ALL CAPITALI$M IS STATE CAPITALI$M

Warning of 'energy-industry Lehman Brothers' moment as gas crisis brings on cash crunchEuropean governments scramble to support utilities buckling under the weight of growing margin calls

Bloomberg News

Archie Hunter

Publishing date:Sep 06, 2022

The aid effort is a response to what is a rapidly worsening situation, particularly after Russia cut off gas supplies through the key Nord Stream pipeline.

PHOTO BY NIKOLAY DOYCHINOV/AFP VIA GETTY IMAGES

Article content

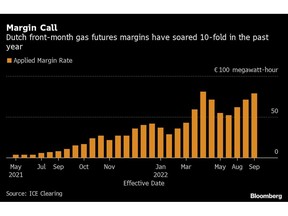

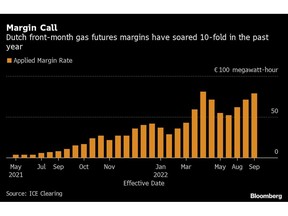

European governments are patching together emergency measures to support utilities amid fears that companies will buckle under the weight of growing margin calls, worsening an energy crisis that’s sent prices soaring and left the continent short of gas.

Recent days have seen a flurry of news — from Sweden to Switzerland to the UK — as companies and governments try to get to grips with the situation. Norway’s Equinor ASA has said that European energy trading risks collapsing under the weight of margin calls amounting to at least US$1.5 trillion

On Tuesday morning, Finnish utility Fortum Oyj got 2.35 billion euros (US$2.3 billion) of bridge funding to ensure adequate liquidity. Switzerland granted Axpo a credit line of up to 4 billion francs (US$4.1 billion). The company, which produces and trades renewable energy, asked for the credit line but hasn’t used it yet.

Along with such actions have come dire warnings as wild price moves increase the amount of collateral companies need to maintain hedges. Finland is warning of an “energy-industry Lehman Brothers” moment, with companies facing sudden cash shortages. It and Sweden announced a US$33 billion emergency liquidity facility Sunday to backstop utilities through loans and credit guarantees.

In the UK, Centrica Plc is in talks with banks on the potential extension of credit lines, according to a person familiar with the matter. Centrica declined to comment.

The aid effort is a response to what is a rapidly worsening situation, particularly after Russia cut off gas supplies through the key Nord Stream pipeline. Power providers and energy traders faced huge margin calls last winter when gas prices jumped to what were then record highs. Now as those levels are dwarfed after months of price surges, governments are beginning to heed industry warnings that policy support may be needed with prices expected to stay higher for longer.

“Companies have been bleeding cash for a long time because of the margin calls and collateral requirements,” said Kristian Ruby, secretary general of power industry group Eurelectric. “This triggers the question — ‘What if things get worse?’ Governments need to be ready to handle such a situation and back up companies with direct credit, otherwise there’s a risk of one falling and dragging down others.”

Article content

European governments are patching together emergency measures to support utilities amid fears that companies will buckle under the weight of growing margin calls, worsening an energy crisis that’s sent prices soaring and left the continent short of gas.

Recent days have seen a flurry of news — from Sweden to Switzerland to the UK — as companies and governments try to get to grips with the situation. Norway’s Equinor ASA has said that European energy trading risks collapsing under the weight of margin calls amounting to at least US$1.5 trillion

On Tuesday morning, Finnish utility Fortum Oyj got 2.35 billion euros (US$2.3 billion) of bridge funding to ensure adequate liquidity. Switzerland granted Axpo a credit line of up to 4 billion francs (US$4.1 billion). The company, which produces and trades renewable energy, asked for the credit line but hasn’t used it yet.

Along with such actions have come dire warnings as wild price moves increase the amount of collateral companies need to maintain hedges. Finland is warning of an “energy-industry Lehman Brothers” moment, with companies facing sudden cash shortages. It and Sweden announced a US$33 billion emergency liquidity facility Sunday to backstop utilities through loans and credit guarantees.

In the UK, Centrica Plc is in talks with banks on the potential extension of credit lines, according to a person familiar with the matter. Centrica declined to comment.

The aid effort is a response to what is a rapidly worsening situation, particularly after Russia cut off gas supplies through the key Nord Stream pipeline. Power providers and energy traders faced huge margin calls last winter when gas prices jumped to what were then record highs. Now as those levels are dwarfed after months of price surges, governments are beginning to heed industry warnings that policy support may be needed with prices expected to stay higher for longer.

