CRIMINAL CAPITALI$M

Meta Seeks Out Secrets From Over 100 Companies to Win Antitrust SuitLeah Nylen and Alex Barinka

Tue, September 13, 2022

(Bloomberg) -- To defend itself against the federal government, Meta Platforms Inc. says it needs its rivals to divulge some of their most closely held secrets.

Facebook’s parent company has so far subpoenaed 132 companies for documents, including Snap Inc., ByteDance Ltd.’s TikTok and the audio startup Clubhouse, and has warned that it may seek information from 100 more. The subpoenas have set off a cascade of legal challenges from Meta’s rivals, which accuse the company of using antitrust litigation as an excuse to dig through their confidential data.

The hunt for information was triggered by the US Federal Trade Commission’s lawsuit against Meta in 2020, alleging that the company monopolized the social networking market in part through its acquisitions of Instagram and WhatsApp. Meta contests the allegation that it has a monopoly and argues that the market is constantly evolving, with newcomers like TikTok and Clubhouse as key examples.

A trial isn’t likely until 2024 at the earliest, but both sides are marshaling evidence for the case.

Kellie Lerner, an antitrust litigator at the law firm Robins Kaplan LLP who isn’t involved in the suit, said Meta’s requests seek “massive amounts of competitively sensitive information.”

“You have a company accused of anticompetitive conduct who is now seeking very competitively sensitive information in discovery,” said Lerner, who has litigated many antitrust disputes. “The sheer breadth of what they are trying to get through discovery is something that, in my view, is not typical.”

Meta has asked for documents relating to some of the most important and sensitive elements of how competitors do business, according to court filings, including how they acquire users, scale up products and make money from features. It also wants materials on rivals’ marketing and sales strategies, quality metrics, contact information for their biggest advertisers, and details on their efforts to attract users from competitors, among other secrets.

Meta’s request is “overbroad and abusive,” Snap said in court filings. A California federal judge is set to decide Tuesday how much Snap -- a key figure in the FTC suit and a company that Meta previously tried to acquire -- must turn over to aid the defense’s case.

Meta’s request seeks “materials on every product and nearly every aspect of Snap’s business, with a time range that spans almost Snap’s entire existence,” lawyers for that company said. “Snap should not be forced to hand Meta insiders a competitive playbook.”

In court filings, Meta said it needs the information from its rivals to dispute the FTC’s contentions that it is a monopoly and doesn’t face competition.

“Meta competes vigorously with many companies to help people share, connect, communicate or simply be entertained,” Meta spokesperson Christopher Sgro said. “As a natural step in preparing our defense to the FTC’s lawsuit, we have served subpoenas on companies with which we compete or which we believe have other information relating to the FTC’s claims.”

While Snap is among the most vocal opponents of Meta’s subpoenas, it’s not the only one. TikTok complained that Meta has sought its “most confidential and highly sensitive business information.” Pinterest Inc., Microsoft Corp.’s LinkedIn and others raised concerns about Meta’s “highly invasive” requests, which they said seek their “most competitively sensitive documents.”

Other companies that Meta has subpoenaed include Tinder parent company Match Group Inc., Twitter Inc., Reddit Inc. and Oracle Corp.

Meta’s document requests also aren’t limited to US social networking services. It has sought information from Line Corp. -- a company owned by SoftBank Corp. and Naver Corp. that’s the top messaging service in Japan, Taiwan and Thailand -- as well as Japanese e-commerce giant Rakuten Group Inc., which owns Viber, a messaging app popular in India, Ukraine and Russia.

Beyond the scope of the requests, Meta’s rivals say the company’s history of hoarding intelligence on competitors should be considered. In 2013, Meta -- then known as Facebook -- acquired a little-known Israeli startup called Onavo that gave the social giant information on how often users open other apps on their phones. Facebook used Onavo’s data to find ways to quash or buy potential rivals, including WhatsApp, the FTC alleged in its complaint.

