Ottawa and BC Bet Big on Second Canadian LNG Terminal

- BC and Ottawa each commit $200M to Cedar LNG, Canada’s second LNG export terminal.

- The $5.9B floating facility co-owned by the Haisla First Nation and Pembina, is expected to begin operations by late 2028.

- Cedar LNG touts low emissions, powered by hydroelectricity and designed to displace higher-emission LNG and coal.

The British Columbia government has agreed to invest CAD$200 million in the Cedar liquefied natural gas project — the second Canadian LNG project expected to come online after LNG Canada, the first, shipped its first cargo from its LNG export terminal in Kitimat in early July.

Cedar LNG, jointly owned by the Haisla First Nation and Pembina Pipeline Corp, has an in-service date of late 2028. The project consists of a floating natural gas liquefaction plant and marine export terminal located in the Douglas Channel near Kitimaat Village, a Haisla community about 380 kilometers west of Prince George, BC.

It will have the capacity to liquefy approximately 3.3 million tonnes of natural gas per year for export to Asian markets.

The federal government has also agreed to contribute $200 million to Cedar LNG. Originally valued at $3 billion, Ottawa now says it will cost an estimated $5.9 billion to build, CBC News reported in March.

British Columbia Premier David Eby and Energy Minister Adrian Dix attended the announcement at the project site.

“Our market position, our proximity to the Asian market, makes it the best LNG in the world, and it's the lowest-emission LNG in the world,” Dix told a news conference on Tuesday. “And that is an achievement.

“It’s not just a question of displacing coal or other dirtier fuels,” he added. “It’s displacing other LNG, which has dramatically higher emissions.”

The $200 million will be put towards electrifying the plant, including a new transmission line and substation.

Cedar LNG is considered low emissions because the plant will be powered by hydroelectricity, including from the recently completed Site C dam.

Like LNG Canada, Cedar would be fed gas from the Coastal GasLink pipeline, in Cedar’s case via an 8-kilometer-long pipeline spur.

To turn it into liquid form, the gas must be cooled to 163 degrees below zero. To do that requires a great deal of power, with massive compression units running 24/7.

While proponents of a Canadian LNG industry say liquefied natural gas from Canada could help reduce global greenhouse gas emissions by replacing coal in countries that still rely on the dirtier fuel, environmentalists argue LNG creates its own emissions through the liquefaction and transportation process, as well as through the drilling and flaring of natural gas.

Opposition Leader John Rustad criticized the long permitting times in BC, noting it’s taken many more years for the industry to get off the ground compared to the United States.

“Americans didn't even consider starting it until 12 years ago. We’ve managed to get one plant up, one major plant up and running. They have 16,” he said.

Premier Eby though is bullish on Canadian LNG, especially in light of the Trump trade war.

“If you are a government in Asia looking for reliable energy sources, that you can count on, nobody would be looking at the United States right now,” he said via this Global TV News clip.

Cedar LNG fits in with Prime Minister Mark Carney’s plan to fast-track major project reviews to make Canada an “energy superpower.”

His government’s Bill C-5 was recently passed.

The legislation fulfils a campaign promise by Carney to speed up approvals of what he calls nation-building projects, including mines and oil pipelines. Proponents of such projects often face duplicate environmental permitting processes involving the federal and provincial governments and affected First Nations.

A new poll suggests Canadians are more in favor of energy infrastructure than previously. The poll by Environics Research found that 73 percent of Canadians support building new oil pipelines.

Talk of Canada as an energy superpower however may be premature.

The Trump administration has been touting LNG from Alaska, a similar product with the same export markets in mind. Trump recently said the United States and Japan are to form a joint venture for Alaskan LNG.

It was unclear whether he was talking about the proposed $44 billion Alaska LNG project, which Reuters says consists of an 800-mile pipeline carrying gas to a planned liquefaction plant for export.

Several Japanese companies have expressed interest in buying LNG from the project, along with Thailand's PTT and India's GAIL.

A recent Oilprice.com piece says floating LNG terminals like Cedar LNG have a bright future:

Floating liquefied natural gas (FLNG) terminals are gaining momentum on the global LNG market, with capacity expected to triple by 2030 according to research from Rystad Energy. Once hindered by technical and operational challenges, FLNG projects are now achieving utilization rates comparable to onshore terminals. With LNG demand rising alongside the growing viability of smaller gas fields, FLNG is emerging as a faster, more flexible and cost-effective solution capable of adapting to shifting market dynamics while unlocking previously stranded reserves.

By Andrew Topf for Oilprice.com

Floating LNG Capacity Set to Skyrocket by 2030

- Global FLNG capacity is expected to more than triple by 2030, reaching 42 million tonnes per annum, due to its increasing viability and adaptability.

