Transport Canada Invests in Saskatchewan

Canadian Pacific photo

Canada’s supply chain is still feeling the impacts of the pandemic, and the Government of Canada says it “is committed to addressing this by strengthening Canada’s supply chains and trade corridors, which will grow the economy and mitigate global inflation.”

Minister of Transport Omar Alghabra announced C$18.3 million in funding for four new projects under the National Trade Corridors Fund, “which will help to improve the efficiency of rail networks in Regina and southern Saskatchewan”:

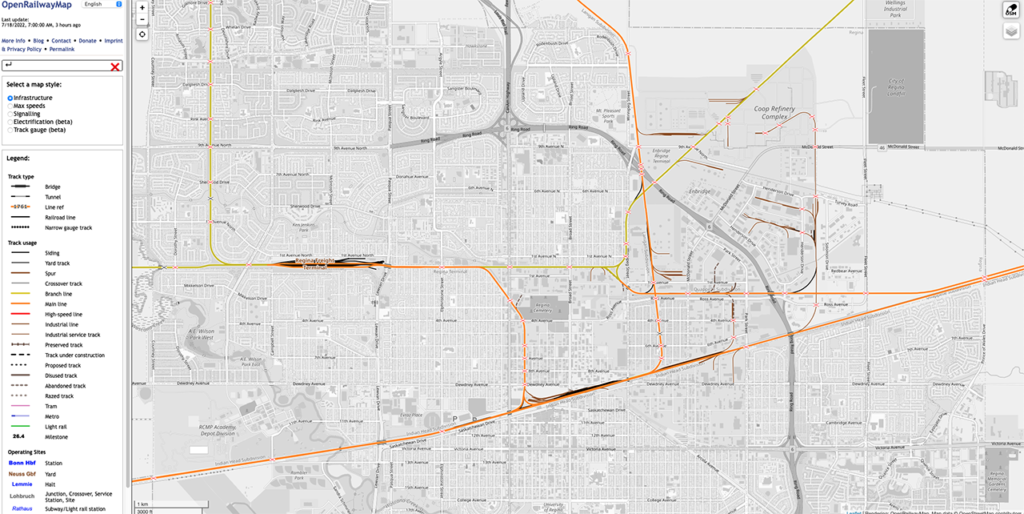

- C$1 million to develop a preliminary design to relocate railroad crossings in Regina, Saskatchewan (above). The City of Regina is contributing the remaining amount for a total investment of C$2.4 million.

- C$13.5 million for a railway grade stabilization project, where extensive railway work will be undertaken on the Canadian Pacific interchange near Eston, Saskatchewan. Last Mountain Railway will contribute an equal amount for a total investment of C$27 million.

- C$1.6 million for a new pre-interchange yard on the Canadian Pacific interchange near the town of Assiniboia, Saskatchewan, which will increase operating interchange capacity, allowing increased traffic flow and improved fluidity. Great Western Railway will contribute an equal amount for a total investment of C$3.2 million.

