Bipartisan bill targets crypto money laundering in wake of FTX collapse

Igor Bonifacic

·Weekend Editor

Wed, December 14, 2022

US Senators Elizabeth Warren and Roger Marshall have introduced a bipartisan bill designed to crack down on illegal uses of cryptocurrency. If passed, The Digital Asset Anti-Money Laundering Act would extend aspects of the Bank Secrecy Act (BSA), a Nixon-era law Congress passed to combat money laundering, to cover crypto entities such as wallet providers and miners. Specifically, the new legislation would apply so-called “Know-Your-Customer” rules to those entities by directing the Treasury Department’s Financial Crimes Enforcement Network (FinCEN) to treat them as money service businesses. Another BSA expansion would require US citizens to file a report with the Internal Revenue Service whenever they engage in transactions that involve more than $10,000 in digital assets.

Additionally, the legislation would direct FinCEN to implement a rule the agency proposed at the end of 2020 that would require financial institutions to report transactions involving “unhosted” digital wallets. Per CoinDesk, those are wallets where the user has complete control over the contents — rather than an exchange or other third party. The legislation would also prohibit financial institutions from using or transacting with digital asset mixers, which are frequently used to obscure the origin of funds.

“Rogue nations, oligarchs, drug lords, and human traffickers are using digital assets to launder billions in stolen funds, evade sanctions, and finance terrorism,” said Senator Warren. “The crypto industry should follow common-sense rules like banks, brokers, and Western Union, and this legislation would ensure the same standards apply across similar financial transactions. The bipartisan bill will help close crypto money laundering loopholes and strengthen enforcement to better safeguard US national security.”

The push from Senators Warren and Marshall to crack down on crypto money laundering comes a day after the Department of Justice, Securities and Exchange Commission and Commodity Futures Trading Commission announced civil and criminal charges against FTX founder and former CEO Sam Bankman-Fried. Due to time constraints, the likelihood of the bill passing in the current lame-duck session is low. Warren and Marshall will almost certainly need to reintroduce it next year.

Warren pushes bipartisan bill to regulate crypto firms after FTX collapse

Ed Pilkington

Wed, December 14, 2022

Photograph: Elizabeth Frantz/Reuters

Elizabeth Warren is pressing Congress to adopt new bipartisan legislation which would force crypto firms to abide by the same regulations as banks and corporations in an attempt to crack down on money laundering through digital assets.

The Democratic US senator from Massachusetts is pushing for the new controls on the crypto industry in the wake of the spectacular collapse of the cryptocurrency exchange FTX. On Tuesday its founder and former CEO Sam Bankman-Fried was charged with eight criminal counts including conspiracy to commit money laundering.

Related: Five things we know about the collapse of FTX and Sam Bankman-Fried

Warren’s bill is being co-sponsored by the Republican senator from Kansas Roger Marshall. The Digital Asset Anti-Money Laundering Act would essentially subject the world of crypto to the same global financial regulations to which more conventional money markets must conform.

Under current systems, crypto exchanges are able to skirt around restrictions designed to stop money laundering and impose sanctions. Should the bill be enacted into law it would authorize the Financial Crimes Enforcement Network (FinCen) to reclassify crypto entities as “money service businesses” which would bring them under basic regulations laid out in the Bank Secrecy Act.

In a statement to CNN, Warren said that the “commonsense crypto legislation” would protect US national security. “I’ve been ringing the alarm bell in the Senate on the dangers of these digital asset loopholes,” she said, adding that crypto was “under serious scrutiny across the political spectrum”.

Bankman-Fried, 30, was indicted by prosecutors at the southern district of New York and is being held in custody in the Bahamas. The US Securities and Exchange commission (SEC) has also brought civil charges against him, accusing him of creating a firm that was a “house of cards”.

An ongoing area of interest to investigators was the vast political contributions made by Bankman-Fried to the Democratic party, as well as to Republicans in the form, he has said, of secretive dark money donations. The Wall Street Journal has calculated that he gave more than $95,000 in direct campaign donations to the same members of the US House financial services committee who are now investigating him.

