“Lots of messages in my Constituency Labour Party WhatsApp saying they are looking forward to canvassing this weekend much more now,” one MP told LabourList in the immediate aftermath of Labour’s first Budget since 2010.

Labour’s £70bn hike to public spending over the next five years – and the tax hikes and borrowing that will fund it – may ruffle feathers on the right, but it has given many on the left a spring in their step after more than a decade of austerity – and months of gloomy messaging from ministers.

One new MP dubbed it a huge success, “nowhere near as gloomy as people were predicting – a proper Labour budget”.

The New Statesman‘s George Eaton called it a “redistributive statement”, The Times’ Patrick Maguire dubbed it “workerist”, and the MP Melanie Ward said charts like the below showed “the difference that a Labour government makes”:

LabourList readers and unions impressed by the Budget

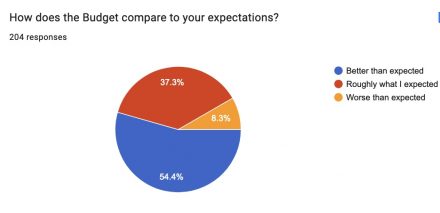

More than half of around 200 readers who voted in our informal snap poll rated the Budget “better than expected”, and less than one in 10 said it was “worse than expected” – albeit partly reflecting just how bleak Labour’s pre-Budget messaging had been.

Around two-thirds said they felt “positive” or “very positive” about the Budget, with fewer than one in five “negative” or “very negative”.

Among the most common words used by those who left comments about what they liked most were “tax”, “investment”, “NHS”, “housing”, the minimum wage and “spending’.

Some 58% said it struck the right balance between tax, spending and borrowing.

Several unions also welcomed the Budget’s tax hikes, with the Fire Brigades Union welcoming the windfall tax on oil and gas and VAT on private school fees . The TUC’s Paul Nowak said tax rises ensured “much-needed funds”, and those with broader shoulders paying “a fairer share”.

Unite’s Sharon Graham called it a “misstep” that Reeves had not gone further to “ensure the super-rich pay their fair share”, however, through a 1% tax on the richest 1%.

MPs delighted by minimum and living wage hike – and small business support

Every MP LabourList spoke to shortly after the Budget highlighted the significance of the record hike to the national minimum and living wages.

“In July, I stood on a manifesto pledge to Make Work Pay. This 6.7% rise in the National Living Wage and a record rise in the minimum wage for 18-20 year olds will put money in the pockets of more than 8000 low paid workers in my area of Fife,” said Ward, MP for Cowdenbeath and Kirkcaldy.

County Durham MP Luke Akehurst made a similar point about the thousands of his constituents who would benefit, noting it meant a £1400 boost for a full-time worker.

Chris Webb, MP for Blackpool South, said it would be “massive” for constituents who “count the pennies”, and the rise was big enough to have real cut-through.

“What I was really pleased by, and never thought possible, was the lower rate rise for younger workers – the amount who have told me they feel exploited, they’ll find moving towards parity hugely welcome.”

Beccy Cooper, new MP for Worthing West, said such measures made this the “first Budget in over a decade that is unambiguously on the side of working people”.

There was also contentment among several MPs about Labour balancing out such measures with some support for firms.

Webb, chair of the all-party parliamentary group on hospitality and tourism, said Labour’s tax measures to support hospitality and leisure firms, as well as some relief for smaller firms from its employer NI hikes, were welcome too. “It shows Labour is pro-business as well as pro-worker, and it puts investment into the high street.”

He said retailers locally would similarly welcome investment in tackling shoplifting, with small firms telling him “crime is one of the biggest issues”.

Paddy Lillis, general secretary of the large Labour-affiliated shopworkers’ union Usdaw, agreed. He said measures would “help save our shops and retail jobs” to ensure job security alongside a welcome “path to a genuine legally binding real living wage”.

NHS cash ‘just what first-time Labour voters wanted’

One new MP in a marginal seat said the £22.6bn investment in the NHS was “just what people who voted for us for the first time in 2024 will want to see – and we’re only getting started”.

That and wider investment in the economy put “the wind in the sails of the government as we press on with our mission of change”.

Another MP made a similar point that it is a “Budget that supports what people value in their community”, through not just NHS investment but also cash for schools and support for high streets and pubs.

Cooper, a public health doctor by background, said she was “particularly delighted” by the NHS funding, calling it a “transformational increase”.

“I hope to work closely with colleagues on a plan to move the NHS from hospital to community, from analogue to digital, from treatment to prevention,” she added.

Webb said it was “vital” for areas like Blackpool, with local A&E services often overstretched amid huge deprivation, severe mental health problems and millions of visitors each year to the seaside town. “It’ll make a huge difference,” said the MP, previously chair of a mental health charity.

Graham said extra cash was “much needed”, and changes Unite had called for to the “borrowing straitjacket” for were “welcome”. She said scanners “need people to use them”, however, noting NHS recruitment challenges.

Miners’ pension funding and school breakfast club cash win praise

Several MPs singled out a tripling in funding for school breakfast clubs and support for former miners for praise, in two moves likely to benefit many Labour MPs’ constituents in more deprived areas.

“I’ve argued for years we should turn the page on a system that’s not working for so many communities, particularly post-industrial ones – and this Budget’s a step towards that,” said Hemsworth MP Jon Trickett.

“I particularly welcome in my constituency the decision on the miners’ pension scheme, putting significant money into the pockets of those who did so much to produce the wealth of this country.”

Akehurst also added: “I am particularly pleased that former mineworkers will receive £1.5bn of money that has been kept from their pensions. This will mean substantial pay-outs for many of my North Durham constituents.”

Concerns over public services and two-child cap

Some 27% of LabourList readers said the Budget didn’t strike the right balance between tax, spending and borrowing, however – and argued Labour should be taxing more to fund services.

Almost half of those polled said the Chancellor should have done more to raise funds through taxes on wealth, on top of measures announced such as inheritance tax and capital gains tax hikes.

Trickett said that extra funding for public services was “welcome”, but said there was still “a lot more to do” overall.

He noted the Budget’s implications for every department’s budgets beyond several highlighted by the Chancellor – such as health, education and defence – were not immediately clear from her speech.

“Some neutral observers are saying its eye-wateringly tight, and it does look it.”

The Labour-affiliated FBU’s general secretary Matt Wrack said increased public spending should “ease some pressures”, but the government must go “further and faster”, saying fire and rescue services had lost 30% of their funding from central government since 2010.

The Public and Commercial Services Union’s general secretary Fran Heathcote claimed the Chancellor “seems to have given with one hand while taking away with the other” by including a 2% savings target for departments alongside a 1.7% increase in cash.

One MP also said they were “disappointed” not to hear more said on child poverty or compensating WASPI women, warning campaigners on the latter – protesting outside Parliament today – were “not going away”, and that the two-child cap row could rumble on for another year. Not signalling some progress on the two-child cap is a “huge misstep”, they added.

But another MP was much more positive about public spending overall, adding: “The weeks of stories beforehand suggested massive cuts to public services and spending, instead we have a Budget for long-term economic growth and which gets to work rebuilding our services and infrastructure.”

Ward noted that Labour had delivered the “largest funding settlement for the Scottish Government in the history of devolution”, putting the onus on the Scottish Government to now deliver “desperately needed improvements in the Scottish NHS”.

Who key Budget policies are aimed at – and the electoral strategy they signal

The Chancellor Rachel Reeves’ Budget today gives one of the biggest signs yet of Labour’s electoral strategy over the coming years.

It also comes hot on the heels of a Downing Street staffing shakeup intended to give the governnment more political edge.

Here are what some of the key policies appear to be aimed at, and what they signal about Labour’s political priorities:

Prioritise the NHS as voters’ key test of Labour’s success

The NHS has been key to Labour messaging around the Budget. Reeves today announced a £22.6bn increase in day-to-day health spending and £3.1bn in capital spending, calling it the largest investment since 2010 (outside Covid).

