Online used-vehicle dealer faces a mountain of financial and legal challenges.

THE STREET

NOV 19, 2022

NOV 19, 2022

The sky is not clearing up for Carvana.

On the contrary, big clouds continue to gather over the company which was one of the big winners of the covid-19 pandemic, with a massive growth.

Since announcing its quarterly results on Nov. 3, Carvana (CVNA) - Get Free Report shares have lost 44% of their value and are currently trading at $8.06 versus $14.35 on that day. This translates into a decline in market capitalization of approximately $1.1 billion in two weeks. Carvana currently has a market value of $1.43 billion.

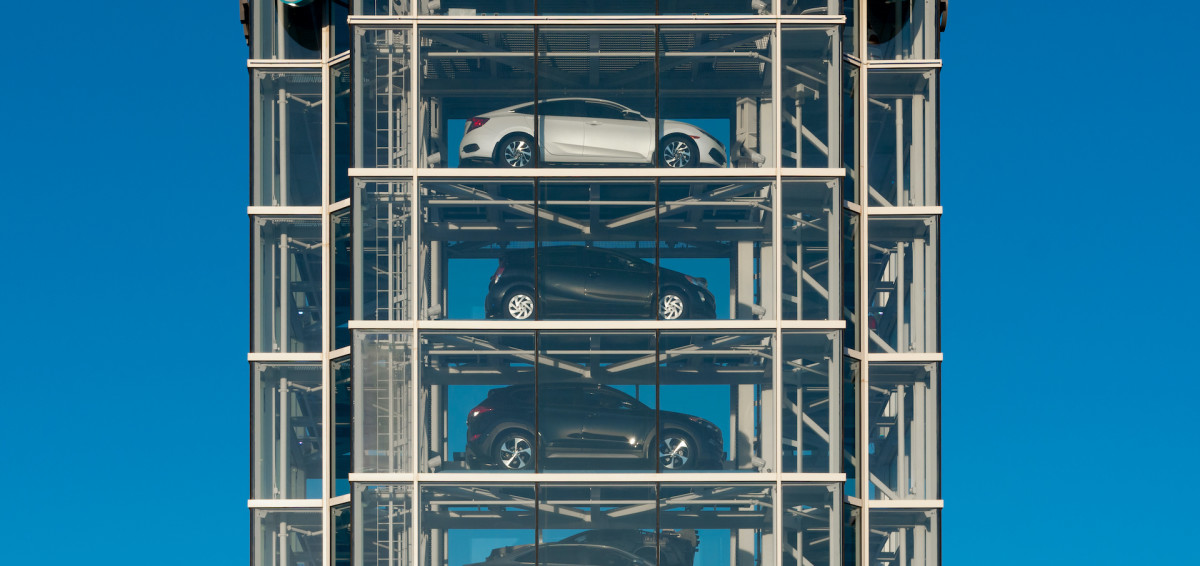

The company, founded in 2012 and based in Arizona, took advantage of favorable conditions to market its new way of buying a car. The group's car vending machines stuck well with the pandemic, a period during which consumers wanted to avoid contact as much as possible, to limit their exposure to the virus.

The federal government had also flooded consumers with money via stimulus programs. Interest rates were almost zero, which meant that financing the purchase of a vehicle cost practically nothing.

On the contrary, big clouds continue to gather over the company which was one of the big winners of the covid-19 pandemic, with a massive growth.

Since announcing its quarterly results on Nov. 3, Carvana (CVNA) - Get Free Report shares have lost 44% of their value and are currently trading at $8.06 versus $14.35 on that day. This translates into a decline in market capitalization of approximately $1.1 billion in two weeks. Carvana currently has a market value of $1.43 billion.

The company, founded in 2012 and based in Arizona, took advantage of favorable conditions to market its new way of buying a car. The group's car vending machines stuck well with the pandemic, a period during which consumers wanted to avoid contact as much as possible, to limit their exposure to the virus.

The federal government had also flooded consumers with money via stimulus programs. Interest rates were almost zero, which meant that financing the purchase of a vehicle cost practically nothing.

Added to this, the supply chains of car manufacturers were disrupted, which made the production of new vehicles difficult. Faced with these challenges, consumers turned to the second-hand market as the waiting times for new vehicles were long. Used car prices therefore jumped, making it a good deal for Carvana.

Basically, all the winds were blowing in the right direction for the company.

New Car or Used Car?