Even before the implosion of FTX, the treasury department was focusing on the feared risks to national security posed by relatively unregulated digital currency exchanges. In August it moved against Tornado Cash, a virtual currency mixer which it accused of laundering more than $7bn in virtual currency since 2019.

The Treasury said that Tornado Cash was attractive to launderers of the proceeds of cybercrime, including the Lazarus Group, a hacking group sponsored by North Korea. The entity’s appeal to cybercriminals was that it could move digital assets around anonymously, obscuring the origin and destination of transactions and hiding the parties involved.

Warren is a former Harvard law professor and expert on consumer protection and economic inequality. She entered the Senate in 2013, where she established herself as a leading progressive critic of corporate largesse and a spirited opponent of Donald Trump.

She made an unsuccessful bid for the White House in 2020.

Ed Pilkington

Wed, December 14, 2022

Photograph: Elizabeth Frantz/Reuters

Elizabeth Warren is pressing Congress to adopt new bipartisan legislation which would force crypto firms to abide by the same regulations as banks and corporations in an attempt to crack down on money laundering through digital assets.

The Democratic US senator from Massachusetts is pushing for the new controls on the crypto industry in the wake of the spectacular collapse of the cryptocurrency exchange FTX. On Tuesday its founder and former CEO Sam Bankman-Fried was charged with eight criminal counts including conspiracy to commit money laundering.

Related: Five things we know about the collapse of FTX and Sam Bankman-Fried

Warren’s bill is being co-sponsored by the Republican senator from Kansas Roger Marshall. The Digital Asset Anti-Money Laundering Act would essentially subject the world of crypto to the same global financial regulations to which more conventional money markets must conform.

Under current systems, crypto exchanges are able to skirt around restrictions designed to stop money laundering and impose sanctions. Should the bill be enacted into law it would authorize the Financial Crimes Enforcement Network (FinCen) to reclassify crypto entities as “money service businesses” which would bring them under basic regulations laid out in the Bank Secrecy Act.

In a statement to CNN, Warren said that the “commonsense crypto legislation” would protect US national security. “I’ve been ringing the alarm bell in the Senate on the dangers of these digital asset loopholes,” she said, adding that crypto was “under serious scrutiny across the political spectrum”.

Bankman-Fried, 30, was indicted by prosecutors at the southern district of New York and is being held in custody in the Bahamas. The US Securities and Exchange commission (SEC) has also brought civil charges against him, accusing him of creating a firm that was a “house of cards”.

An ongoing area of interest to investigators was the vast political contributions made by Bankman-Fried to the Democratic party, as well as to Republicans in the form, he has said, of secretive dark money donations. The Wall Street Journal has calculated that he gave more than $95,000 in direct campaign donations to the same members of the US House financial services committee who are now investigating him.

Even before the implosion of FTX, the treasury department was focusing on the feared risks to national security posed by relatively unregulated digital currency exchanges. In August it moved against Tornado Cash, a virtual currency mixer which it accused of laundering more than $7bn in virtual currency since 2019.

The Treasury said that Tornado Cash was attractive to launderers of the proceeds of cybercrime, including the Lazarus Group, a hacking group sponsored by North Korea. The entity’s appeal to cybercriminals was that it could move digital assets around anonymously, obscuring the origin and destination of transactions and hiding the parties involved.

Warren is a former Harvard law professor and expert on consumer protection and economic inequality. She entered the Senate in 2013, where she established herself as a leading progressive critic of corporate largesse and a spirited opponent of Donald Trump.

She made an unsuccessful bid for the White House in 2020.