Apple Inc. banned Onavo in 2018, saying the data collection violated its App Store rules, and Facebook shut it down in 2019. That year, the social giant launched a new research app called Study that would compensate users for data on what smartphone apps they download, what features they use and how much time they spend on them.

TikTok is worried that Meta’s lawyers may inadvertently disclose information that could be used by the company, given its history of copying the features and tactics of its competitors. Meta duplicated Snapchat’s Stories product and TikTok’s short-form videos on both Facebook and Instagram. And the company is currently looking at changing users’ content feeds in a way that would resemble the approach used by TikTok.

TikTok’s attorneys said they have tried for months to narrow Meta’s request and asked the court to limit the information that Meta’s in-house lawyers could view.

“They cannot unlearn any highly sensitive competitive information they receive from TikTok, and it is unclear how they can do their job as in-house antitrust lawyers without advising Meta on competitive matters,” TikTok’s lawyers said.

Lerner, the antitrust litigator, noted that Meta also sought expansive documents from the FTC itself, asking the court to force the agency to turn over its original analysis of the 2012 Instagram and 2014 WhatsApp deals. The judge rejected Meta’s request.

“It reflects their scorched-earth defense strategy here to fight in whatever manner is available to them,” she said.

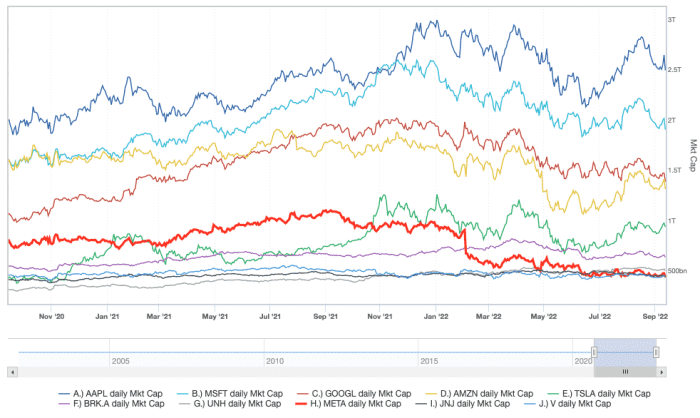

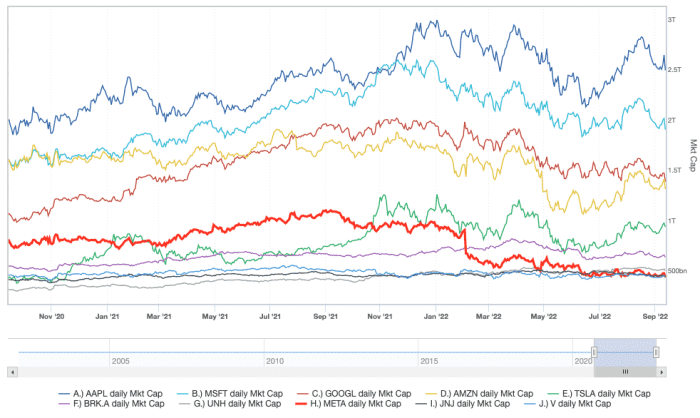

In One Chart

The Meta meltdown: This chart shows Facebook’s fall from grace among the most valuable U.S. companies

In-depth: Apple decimated Meta’s ad-tech empire. Now, it’s homing in on Facebook’s advertisers, too.

“Additional factors include competition from TikTok and investor skepticism regarding the company’s metaverse efforts,” Mazing said.

Executives at Meta have cautioned about the impact that inflationary pressures and other economic issues could have on the business, with Sheryl Sandberg, then the company’s chief operating officer, telling investors on Meta’s last earnings call that “recessions put pressure on marketers to make sure their ad budgets are spent in the smartest way possible,” though she thought that Meta tools could help them maximize their investments.

Chief Executive Mark Zuckerberg said on that July call that “we seem to have entered an economic downturn that will have a broad impact on the digital advertising business.”.

Visa shares have held up better amid the inflationary backdrop, falling just 8% on the year as Meta shares have lost 54%.