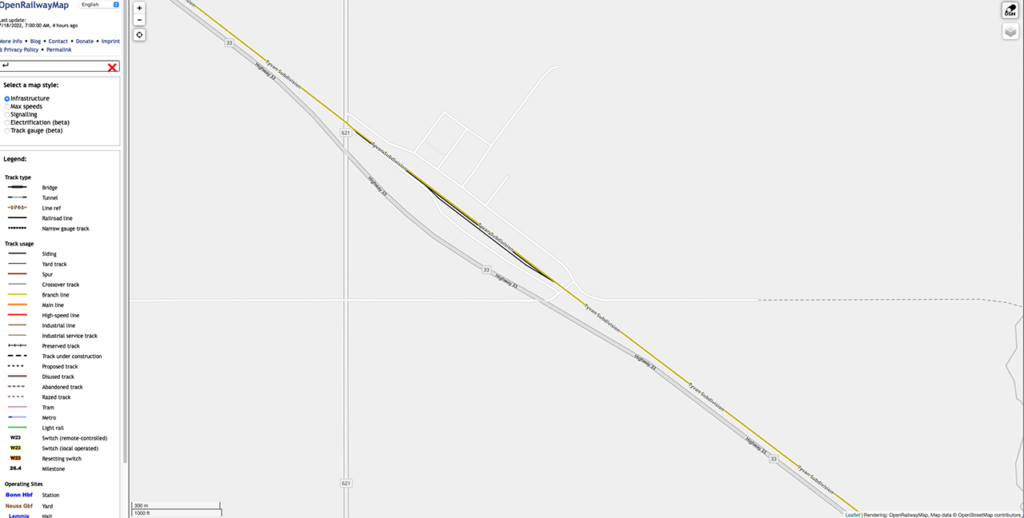

- C$2.2 million to build 12,000 feet of additional track to address congestion issues at the interchange between the Stewart Southern Railway (former CP Tyvan Subdivision) and Canadian Pacific in Lajord, Saskatchewan (below). Purely Canada Foods will contribute the remaining funding toward the project for a total investment of more than C$6.5 million.

“Through the National Trade Corridors Fund, the Government of Canada is investing in well-functioning trade corridors to help Canadians compete in key global markets, trade more efficiently with international partners, and keep Canadian supply chains competitive,” Alghabra said. “This is part of the Government of Canada’s long-term commitment to work with stakeholders on strategic infrastructure projects to address transportation bottlenecks, vulnerabilities, and congestion along Canada’s trade corridors.

“An efficient and reliable transportation network is key to Canada’s economic growth. The Government of Canada, through the National Trade Corridors Fund, is making investments that will support the flow of goods across Canada’s supply chains. The National Trade Corridors Fund is a competitive, merit-based program designed to help infrastructure owners and users invest in the critical transportation assets that support economic activity in Canada. Under this program, a total of C$4.6 billion over 11 years (2017-2028) has been announced. Budget 2022 provided C$450 million over five years, starting in 2022-23, to support supply chain projects through the National Trade Corridors Fund, which will help ease the movement of goods across Canada’s transportation networks.”

Transport Canada administers the National Trade Corridors Fund, “which supports improvements to Canada’s roads, rail, air, and marine shipping routes to foster domestic and international trade.” Provincial, territorial, and municipal governments, Indigenous groups, not-for-profit and for-profit private-sector organizations, some federal Crown corporations, and academia are all eligible for funding under the National Trade Corridors Fund.

Editor-in-Chief William C. Vantuono contributed to this story.

CP, KCS to STB: CPKC ‘Compellingly in the Public Interest, Should Be Approved Without Conditions’

KCS and CP locomotives at the top of the westbound grade at the Continental Divide in Crowsnest Pass, Alberta. Photo by David Duffin

The document exceeds 4,300 pages: Canadian Pacific’s and Kansas City Southern’s Surface Transportation Board filing on their merger: “Applicants’ Response to Comments and Requests for Conditions, Opposition to Responsive Applications, and Rebuttal in Support of the Application.”

The entire filing can be accessed from the STB website. The Filing ID is 304973. Here’s a summary of the points that CP and KCS make in response to the numerous comments and condition requests various parties have thus far filed with the STB:

“As we demonstrate in the Application and the evidence and argument submitted herewith, the Application is compellingly in the public interest and should be approved without conditions beyond those embodying the commitments Applicants are making … to ensure that the public interest benefits of the combination of CP and KCS come to pass,” the merger partners say in their introduction. “The transaction is supported by hundreds of shippers, short lines, passenger rail interests, labor organizations, and others. No shipper or shipper association requests that the transaction be denied. The Federal Railroad Administration endorses Applicants’ Safety Implementation Plan. Amtrak and other passenger rail interests support the transaction. Amtrak stresses ‘CP’s excellent record as an Amtrak host railroad and CP’s commitments to Amtrak’s efforts with states and others as detailed in the agreement’ reached between Amtrak and CP, and believes that the CP/KCS transaction ‘promises significant public benefits for the U.S. rail network.’ What opposition there is comes principally from the five Class I railroads. The protection these Class I railroads seek is itself evidence that they see the CP/KCS transaction an injecting new competition into the North American rail network.”