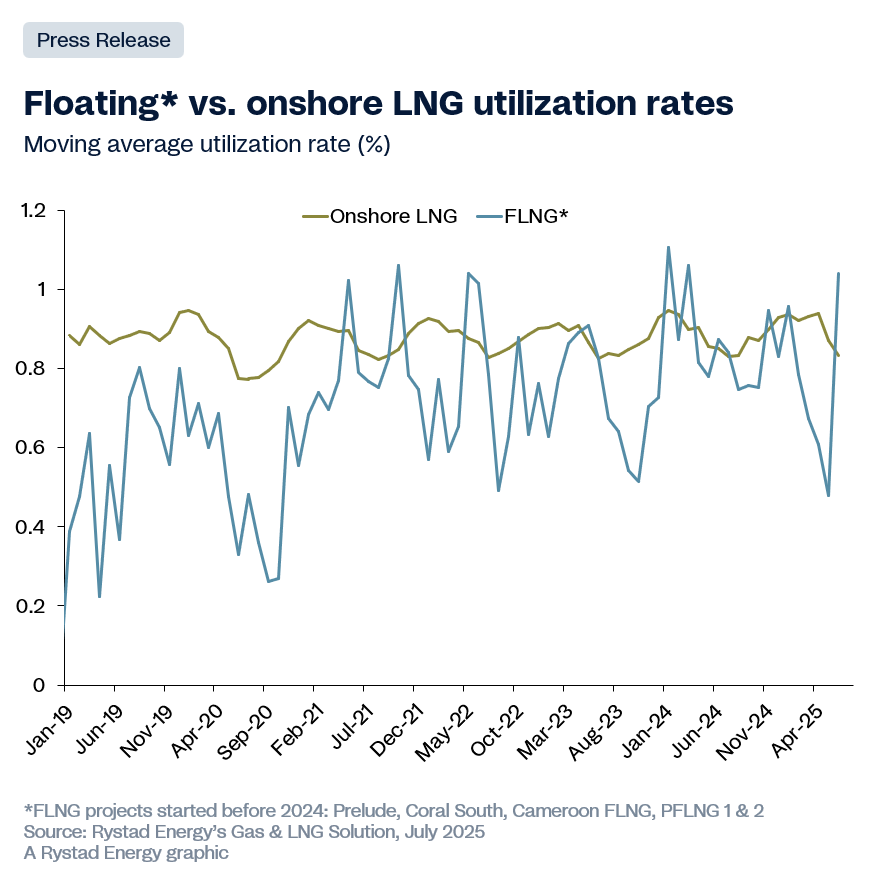

- FLNG projects have overcome initial technical challenges and now achieve high utilization rates comparable to onshore terminals, with capital expenditure per tonne significantly declining.

- The accelerated project timelines of FLNG units, averaging around three years for newbuilds, make them a preferred solution for developers seeking faster returns and reduced risk.

Floating liquefied natural gas (FLNG) terminals are gaining momentum on the global LNG market, with capacity expected to triple by 2030 according to research from Rystad Energy. Once hindered by technical and operational challenges, FLNG projects are now achieving utilization rates comparable to onshore terminals. With LNG demand rising alongside the growing viability of smaller gas fields, FLNG is emerging as a faster, more flexible and cost-effective solution capable of adapting to shifting market dynamics while unlocking previously stranded reserves.