While Meta executives have sounded a cautious tone on the current landscape, Visa’s management team has come off more upbeat due to the nature of the payments giant’s business. Back in April, Visa Chief Financial Officer Vasant Prabhu said that inflation had “net-net” been positive for Visa, and as recently as Monday, he said that consumer spending remained resilient.

Visa “is somewhat isolated from the big macro story, the persistent inflation, as they get paid on nominal volumes,” Mazing told MarketWatch, noting that the company has also been benefiting from the big rebound in international travel and the spending that comes with it.

Meta briefly flirted with placement outside the top 10 U.S. most valuable U.S. companies at the start of August, but its dip below Visa this time around keeps it inside the top 10 as fellow technology company Nvidia Corp. NVDA, -9.47% has also seen its value fall sharply in recent weeks.

Nvidia ranked as high as seventh by market cap earlier this year, but it now stands in 15th place with a $327 billion valuation, per Dow Jones Market Data, amid inventory issues that have hit revenue totals and a U.S. crackdown on sales of high-performance artificial-intelligence technology to China.

The Meta meltdown: This chart shows Facebook’s fall from grace among the most valuable U.S. companies

Published: Sept. 13, 2022

Facebook parent company Meta Platforms was the fifth-most-valuable company in the U.S. near the end of last year, but has since fallen behind Visa, Tesla and others

Meta Platforms Inc. has seen a sharp decline in its market value since the end of last year, taking the company from the fifth-most-valuable U.S. company as of December to now the 10th-most-valuable. ASSOCIATED PRES

Dogged by competitive and macroeconomic threats, Meta Platforms Inc. is sinking down the ranks of the largest U.S. companies.

After a 9.4% daily slide in its stock, Meta META, -9.37% ranked 10th by market value as of Tuesday’s close, falling below Visa Inc. V, -3.37% for the first time since the start of August. Meta, the parent company of Facebook and Instagram, ranked fifth among U.S. companies as recently as December, according to Dow Jones Market Data, and joined the four other Big Tech companies — Apple Inc. AAPL, -5.87%, Microsoft Corp. MSFT, -5.50%, Google parent Alphabet Inc. GOOGL, -5.90% GOOG, -5.86% and Amazon.com Inc. AMZN, -7.06% — in the $1 trillion club briefly last year.

Meta’s shares have been punished this year, however, amid concerns about competitive dynamics and the impact of economic uncertainty on advertising revenue. That $1 trillion market cap has been cut by more than half, allowing several companies to jump in front of Meta — which announced its new corporate name last October — on the valuation chart.

Meta’s market value has taken a steep plunge in the past year. SENTIEO

Visa was valued at $413 billion as of Tuesday’s close, compared with $412 billion for Meta. Exxon Mobil Corp. XOM, -2.34% is next on the list with a market capitalization of $397 billion, per Dow Jones Market Data. Standing above Visa are still the four other Big Tech companies in Apple, Microsoft, Alphabet and Amazon, as well as Tesla Inc. TSLA, -4.04%, Berkshire Hathaway Inc. BRK.A, -3.32%, UnitedHealth Group Inc. UNH, -3.25% and Johnson & Johnson JNJ, -2.60%.

Meta’s stock suffered its sharpest daily decline since February in Tuesday’s trading amid broad-market pressure brought on by the latest consumer-price-index reading, which resurfaced fears about the potential effects of inflation on the advertising landscape.

“Meta, like the other social-media companies, has been negatively affected by the moves that Apple did in the advertising business as well as the general anticipation of lower ad spending as we might be going into a recession,” said Nick Mazing, the director of research at Sentieo, who’s been tracking the changes in market values over recent weeks.

Facebook parent company Meta Platforms was the fifth-most-valuable company in the U.S. near the end of last year, but has since fallen behind Visa, Tesla and others

Meta Platforms Inc. has seen a sharp decline in its market value since the end of last year, taking the company from the fifth-most-valuable U.S. company as of December to now the 10th-most-valuable. ASSOCIATED PRES

Dogged by competitive and macroeconomic threats, Meta Platforms Inc. is sinking down the ranks of the largest U.S. companies.