She said funding and reform would bring down waiting lists and “move towards” waiting lists being no longer than 18 weeks and delivering on manifesto pledges of 40,000 appointments a week.

Reeves notably chose this week to visit a hospital on Monday too, and told journalists: “We will be known as the government that took the NHS from its worst crisis in its history, got it back on its feet again and made it fit for the bright future ahead of it.”

Labour has ploughed a huge amount into public services, with £70bn extra spending a year over the next five years, funded through measures including £36bn in tax hikes and £32bn in borrowing.

It could have chosen to spread cash more evenly among government departments, though – and the level of focus on the NHS signals senior strategists think it’s on healthcare where most voters will either most want progress or most notice a lack of it in the coming years.

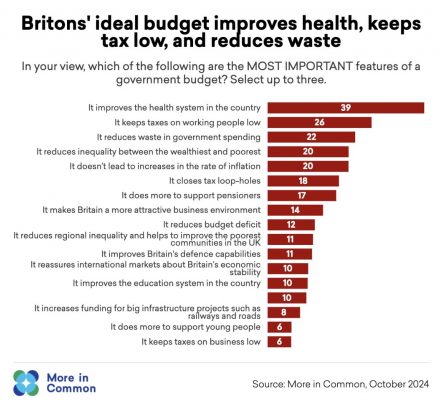

Recent polling seems to vindicate that idea politically:

While improving education isn’t that high on that poll at least, the £6.7bn pledged for education capital projects could reflect having the most state-educated cabinet ever. It could also reflect a sense new or repaired school buildings will be a highly visible signal to many parents that Labour is fixing the public realm, with New Labour similarly investing significantly in school buildings.

Extra funding for special educational needs support budgets, devastated in recent years, will also help not just unitary authorities in deprived Labour-leaning urban areas, but also many similarly cash-strapped county councils in wealthier and poorer areas alike ahead of local elections next year.

Note how high reducing “waste in government spending” is too on that voter priority list – that may partly explain measures announced like a new covid corruption commissioner and chair of the new Office for Value for Money. There was also a promise of a “new approach to public service reform” alongside cash. There is also a crackdown on fraud in our welfare system”.

The latter is unlikely to go down well on the left given how much the Conservatives whipped up public scepticism about benefit claimants – which is probably why Reeves hastily said fraud is “often the work of criminal gangs”.

A left agenda for working people – and employers will have to lump it

Tough questions from journalists over the definition of ‘working people’ may have caused ministers headaches in recent weeks, and Labour may have ditched some of its more radical policies in recent years, but make no mistake – making workers substantially better off remains absolutely central to Labour’s agenda.

No. 10 chief of staff Morgan McSweeney is said to be a strong believer it’s crucial to Labour’s broad election-winning coalition. Joe Biden’s troubles in the US have also cemented the sense economic growth is not enough – as both Starmer and Reeves said this week, “change must be felt”. There’s a reason that most of the New Deal – now rebranded Make Work Pay – has survived the cull of more contentious policies in recent years.

So it’s no surprise it’s central to Budget messaging:

It’s no surprise that Labour has stuck to its pledge of no national insurance or income tax hikes for workers, and vowed not to extend the freeze on tax thresholds, despite speculation about the latter – and despite the taxes being such a large potential source of much-needed revenue.

It’s no surprise Labour has significantly hiked the minimum and living wages, too: Reeves confirmed that the living wage will rise by 6.7 percent,

Given Reeves’ need for revenue to avoid the Tories’ real-terms spending cuts, she’s instead opted for significant hikes to employment national insurance (up 1.2 percentage points to 15%) and a lower threshold it’s paid at, plus a hike to capital gains tax (the lower rate will rise from 10% to 18%; the higher rate from 20% to 24%).

That signals a Labour party much more willing to face down intense business lobbying than many of Keir Starmer’s critics on the left might think – and than Starmer and Reeves let on themselves in the run-up to the election.

There may be a political battle to stop the employer NI hikes undermining its messaging though, as Bloomberg’s Alex Wickham notes:

Perhaps sensitive to how many small (as opposed to large) businesses owners there are in Britain though, and how much many voters care about their high streets, Reeves notably raised the NI allowance for employers, taking 850,000 organisations out of paying it altogether.

Meanwhile the 40% relief on business rates for retail, leisure and hospitality will be extended, and small business multiplier be frozen. Reeves also pledged tougher action on shoplifting, which will make many shopkeepers and retail workers cheer.

Hammer home Tory blame game for floating voters

Political anoraks may tire of Labour’s relentless repetition of attacks on the Tories for their legacy, but there’s an old saying that once journalists get bored of a message, it’s probably only just starting to cut through.

Senior figures know their best bet for getting the public and media to acquiesce in the £40bn Reeves confirmed in controversial tax hikes – to fund public services crying out for investment – is to lay the blame squarely on the Tories.

Hence Reeves spending the first chunk of her Budget attacking the “broken public finances” inherited, and accusing the Tories of hiding “hundreds of unfunded pressures”.

For good measure, Reeves similarly tried to buy the government some further time to fix “broken public services”, highlighting the grim state of school buildings, NHS waiting lists, pollution and prisons “overflowing”.

Rule changes and savings to reassure markets over borrowing hike

Governments rely on investors buying up bonds to fund much of their spending, and past Labour governments and Liz Truss alike have paid the price for market fears about unsustainable spending and inflation, which raises borrowing costs.

So reaassuring investors Labour can be trusted is key for Reeves, particularly when official figures suggest her revised fiscal rules will mean a £32bn-a-year hike in borrowing – one of the biggest leaps in decades.

Her new “stability rule” – imposing even tougher debt reduction targets than the Tories had on day-to-day spending, and pledging to bring it down within three years, not five – is a clear bid to do just that.

So is confirming too that Labour will implement Britain’s fiscal watchdog’s recommendations and a new Charter for Budget Responsibility.

Perhaps her 2% productivity, effiicency and savings target for each government department has the same intent – even if it won’t endear Reeves to her cabinet colleagues.

The Treasury will hope such moves help to counterbalance investor worry over Labour’s “investment rule”, which allows Labour more leeway to borrow for longer-term projects by redefining government debt.

A pitch for aspiring homeowners – as wealthy ones pay the price

Other notable pledges include £5bn on its housing plans, including £3.1bn to increase housebuilding, and funds to recruit more planners, remove more cladding and make the government’s mortgage guarantee scheme permanent for first-time buyers with low deposits.

That could reflect how important senior figures think aspiring homeowners, or recent buyers hoping to upsize, are to their electoral coalition. Age was a key factor at the last election, and the move will be welcomed by many younger voters.

The funding, and a wider boost to local government budgets, are a win for deputy PM Angela Rayner too after years of local government funding squeezes – and be welcomed by Labour councillors nationwide.

Given how many more MPs in marginal seats Labour now has in slightly better-off areas with often-higher house prices, perhaps the home ownership focus should also come as no surprise.

Reeves effectively declared war on second-homeowners as well by raising the stamp duty surcharge they pay from tomorrow – and explicitly said it could help more than 100,000 people to buy their first home or move in the next five years.

Meanwhile inheritance tax changes – often spurned by governments worried about alienating better-off older voters or the newspapers they read – could hit some wealthier homeowners hard.

That said, the voter targeting has a limit – with Reeves not extending a wider stamp duty discount that expires early next year.

Fending off Farage and the Tories on fuel, defence and pints

Pre-Budget speculation of fuel duty hikes came to nothing – as Reeves confirmed the current temporary 5p cut will endure for another year.

With low-traffic neighbourhoods under fire in recent years and newspapers regularly championing drivers, there was always a risk someone like Nigel Farage used any fuel duty hike to whip up anti-Labour sentiment.

It was a fuel tax rise that sparked the yellow-vest movement in France, sparking wider unrest and a sense among many drivers the French government didn’t represent the interest of people like them.

Similarly, a cut to draught duty lets Reeves claim there’ll be “a penny off a pint”, depriving Farage of another potential campaign given other drinks taxes are set to rise. A pledge of extra defence spending also helps shore up Labour against the Tories and right-wing press questioning, as ever, how far it can be trusted on defence.