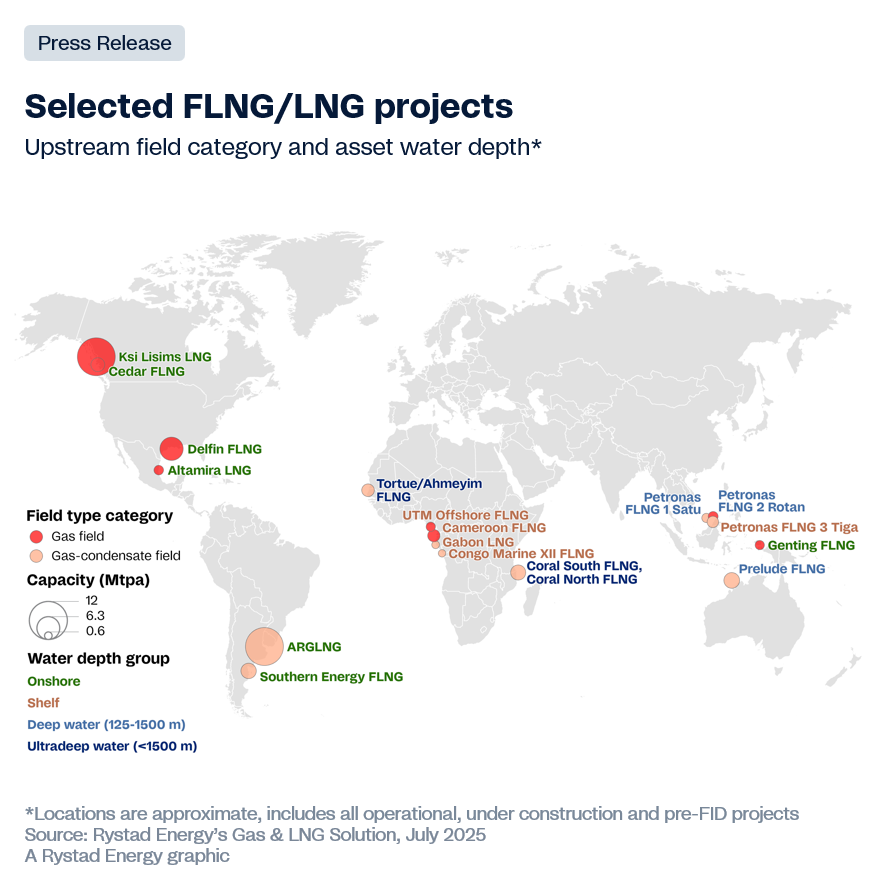

Rystad Energy estimates global FLNG capacity will reach 42 million tonnes per annum (Mtpa) by 2030, climbing to 55 Mtpa by 2035, almost four times the 14.1 Mtpa recorded in 2024. Terminals commissioned before 2024 achieved an average utilization rate of 86.5% in 2024 and 76% to date in 2025, figures comparable to global onshore LNG facilities.

FLNG has come a long way in less than a decade. The only real roadblocks were early teething issues that come with any new technology, as seen with projects like Shell’s Prelude, which faced cost overruns and unstable output. But since then, the industry has matured significantly, including Prelude itself. Utilization rates are improving, the technology is proving reliable across a range of environments, and the economics are starting to make more sense. From navigating permitting challenges in Canada to unlocking remote offshore reserves in Africa and Asia, FLNG is finally going mainstream,

Kaushal Ramesh, Vice President, Gas & LNG Research, Rystad Energy

Learn more with Rystad Energy's Gas & LNG Solution.

Without a prior blueprint to follow, early FLNG projects, such as Shell's Prelude, built in South Korea by the Technip–Samsung consortium, became a negative demonstration of FLNG's early limitations. Costs ballooned to $2,114 per tonne for liquefaction alone. However, as the industry gained operational and construction experience, capital expenditure per tonne has declined significantly, bringing costs in line with onshore LNG projects.

Proposed developments along the US Gulf Coast now average around $1,054 per tonne. Delfin FLNG, a proposed project in the US, sits just above that average at $1,134 per tonne, while Coral South FLNG in Mozambique, which is similar in scale, reports a comparable liquefaction cost of $1,062 per tonne. However, we note that project concepts are not entirely comparable. Some are complex integrated producers with upstream components as part of the LNG facilities, while others simply liquefy pipeline-spec gas.

In parallel, FLNG developers are increasingly turning to vessel conversions as a cost-efficient alternative to newbuild facilities. Projects such as Tortue/Ahmeyim FLNG, Cameroon FLNG and Southern Energy’s FLNG MK II have achieved notably lower capex levels of $640, $500 and $630 per tonne, respectively, by repurposing Moss-type LNG carriers. These conversions benefit from the vessels’ modular spherical tank design, which allows for simpler integration of prefabricated liquefaction modules. With several Moss-type LNG tankers expected to retire in the coming years, more could be repurposed, expanding the pipeline of lower-cost FLNG solutions.

FLNG vessels are also proving their operational flexibility across diverse environments, from deepwater to ultra-deepwater fields and even onshore supply. Should certain projects stall, their vessel could be relocated or sold, demonstrating the inherent mobility and adaptability of FLNG assets.

In the current energy environment, where markets remain tight but face the risk of oversupply, speed to first production is critical. Extended construction timelines delay revenue generation and expose projects to a higher risk of cost overruns. Rystad Energy data also shows that FLNG units can be delivered significantly faster than onshore liquefaction facilities, enabling quicker final investment decisions and more agile execution. On average, newbuild FLNG projects are completed in approximately three years, compared to about 4.5 years (capacity-weighted) for operational onshore plants. For FLNG vessels currently under construction, the average projected build time is even lower at 2.85 years. This accelerating timeline is a key factor in the growing preference for FLNG, as developers seek to minimize exposure and accelerate returns.

No comments:

Post a Comment