Point By Point

• “The transaction will result in significant public benefits. There is no merit to claims by Class I rivals that CPKC will not provide valuable new competitive options. The Class I critique of CPKC traffic estimates misses the fundamental point that the stronger competition that comes with the transaction is what really matters. [Our] estimates of the traffic CPKC will attract are reasonable and sound [and] are validated by the transaction’s Extensive shipper support and real-world developments. The KCS Board’s highly conservative pre-agreement synergies Estimates do not Undermine applicants’ anticipated benefits. There is zero risk to CPKC’s financial viability and continued investment, regardless of how much new traffic is attracted to the CPKC system, or at what rates. The Class I critique of the operating efficiencies generated by the transaction is invalid. CN’s continuing criticisms of the operating plan lack merit and are irrelevant to the Board’s evaluation of the transaction’s impacts.

• “There is no basis for concern about ‘vertical’ competition. The Board has extensive experience with end-to-end mergers and the net benefits they have brought. Commenters offer no new economic or other learning that calls into question the Board’s consistent precedents and factual conclusions. KCS has not used its control of Tex Mex and KCSM to foreclose UP or BNSF routings through the Laredo Gateway, and neither will CPKC. The same forces that ensured there was not foreclosure following KCS/Tex Mex and other cases will apply here. [Our] commitments—enforced as appropriate by shippers—are the tried-and-true way to address concerns about vertical foreclosure. The rate-setting mechanism proposed by UP and BNSF is both unnecessary and would be affirmatively anticompetitive. Shipper group desires for “open access” and other reregulatory remedies are not merger-related. Certain requests relating to “gateways” and “bottlenecks” represent an improper effort to revisit the Board’s bottleneck rate rules. Requests for “reciprocal switching access” are similarly unrelated to this transaction

• “The transaction will not lead to service disruption. Additional service-related conditions would unduly burden CPKC’s competition for no valid purpose.

• “Basic features of the transaction will prevent CPKC traffic growth from overwhelming rail capacity. The transaction will not cause disruption on the Lines KCS shares with UP and BNSF in Texas. UP and BNSF proceed from the false premise that CPKC Needs their permission to Use shared trackage to compete against them. The facts show that CPKC’s potential new trains will not exceed capacity on UP/BNSF trackage rights segments in Texas. There will be no capacity shortfall in the Houston Terminal complex. There is adequate capacity on the UP-owned Lines between Houston and Beaumont. Concerns about the Neches River Bridge at Beaumont are unwarranted. There is adequate capacity on the UP-owned Lines between Victoria and Robstown. UP and BNSF demands that CPKC fund 100% of any new infrastructure is overreaching and inappropriate. There will be adequate capacity for the traffic that CPKC hopes to attract elsewhere on its network.

• “The transaction will not adversely Impact Metra’s commuter services and will not meaningfully increase freight traffic on lines shared with Metra. Metra further misunderstands the transaction’s impacts because its expert’s RTC model is fundamentally flawed. The MD-W Line west of Bensenville Yard has ample capacity to accommodate eight additional daily freight trains. Developments independent of the transaction will further improve the performance of Metra’s trains on lines shared with CP, which values its partnership with Metra and regrets that Metra’s comments have mischaracterized Metra’s solid performance on lines shared with CP. Metra has consistently performed well on CP’s lines. CP leadership is committed to supporting Metra’s operations, consistent with its contractual obligations. None of Metra’s complaints about CP are related to the transaction; most of Metra’s pre-transaction dispatching concerns relate to operations that will be unaffected by the transaction. Dispatching Metra trains on the ‘wrong track’ is a pre-transaction concern without merit. Pre-transaction issues having no bearing on this proceeding. Metra’s complaints about PTC implementation issues are irrelevant and unfair. [We] are committed to reassure Metra and its ridership that the transaction will not impact Metra’s passenger service. Metra’s requests to force a shift of dispatching to Metra would override CP’s contractual rights and undermine rather than improve the handling of Metra trains. Metra has long sought control of dispatching on the MD-W and MD-N Lines; the Board’s precedents sharply disfavor forced shifts in dispatching. Transferring dispatching control to Metra would create more issues than it resolves. Metra’s request to alter the compensation terms of the CP/Metra agreement are overreaching. Demands for hundreds of millions in new infrastructure are either wildly overreaching or already in progress. Metra’s request for a binding standard and process for schedule changes and new trains improperly seeks to improve its contractual rights. Metra’s requested oversight conditions are inappropriate and unnecessary .