That said, the raising of the bus fare cap, like the winter fuel cuts, could prove a continued thorn in the government’s side that Labour’s opposition left and right exploit in the weeks and months to come.

Left Foot Forward

Chancellor Rachel Reeves laid out her plans to rebuild Britain once more, as she set out Labour’s policies to repair public services, help those struggling to make ends meet and repair the economy.

Today was a day many in the Labour Party had been waiting for. Labour’s first budget in 14 years and the first ever delivered by a female Chancellor.

Following 14 years of stagnant wages, falling living standards and poor productivity, after the Tories took a wrecking ball to the economy, today was the day that the Labour government set out its plans to repair public finances, grow the economy and deliver for working people.

Chancellor Rachel Reeves laid out her plans to rebuild Britain once more, as she set out Labour’s policies to repair public services, help those struggling to make ends meet and repair the economy. So, what are the key takeaways from Reeves’ budget? We take a look at five of them below:

1.Labour gives a pay boost to millions of working people with a 6.7% rise in minimum wage

The Labour government has announced a pay boost for millions of working people with a 6.7% rise in the minimum wage. The minimum wage will rise to £12.21 an hour next year.

The minimum wage for over 21s, known officially as the National Living Wage, will rise from £11.44 to £12.21 from April 2025. For someone working full time, or a 37.5 hour week, that equates to £23,873.60 a year, up from £22,368.06.

For 18 to 20-year-olds, the minimum wage will rise from £8.60 to £10. This means someone on a 37.5 hour week would earn £19,552 a year, up from £16,815.

Apprentices will also benefit, with their pay rising from £6.40 to £7.55 an hour.

As a result of the increase in the minimum wage, more than 3 million low-paid workers are in line for a pay rise.

2. Compensation schemes for the victims of the infected blood and Post Office Horizon IT scandals

The Chancellor also announced funding for compensation schemes for victims of the infected blood and post office scandals, announcing £11.8bn for victims of infected blood scandal and their families, and £1.8bn for victims of Post Office Horizon scandal.

Reeves argued that while the last government had apologised for the infected blood scandal, it had failed to budget at all for compensation payments.

3. NHS budget increases

After more than a decade of being neglected by the Tories, Reeves also announced a £22.6bn increase in the day-to-day health budget, and £3.1bn increase in the capital budget. That includes £1bn for repairs and upgrades and £1.5bn for new beds in hospitals and testing capacity. She said: “This is the largest real terms growth in day to day NHS spending outside of Covid since 2010.”

4. More money for schools and education

The budget for free school breakfast clubs will be tripled to £30m, in 2025 and 2026. The core budget for schools will also rise by £2.3bn next year.

Reeves also announced that there will be a £6.7bn increase in capital funding for school building.

5. Capital gains and inheritance tax changes

Rachel Reeves also announced changes to capital gains and inheritance tax. Capital Gains tax will be increased. The lower rate will be raised from 10% to 18%, while the higher rate will rise from 20% to 24%.

The government will extend a freeze on the threshold for inheritance tax, allowing £325,000 to be inherited tax free.

There will be tax raises worth £2bn from reforming reliefs for business and agricultural assets. After £1m, those assets will attract inheritance tax of 20%.

Basit Mahmood is editor of Left Foot Forward

Chart shows how poorest households gain most, while wealthiest pay most after Labour’s budget

Left Foot Forward

With economists and analysts still digesting Labour’s first budget in 14 years, one thing is becoming increasingly clear, those on lower incomes stand to benefit the most while the wealthiest households will pay the most.

Chancellor Rachel Reeves set out plans yesterday to get Britain’s economy growing again, investing in public services which had been neglected under the Tories.

Labour announced a 6.7% hike in the minimum wage, which will benefit millions of low-paid workers, while the budget also saw a £22bn increase in the day-to-day budget of the NHS. Other measures included committing to the largest increase in Carers allowance since it was introduced in 1976, more money for our schools and compensation for the victims of the infected blood and Post Office Horizon IT scandals.

While right-wing papers bemoaned tax rises, which include changes to capital gains and inheritance tax, a chart produced by the Treasury shows how the poorest households stand to gain most from the policies contained in the budget, while the wealthiest households will pay the most.

Analysis of the policies in the Treasury impact assessment report states: “Increases in spending on public services, such as health and education, benefit households on lower incomes the most. The distributional analysis published alongside the Budget shows that on average, households in the lowest income deciles in 2025-26 will benefit most from the policy decisions as a percentage of net income and increases in tax will be concentrated on the highest income households. Overall, on average, all but the richest 10% of households will benefit as a percentage of income from policy decisions in 2025-26.”

Basit Mahmood is editor of Left Foot Forward

Left Foot Forward

"Today's budget is a vital first step towards the growth, jobs and living standards working people desperately need."

The Chancellor of the Exchequer Rachel Reeves today delivered her first budget since Labour entered government earlier this year. Being Labour’s first budget in 14 years, it has naturally attracted significant public discussion and reaction from across the political spectrum.

The UK’s trade unions are among the organisations to issue extensive responses to the budget. And, in general, the budget has been welcomed by the labour movement.

Giving an overall verdict on the budget, the GMB union’s general secretary Gary Smith said: “After 14 years of chaos and failure, it’s great to see a serious budget that focuses on the big issues facing our country.

“Much needed money for schools, including SEND, hospitals and a hefty wage rise for millions of low paid workers is something to be celebrated.

“And, there is good news on investment in hydrogen and carbon capture and storage. But, the government must get moving on other key infrastructure projects too – starting with a new nuclear power station at Sizewell.”

In a statement, the Trades Union Congress (TUC) called the budget a ‘vital first step’ towards growth. The statement read: “Today’s budget is a vital first step towards the growth, jobs and living standards working people desperately need.

“The Chancellor was dealt a terrible hand by the Conservatives – economic chaos, falling living standards and broken public services. But with today’s budget she has acted decisively to deliver an economy that works for working people.

“Tax rises will ensure much-needed funds for our NHS, schools and the rest of our crumbling public services, with those who have the broadest shoulders paying a fairer share. The Chancellor was right to prioritise hospitals and classrooms over private jets.

“There is still a lot more work to do to clean up 14 years of Tory mess and economic decline – including better supporting and strengthening our social security system. But this budget sets us on an urgently needed path towards national renewal.”

Public service workers’ union UNISON likewise praised the budget. UNISON assistant general secretary Jon Richards said: “The chancellor’s vision shows economic stability can be restored by investing in the NHS, schools, care and local councils.

“Good quality, well-funded and sufficiently staffed services are essential for a healthy, highly skilled and well-supported population.

“The last government hid the true state of the country’s finances, leaving public services in tatters. No one should have to put up with long delays for treatment, dilapidated schools, roads full of holes, community facilities sold off to prevent councils from going under or a lack of support when their elderly relatives need care.

“By putting up the minimum wage and ending the freeze on tax thresholds, the government has shown it understands the pressures working families face.

“Asking those with deeper pockets to pay more is the right thing to do. Decent public services can’t be delivered on the cheap. It’s important to spend to invest in the UK’s future.”

On specific elements of the budget, the verdict has been more mixed. The move to raise the minimum wage by 6.7 per cent has been welcomed by many in the trade union movement. Paddy Lillis – the general secretary of the shop workers union Usdaw – said: “Usdaw very much welcomes these significant pay increases for the lowest paid, after a three-year long cost of living crisis under the Tories.

“We are pleased that Labour’s new remit for the Low Pay Commission has resulted in progress towards delivering a statutory real living wage and started on the road to ending rip-off youth rates.

“Usdaw has consistently campaigned for a legal minimum hourly rate of over £12 per hour, so we are pleased to see that achieved within months of Labour being elected. We are now looking for a roadmap to achieve £15.”

Paul Nowak – the TUC general secretary – made similar comments. He said: “The TUC wants to see a £15 minimum wage as soon as possible – but this is an important step forward. When low paid workers get a pay rise, we all benefit, because that money goes straight back into local communities.”

