Liz Capo McCormick and Anchalee Worrachate

Sat, November 12, 2022

(Bloomberg) -- The historic bond selloff has wreaked havoc across global markets all year, while fueling a crisis of confidence in everything from the 60-40 portfolio complex to the world of Big Tech investing.

Now, heading into a possible economic downturn, the near-$24 trillion Treasury market is looking less dangerous all of a sudden.

The latest US consumer price data suggest inflation may be cooling at long last, driving investors back to the asset class in droves on Thursday as traders pared bets on the Federal Reserve’s hawkishness. Another reason why this once-reliable safe haven appears safer than it has in a while: Even rising interest rates have less power to crush bond portfolios like they have over the past two years.

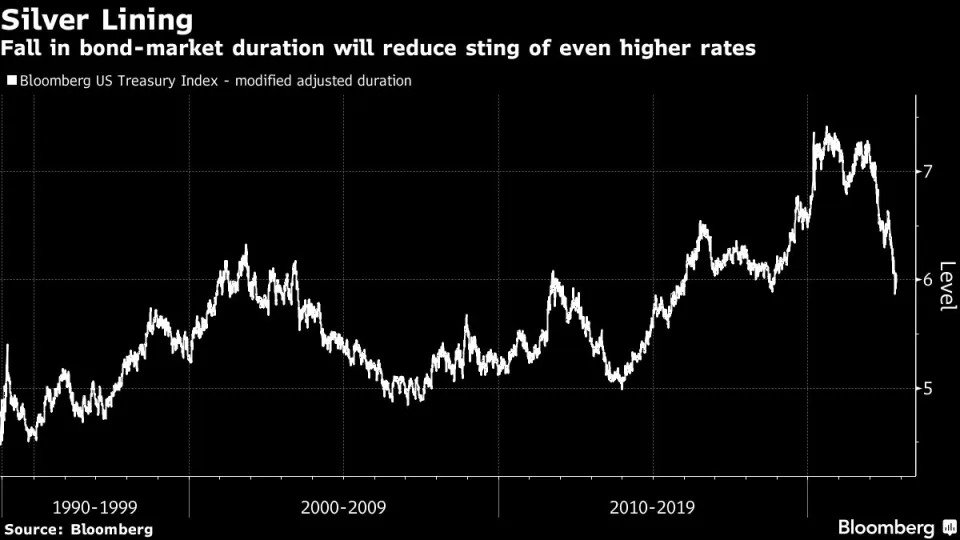

Just look at duration, which measures the sensitivity of bond prices to changes in yields. It’s a tried-and-tested gauge of risk and reward that guides all flavors of fixed-income investing -- and it’s fallen sharply this year.

With the Fed’s aggressive policy-tightening campaign this year pushing Treasury yields to around decade-highs, the margin of safety for anyone buying US debt right now has improved notably compared with the low-rate era, before the bull market collapsed in the inflationary aftermath of the pandemic.

Thanks to higher yields and coupon payments, simple bond math shows duration risk is lower, meaning a fresh selloff from here would inflict less pain for money managers. That’s a merciful prospect after two years of gut-wrenching losses on a scale largely unseen in the modern Wall Street era.

“Bonds are getting a bit less risky,” said Christian Mueller-Glissmann, head of asset allocation strategy at Goldman Sachs Group Inc., who shifted from underweight positions in bonds to neutral at the end of September. “The total volatility of bonds is likely to fall because you don’t have the same amount of duration, and that’s healthy. Net-net, bonds are becoming more investible.”

Consider the two-year Treasury note. Its yield would need to rise a whopping 233 basis points from before holders would actually incur a total-return loss over the coming year, primarily thanks to the cushion provided by beefy interest payments, according to analysis conducted by Bloomberg Intelligence strategist Ira Jersey.

With higher yields, the amount an investor is compensated for each unit of duration risk has risen. And it’s increased the bar before a further rise in yields creates a capital loss. Higher coupon payments and shorter maturities can also serve to reduce interest-rate risk.