Senate crypto hearing yields big claims, possible regulation

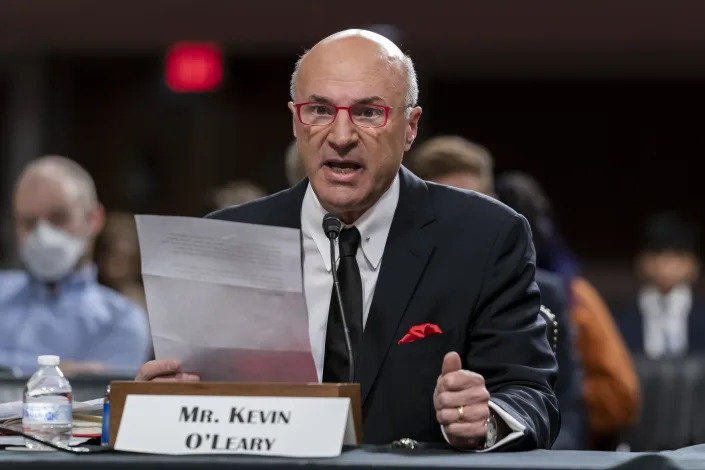

Investor and star of "Shark Tank" Kevin O'Leary, testifies before the Senate Banking Committee about cryptocurrency and the collapse of FTX, at the Capitol in Washington, Wednesday, Dec. 14, 2022. (AP Photo/J. Scott Applewhite)

GLENN GAMBOA

Wed, December 14, 2022

Whether increased regulation would have prevented the spectacular collapse of cryptocurrency exchange FTX was fiercely debated at a hearing of the Senate’s banking committee Wednesday. However, new legislation is potentially on the way.

Sen. Elizabeth Warren announced at the hearing bipartisan legislation aimed at cracking down on cryptocurrencies being used in money laundering. The legislation, co-sponsored by Republican Sen. Roger Marshall of Kansas, would require cryptocurrency exchanges to verify customer identities like banks and other financial institutions do.

“Crypto has become the preferred tool for terrorists, for ransomware gangs, for drug dealers and for rogue states that want to launder money,” said Warren, the Massachusetts Democrat, adding that “crypto doesn’t get a pass to help the world’s worst criminals – no matter how many television ads they run or how many political contributions they make.”

Republican Sen. Cynthia Lummis, of Wyoming, said she and Democratic Sen. Kirsten Gillibrand, of New York, would reintroduce their bipartisan legislation, the Responsible Financial Innovation Act, next year. That act would require disclosures and consumer protection obligations from cryptocurrency issuers.

Lummis, like several other Republicans on the banking committee, said the alleged financial crimes of former FTX CEO Sam Bankman-Fried should not be used to target cryptocurrency more generally.

“Let’s separate digital assets from corrupt organizations,” she said. “FTX is good old-fashioned fraud.”

However, Democratic Sen. Sherrod Brown, chairman of the Senate Committee on Banking, Housing and Urban Affairs, asked the hearing’s four witnesses – two crypto proponents and two critics – whether fraud was systemic at other firms in the industry. They all indicated that it was – one of the few points of agreement in the entire hearing.

Hilary J. Allen, professor of law at the American University Washington College of Law, testified that the current environment cryptocurrency operates in is highly conducive to fraud.

“Sam Bankman-Fried may have engaged in good old-fashioned embezzlement,” she said, “but the embezzlement was able to reach such a scale and go undetected for so long because it was crypto – shrouded in opacity, complexity, and mystique.”

Entrepreneur Kevin O’Leary, best known as Mr. Wonderful on the TV show “Shark Tank,” disagreed with the characterization, even though the $15 million he earned as a paid spokesman for FTX is now essentially worthless.

“I am of the opinion that crypto, blockchain technology and digital payment systems will be the 12th sector of the S&P within a decade,” he said, referring to the S&P 500, a well-known benchmark for stocks.

O’Leary also testified that Bankman-Fried told him that the collapse of FTX was due to its battle with crypto competitor Binance, which also held a stake in FTX.

“These two behemoths that owned the unregulated market together… were at war with each other,” O’Leary said. “And one put the other out of business.”

Federal prosecutors say Bankman-Fried defrauded FTX customers and investors starting in 2019 and illegally diverted their money to cover expenses, debts and risky trades at the crypto hedge fund he started in 2017, Alameda Research. Bankman-Fried, 30, was arrested Monday in the Bahamas at the request of the U.S. government, and remains in custody after being denied bail.