• “The Board should Reject CN’s proposed ‘inconsistent’ purchase of CPKC’s Springfield/East St. Louis Line. CN’s gambit is yet another round in CN’s effort to disrupt or delay the CP/KCS transaction. There is no competitive harm to address. Any divestiture of the Springfield/East St. Louis Line would harm the public interest, not enhance it. If CN is right about the ‘truck diversion’ potential of joint investments in the Springfield Line, a divestiture would not be necessary to achieve it. Were the Board to conclude that a remedy is required, it should not order a sale of the line, much less specify CN as the buyer.

• “Norfolk Southern’s requested relief is based on a misreading of the operating plan and would inappropriately alter pre-existing contractual rights to NS’s commercial advantage. CPKC will be highly motivated to continue to reap the rewards of the successful Meridian Speedway LLC joint venture. The facts contradict NS’s concerns about service impacts. The Wylie Intermodal Terminal has ample capacity to support [our] projected traffic increases. NS’s proposed contingent trackage rights make no sense as a ‘remedy’ for potential service concerns. NS’s request for contingent trackage rights would improperly convey to NS commercial rights that NS did not negotiate or pay for in 2006.

• “The Board should reject the relief requested by CSX. CSX’s arguments about the Meridian Speedway are unrelated to the transaction and should be ignored. CPKC will be eager to maintain or explore efficient interline relationships with CSX via all available gateways, and there is no need for relief protecting CSX.

• “BNSF’s veiled threats to demand future trackage rights it chose not to seek in this proceeding should be rejected with prejudice. BNSF’s desire for Board intervention in support of its quest for a future Mexican concession is not merger- related and would improperly involve the Board in Mexican affairs. BNSF’s proposed rights between Dallas and Shreveport would grant commercial rights BNSF chose not to acquire. BNSF’s proposed rights between Savanna, Ill. and Clinton, Iowa would grant commercial rights BNSF has previously sought.

• “The Board should not grant Union Pacific’s demand for conditions granting compulsory access to KCS’s self-funded new bridge at Laredo.

• “The Coalition [to Stop CPKC] communities demand mitigation measures disproportionate to the likely effects on the community. Hennepin County concerns fail for similar reasons. The Sierra Club’s requested conditions have no nexus to the transaction, which is expected to lower greenhouse gas emissions.

• “Concerns about CP’s tariff provisions applicable to hazardous shipments are not competitive issues or transaction-related and should be rejected. Concerns of certain wheat growers’ associations about potential competition from Canadian grain suppliers reflect more competition, not less … The late-submitted concerns of certain Federal Maritime Commissioners about diversions to Canadian ports are meritless.”

CPKC: CN, NS Seek Conditions

Written by Marybeth Luczak, Executive EditorThe Surface Transportation Board (STB) on July 1 accepted for consideration responsive applications by CN and Norfolk Southern (NS) regarding the Canadian Pacific-Kansas City Southern merger, which is under STB review and seeks to create North America’s first transnational freight railroad, Canadian Pacific Kansas City, or CPKC.

CP and KCS in September 2021 agreed to combine; STB in November 2021 accepted their application to form CPKC.

CP and KCS on May 13, 2022, submitted a revised operating plan as ordered by STB, and CN and NS on June 9 filed amended responses with each railroad requesting a number of conditions, including acquisition of the Springfield Line in Illinois and Missouri as well as certain trackage rights.

CN and its U.S. subsidiary Illinois Central Railroad Company (ICRR) seek, as a condition to any approval of the CP-KCS merger, approval of the sale of KCS’s line between Kansas City, Mo., and Springfield and East St. Louis, Ill., to ICRR.

“In connection with the line acquisition, ICRR also seeks acquisition of an 8.33% ownership share of Kansas City Terminal Railway Company (KCT), which would enable ICRR to operate over KCT-controlled trackage in Kansas City, and a 50% ownership interest in KCS’s International Freight Gateway terminal (IFG Terminal) south of Kansas City,” among other conditions, according to the STB decision (download below).

