Uranium price showing resilience relative to other commodities – report

MINING.com Editor | April 18, 2023 |

Stock image.

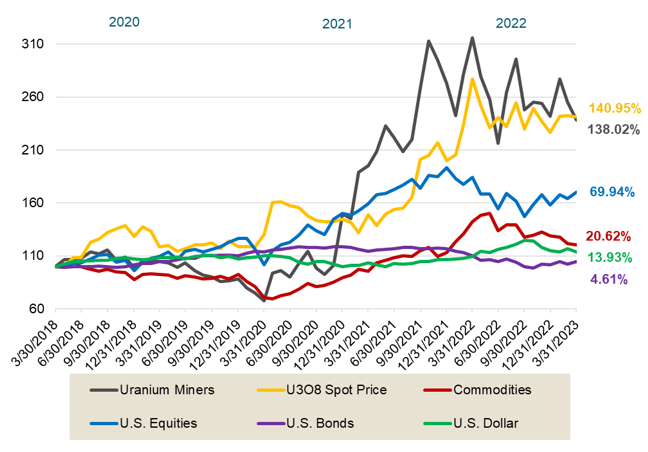

The U3O8 uranium spot price fell slightly from $50.85 to $50.70 in March and remains up 4.93% year-to-date as of March 31, 2023, showing strength relative to other commodities, which declined 6.47% YTD (as measured by the BCOM Index), Sprott Asset Management said in its latest uranium report.

Over the longer term, uranium has demonstrated even greater resilience within the commodity space, Sprott added. For the five years ended March 31, 2023, U3O8 spot appreciated a cumulative 140.95% compared to 20.62% for the BCOM.

Physical uranium and uranium stocks have outperformed other asset classes over past five years. Credit: Sprott

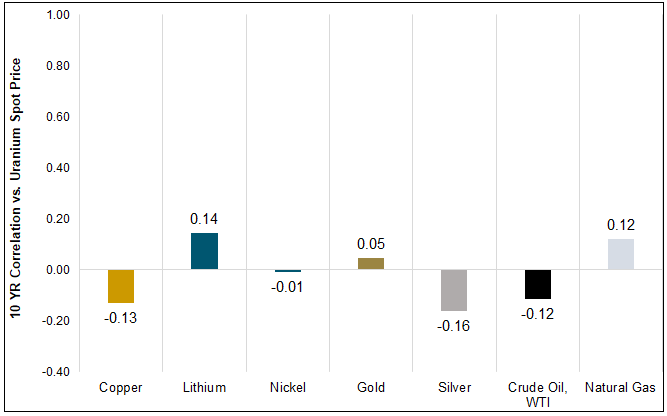

“We believe that uranium market fundamentals, which are the most positive in over a decade, will continue to support prices. Physical uranium, which demonstrates low correlation to other major asset classes, also shows low historical correlation to other commodities,” said Jacob White, ETF product manager at Sprott Asset Management.

“These characteristics make uranium an attractive option when considering portfolio diversification,” he added.

“We believe that uranium market fundamentals, which are the most positive in over a decade, will continue to support prices. Physical uranium, which demonstrates low correlation to other major asset classes, also shows low historical correlation to other commodities,” said Jacob White, ETF product manager at Sprott Asset Management.

“These characteristics make uranium an attractive option when considering portfolio diversification,” he added.

Uranium spot demonstrates low correlation to other commodities. Credit: Sprott

Uranium mining equities, in contrast to physical uranium, fell 6.74% in March and are off just 1.48% year-to-date, buoyed by January’s stellar performance. Like physical uranium, uranium mining equities have had notable long-term results, having gained a cumulative 138.02% for the five years ending March 31, 2023, Sprott noted.

According to Sprott’s analysis, uranium equities were impacted by March’s challenging headwinds (i.e. the US banking crisis), and smaller-cap, junior uranium miners were the main detractors for the month. However, the firm noted that despite the selling pressure in March, junior uranium miners continue to make progress with production restarts, uranium contracting with utilities and exploration programs.

While the stronger uranium price is encouraging the restart of idle capacity, pricing remains well below the levels required for new greenfield production, Sprott said. In addition, while utilities have contracted to purchase the highest amount of uranium in 10 years, their purchasing activity remains below annual replacement levels.

“The performance of uranium miners in March did not reflect the sector’s increasingly bullish fundamentals. We believe the uranium bull market still has a long way to run. Conversion and enrichment services price increases may likely cascade to the uranium spot price and support uranium miners,” noted White.

“Over the long term, increased demand in the face of an uncertain uranium supply may likely support a sustained bull market,” he added.

Uranium mining equities, in contrast to physical uranium, fell 6.74% in March and are off just 1.48% year-to-date, buoyed by January’s stellar performance. Like physical uranium, uranium mining equities have had notable long-term results, having gained a cumulative 138.02% for the five years ending March 31, 2023, Sprott noted.

According to Sprott’s analysis, uranium equities were impacted by March’s challenging headwinds (i.e. the US banking crisis), and smaller-cap, junior uranium miners were the main detractors for the month. However, the firm noted that despite the selling pressure in March, junior uranium miners continue to make progress with production restarts, uranium contracting with utilities and exploration programs.

While the stronger uranium price is encouraging the restart of idle capacity, pricing remains well below the levels required for new greenfield production, Sprott said. In addition, while utilities have contracted to purchase the highest amount of uranium in 10 years, their purchasing activity remains below annual replacement levels.

“The performance of uranium miners in March did not reflect the sector’s increasingly bullish fundamentals. We believe the uranium bull market still has a long way to run. Conversion and enrichment services price increases may likely cascade to the uranium spot price and support uranium miners,” noted White.

“Over the long term, increased demand in the face of an uncertain uranium supply may likely support a sustained bull market,” he added.

No comments:

Post a Comment