MINING.COM and Lomiko Metals | July 16, 2021 |

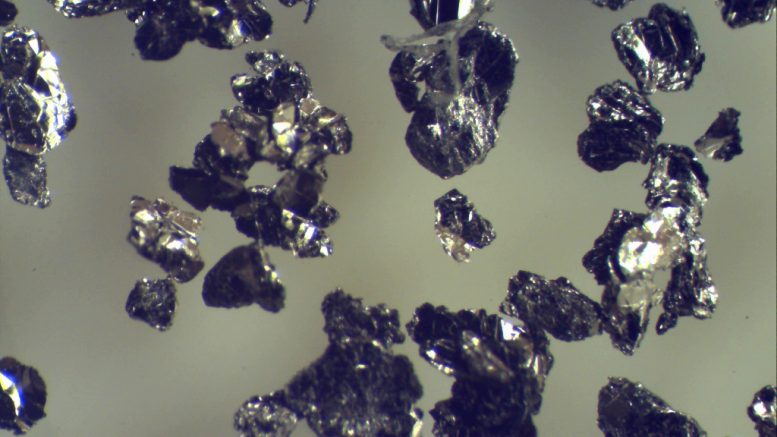

+50 mesh carbon flake graphite from Lomiko Metals’ La Loutre project in Quebec. Credit: Lomiko Metals.

Canadian junior Lomiko Metals (TSXV: LMR, US-OTC: LMRMF) is exploring for graphite and lithium – critical materials used in the lithium-ion batteries driving electric vehicles (EVs) and in grid-level energy storage systems.

Lomiko’s flagship asset is its high-grade La Loutre project in Quebec, about 120 km northwest of the port of Montreal. It is also earning a 70% stake in Critical Elements Lithium’s (TSXV: CRE; US-OTC: CRECF) Bourier lithium project in the province’s James Bay region.

The company’s current focus is on its wholly-owned La Loutre project, which Paul Gill, Lomiko’s CEO, believes “could potentially provide the low-cost, high-quality natural graphite needed to produce spherical graphite used in the anodes of lithium-ion batteries.”

Lomiko is working on a preliminary economic assessment for La Loutre, which Gill said will be released soon, and initial findings suggest that the project “could have attractive economics for potential investors.”

“Our goal for the project is to provide a source of competitively-priced graphite for customers in the North American and European markets,” he said.

The project, near the port of Montreal, is close to major industrial centres on the east coast of the United States, and also has easy access to European markets – making it in Gill’s view the perfect spot to source critical minerals needed in the shift to clean energy.

It also lies in the middle of several other graphite projects in a mineralised area called the Grenville Trend and therefore benefits from existing infrastructure, including access via highways and electricity generated from hydropower, as well as a skilled workforce.

In addition, the Lac-des-Iles mine, the only graphite mine currently operating in North America, is about 53 km northwest of La Loutre. The mine is owned by Imerys Graphite & Carbon.

Lac-des-Iles commenced operations in 1988 but is slated for closure in 2022. That mine “will need a replacement if there is going to be a domestic supply of graphite,” Gill said, adding that “currently, La Loutre is the best candidate.”

Created in 2009, Lomiko initially focused on optioning lithium properties around the world. However, as it searched for good projects, Quebec appeared to be one of the best jurisdictions in which to take a project from exploration to a producing mine, explained Gill. “It now looks a wise decision, and we feel that we have found that opportunity with La Loutre.”

Previous owners initially explored La Loutre for base and precious metals. But graphite mineralisation at the property ranged from 1-17% graphite close to surface, including visible outcrops of graphite flakes, historic data showed.

The 2,509-hactare La Loutre project comprises two zones: the Electric Vehicle (EV) zone and Graphene-Battery (GB) zone. The names, Gill noted, reflect the potential applications for the graphite from each zone.

A recent grab sampling and mapping program confirmed a graphite-bearing structure approximately seven km by one km in area. Samples returned multiple parallel zones of mineralisation 30-50 metres wide in the EV zone with grades of up to 20% graphite, and 20-50 metres wide on the GB zone grading up to 18% graphite.

In 2019, a 21-hole (2,985 metre) drill program completed on the EV zone returned multiple intervals of near-surface mineralisation. Highlights included drillholes LL-19-05, which intersected 116.9 metres grading 4.8% graphite starting from 51 metres down hole, including 15.2 metres of 18.04% flake graphite. Hole LL-19-17 cut 47.3 metres of 7.56% graphite from 15 metres, including 11.3 metres of 17.45% graphite.