STB reported that NS is pursuing “certain contingent trackage rights for overhead movement on KCS’s line, between the connection of KCS with the Meridian Speedway, at Shreveport, La., at or near milepost V-169.85, and the Wylie Intermodal Terminal, in Wylie, Tex., at or near milepost T-197,” as a condition to any approval of the CP-KCS merger. The contingent trackage rights would apply only to intermodal traffic originating or terminating at the Wylie Intermodal Terminal, according to STB.

STB reported that it found “CN and NS’s responsive applications to be in substantial compliance with the regulations under which they were filed and finds no basis for rejecting them. The Board reserves the right to require supplemental information, if necessary. The Board also finds that it is not necessary to designate CN and NS’s proposed transactions as minor or significant.”

Formal written comments regarding the responsive applications are due by July 12, 2022. They must include “the commenter’s position in support of or in opposition to the transaction proposed in the responsive filing; any and all evidence, including verified statements, in support of or in opposition to the proposed transaction; and specific reasons why approval of the proposed transaction would or would not be in the public interest,” according to STB, which provides more information on filing requirements on its website.

Canada Investing $4.4MM to Improve Hudson Bay Railway Corridor Safety

Written by Marybeth Luczak, Executive Editor

“Our new investment will not only improve the safety and efficiency of Canada’s railways, but also strengthen our supply chain and tackle inflation by addressing bottlenecks, vulnerabilities and congestion along Canada’s trade corridors,” reported Transport Canada Minister Omar Alghabra reported in a July 13 Twitter post. (Photograph Courtesy of Alghabra via Twitter)

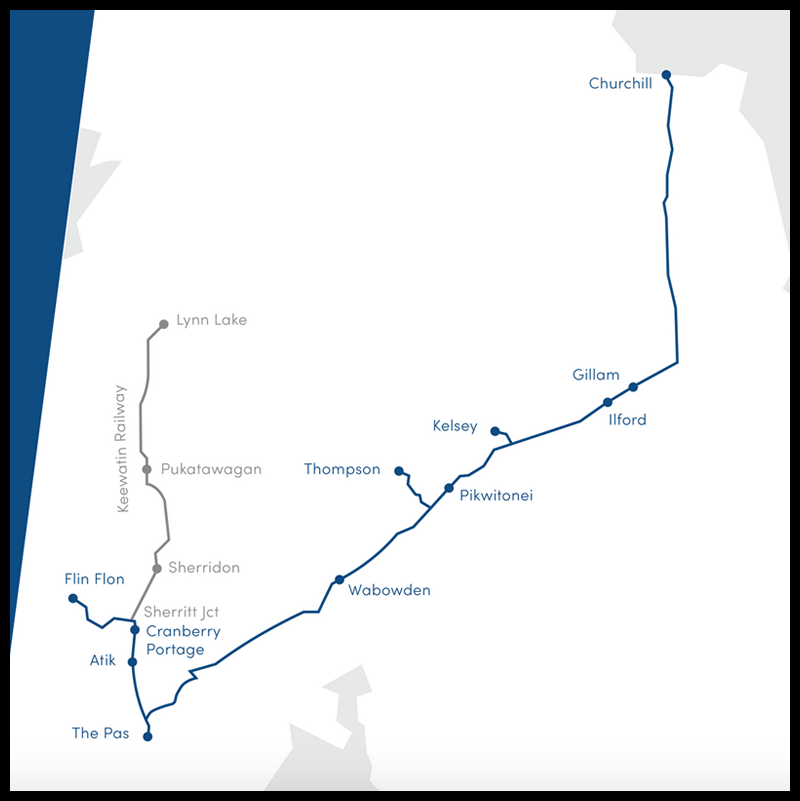

The government of Canada is committing C$4.4 million to identify potential mitigation strategies for permafrost hazards along the Hudson Bay Railway corridor in Manitoba, reported Minister of Transport Omar Alghabra on July 13.

The University of Calgary will undertake the study, and the results will be used “to ensure the safety and resiliency” of the corridor, which includes 627 miles of former CN trackage, according to Transport Canada. The funding is being provided through the National Trade Corridors Fund, which is described as “a competitive, merit-based program designed to help infrastructure owners and users invest in the critical transportation assets that support economic activity in Canada.”