“Companies have been bleeding cash for a long time because of the margin calls and collateral requirements,” said Kristian Ruby, secretary general of power industry group Eurelectric. “This triggers the question — ‘What if things get worse?’ Governments need to be ready to handle such a situation and back up companies with direct credit, otherwise there’s a risk of one falling and dragging down others.”

The European Commission is also examining measures to help with liquidity. These could include credit lines from the European Central Bank, new products as margin collateral, and temporary suspensions of derivatives markets, according to a policy background paper seen by Bloomberg News.

“We now have to do everything we can to secure our power supply,” Swiss Energy Minister Simonetta Sommaruga said Tuesday. “We need to avoid that because of a temporary liquidity bottleneck a company gets into a tailspin and pulls others with it.”

As wholesale buyers of power and energy, utilities tend to hold majority short hedging positions against their physical contracts, leaving them vulnerable if prices rise sharply and turn those positions loss making. When this happens, a company’s broker, bank or exchange may request cash to act as collateral against the position.

Late last month, Fortum said its collateral requirement rose by 1 billion euros to 5 billion euros in the space of a week. Analysts at Citigroup Inc. said last week that soaring power and gas prices forced utilities to put up more than 100 billion euros of additional collateral to cover margin calls.

“This is just capital that is dead and tied up in margin calls,” Helge Haugane, Equinor’s senior vice president for gas and power, said in an interview. “If the companies need to put up that much money, that means liquidity in the market dries up.”

One measure popular among lobby groups is to allow utility companies, but not financial participants in derivatives markets, to post products other than cash as collateral against trades, such as bank guarantees or carbon credits. That would free up utility balance sheets to use capital for other “meaningful purposes,” Eurelectric’s Ruby said.

As for credit , so far Germany has introduced Europe’s biggest scheme to backstop companies affected by the fallout of the war in Ukraine, setting aside 7 billion euros in loans to be made available to companies facing liquidity issues on top of a 100 billion-euro aid package. German energy giant Uniper SE last week sought an extra 4 billion euros after fully using a 9 billion-euro existing facility.

Vienna’s municipal power utility also secured 2 billion euros from the Austrian government to cover trading positions.

“European governments need someone to take the price and commodity risk right now,” said Steven Kelly, Senior Research Associate at the Yale Program on Financial Stability. “And if the banks aren’t able to play the intermediary role you’re going to have to go to the source and see sovereigns pick it up if they don’t want a liquidity crisis to turn into a balance-sheet crisis.”

Bloomberg.com

Sweden, Finland step in to avert Lehman-like situation for power companies

Swedish Finance Minister Mikael Damberg attends a press conference to propose relief for households affected by high electricity prices, in Rosenbad

Sun, September 4, 2022

By Supantha Mukherjee and Essi Lehto

STOCKHOLM/HELSINKI (Reuters) -Finland and Sweden on Sunday announced plans to offer billions of dollars in liquidity guarantees to power companies in their countries after Russia's Gazprom shut the Nord Stream 1 gas pipeline, deepening Europe's energy crisis.

Finland is aiming to offer 10 billion euros ($9.95 billion) and Sweden plans to offer 250 billion Swedish crowns ($23.2 billion) in liquidity guarantees.

"This has had the ingredients for a kind of a Lehman Brothers of energy industry," Finnish Economic Affairs Minister Mika Lintila said on Sunday.

When Lehman Brothers, the fourth-largest U.S. investment bank at the time, filed for bankruptcy in September 2008 with more than $600 billion in debt, it triggered the worst parts of the U.S. financial crisis.

"The government's programme is a last-resort financing option for companies that would otherwise be threatened with insolvency," Finland's Prime Minister Sanna Marin told a news conference.

State-controlled Finnish power company Fortum, which last week had urged Nordic regulators to take immediate action to avert defaults even among smaller players, praised the proposals made by Helsinki and Stockholm.

"We appreciate Finnish and Swedish governments taking swift action to stabilise the Nordic derivatives market and support Nordic energy companies in time of crisis," the company tweeted.

"It's crucial to keep companies operational. Our discussions with the Finnish government are ongoing," it said.

The guarantees aim to prevent ballooning collateral requirements from toppling energy companies that trade electricity on the Nasdaq Commodities exchange, an event that could in turn spread to the financial industry, the governments said.

Lower gas flows from Russia both before and after its February invasion of Ukraine have pushed up European prices and driven up electricity costs.

The rapid rise in electricity prices has resulted in paper losses on electricity futures contracts of power companies, forcing them to find funds to post additional collateral with the exchanges.