Pennsylvania Republican Sen. Pat Toomey, the ranking member of the banking committee, said FTX’s actions do not reflect the business of cryptocurrency as a whole.

“There’s nothing intrinsically good or evil about software – it’s about what people do with it,” he said. “Code committed no crime.”

However, actor and author Ben McKenzie Schenkkan, best known for his role as Jim Gordon on “Gotham,” said his research shows cryptocurrency is built on “misinformation, hype and fraud” and that the estimated 40 million Americans who have invested in it were lied to.

“In my opinion, the cryptocurrency industry represents the largest Ponzi scheme in history,” he said. “The fact that it has roped in tens of millions of Americans from all walks of life, as well as hundreds of millions of people worldwide, should be of concern to us all.”

Democratic Sen. Sherrod Brown, Republican Sen. Pat Toomey

Kevin O’Leary Says Binance ‘Intentionally’ Killed FTX 😳 #crypto

Brittany Bernstein

Wed, December 14, 2022

Kevin O’Leary, an investor and judge on Shark Tank who was paid $15 million to act as a spokesman for FTX, testified before the Senate Banking Committee on Wednesday about the crypto exchange’s collapse.

O’Leary has said as an investor he lost all of the money he was paid to act as a spokesman for the exchange, which fell apart in November, costing investors millions in losses.

FTX founder Sam Bankman-Fried was recently arrested on charges that he misled investors and mishandled billions in funds. He has been accused of misusing customer funds deposited with FTX to boost his crypto hedge fund, Alameda Research.

O’Leary was among a group of celebrities, including Tom Brady and Larry David, who were sued by FTX investors for their promotion of the firm. He said he put roughly $9.7 million into crypto from the $15 million deal. The rest went to taxes and agent fees, he said.

Senator Pat Toomey (R., Pa.) asked O’Leary on Wednesday why he believes FTX failed.

O’Leary recounted reaching out to Bankman-Fried after the investor discovered his accounts were stripped of all of their assets and accounting and trade information.

“I couldn’t get answers from any of the executives in the firm so I simply called Sam Bankman-Fried and said, ‘Where is the money, Sam?'” O’Leary testified.

He said he then discovered that Bankman-Fried had spent between $2 billion and $3 billion to repurchase shares from Binance CEO Changpeng Zhao, who held 20 percent ownership in Bankman-Fried’s firm.

O’Leary said he asked Bankman-Fried what would compel him to do that. The founder replied that Zhao would not comply with regulators’ requests for data that would allow the firm to get licensed. The founder allegedly told O’Leary “the only option” FTX had was to buy Zhao out at an “extraordinary valuation” of close to $32 billion.

“That stripped the balance sheet of assets,” O’Leary said. “You ask me why it went bankrupt. Go to the last week. All of a sudden in social media, CZ is asking for another $500 million. He wants to do a block trade of FTT, or the proprietary token of FTX. He wants to convert it back to fiat. Why would you put that out there? You know it’s going to push down the value of that coin dramatically. That’s exactly what happened.”

O’Leary said the two “behemoths that own the unregulated market together” were at “war with each other and one put the other out of business intentionally.”

“Now, maybe there’s nothing wrong with that,” he said. “Maybe there’s nothing wrong with love and war. But Binance is a massive unregulated global monopoly now. They put FTX out of business.”

Binance was founded in China but quickly moved out of the country when the government announced it would impose regulations on cryptocurrency trading.

Despite the company’s founding in Shanghai, Zhao has said it “couldn’t be further from the truth” that Binance is run by the Chinese Communist Party or is a “Chinese spy.” Zhao was born in China but is a naturalized Canadian citizen.

Zhao argued in a blog post that it would be impossible for Binance to be a Chinese company today as Binance and other crypto exchanges “have been designated a criminal entity in China.”

No comments:

Post a Comment