“The Hudson Bay Railway corridor is a critical transportation, supply and tourism link for communities along the route, connecting Manitoba from north to south,” said Daniel Vandal, Canada’s Minister of Northern Affairs, and the Minister responsible for Prairies Economic Development Canada and for the Canadian Northern Economic Development Agency. “It also strengthens local economies by connecting the Port of Churchill to producers across the Prairies, supplying the world with Canada’s agricultural products and other goods. This funding will help address the hazards and impacts of climate change along the railway, keeping Indigenous and northern communities in Manitoba connected and safe.”

“Canada’s rail network is crucial to our supply chain,” said Minister Alghabra, who made the announcement at the CN Intermodal Terminal in Winnipeg. “Through the National Trade Corridors Fund and Rail Safety Improvement Program funding, we are addressing the impacts of climate change and improving the safety and resiliency of Manitoba’s rail network, thereby strengthening Canada’s trade corridors.”

Transport Canada last month announced that the Rail Safety Improvement Program for 2022-23 would distribute C$24 million to 147 grade crossing, infrastructure and research projects; C$700,000 in funding will go toward 10 projects in Manitoba.

In related developments, Transport Canada on July 5 announced new fire-mitigation rules and a research-funding program to help railroads improve safety and security and build “climate resiliency.”

NWT Unity Rail Port Under Way

Written by William C. Vantuono, Editor-in-Chief JULY 6, 2022NWT photo

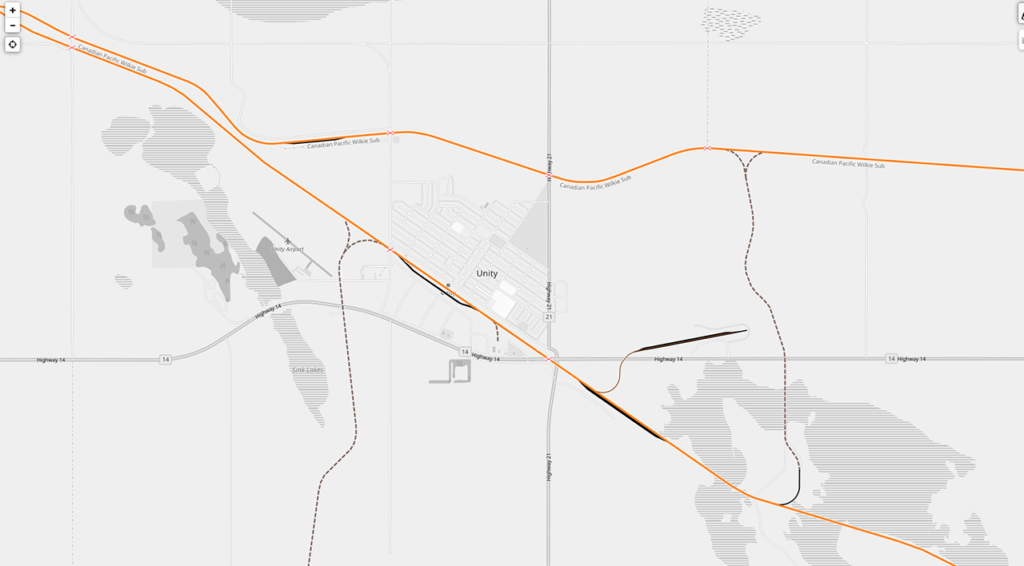

North West Terminal Ltd. (NWT), an independent farmer/shareholder-owned company headquartered near Unity, Saskatchewan in the Northwest region of the province that owns and operates an inland grain terminal and fermentation facility, is developing Unity Rail Port, a processing and transportation hub.

Phase 1 of Unity Rail Port is expected to encompass almost 75 acres of sublots for lease within the limits of the Town of Unity. Phase 2 is expected to include just over 210 acres of sublots for lease in the Rural Municipality of Round Valley. Phase 1 and 2 are located to the West and North, respectively, of a rail infrastructure expansion under way at NWT. The expansion is expected to include a dual loop track.

