career goals” to make sure both you and your manager are in the same frame of mind before launching into raise talks.

Show your value

Don’t focus on arguments related to your tenure at the company, or how much you need the raise right now, Vermunt suggests.

Those kinds of points don’t show your company why you’re worth the extra money.

Instead, focus on three to four examples that show how your performance has materially benefited the company: a time when you earned the company more money, reduced costs, moved the needle forward — anything quantifiable that shows why you should continue to be an investment priority.

“You want to make it about your performance,” Vermunt says.

Avoid ambushing your boss, but put the onus on them

Though your instinct might be to avoid showing your hand, French says the last person who should be surprised by a raise request is your manager themselves.

If you’ve set your expectations for career advancement well, your manager can help you “craft the path to get there,” he says.

“They should be the first person you’ve talked to and they’ll actually, in most cases, help you sort of craft the path to get there,” he says.

“Talk to your manager, have a very frank, transparent conversation, and it usually will pay dividends for you.”

READ MORE: Canadians young and old left behind in pandemic jobs recovery

Vermunt notes that not every raise comes after the first ask. If you’re rebuffed at first, ask for tangible steps you can take to earn the higher pay and set a follow-up meeting in six months’ time to double back on your request.

“That then puts the onus on them to say what they’re looking for if they’re willing to give a salary bump and it gives you something concrete to work towards to then be able to use as evidence when you reopen the conversation a little while down the road,” she says.

“It holds them accountable for doing what they say they’re going to do in the future.”

Look for ‘Plan B’

Sometimes, even when you’ve put in the work and proven your worth, the company’s budget doesn’t have any wiggle room for you.

In cases like that, French encourages workers to look beyond the bottom line when they’re negotiating.

There are some perks and benefits employers can offer in lieu of a raise, such as more flexibility in your work schedule, extra vacation or other quality-of-life improvements.

“What else could they be doing for you? Don’t just focus on the money. Focus on the entire package,” French says.

Vermunt agrees.

“I personally think it’s also important to think about what your Plan B is if they say no or if they give pushback,” she says.

Can I push up a starting offer?

For some people, Plan B looks like alternate compensation. For others, it’s striking out to find a new job.

While Canada might be firmly in a job seeker’s market at the moment, Vermunt says the quitting point is different for everyone.

But even for those who have tested the job market and found themselves with a new offer in hand, Vermunt notes there’s always room for a raise there, too.

READ MORE: Meta’s plans to hire in Canada have the tech sector worried. Here’s why

“People often don’t realize this, but you are in your most powerful salary negotiation position when you’ve just been offered a new job that you haven’t accepted yet,” she says.

Whatever starting salary you accept with a new company, you’re “setting a precedent” for what you’ll take going forward, according to Vermunt. Even if your job performance is off the chart in the first few months of the new gig, she says it would be hard to argue for a raise in that timeframe, so soon into the position.

“You should be doing some good salary negotiation at the beginning of a new job because that’s your power position.”

No comments:

Post a Comment