However, some unions were critical of other elements of the budget.

The UCU – which represents teaching staff in universities and colleges – has criticised the lack of funding for universities. Jo Grady, the union’s general secretary, said the budget was ‘thin gruel’ for the higher education sector. She said: “Today’s Budget is thin gruel for those working in universities. Employer national insurance rises will hit the sector hard when higher education is already on its knees. Universities are crying out for increased public funding to secure their future as Britain’s last world-leading sector, yet the Chancellor failed to deliver.

“There will be no decade of national renewal if the government’s approach to universities continues to be one of de facto disinvestment. This is not a matter of special pleading: a properly funded higher education sector is a foundation stone of economic growth”

Meanwhile, civil servants’ union PCS, expressed concern about the impact efficiency savings on government departments will have on public services. The union’s general secretary Fran Heathcote said: “The Chancellor seems to have given with one hand while taking away with the other.

“By announcing a 2% ‘productivity, efficiency and savings target’ for all government departments, she appears to be wiping out the 1.7% real terms increase in departmental spending. This is concerning at a time when the vital public services our members work so hard to deliver are crying out for real investment.”

Image credit: Lauren Hurley / DESNZ – Creative Commons

Chris Jarvis

MPs on the left have responded to Labour's budget

MPs from across the political spectrum have been responding to the first Labour budget in 14 years announced by the Chancellor Rachel Reeves today.

Here’s a quick rundown of what parties on the left have said about Labour’s budget.

The Green Party

While the Greens have praised some elements of the budget, they’ve been critical of it overall, with the party’s co-leader Carla Denyer saying that Reeves delivered ‘half measures’. She tweeted: “We needed a Budget to build a fairer society and a greener economy. The chancellor had the option to fund our future by taxing the super-rich. Instead, today we have a set of half-measures, some positive, but a #Budget2024 that gives with one hand and takes away with the other.”

Delivering heavier criticism, the party’s other co-leader Adrian Ramsay argued that the budget fails to address the climate and ecological crises. He said: “Yet again, a Chancellor delivers a budget which makes absolutely no mention of the two biggest crises facing us – climate breakdown & nature degradation We will not *restore stability & rebuild Britain* if the natural world we all depend on is ignored”.

Meanwhile, Green MP Sian Berry criticised the level of funding given for active travel infrastructure. She said: “Rachel Reeves has only allocated £100 million extra to cycling and walking infrastructure: a fraction of what was needed. A failure to invest in Labour’s commitment to safer roads, cleaner air, healthier people and a healthier planet.”

Independents

A number of independent MPs have also released comments on the budget.

The Independent Alliance – a group of independent MPs which includes the former Labour leader Jeremy Corbyn – were heavily critical of the budget, branding it a ‘missed opportunity’. In a statement, the five MPs said: “Today’s budget was a missed opportunity to bring about the transformative change this country needs.

“These crises demand bold solutions. The government could have implemented wealth taxes to bring about a more equal and sustainable society. Instead, it has chosen to bake in decades of inequality by feigning regret over “tough choices” it does not have to make.”

The statement went on to criticise the inclusion of additional military spending in the budget, the retention of the two-child benefit cap and the cutting of the Winter Fuel Allowance. It continued by arguing for water and energy to be brought into public ownership.

Liberal Democrats

Like the Greens, the Liberal Democrats have welcomed some aspects of the budget while being outspoken on others.

The party’s leader Ed Davey said: “I’m glad that the Chancellor has listened to Lib Dem calls for more investment in the NHS to start repairing all the damage done to local health services by the Conservatives. But the Government is still ignoring the elephant in the NHS waiting room: the crisis in social care.

“I urge the Government to end the dither and delay and begin cross-party talks on social care now. Liberal Democrats will now hold the Government to account on delivering its promises so people can see a GP or dentist when they need to.”

The Lib Dems’ work and pensions spokesperson Steve Darling struck a similar tone, saying: “There’s good news like the NHS funding boost & minimum wage increase, but concerns remain. The bus fare cap hike and NI rise will hit hard-working people and small businesses.”

The SNP

The SNP have similarly welcomed additional funding for the NHS and public services. Stephen Flynn, the party’s Westminster leader said: Commenting on the UK Budget, SNP Westminster Leader Stephen Flynn MP said: “It’s clear the SNP is winning the argument on the need for more investment in our NHS and public services. I welcome those areas where the Chancellor has listened, including the decision to change the Labour government’s conservative fiscal rules to allow for more investment.”

However, Flynn was also critical of the government’s policy on welfare and the decision to increase National Insurance. He said: “The Chancellor’s decision to cut the winter fuel payment will leave around 900,000 Scottish pensioners up to £600 worse off this winter. The decision to keep the two child benefit cap and bedroom tax will push thousands of Scottish children into poverty. And the decision to raise National Insurance will hit low and middle income workers, and small businesses, the hardest.”

Plaid Cymru

Plaid Cymru have also been critical of the budget. Liz Saville Roberts, the party’s leader in Westminster, focussed her criticism on funding for Wales and – like the SNP – welfare cuts. She said: “The Budget will still feel like austerity to many. The Chancellor promised to ‘get to grips with HS2’, but failed to deliver the billions owed to Wales. She kept Tory cuts to welfare, failed to help pensioners keep warm this winter, and failed to scrap the two-child limit.”

Chris Jarvis is head of strategy and development at Left Foot Forward

Image credit: Kirsty O’Connor – Creative Commons

Autumn Budget 2024: Updates and reaction as £40bn tax hikes and huge NHS boost unveiled

Chancellor Rachel Reeves is unveiling Labour’s first Budget since 2010 today, laying out new spending policies alongside long-promised “difficult decisions” over £40bn tax hikes and departmental spending plans that could define the years to come.

Follow for live updates below as Reeves, the first woman to ever deliver the Budget, gives her speech in Parliament from around 12.30pm following Prime Minister’s Questions, and the Treasury publishes accompanying documents on the small print soon after. (Scroll to 10.50am below to stream live or watch back)

READ MORE: Who key Budget policies are aimed at – and the electoral strategy they signal

“Rebuilding Britain”, fixing the health service, and “protecting working people’s payslips” are the key Labour messages.

Reeves confirmed the biggest hike to carers’ allowance in decades, a fuel duty freeze, a £25bn-a-year hike to employer national insurance, and compensation worth £11.8bn for infected blood victims and £1.8bn for Post Office scandal victims.

Policies revealed in advance (full list here) include a minimum wage boost, an extended but increased bus fare cap, extra NHS, school and defence funding, and overhauled fiscal rules to boost investment.

Refresh this page for the latest updates, analysis and reaction below from across the Labour movement and beyond.

4.10pm: ‘A proper Labour Budget’

Another new Labour MP has praised the Budget and described it as a “proper Labour Budget”.

They said: “I thought it was a huge success and nowhere near as gloomy as people were predicting.”

4.00pm: Read Rachel Reeves’ speech in full

In case you missed it, you can read all of Rachel Reeves’ Budget speech in Parliament here.

3.50pm: ‘Just what the country needed’

One MP in a marginal seat told LabourList: “This is just what the country needed. Turning a page on 14 years of Tory failure, and putting the wind in the sails of the government as we press on with our mission of change.

“This Budget delivered just what people who voted for us for the first time in 2024 will want to see: investment in the NHS and investment in our economic future. And we’re only just getting started.”

3.45pm: Reeves 1/3 to remain as Chancellor for next Budget

As if it were in any doubt, bookmakers William Hill give the Chancellor Rachel Reeves 1/3 odds on her remaining in post by the time of the next Budget.

A spokesman for William Hill said: “achel Reeves’ daring Autumn Budget – Labour’s first in 14 years – will certainly have divided opinion, but we think the Chancellor has a very strong chance of remaining in her post for the next Autumn Statement in 12 months’ time.”

3.40pm: ‘Government serious about industrial revival’

TUC general secretary Paul Nowak has said that the Budget shows the government is serious about industrial revival and described it as a “step change from the Conservatives who started our nation’s infrastructure of investment”.