“Unity Rail Port will be unique as it is expected to offer prospective tenants access to: Canadian Pacific (Wilkie Subdivision)and CN; grain sourcing and procurement services through NWT’s elevator facilities; and other transloading resources.,” the company said. “As well, the hub is situated on the intersection of two major highways and currently boasts more than 200 railcar spots.

“The Board of Directors is pleased to be announcing this project,” said NWT President Brad Sperle. “We have a solid foundation here at Unity as we already produce plant-based protein and renewable energy at our fermentation facility, have a long list of local-farmer customers, and have an existing tenant that transloads lumber, among other things, from truck to rail. We want to continue expanding on these types of opportunities and attract tenants that have synergies with our existing infrastructure. We are also looking at the potential to make the hub green in the future by offering renewable power and carbon sequestration.”

In addition to its inland-grain terminal and fermentation facility at Unity, NWT is also a minority owner of Alliance Seed Corp. (ASC) in Winnipeg, Manitoba, and Alliance Grain Terminal Ltd. (AGT) in Vancouver, British Columbia.

For Canada, New Measures to Address Extreme Weather, Climate Change Impacts on Rail

Written by Marybeth Luczak, Executive Editor

“In a period where we are seeing the impacts of climate change and extreme weather in Canada, it’s important that we do everything we can to mitigate future risks,” Minister of Transport Omar Alghabra said on July 5.

Transport Canada on July 5 announced new fire-mitigation rules and a research-funding program to help railroads improve safety and security and build “climate resiliency.”

Under the new rules for the fire season (April 1 to Oct. 31), Transport Canada is requiring rail companies to:

• Reduce train speeds and conduct additional track inspections when temperatures are high to reduce the risk of a derailment caused by track conditions.

• Inspect locomotive exhaust systems more frequently to ensure they are free of any deposits that could pose a fire risk.

• Implement a fire risk reduction plan, which “requires companies to monitor fire risk levels, manage vegetation, reduce activities that could spark fires, and respond to detected fires.” Companies must also engage local governments and Indigenous communities on their plans.

The new rules make permanent the measures contained in Ministerial Order 21–06, issued in July 2021, to reduce the risk of wildfires in the context of extreme weather, according to Transport Canada, which noted that they also complement recent revisions to the Rules Respecting Track Safety. “Rules and regulations have the same force of law, under the Railway Safety Act, and a railway company can be subject to monetary penalties or prosecution for non-compliance to a rule,” the government agency added.

Additionally, the Rail Climate Change Adaptation Program has been launched “to support research, development and implementation of innovative technologies, tools and approaches to better understand and address the increasing risks and impacts of climate change on Canada’s rail sector,” according to Transport Canada.

The program will provide up to C$2.2 million in contribution funding to “cost-share” research, according to the government agency. Federally or provincially regulated railway companies incorporated in Canada—including CN and Canadian Pacific as well as most short lines—have until Sept. 28, 2022, to submit projects for consideration.

“In a period where we are seeing the impacts of climate change and extreme weather in Canada, it’s important that we do everything we can to mitigate future risks,” Minister of Transport Omar Alghabra said. “Our new rules will protect our railways against wildfires in the context of extreme weather. At the same time, the new Rail Climate Change Adaption Program will help railways assess and adopt next-generation tools to mitigate adverse issues caused by climate change.”

ESG Briefs: CN/CP, CSX, OmniTRAX

CSX and subsidiary Quality Carriers employees recently assembled 5,000 care packages for U.S. troops stationed in Eastern Europe, who have been mobilized in response to the conflict in Ukraine. (Photograph Courtesy of CSX)

CN and Canadian Pacific (CP) have earned spots on the Best 50 Corporate Citizens in Canada list for 2022. Also, care packages from CSX, in partnership with Operation Gratitude, are headed to U.S. active-duty service members in Eastern Europe; and Newburgh & South Shore Railroad (NSR), a managed affiliate of OmniTRAX, presented a community donation to a Cleveland, Ohio-area fire department in honor of Charter Steel.

CN and CP have ranked on the Corporate Knights Best 50 Corporate Citizens list. They came in at No. 35 and No. 17, respectively. Both Class I railroads were part of the “Freight Transport, All Modes” category, one of 18 included. Other industry groups ranked were: WSP Global Inc., No. 6 (“Engineering Construction”); Societe de Transport de Montreal, No. 10 (“Transit and Ground Transportation”); and Aecon Group Inc., No. 46 (“Engineering Construction”).