“The simple bond math of yields going up brings duration down,” said Dave Plecha, global head of fixed income at Dimensional Fund Advisors.

And take the Sherman ratio, an alternative measure of interest-rate risk named after DoubleLine Capital Deputy Chief Investment Officer Jeffrey Sherman. On the Bloomberg USAgg Index, it’s increased from 0.25 a year ago to 0.76 today. That means it would take an 76 basis-point rise in interest rates over one year to offset the yield of a bond. A year ago it would have taken just 25 basis points -- equivalent to a single regular-sized hike from the Fed.

All told a key measure of duration on the Bloomberg US Treasury index, which tracks roughly $10 trillion, has fallen from a record 7.4 to 6.1. That’s the least since around 2019. While a 50 basis-point rise in yields inflicted a more than $350 billion loss at the end of last year, today that same hit is a more modest $300 billion.

That’s far from the all-clear, but it does reduce the downside risk for those wading back into Treasuries attracted to the income -- and the prospect that lower inflation or slowing growth will increase bond prices ahead.

After all, cooling US consumer prices for October offer hope that the biggest inflation shock in decades is easing, in what would be a welcome prospect for the US central bank when it meets next month to deliver a likely 50 basis-point increase in benchmark rates.

Two-year Treasury yields surged this month to as high as 4.8% -- the most since 2007 -- yet plunged 25 basis points Thursday on the CPI report. The 10-year note yield, which now hovers around 3.81%, up from 1.51% at the end of 2021, also slid 35 basis points over the past week, which was shortened due to Friday’s Veteran’s Day holiday.

The counterpoint is that buying bonds is far from a slam-dunk trade given the continued uncertainty over the inflation trajectory while the Fed is threatening further aggressive rate increases. But the math does suggests investors are now somewhat better compensated for the risks across the curve. That, along with the darkening economic backdrop, is giving some managers the conviction to slowly rebuild their exposures from multi-year lows.

“We’ve been covering duration underweights,” said Iain Stealey, CIO for fixed income at JPMorgan Asset Management. “I don’t think we are completely out of the woods yet, but we are definitely closer to the peak in yields. We are significantly less underweight than we were.”

And of course the recent rally suggests an asset class that’s fallen sharply out of favor over the past two years is finally turning the corner.

The defining narrative of 2023 will be “a worsening labor market, a low growth environment and moderating wages,” BMO strategist Benjamin Jeffery said on the firm’s Macro Horizons podcast. “All of that will reinforce this safe-haven dip-buying that we argue has started to materialize over the past few weeks.”

Global debt levels rose 'substantially' in 2021 - World Bank's Malpass

Andrea Shalal

Sat, November 12, 2022

World Bank President David Malpass holds a news conference at the headquarters of the International Monetary Fund

WASHINGTON (Reuters) - Debt levels among low- and middle-income countries rose sharply in 2021, with China accounting for 66% of lending by official bilateral creditors, World Bank President David Malpass said, underscoring the need to reduce the debt of poorer countries.

The World Bank's annual report on global debt statistics, due out next month, makes clear that private sector creditors also needed to participate in debt reductions, Malpass told Reuters in an interview on Friday.

The Group of 20 major economies and the Paris Club of official creditors created a common framework for debt treatments in late 2020 to help countries weather the fallout of the COVID-19 pandemic, but its implementation has been halting.

The creditors of Chad reached the first agreement negotiated under the framework this week, but it leaves the country's longer-term debt sustainability in question because it does not include actual debt reduction, Malpass warned on Friday.

The World Bank, the International Monetary Fund and Western officials have become increasingly vocal about their frustration with China, now the world's biggest official bilateral creditor, and private sector lenders for not moving forward more quickly.

Preliminary data released by the World Bank in June showed the external debt stock of low- and middle-income countries rose, on average, 6.9% in 2021 to $9.3 trillion, outpacing the 5.3% growth seen in 2020.

Malpass said the bank's forthcoming International Debt Statistics report was troubling, but gave no specific numbers.

"It shows that the amount of debt grew substantially ... and the amount owed to China is some 66% of the total for the official bilateral creditors," he said, adding that Chinese entities were also big commercial creditors.