The collateral requirement on Nasdaq clearing recently hit 180 billion Swedish crowns, up from around 25 billion in normal times due to the surge in power prices, which have risen some 1,100%, Sweden's debt office said on Saturday.

The government feared that the Nord Stream 1 shutdown would lead to a further surge.

Finland's Marin said there needed to be measures at the European Union level to stabilize the functioning of both the derivatives market and the energy market as a whole.

Nasdaq clearing is a Swedish company supervised by Swedish authorities, which is the main reason Sweden was the first country to step in to tackle the potential crisis.

Swedish Finance Minister Mikael Damberg said on Sunday that the guarantees would last until March next year in Sweden and would also cover all Nordic and Baltic nations for the next two weeks only.

Without government guarantees, electricity producers could have ended up in "technical bankruptcy" on Monday, Damberg said.

($1 = 10.7633 Swedish crowns)

($1 = 1.0049 euros)

(Reporting by Supantha Mukherjee in Stockholm and Essi Lehto in HelsinkiEditing by Terje Solsvik, Hugh Lawson and Frances Kerry)

Nordic Utilities Get €33 Billion Backstops as Power Markets Fray

Nordic Utilities Get €33 Billion Backstops as Power Markets Fray

Niclas Rolander, Leo Laikola and Kati Pohjanpalo

Sun, September 4, 2022

(Bloomberg) -- The governments of Sweden and Finland decided to create emergency backstops to help utilities struggling to trade on power markets gripped by unprecedented turbulence.

They’re setting up liquidity facilities made up of loans and credit guarantees, worth $33 billion in total, to avoid some power companies going into technical defaults as soon as Monday over surging collateral requirements. The aim is to prevent Russia’s energy curbs from sparking a financial crisis.

“This has, in a way, the ingredients for an energy-industry Lehman Brothers” moment, Finnish Economy Minister Mika Lintila said at a news conference in Helsinki, referring to the US investment bank whose name has become synonymous with systemic risk after its collapse set off the global financial crisis in 2008.

Earlier on Sunday, Sweden’s Finance Minister Mikael Damberg had warned that failing to act “could have contagion effects on the rest of the financial market,” even as the “issue is currently isolated to energy producers.” Sweden is home to Nasdaq Clearing AB, which sits at the heart of the Nordic power market.

Russia has been limiting supply of its gas to the European Union, contributing to a surge in prices and concerns about shortages during the colder winter months ahead. Already at four times the level of a year ago, natural-gas prices are set to jump on Monday after Russia’s announcement its Nord Stream 1 gas pipeline to Germany would stay shut. That’s piling more pressure on industries and households -- and on policy makers to act.

“This winter, Russia is preparing for a decisive energy attack on all Europeans,” Ukraine’s President Volodymyr Zelenskiy said on Saturday. “It wants to weaken and intimidate the entire Europe, every state. Where Russia cannot do it by force of conventional weapons, it does so by force of energy weapons.”

Sweden is extending as much as 250 billion kronor ($23 billion) in credit guarantees, while Finland’s program worth as much as 10 billion euros ($10 billion) includes loans and guarantees. Both countries’ parliaments are set to begin processing the motions on Monday.

Norway’s government said in a separate statement it is closely monitoring developments in the financial power market but currently sees no need for measures of its own.

“Norwegian hydropower producers have high profitability and are not known to have challenges in securing market funding,” it said.

The skyrocketing price of energy in Europe has made it more expensive for utilities to buy and sell electricity, because of the collateral required to guarantee trades. Fortum Oyj said Aug. 29 its collateral rose by 1 billion euros in a week to 5 billion euros, excluding funds posted by its German subsidiary Uniper SE.

The utility welcomed the government action, and said its discussions on liquidity support continue with the Finnish state, its majority owner.

“It’s good that the Finnish and Swedish governments seek to quickly stabilize the Nordic power markets and come to the energy companies’ aid at this difficult time,” the Espoo, Finland-based company said in a statement on Sunday.

Fortum had turned to the Finnish state for assistance to secure its liquidity needs until its hedged power contracts go to delivery and collaterals are released. Uniper, which has also sought further liquidity help, is not eligible for funds under the Finnish plan. The German company was bailed out just weeks ago after a massive shortfall in deliveries of natural gas from Russia led to huge losses.

The European Energy Exchange AG has also asked for more government support to traders to guarantee their buying and selling as billions of euros put up as collateral for trades are sapping liquidity and making prices even more volatile.

While the Finnish program has no set limits per company, the European Commission may impose such restrictions, the government said.