He also praised the decision to redefine fiscal rules to allow for greater capital investment and said: “This is common sense – countries that invest in the infrastructure of the future are better off over time. The Chancellor’s approach marks a vital first step towards the good jobs, energy independence and high-quality national infrastructure that the nation urgently needs.”

3.30pm: ‘Budget comes up short for people in fuel poverty’

The End Fuel Poverty Coalition has said that the Budget does not go far enough to help those suffering with energy bills.

Simon Francis, co-ordinator of the organisation, said that the only way to bring bills down permanently is through investment in insulation, home improvements, renewable energy and infrastructure.

He expressed fears that the increase to the Household Support Fund with no adjustment for inflation would see local authorities stretched even further and was disappointed at a lack of support for vulnerable households affected by the means testing of the winter fuel allowance.

Francis said: “What we needed to see in the short term was a restoration of winter fuel payments, an expansion of warm home discounts and reforms to improve and extend cold weather payments. Longer term, the Chancellor also needed to commit to a social tariff providing a unit rate discount on energy alongside existing support.”

3.20pm: ‘Step in right direction, but need for bold measures’

NEC member Jess Barnard has said that the Budget is a “step in the right direction”, but said that, after 14 years of austerity, “we need and expect Labour to deliver bold measures to tackle inequality and to revitalise our public services and infrastructure”.

She said that the hike employer national insurance contributions would “impact millions of workers who are likely to feel the effects of this in wage freezes” and expressed disappointment at the Budget not axing the “cruel” two child benefit cap.

Barnard said: “In short, this is a Budget with some welcome measures, but it falls short of the change we need, to revitalise services, put pay in workers’ pockets and destroy the Tory legacy of rampant inequality.”

3.10pm: £1bn boost for SEN ‘music to my ears’, says new NEC member

3.00pm: ‘A government that finally understands problems and opportunities London faces’

Labour’s Mayor of London Sadiq Khan has welcomed the Budget this afternoon, particularly more funding for Transport for London, social housing, schools and the NHS.

He said: “I am under no illusion about the extent of the economic difficulties inherited by the new Government. This budget is about fixing our economy and public services after more than a decade of mismanagement and decline, and beginning the process of national renewal.”

2.57pm: More in Common reaction to Budget

2.55pm: ‘Decisive shift but more ambition still needed’

The IPPR think tank has said that the government will have to continue ramping up investment and make the tax system fairer over the rest of the parliament.

Interim executive director Harry Quilter-Pinner said that the Budget marks a “decisive, positive shift” for the economy, but said there is more to do on tax reform, especially for high earners.

He said: “Today’s tax reforms have prevented the worst of the planned spending cuts that were inherited from the previous government. But there is more work to do. A wealthy millionaire or billionaire will still be able to pay a lower rate of tax than the average nurse. And the overall spending envelope will still leave some departments with tough decisions to make.

“The new government inherited a terrible economic situation after many years of crisis and mismanagement. Today the chancellor has taken important steps towards building a better Britain. But decades of economic damage cannot be undone in one budget. This must be the start of a decade of national renewal.”

2.50pm: What do the Budget’s policies mean?

As the dust begins to settle following Rachel Reeves’ inaugural Budget speech, it’s becoming increasingly clear what electoral strategy the Chancellor’s announcements point to down the line.

Read post-Budget analysis from LabourList editor Tom Belger here

2.45pm: ‘Enormous relief’

One new Labour MP has said they feel “enormous relief” after the Budget. They told LabourList: “The weeks of stories beforehand suggested massive cuts to public services and spending, instead we have a Budget for long-term economic growth and which gets to work rebuilding our services and infrastructure.”

2.40pm: Budget ‘absolutely superb’ says Labour council leader

A Labour council leader in England has told LabourList they thought the Budget was “absolutely superb”.

Among their highlights included increased funding for local government, especially for social care and homelessness, school breakfast clubs, taking small businesses out of employer national insurance contributions and a “transformational investment” in the NHS.

2.32pm: ‘Our two governments are working together to deliver for Wales’

First Minister of Wales Eluned Morgan has said the Budget shows the benefit of having two Labour governments working in tandem to improve the lives of people in Wales. She heralded the boost in the funding block grant for Wales, the largest in real terms in the history of devolution.

She said: “Over the past fourteen years, the Welsh government has tried again and again to have productive conversations with our UK counterparts. It has been like wading through mud.

“Meaningfully engaging with the UK government in this process shows once again that this UK government respects devolution, and our two governments are working together to deliver for the people of Wales.

“We knew that this Budget, tough choices would have to be made. But Rachel Reeves has set out her plan to fix the foundations of the economy, and look to the future.”

2.29pm: ‘First Budget in over a decade on side of working people’

Worthing West MP Beccy Cooper has said that the Budget “delivers on our promise of change”.

She said: “I am particularly delighted to hear the Chancellor announce a transformational increase in funding for frontline NHS services of £22.6bn. I hope to work closely with colleagues on a plan to move the NHS from hospital to community, from analogue to digital, from treatment to prevention.

“From investment in school breakfast clubs to raising the minimum wage for millions, this is the first Budget in over a decade that is unambiguously on the side of working people.”

2.25pm: Working people tax commitment ‘in place through parliament’, says Jones

Speaking to the BBC, Chief Secretary to the Treasury Darren Jones has said the manifesto commitment to not raise income tax, VAT or national insurance on working people will last for the duration of the parliament.

He said: “Our promise not to increase income tax, national insurance or VAT on working people is a promise that has been honoured today in the Budget, very clearly. They will see that in their payslips.

“That is not just the promise for this Budget, it is the promise for the whole of this parliament – so I can categorically tell you today, we will not be coming back in future Budgets to break that manifesto commitment. It is a commitment that lasts between the last election and the next.”

2.20pm: ‘Significant missed opportunities’, says FBU general secretary

Matt Wrack has praised elements of Rachel Reeves’ Budget but lamented “significant missed opportunities”.

He said: “Firefighters and other public sector workers have faced years of real term cuts to pay since 2010, while frontline services have been starved of funding.

“An increase in the minimum wage and additional funding for the NHS, which is facing its worst crisis in decades as a consequence of Tory cuts, is welcome. So are windfall taxes on oil and gas, and adding VAT to public school fees.

“But there are also significant missed opportunities. Having the lowest corporation tax in the G7 is not something to boast about it – it is a symptom of a broken economic model in which profits are prioritised above the needs and safety of the public.

“While a real-terms increase in day-to-day spending should ease some pressures, the government must go further and faster in rebuilding our broken public services.

“The FBU will fight hard for substantial increases in funding for the fire and rescue service, which has lost 30% of its central government funding since 2010. This must be a feature of the forthcoming spending review. That’s what the FBU expects from a Labour government.”

2.15pm: Full details of Budget published

The “red book” of the Budget has just been published online – you can view it here.

2.10pm: ‘Reeves failed to outline bold, transformative vision’

Left-wing campaign group Momentum has responded to Labour’s first Budget for almost 15 years, accusing the government of failing to outline a “bold, transformative vision to fix Britain”.

A spokesperson for the group said: “We welcome the Chancellor’s decision to raise the minimum wage and increase public borrowing for infrastructure.

“But overall, the Budget fails to outline a bold, transformative vision to fix a declining Britain. Refusing to scrap the two-child benefit cap, cuts to Winter Fuel Payments and lifting the cap on bus fares are damaging and unnecessary political decisions. The government must change course immediately and start standing up for real Labour values.”

2.06pm: ‘Serious budget that focuses on big issues’

Gary Smith, GMB General Secretary, said: “After 14 years of chaos and failure, it’s great to see a serious budget that focuses on the big issues facing our country.

“Much needed money for schools, including SEND, hospitals and a hefty wage rise for millions of low paid workers is something to be celebrated.

“And, there is good news on investment in hydrogen and carbon capture and storage. But, the government must get moving on other key infrastructure projects too – starting with a new nuclear power station at Sizewell.”