"The report makes clear that debt reduction needs to extend broadly to include the private sector and China," Malpass said, adding that the overall debt issue would be a big topic at the upcoming meeting of G20 leaders.

"There will be a recognition of the severity of the problem," Malpass said, although he said there had been "little uptake" of his push for an immediate freeze in debt payments when countries sought relief under the G20 common framework and other reforms aimed at speeding up debt restructuring efforts.

IMF and World Bank officials say 25% of emerging market and developing economies are in or near debt distress, and the number rises to 60% for low- and middle-income countries. Climate shocks, interest rate increases and inflation had heightened pressures on economies still recovering from COVID.

Malpass said China had been a reluctant player in the slow-moving process to date. "They're mostly an observer," he said.

Malpass also called for faster work on a debt restructuring for Zambia, which first requested help under the common framework in early 2021.

"There's an urgency to getting it done so that the debt reduction can occur and Zambia can begin attracting the new investment that's needed," he said.

For both Chad and Zambia, it was critical to speed up the process and enact real debt reductions, he said. "The longer the process goes on, the harder it is for the for the country and the people in the country to get back on their feet."

(Reporting by Andrea Shalal, Editing by Franklin Paul)

Andrea Shalal

Sat, November 12, 2022

World Bank President David Malpass holds a news conference at the headquarters of the International Monetary Fund

WASHINGTON (Reuters) - Debt levels among low- and middle-income countries rose sharply in 2021, with China accounting for 66% of lending by official bilateral creditors, World Bank President David Malpass said, underscoring the need to reduce the debt of poorer countries.

The World Bank's annual report on global debt statistics, due out next month, makes clear that private sector creditors also needed to participate in debt reductions, Malpass told Reuters in an interview on Friday.

The Group of 20 major economies and the Paris Club of official creditors created a common framework for debt treatments in late 2020 to help countries weather the fallout of the COVID-19 pandemic, but its implementation has been halting.

The creditors of Chad reached the first agreement negotiated under the framework this week, but it leaves the country's longer-term debt sustainability in question because it does not include actual debt reduction, Malpass warned on Friday.

The World Bank, the International Monetary Fund and Western officials have become increasingly vocal about their frustration with China, now the world's biggest official bilateral creditor, and private sector lenders for not moving forward more quickly.

Preliminary data released by the World Bank in June showed the external debt stock of low- and middle-income countries rose, on average, 6.9% in 2021 to $9.3 trillion, outpacing the 5.3% growth seen in 2020.

Malpass said the bank's forthcoming International Debt Statistics report was troubling, but gave no specific numbers.

"It shows that the amount of debt grew substantially ... and the amount owed to China is some 66% of the total for the official bilateral creditors," he said, adding that Chinese entities were also big commercial creditors.

"The report makes clear that debt reduction needs to extend broadly to include the private sector and China," Malpass said, adding that the overall debt issue would be a big topic at the upcoming meeting of G20 leaders.

"There will be a recognition of the severity of the problem," Malpass said, although he said there had been "little uptake" of his push for an immediate freeze in debt payments when countries sought relief under the G20 common framework and other reforms aimed at speeding up debt restructuring efforts.

IMF and World Bank officials say 25% of emerging market and developing economies are in or near debt distress, and the number rises to 60% for low- and middle-income countries. Climate shocks, interest rate increases and inflation had heightened pressures on economies still recovering from COVID.

Malpass said China had been a reluctant player in the slow-moving process to date. "They're mostly an observer," he said.

Malpass also called for faster work on a debt restructuring for Zambia, which first requested help under the common framework in early 2021.

"There's an urgency to getting it done so that the debt reduction can occur and Zambia can begin attracting the new investment that's needed," he said.

For both Chad and Zambia, it was critical to speed up the process and enact real debt reductions, he said. "The longer the process goes on, the harder it is for the for the country and the people in the country to get back on their feet."

(Reporting by Andrea Shalal, Editing by Franklin Paul)

No comments:

Post a Comment