After a 9.4% daily slide in its stock, Meta META, -9.37% ranked 10th by market value as of Tuesday’s close, falling below Visa Inc. V, -3.37% for the first time since the start of August. Meta, the parent company of Facebook and Instagram, ranked fifth among U.S. companies as recently as December, according to Dow Jones Market Data, and joined the four other Big Tech companies — Apple Inc. AAPL, -5.87%, Microsoft Corp. MSFT, -5.50%, Google parent Alphabet Inc. GOOGL, -5.90% GOOG, -5.86% and Amazon.com Inc. AMZN, -7.06% — in the $1 trillion club briefly last year.

Meta’s shares have been punished this year, however, amid concerns about competitive dynamics and the impact of economic uncertainty on advertising revenue. That $1 trillion market cap has been cut by more than half, allowing several companies to jump in front of Meta — which announced its new corporate name last October — on the valuation chart.

Meta’s market value has taken a steep plunge in the past year. SENTIEO

Visa was valued at $413 billion as of Tuesday’s close, compared with $412 billion for Meta. Exxon Mobil Corp. XOM, -2.34% is next on the list with a market capitalization of $397 billion, per Dow Jones Market Data. Standing above Visa are still the four other Big Tech companies in Apple, Microsoft, Alphabet and Amazon, as well as Tesla Inc. TSLA, -4.04%, Berkshire Hathaway Inc. BRK.A, -3.32%, UnitedHealth Group Inc. UNH, -3.25% and Johnson & Johnson JNJ, -2.60%.

Meta’s stock suffered its sharpest daily decline since February in Tuesday’s trading amid broad-market pressure brought on by the latest consumer-price-index reading, which resurfaced fears about the potential effects of inflation on the advertising landscape.

“Meta, like the other social-media companies, has been negatively affected by the moves that Apple did in the advertising business as well as the general anticipation of lower ad spending as we might be going into a recession,” said Nick Mazing, the director of research at Sentieo, who’s been tracking the changes in market values over recent weeks.

In-depth: Apple decimated Meta’s ad-tech empire. Now, it’s homing in on Facebook’s advertisers, too.

“Additional factors include competition from TikTok and investor skepticism regarding the company’s metaverse efforts,” Mazing said.

Executives at Meta have cautioned about the impact that inflationary pressures and other economic issues could have on the business, with Sheryl Sandberg, then the company’s chief operating officer, telling investors on Meta’s last earnings call that “recessions put pressure on marketers to make sure their ad budgets are spent in the smartest way possible,” though she thought that Meta tools could help them maximize their investments.

Chief Executive Mark Zuckerberg said on that July call that “we seem to have entered an economic downturn that will have a broad impact on the digital advertising business.”.

Visa shares have held up better amid the inflationary backdrop, falling just 8% on the year as Meta shares have lost 54%.

While Meta executives have sounded a cautious tone on the current landscape, Visa’s management team has come off more upbeat due to the nature of the payments giant’s business. Back in April, Visa Chief Financial Officer Vasant Prabhu said that inflation had “net-net” been positive for Visa, and as recently as Monday, he said that consumer spending remained resilient.

Visa “is somewhat isolated from the big macro story, the persistent inflation, as they get paid on nominal volumes,” Mazing told MarketWatch, noting that the company has also been benefiting from the big rebound in international travel and the spending that comes with it.

Meta briefly flirted with placement outside the top 10 U.S. most valuable U.S. companies at the start of August, but its dip below Visa this time around keeps it inside the top 10 as fellow technology company Nvidia Corp. NVDA, -9.47% has also seen its value fall sharply in recent weeks.

Nvidia ranked as high as seventh by market cap earlier this year, but it now stands in 15th place with a $327 billion valuation, per Dow Jones Market Data, amid inventory issues that have hit revenue totals and a U.S. crackdown on sales of high-performance artificial-intelligence technology to China.

No comments:

Post a Comment