“These high-grade graphite intervals are common on the EV zone,” noted Gill. “The graphite flakes on La Loutre are also larger and have lower sulphur content than those observed from the other graphite projects in the region, which increases the value of the graphite from the project.”

In April, metallurgical testing on composite samples returned a 93.5% recovery rate for graphitic carbon. The program culminated in a locked cycle test that yielded a combined graphite concentrate grading over 97% graphite.

These initial test results “were very encouraging and suggested that the graphite produced at La Loutre may be suitable for high-end industrial use,” said Gill.

Lomiko’s other asset in Quebec, Bourier, is about 450 km northeast of the town of Val-d’Or and lies within a region that Gill refers to as the “lithium triangle north.” The project, he said, could potentially provide a new source of lithium.

Under its earn-in agreement signed in April the company has the right to earn an initial 49% interest in Bourier by paying $50,000 in cash, issuing five million common shares of Lomiko to Critical Elements Lithium, and spending $1.3 million on exploration by December 31, 2022.

Once completed, Lomiko will then have the option to increase its interest in Bourier from 49% to 70% by paying an additional $250,000 in cash, issuing a further 2.5 million common shares, and spending $2 million on exploration. It must also deliver a resource estimate on the project by the end of December 2023.

Critical Elements Lithium will retain a 2% net smelter return (NSR) royalty on Bourier, of which Lomiko can purchase 1% for $2 million. Critical Elements Lithium will remain as project operator while Lomiko is completing its earn-in.

“Bourier also hosts a volcanic massive sulphide system over fifteen miles [24 km] long,” said Gill. “Under the option agreement with Critical Elements, we can also explore for other battery mineral discoveries, including nickel, copper, and zinc, which ideally positions us to provide the materials for de-carbonising global economies.”

Lomiko’s two projects should benefit from the support of the government of Quebec, which is keen to develop the province’s graphite resources and is supportive of the region’s extractive industries, Gill said.

Last year the province unveiled the Quebec Plan for the Development of Critical and Strategic Minerals 2020-25. Among other things, the plan is designed to support the exploration and mining of battery materials such as graphite, lithium, nickel, and cobalt by sharing the financial risk of exploration and helping mining companies manage their relationships with local communities and First Nations.

The federal government is also helping to support the development of a supply chain for EV battery materials in Quebec, Gill said.

In March, Ottawa and the government of Quebec pledged to invest $100 million ($50 million each) in Lion Electric, which is building a lithium-ion battery factory in Quebec. The plant is expected to produce lithium-ion battery packs for 14,000 medium-sized and heavy-duty vehicles per year. Scheduled to begin operations in 2023, the facility will likely be a significant source of demand for La Loutre’s graphite, Gill noted.

He also expects La Loutre to benefit from U.S. President Joe Biden’s decision to invest US$400 billion over the next ten years as part of a broad mobilization of public investment in clean energy and innovation. Those funds will be used to accelerate the deployment of clean energy technology throughout the U.S., including the deployment of more than 500,000 new public charging outlets for EVs by the end of the decade.

In addition, recent agreements between Canada and the U.S. have identified graphite as a critical element and recognised the need to develop a North American supply chain for the material.

In January last year, the two countries signed the Joint Action Plan on Critical Minerals Collaboration. The plan aims to secure supply chains for critical minerals, including graphite and lithium, needed for essential manufacturing industries, including communication, aerospace, defence, and clean energy technology.

“It will be essential to develop a source of inexpensive, high quality graphite for the North American market as quickly as possible,” said Gill, who is also CEO of Lomiko Technologies, a wholly owned subsidiary of Lomiko Metals. He has also funded the launch of G6 Materials (TSXV: GGG; US-OTC: LMRMF), a graphene and 3D printing company.

Demand for high-quality graphite is forecast to increase 15-fold over the next decade, rising from the current 200,000 tonnes to three million tonnes annually by 2030, according to forecasts by Benchmark Mineral Intelligence.

The market analyst said it expects the lithium-ion battery segment to be the fastest-growing application for natural graphite and is expected to be the largest end-user of graphite by 2024.

However, graphite supply is likely to remain tight over this period, says UK-based analytics firm GlobalData. In 2020, total global graphite output was 952,600 tonnes, a 15% decline from the previous year, it said.

“This market imbalance will keep upward pressure on graphite prices, making La Loutre an increasingly attractive prospect for investors,” noted Gill.

The preceding Joint-Venture Article is PROMOTED CONTENT sponsored by LOMIKO METALS and produced in cooperation with The Northern Miner. Visit www.lomiko.com for more information.

No comments:

Post a Comment