2.00pm: First reaction from Labour MPs

We have received some reaction from Labour MPs immediately after the Budget, praising the measures taken despite difficult economic challenges.

One MP described the Budget as a “very strong response to the very difficult economic situation we inherited from the Tories”.

Another praised moves on the minimum wage while protecting SME businesses, as well as the “big boost for the NHS”.

One new MP also told LabourList that she has seen “lots of messages in my CLP WhatsApp saying they are looking forward to canvassing this weekend much more now”.

They added: “I think it’s a Budget that lays the foundation to fix all that has become crumbling after fourteen years of Tory misrule.

“It’s a Budget that supports what people value in their community, like their high street and the local pub, invests in the public services we all care about like our schools and the NHS, takes first steps to fix our broken housing system, and puts more money in people’s pockets while driving long term economic growth.

“It’s a Budget I’m keen to get out on the doorstep and discuss with residents this weekend.”

1.50pm: Labour taking the steps to ‘rebuild Britain’

Rachel Reeves is concluding her Budget address, saying that the government is taking the difficult steps to “rebuild Britain”. She also challenges the Conservatives to explain what they would cut or what taxes they would raise if they disagree with the measures she has taken.

Revees says she has made “responsible choices to protect working people” and restore stability to the economy.

1.48pm: ‘Fixing the foundations’ of the health service

The government has unveiled its plans to grant the NHS more funding in order to “fix the foundations” of the health service. Among the policies announced by the Chancellor include a £22.6bn increase in the NHS’ day-to-day budget, £1bn of capital investment for repairs and upgrades, and £1.57bn of capital investment for new surgical hubs, scanners and radiotherapy machines.

It comes after the new Labour government allocated £1.8bn to cover work by hospitals in England to reduce waiting lists for planned treatment and appointments soon after the general election.

Reeves has said the government will work to cut waiting lists to no more than 18 weeks.

1.44pm: £6.7bn capital investment for education

Reeves has outlined extra investment to improve education, including £2.1m to improve school maintenance.

1.42pm: £100bn in investment via capital spending

Reeves said that the government will invest £100bn of capital spending over the next five years through the change to the government’s fiscal rules.

1.41pm: Bus fare cap to rise

The Chancellor has said that the bus fare cap in England introduced by the Conservatives will continue next year, but at the higher rate of £3. The measure was confirmed by the Prime Minister on Monday, who said that the Tories had only funded the £2 cap until the end of this year. The extension of the scheme will last until the end of December 2025.

1.40pm: Increase in funding to tackle potholes

Rachel Reeves has confirmed plans to increase funding to tackle potholes across the country. The new Labour government has allocated £500m in funding to fix roads, helping to deliver on the party’s manifesto pledge to fix one million potholes. Reeves has said the extra cash will come from deferring the delayed A27 bypass in Sussex, which was set to cost around £320m.

1.38pm: HS2 will reach Euston, Reeves confirms

The Chancellor has confirmed rumours that HS2 will reach Euston station, after initial speculation that the rail project could be cut short at Old Oak Common railway station.

1.36pm: £5bn investment for house building plans

Reeves has announced £5bn in investment to support the government’s housebuilding plans over the course of the parliament.

1.31pm: Fiscal rules altered to boost investment

Rachel Reeves has said that the government will change Britain’s fiscal rules in order to open the door to spend more on infrastructure projects and “drive growth in the economy”. She confirmed the move will free up £15.7bn of headroom.

The move was announced last week in Washington, when the Chancellor addressed the International Monetary Fund.

Read more about the change here

1.26pm: Support for local government

Reeves has said there will be an increase in funding to help local councils with the cost of social care and tackling rough sleeping.

She said there will be a real-terms funding increase next year, including £1.3bn for additional grant funding for essential services.

1.24pm: Almost £3bn allocated for defence spending

The Chancellor has confirmed that £2.9bn will be allocated in the Budget for the armed forces. However, some have noted that updated growth forecasts mean that defence spending is actually slightly down as a percentage of GDP.

In July, the Prime Minister committed to spending 2.5% of GDP on defence, with a Strategic Defence Review setting out a roadmap to reaching that target. The Chancellor confirmed that the government intends to reach this target at a future fiscal event.

1.21pm: Tripling investment in breakfast clubs

Reeves has said there will be no return to austerity and unveiled plans to triple investment in breakfast clubs to help young people.

She also unveiled £300m in investment for further education and a £1bn uplift in funding for special educational needs schools.

1.17pm: Income tax and national insurance thresholds will not be frozen, Reeves reveals

Reeves has said there will be no extension of the frozen on income tax and national insurance once they expire in 2028.

She said: “When it comes to choices on tax, this government chooses to protect working people every single time.”

1.15pm: Abolition of non-dom tax regime

Reeves has announced a new residence-based tax scheme and said she will close loopholes made by the Conservative government.

1.15pm: Penny off pints in pubs

Rachel Reeves has announced she will cut draft duty by 1.7%, which she says will shave a penny off the cost of pints in pubs. She also said there will be a 40% relief on business rates for the retail, hospitality and leisure sector.

1.12pm: New duty on vaping liquid

1.10pm: Inheritance tax thresholds remain frozen

Reeves has said inheritance tax thresholds have remained frozen until 2030.

1.08pm: Capital gains tax hiked on shares

The Chancellor has confirmed that capital gains tax on the sale of shares will be hiked, with the higher threshold rising from 20% to 24%. However, the rate for second homes has not been altered.

1.06pm: Rise in employer contributions to national insurance

Rachel Reeves has confirmed that employer national insurance contributions will rise to 15% in April 2025, with the salary threshold where contributions come into force also cut significantly from £9,100 to £5,000. The measure will raise £25bn a year. The employment allowance has been raised from £5,000 to £10,500.

She said: “In the circumstances I have inherited, this is the right choice to make.”

1.04pm: ‘Working people will not see higher taxes’

Rachel Reeves has said the government has stuck to its pledge not to raise income tax, VAT or national insurance on working people.

1.02pm: Fuel duty to remain frozen

Rachel Reeves admits she has had to take “difficult decisions on tax” but said that the fuel duty freeze will remain in place next year amid concerns about the cost of living, costing the Treasury almost £3bn and saving motorists £60 a year.

1.01pm: Carer’s allowance boosted

The Chancellor has announced that the carer’s allowance will be increased, allowing carers to earn more £10,000 a year, “the largest increase in carer’s allowance since it was introduced in 1976”.

1.00pm: Productivity savings target for departments

Reeves has also said the government will work to reduce wasteful spending in government, with a two percent productivity savings target for government departments.

12.57pm: Inflation-busting increase to minimum wage confirmed

Rachel Reeves has confirmed that the minimum wage will rise by six percent, granting millions of workers on low wages a significant pay rise. From next year, the national living wage for over 21s will rise from £11.44 an hour to £12.21 an hour, an increase of 6.7%. She also said the government will move towards implementing a single adult minimum wage, to be phased in over time.

12.55pm: Crackdown on fraudsters

Reeves has announced a crackdown on welfare fraudsters, which is forecast to save £4.3bn for the Treasury.

12.53pm: Government to appoint Covid corruption commissioner

Reeves said that the government will soon appoint a Covid corruption minister to recover money paid for dodgy pandemic contracts.

12.45pm: Budget to raise taxes by £40bn

Reeves confirms that the Budget will raise taxes by £40bn. She said that any Chancellor would “face the same reality”.

12.44pm: ‘Tories did not budget for scandal compensation’

Reeves has set aside £11.8bn for those affected by the infected blood scandal and £1.8bn for those affected by the Post Office Horizon scandal, accusing the Conservatives of not budgeting for the cost of the compensation scheme.

12.42pm: ‘Government has inherited broken public services’

Reeves is now talking about the poor state of the country’s public services inherited by the Conservatives and claims they had no plan to improve them or put the nation’s finances on a stable footing.