But coming out of the pandemic, Carvana's fortunes seem to have turned completely. The used car market remains hot. But all the other factors have reversed. There is no more stimulus money. The central bank is aggressively raising interest rates and inflation is at its highest in 40 years. The economy is also close to a recession more than ever, and the waves of job cuts follow one another. Used car prices remain high but financing the transaction has become very expensive for consumers. Supply chains have improved significantly, facilitating the production of new vehicles.

This was felt in the latest quarterly results from Carvana: In the third quarter, Carvana's revenue fell 2.7% year-on-year to $3.4 billion, while net loss jumped to $283 million from just $32 million in the third quarter of 2021, the company said in a letter to shareholders.

Used car sales in the U.S. fell almost 13% year-on-year, in the third quarter of 2022.

"If you’re looking at newer used cars — models in the 1 to 3-year-old range, you may find that prices are still relatively close to what they sold for new," Consumer Reports said. "If you have to borrow money to buy the car, it may be better to find a new car that can qualify you for a lower interest rate, to say nothing of the benefit of a fresh factory warranty. Many manufacturers subsidize financing and may offer interest rates that are much lower than normal to qualified buyers."

All this complicates the affairs of Carvana, which had to go into $3.3 billion of debt to finance the acquisition of auctioneer Adesa’s physical auction business this year.

Elimination of 1,500 Additional Jobs

The group is therefore under enormous financial pressure.

"Significant nearer-term operational and financial risks for Carvana have emerged and are likely to cloud the CVNA investment story for the foreseeable future," Oppenheimer analyst Brian Nagel said in a note on Nov. 15, downgrading the stock.

He added that "we do not envision investors bidding CVNA meaningfully higher until prospects for a manageable and sustained capital base become clearer."

Nagel seems to confirm that Carvana has a liquidity problem which the group must address fairly quickly if it wants to stop the collapse. The company has between $6 billion and $7 billion in debt net of the cash on the balance sheet, according to FactSet.

But Carvana is not profitable: its adjusted EBITDA margin loss increased by 6.2% in the third quarter. EBITDA refers to earnings before interest, taxes, depreciation and amortization, which helps investors to gauge the financial health of a company.

The company is struggling to try to change things and delay as much as possible raising equity capital or adding more debt. Carvana, for example, is determined to drastically reduce costs. After cutting 2,500 jobs in May, the company has just announced an additional wave of layoffs which affects 8% of its workforce, or 1,500 employees.

"It is fair to ask why this is happening again, and yet I am not sure I can answer it as clearly as you deserve," Chief Executive Officer Ernie Garcia told employees in an email on Nov. 18. "I think there are at least a couple of factors. The first is that the economic environment continues to face strong headwinds and the near future is uncertain. This is especially true for fast-growing companies and for businesses that sell expensive, often financed products where the purchase decision can be easily delayed like cars."

In addition, "we failed to accurately predict how this would all play out and the impact it would have on our business. As a result, we find ourselves here."

The new cuts will affect "many corporate and technology teams as well as some operations teams where we are eliminating roles, locations or shifts to match our size with the current environment," Garcia wrote.

Reached by TheStreet, Carvana didn't comment.

Legal Issues

The new job cuts come after ratings agency S&P Global Ratings warned it was likely to downgrade Carvana in the near term, changing the outlook from stable to negative.

"GPU [gross profit per unit] is expected to remain weak due to higher used car depreciation rates and lower returns from selling loans and other products," said the rating agency. "Carvana generates over 50% of its GPU from selling loans and other products. With rising interest rates, it is more difficult for Carvana to compete with the large banks that can keep loan rates low, which will reduce the number of loans allocated to Carvana."

Garcia ruled out the option of raising capital on Nov. 3.

"Our goals are going to be on driving down expenses and trying to get positive EBITDA as quickly as we can," he told analysts. "We've got a bunch of committed liquidity. We've got a bunch of real estate. And I think that we feel like that puts us in a good position to ride out this storm. And we're making great moves inside the company."

But apart from these financial difficulties, Carvana also faces legal challenges. The company is facing lawsuits from customers in multiple states involving alleged issues over titles and registration and over purchasing vehicles.

Michigan Secretary of State Jocelyn Benson also suspended the retailer's license, with Carvana suing in return.

Carvana has said the lawsuits are without merit and called the decision in Michigan "arbitrary."

No comments:

Post a Comment