To determine the rankings, Corporate Knights magazine analyzed 332 large Canadian organizations against Canadian and global industry peers. It assessed companies’ performance using 24 quantitative key performance indicators (KPIs) related to resource management, employee management, financial management, clean revenue, clean investment and supplier performance. The magazine has produced the annual list since 2002.

“Large Canadian companies now earn almost a quarter (24%, up from 18% in 2021) of their total revenues ($113.6 billion) from products and services that have a beneficial environmental or social impact, as determined by the Corporate Knights Clean Taxonomy, which is aligned with the United Nations Sustainable Development Goals (SDGs),” Corporate Knights reported. “Best 50 companies continue to lead the way, earning 37% of their revenues in line with the clean economy. That’s six times more than the 6.2% clean revenue earned by other big Canadian companies (excluding the Best 50).”

“Almost no companies had net-zero commitments five years ago, but the tides are changing,” Corporate Knights noted. “Today, 40% of large companies around the world have net-zero commitments (by market capitalization). Even among Canada’s corporate sustainability leaders, just 13 of this year’s Best 50 companies have made net-zero commitments. However, 25 (50%) achieved year-over-year emissions-intensity reductions of at least 7.6%, the rough global benchmark to be aligned with a net-zero trajectory.” Additionally, the magazine found that among Best 50 companies, 9% of Board members are non-white.

“We are pleased to have made the top 50 Best Corporate Citizens list,” said Tracy Robinson, President and CEO of CN, which has earned a place on the list for 14 consecutive years. “CN believes in ‘Delivering Responsibly.’ This means moving our customers’ goods safely and efficiently, ensuring we deliver in an environmentally responsible manner; attracting, developing, and retaining top diverse talent; helping to make the communities we serve safer and stronger; and adhering to the highest ethical standards. This is the way we approach our job.”

“CP is proud to be recognized by Corporate Knights as one of Canada’s ‘Best 50 Corporate Citizens’ for 2022 as an industry leader in sustainability,” CP reported via Twitter.

More than 150 employees of CSX and its subsidiary Quality Carriers assembled 5,000 care packages for U.S. military service members, who have been mobilized to Eastern Europe in response to the Ukraine conflict.

The effort was part of “Pride in Service,” CSX’s ongoing community investment initiative, which it says is “focused on delivering resources and support to military members and their families, when and where they need it.” Care packages are slated to arrive in time for “Christmas in July, a military tradition that started in 1944 as a way for Americans to support deployed service members outside of the crowded shipping timeframe surrounding year-end holidays,” the railroad reported.

Care package assembly took place at the Tampa, Fla. headquarters of Quality Carriers, a provider of bulk liquid chemicals truck transportation. Employees and their family members filled packages with snacks, games, supplies, and handwritten letters from Americans across the country.

Assembly days like this “are a big part of Operation Gratitude[’s] overarching mission to express deep appreciation for those who step forward to serve and sacrifice on behalf of the American people,” CSX said.

NSR presented a $1,000 donation to the Cuyahoga Heights Fire Department at a recent ceremony honoring Charter Steel of Cleveland, Ohio, NSR’s recipient of the 2021 OmniTRAX Safe Shipper Award. The award recognizes “companies that model exemplary shipping safety by shipping or receiving loaded cars with no accidental releases during the previous year,” according to Denver, Colo.-based OmniTRAX, the transportation affiliate of The Broe Group. Charter Steel also received the award in 2020.

“Community safety is a shared effort with our partners, and we applaud the shared commitment to safety modeled by OmniTRAX and Charter Steel,” Cuyahoga Heights Fire Department Fire Chief Michael Suhy said. “We are also grateful for this donation to help maintain community safety throughout Cuyahoga Heights.”

“OmniTRAX network-wide safety milestones reflect a relentless team commitment and true collaboration with our shipping partners,” OmniTRAX Senior Vice President of Operations John Bradley said. “We are proud to recognize a two-time NSR award winner that models a consistent commitment to safety.”