12.40pm: £22bn black hole in public finances

Reeves is discussing the state of the public finances and repeats how the government uncovered a £22bn black hole, which she claims was covered up by the last government. She quotes an OBR report that said that the government had not disclosed all pressures on public finances, something Reeves as the “height of irresponsibility”.

12.38pm: ‘Deeply proud to be Britain’s first female Chancellor’

Reeves has addressed that she is the first female Chancellor and said that her place should send a message to girls and young women that there is no ceiling to their ambition.

12.37pm: ‘Turning the page’

Reeves said that investment is necessary in order to drive economic growth, and investment requires economic stability. She says it is not the first time the Labour Party has been put in the position to rebuild Britain and said that the government would “rebuild Britain once again”.

12.35pm: ‘Country voted for change’

Rachel Reeves is beginning her address to Parliament by saying the country voted for a “decade of national renewal” and said that her belief in Britain “burns brighter than ever”.

She said that change must be felt with an NHS that is there when you need it and with more pounds in people’s pockets.

12.32pm: Rachel Reeves to take to dispatch box imminently

PMQs has just concluded, with Rachel Reeves expected to take to the dispatch box to deliver her first Budget within the next few minutes. It is hard not to overstate the historic nature of this occasion – not only is this an important moment for the party, but also for the country as the first Budget delivered by a female Chancellor.

12.29pm: Budget ‘potentially era-defining moment’

12.20pm: Budget will deliver change Britain needs, says Nandy

12.10pm: ‘Let this be a sign that there should be no ceiling on your ambitions’

12.04pm: Starmer pays tribute to Sunak

Starmer has thanked Rishi Sunak for his service as they have their final exchange across the dispatch box, thanking him for his decency and wishing him and his family well in whatever he goes on to do next.

12.00pm: ‘Budget to fix the foundations’

11.55am: Who is speaking at PMQs?

Before we have the Budget, we have the weekly clash of Prime Minister’s Questions – the last where Rishi Sunak will be posing questions as leader of the opposition.

The full list of those who will be asking a question to the Prime Minister later is:

- Katrina Murray (Cumbernauld and Kirkintilloch)

- Meg Hillier (Hackney South and Shoreditch)

- Rachael Maskell (York Central)

- Melanie Ward (Cowdenbeath and Kirkcaldy)

- Rachel Blake (Cities of London and Westminster)

- Ben Goldsborough (South Norfolk)

- Jim Dickson (Dartford)

- Richard Tice (Boston and Skegness)

- Alex Baker (Aldershot)

- Dan Norris (North East Somerset and Hanham)

- John Slinger (Rugby)

- Yuan Yang (Earley and Woodley)

- Lincoln Jopp (Spelthorne)

- Helen Morgan (North Shropshire)

11.45am: Louise Haigh on £3 bus fare cap

Transport Secretary Louise Haigh has heralded the decision of the government to maintain the bus fare cap, albeit at the higher rate of £3. Haigh said that the government is “stepping in to keep fare affordable and protect services”.

11.40am: Ellie Reeves with sister and Chancellor Rachel ahead of Budget

11.35am: ‘Circles of fiscal hell’

The dire state of public finances is absolutely no secret, with Labour’s core messaging ahead of the Budget revolving around fixing the fiscal black hole left by the Tories.

In a thought-provoking piece on LabourList, Keir Starmer’s former chief of staff Sam White looks at the challenges facing the Chancellor by way of a tour through the circles of hell.

11.30am: What taxes do people want to see increased?

According to pollster Ipsos, 71% of voters think it is likely the government will increase taxes in today’s Budget. Their survey found that those polled were more supportive of raising taxes for higher earners, with 48% backing an income tax increase paid on income over £125,000.

11.25am: Business leaders ‘concerned’ ahead of Budget

New polling from Savanta has found that business leaders are feeling anxious and apprehensive ahead of the Budget this afternoon.

The pollster found that one in four business owners and senior leaders (25%) surveyed felt “concerned” about the Autumn Statement, with a similar number (22%) feeling “apprehensive”. A further 12% said they felt “nervous” ahead of the announcement by Rachel Reeves.

However, one in five (20%) said they felt “positive”, with eight percent feeling “excited”.

Matt McGinn, consultant at Savanta, said: “There’s a real sense of concern among business leaders ahead of Labour’s first Budget in 15 years. Our research suggests that the optimism of summer hasn’t just made way for realism, but some pretty apprehensive company leaders.

“In some ways, this is all unsurprising. Labour and everyone else knew there was a challenging financial settlement to contend with in government, and someone had to pay for it. But Keir Starmer and Rachel Reeves will likely be concerned how quickly years of goodwill among businesses appears to have dissipated.”

11.20am: Rachel Reeves leaves No 11

11.17am: PM says Budget ‘huge day for Britain’

11.15am: What are MPs looking for from today’s Budget?

Speaking to MPs ahead of today’s Budget, there has been an acknowledgement of the difficult choices set to be unveiled in just over an hour’s time. However, some expressed hope around greater investment in healthcare and efforts to build more homes across the country.

One key message that Downing Street will be keen to follow came from one MP, who said the government need to avoid today’s announcement as an “austerity Budget”.

Read more of their thoughts here

10.50am: Watch the Budget live

10.30am: ‘Labour chooses investment over decline,’ says Reeves

10.10am: Local government’s role in boosting growth

Councils up and down the country have been facing nothing short of a funding emergency in recent years, with several declaring bankruptcy over the financial strain. But Luton council leader Hazel Simmons has written for LabourList about what local government can offer Whitehall when it comes to chasing economic growth – it is well worth a read.

Autumn Budget 2024: Read Chancellor Rachel Reeves’ full Budget speech

Photo: Simon Dawson / No 10 Downing Street

Photo: Simon Dawson / No 10 Downing StreetMadam Deputy Speaker, on July the 4th, the country voted for change.

This government was given a mandate to restore stability to our economy and to begin a decade of national renewal, to fix the foundations and deliver change through responsible leadership in the national interest.

That is our task, and I know that we can achieve it.

My belief in Britain burns brighter than ever and the prize on offer is immense.

As my Right Honourable Friend the Prime Minister said on Monday – change must be felt.

More pounds in people’s pockets, an NHS that is there when you need it, an economy that is growing, creating wealth and opportunity for all because that is the only way to improve living standards and the only way to drive economic growth is to invest, invest, invest.

There are no shortcuts and to deliver that investment we must restore economic stability and turn the page on the last 14 years.

This is not the first time that it has fallen to the Labour party to rebuild Britain.

In 1945, it was the Labour party that rebuilt our country from the rubble of the Second World War. In 1964, it was the Labour party that rebuilt Britain with the white heat of technology. And in 1997, it was the Labour party that rebuilt our schools and our hospitals.

Today, it falls to this Labour party, this Labour government, to rebuild Britain once again.

And while this is the first Budget in more than fourteen years to be delivered by a Labour Chancellor it is the first Budget in our country’s history to be delivered by a woman.

I am deeply proud to be Britain’s first ever female Chancellor of the Exchequer.

To girls and young women everywhere, I say: Let there be no ceiling on your ambition, your hopes and your dreams.

And along with the pride that I feel standing here today there is also a responsibility to pass on a fairer society and a stronger economy to the next

generation of women.

Madam Deputy Speaker, the party opposite failed this country.

Their austerity broke the National Health Service, their Brexit deal harmed British businesses and their mini-budget left families paying the price with higher mortgages.

The British people have inherited their failure. A black hole in the public finances, public services on their knees, a decade of low growth and the worst parliament on record for living standards.

Let me begin with the public finances.

In July, I exposed a £22bn black hole at the heart of the previous government’s plans.

A series of promises that they made, but had no money to deliver.

Covered up from the British people, covered up from this House.

The Treasury’s reserve, set aside for genuine emergencies spent three times over just three months into the financial year.

Today, on top of the detailed document that I have provided to the House in July the government is publishing a line by line breakdown of the £22bn black hole that we inherited. It shows hundreds of unfunded pressures on the public finances this year, and into the future too.

The Office for Budget Responsibility have published their own review of the circumstances around the Spring Budget forecast.

