Whitehaven Coal expects govt to decide by Aug 30 on controversial mine expansion

Reuters | July 14, 2021 | 10:24 pm Exploration Australia Coal

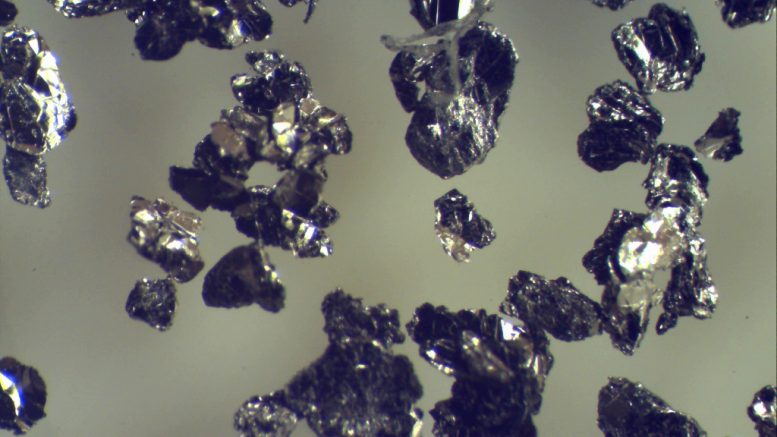

Site of the proposed Vickery coal mine. (Image courtesy of Whitehaven Coal).

Australia’s Whitehaven Coal said on Thursday it expected a government decision by Aug. 30 on approval for its Vickery coal mine extension, after a court ruled in May that climate change factors must be considered in the decision.

The Federal Court of Australia had ruled that the country’s environment minister has an obligation to children to consider the harm caused by climate change as part of her decision-making in approving the project.

The ruling came in response to a class-action lawsuit brought by eight teenagers that argued the expansion of the project in New South Wales state would contribute to climate change and endanger their future.

Australia’s government said last week it would challenge the court ruling.

“This does not prevent the minister from determining the project,” Whitehaven said in a production report, in its first public comments on the matter since the government indicated it would appeal. It added that it expected a government decision on the project by the Aug. 30 deadline.

Whitehaven also welcomed the government’s intention to appeal the court decision.

“There are broader potential implications of the judgement for greenhouse gas-emitting projects as a precedent,” it said.

“We are aware the government is seeking to have this appeal dealt with on an expedited basis.

“Whitehaven continues to progress design work for site infrastructure and draft management plans which will be further updated once conditions of approval of (environmental regulations) have been received,” it said.

The International Energy Agency, which has previously championed the oil and gas industry, outlined in May a path to net-zero emissions that suggested stopping new investments in oil, gas and coal supply.

Australia is the world’s top coal exporter and has not signed up to a zero emissions target by 2050, unlike most other developed nations. It ranked last out of 193 United Nations member nations for action taken to cut greenhouse gas emissions in the Sustainable Development Report 2021 released last month.

Whitehaven announced a 39.2% fall in fourth-quarter saleable coal production, hurt by downtime at the Narrabri mine following geological challenges and repair work.

(By Melanie Burton; Editing by Muralikumar Anantharaman)