The Swedish guarantees will be provided by the National Debt Office, and are primarily aimed at Swedish companies, though entities based in other Nordic and Baltic countries can access them during the initial two weeks, or until their governments provide support. The move comes a week ahead of Sweden’s election, in which a constellation of conservative and liberal parties are seeking to unseat the Social Democratic minority cabinet, led by Prime Minister Magdalena Andersson.

The European Union is also preparing to step into the energy market to dampen soaring power costs. The bloc aims to limit prices in the short term and in the longer term change the way energy is priced by severing the link between gas and electricity, blunting the weapon Russia is wielding.

Nordic Utilities Get €33 Billion Backstops as Power Markets Fray

Niclas Rolander, Leo Laikola and Kati Pohjanpalo

Sun, September 4, 2022

(Bloomberg) -- The governments of Sweden and Finland decided to create emergency backstops to help utilities struggling to trade on power markets gripped by unprecedented turbulence.

They’re setting up liquidity facilities made up of loans and credit guarantees, worth $33 billion in total, to avoid some power companies going into technical defaults as soon as Monday over surging collateral requirements. The aim is to prevent Russia’s energy curbs from sparking a financial crisis.

“This has, in a way, the ingredients for an energy-industry Lehman Brothers” moment, Finnish Economy Minister Mika Lintila said at a news conference in Helsinki, referring to the US investment bank whose name has become synonymous with systemic risk after its collapse set off the global financial crisis in 2008.

Earlier on Sunday, Sweden’s Finance Minister Mikael Damberg had warned that failing to act “could have contagion effects on the rest of the financial market,” even as the “issue is currently isolated to energy producers.” Sweden is home to Nasdaq Clearing AB, which sits at the heart of the Nordic power market.

Russia has been limiting supply of its gas to the European Union, contributing to a surge in prices and concerns about shortages during the colder winter months ahead. Already at four times the level of a year ago, natural-gas prices are set to jump on Monday after Russia’s announcement its Nord Stream 1 gas pipeline to Germany would stay shut. That’s piling more pressure on industries and households -- and on policy makers to act.

“This winter, Russia is preparing for a decisive energy attack on all Europeans,” Ukraine’s President Volodymyr Zelenskiy said on Saturday. “It wants to weaken and intimidate the entire Europe, every state. Where Russia cannot do it by force of conventional weapons, it does so by force of energy weapons.”

Sweden is extending as much as 250 billion kronor ($23 billion) in credit guarantees, while Finland’s program worth as much as 10 billion euros ($10 billion) includes loans and guarantees. Both countries’ parliaments are set to begin processing the motions on Monday.

Norway’s government said in a separate statement it is closely monitoring developments in the financial power market but currently sees no need for measures of its own.

“Norwegian hydropower producers have high profitability and are not known to have challenges in securing market funding,” it said.

The skyrocketing price of energy in Europe has made it more expensive for utilities to buy and sell electricity, because of the collateral required to guarantee trades. Fortum Oyj said Aug. 29 its collateral rose by 1 billion euros in a week to 5 billion euros, excluding funds posted by its German subsidiary Uniper SE.

The utility welcomed the government action, and said its discussions on liquidity support continue with the Finnish state, its majority owner.

“It’s good that the Finnish and Swedish governments seek to quickly stabilize the Nordic power markets and come to the energy companies’ aid at this difficult time,” the Espoo, Finland-based company said in a statement on Sunday.

Fortum had turned to the Finnish state for assistance to secure its liquidity needs until its hedged power contracts go to delivery and collaterals are released. Uniper, which has also sought further liquidity help, is not eligible for funds under the Finnish plan. The German company was bailed out just weeks ago after a massive shortfall in deliveries of natural gas from Russia led to huge losses.

The European Energy Exchange AG has also asked for more government support to traders to guarantee their buying and selling as billions of euros put up as collateral for trades are sapping liquidity and making prices even more volatile.

While the Finnish program has no set limits per company, the European Commission may impose such restrictions, the government said.

The Swedish guarantees will be provided by the National Debt Office, and are primarily aimed at Swedish companies, though entities based in other Nordic and Baltic countries can access them during the initial two weeks, or until their governments provide support. The move comes a week ahead of Sweden’s election, in which a constellation of conservative and liberal parties are seeking to unseat the Social Democratic minority cabinet, led by Prime Minister Magdalena Andersson.

The European Union is also preparing to step into the energy market to dampen soaring power costs. The bloc aims to limit prices in the short term and in the longer term change the way energy is priced by severing the link between gas and electricity, blunting the weapon Russia is wielding.

No comments:

Post a Comment