They say that the previous government – and I quote – “did not provide the OBR with all the [available] information to them” and – had they known about these “undisclosed spending pressures that have since come to light” then their Spring Budget forecast for spending would have been, and I quote again: “materially different”.

Let me be clear: that means any comparison between today’s forecast and the OBR’s March forecast is false because the party opposite hid the reality of their public spending plans.

Yet at the very same budget they made another ten billion pounds worth of cuts to National Insurance.

It was the height of irresponsibility, and they knew it because they had run out of road. They called an election to avoid making difficult choices.

So, let me make this promise to the British people. Never again will we allow a government to play fast and loose with the public finances and never again will we allow a government to hide the true state of our public finances from our independent forecaster.

That’s why today, I can confirm that we will implement in full the 10 recommendations from the independent Office for Budget Responsibility’s review.

But, the country has inherited not just broken public finances but broken public services too.

The British people can see and feel that in their everyday lives. NHS waiting lists at record levels, children in portacabins as school roofs crumble, trains that do not arrive, rivers filled with polluted waste, prisons overflowing crimes which are not investigated and criminals who are not punished.

That is the country’s inheritance from the party opposite.

But they had no plan to improve our public services and they had no plan to put our public finances on a sustainable footing.

Quite the opposite. Since 2021, there had been no detailed plans for departmental spending set out beyond this year.

And their plans relied on a baseline for spending this year which we now know was wrong because it did not take into account the £22bn black hole.

The previous government also failed to budget for costs which they knew would materialise. That includes funding for vital compensation schemes for victims of two terrible injustices, the infected blood scandal and the Post Office Horizon scandal.

The Leader of the Opposition rightly made an unequivocal apology for the injustice of the infected blood scandal on behalf of the British state but he did not budget for the costs of compensation.

Today, for the very first time, we will provide specific funding to compensate those infected and those affected, in full with £11.8bn in this budget.

And I am also today setting aside £1.8bn to compensate victims of the Post Office Horizon scandal redress that is long overdue for the pain and injustice that they have suffered.

Madam Deputy Speaker, the leadership campaign for the party opposite has now been going on for over three months. But in all that time not one single apology for what they did to our country. Because the Conservative party has not changed.

But this is a changed Labour party and we will restore stability to our country again. The scale and seriousness of the situation that we have inherited cannot be underestimated.

Together, the hole in our public finances this year, which recurs every year, the compensation schemes that they did not fund and their failure to assess the scale of the challenges facing our public services means this budget raises taxes by £40bn.

Any Chancellor standing here today would have to face this reality. And any responsible Chancellor would take action.

That is why today, I am restoring stability to our public finances and rebuilding our public services.

As a former economist at the Bank of England, I know what it means to respect our economic institutions.

I want to put on record my thanks to the Governor of the Bank, Andrew Bailey and to the independent Monetary Policy Committee.

Today, I can confirm that we will maintain the MPC’s target of two per cent inflation, as measured by the 12-month increase in the Consumer Prices Index.

I want to thank James Bowler, the Permanent Secretary to the Treasury, and my team of officials.

Madam Deputy Speaker, I would also like to thank my predecessors as Chancellor of the Exchequer for their wise counsel as I have prepared for this Budget. In particular, I would like to thank the former Rt Hon member for Spelthorne for his invaluable advice in this weekend’s papers where he concluded that his “mini-budget” – and I quote – “wasn’t perfect.”

For once, Madam Deputy Speaker, I think he and I are in absolute agreement.

Finally, I want to thank Richard Hughes and his team at the Office for Budget Responsibility for their work in preparing today’s economic and fiscal outlook.

Let me now take the House through that forecast.

The cost of living crisis under the last government stretched household finances to their limit, with inflation hitting a peak of above 11%.

Today, the OBR say that CPI inflation will average 2.5% this year, 2.6% in 2025, then 2.3% in 2026, 2.1% in 2027, 2.1% in 2028 and 2.0% in 2029.

Next, I move on to economic growth.

Today’s budget marks an end to short-termism. So I am pleased, that for the first time, the OBR have published not only five year growth forecasts but a detailed assessment of the growth impacts of our policies over the next decade, too and the new Charter for Budget Responsibility, which I am publishing today, confirms that this will become a permanent feature of our framework.

The OBR forecast that real GDP growth will be 1.1% in 2024, 2.0% in 2025, 1.8% in 2026, 1.5% in 2027, 1.5% in 2028 and 1.6% in 2029.

And the OBR are clear: this budget will permanently increase the supply capacity of the economy, it may sound shocking to them, boosting long-term growth.

Every budget I deliver will be focused on our mission to grow the economy and underpinning that mission are the seven key pillars of our growth strategy developed and delivered alongside business all driven forward by our Financial Secretary to the Treasury.

First, and most important, is to restore economic stability. That is my focus today.

Second, increasing investment and building new infrastructure is vital for productivity, so we are catalysing £70bn of investment through our National Wealth Fund and we are transforming our planning rules to get Britain building again.

Third, to ensure that all parts of the UK can realise their potential we are working with the devolved governments and partnering with our Mayors to develop local growth plans.

Fourth, to improve employment prospects and skills we are creating Skills England, delivering our plans to Make Work Pay and tackling economic inactivity.

Fifth, we are launching our long-term modern industrial strategy and expanding opportunities for our small and medium sized businesses to grow.

Sixth, to drive innovation we are protecting record funding for research and development to harness the full potential of the UK’s science base.

And finally, to maximise the growth benefits of our clean energy mission, we have confirmed key investments such as Carbon Capture and Storage to create jobs in our industrial heartlands.

Our approach is already having an impact. Just two weeks ago – we delivered an International Investment Summit which saw businesses commit £63.5bn of investment into this country creating nearly 40,000 jobs across the United Kingdom.

But we cannot undo fourteen years of damage in one go. Economic growth will be our mission for the duration of this parliament.

Madam Deputy Speaker, in our manifesto, we set out the fiscal rules that would guide this government. I am confirming those today our stability rule and our investment rule.

The “stability rule” means that we will bring the current budget into balance so that we do not borrow to fund day to day spending. We will meet this rule in 2029-30, until that becomes the third year of the forecast. From then on, we will balance the current budget in the third year of every budget, held annually each autumn.

That will provide a tougher constraint on day to day spending so difficult decisions cannot be constantly delayed or deferred.

The OBR say that the current budget will be in deficit by £26.2bn in 2025-26 and £5.2bn in 2026-27 before moving into surplus of £10.9bn in 2027-28, £9.3bn in 2028-29 and £9.9bn in 2029-30 meeting our stability rule two years early.

Monthly public sector finances data shows that government borrowing in the first six months of this year was already running significantly higher than the OBR’s March forecast.

And so the OBR confirmed today, that borrowing in this financial year is now £127bn reflecting the inheritance left by the party opposite.

The increase in the net cash requirement in 24-25 is lower than the increase in borrowing, at £22.3bn higher than the spring forecast.

Because of the action that we are taking borrowing falls from 4.5% of GDP this year to 2.1% of GDP by the end of the forecast.

Public sector net borrowing will be £105.6bn in 2025-26, £88.5bn in 2026-27, £72.2bn in 2027-28, £71.9bn in 2028-29 and £70.6bn in 2029-2930.

Madam Deputy Speaker, before I come to tax it is vital that we are driving efficiency and reducing wasteful spending.

In July, to begin delivering, and dealing with our inheritance, I made £5.5bn of savings this year.

Today we are setting a 2% productivity, efficiency and savings target for all departments to meet next year by using technology more effectively and joining up services across government

As set out in our manifesto, I will shortly be appointing our Covid Corruption Commissioner, they will lead our work to uncover those companies that used a national emergency to line their own pockets.

Because that money belongs in our public services. And taxpayers want that money back.

And I can confirm today that David Goldstone has been appointed as the Chair of the new Office for Value for Money to help us realise the benefits from every pound of public spending.

Today, I am also taking three steps to ensure that welfare spending is more sustainable.