Matthew Fox

Sat, November 19, 2022

Sam Bankman-Fried, founder of crypto exchange FTX.

The downfall of crypto exchange FTX has led to a bankruptcy filing that is full of crazy details.

Documents filed in court this week reveal much deeper problems than anyone would have thought.

From billion dollar loans to accountants in the metaverse, these are the craziest details of the FTX bankruptcy filing.

Bankruptcy filings from FTX shed new light on how crypto exchange FTX, once worth $32 billion, lost it all. To put it mildly—it's a doozy.

Anyone who watched a few weeks ago as Sam Bankman-Fried, the CEO of the third largest crypto exchange, flailed through rumors of insolvency on Twitter only to file for bankruptcy a few days later, probably thought, "well this seems bad". To say it got worse would be an understatement.

Among the people looking on in sheer awe at the magnitude of the disaster was new FTX CEO John Ray III, who oversaw the liquidation of Enron in 2001. "Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here."

From the guy who presided over the cleanup of the worst financial scandal of its time, that's saying something.

The swift collapse FTX sent shockwaves across the industry and may leave an untold number of creditors—up to one million—holding the bag, including countless customers who had funds on the exchange, many of them retail clients.

Losses for both investors in the company and its customers are expected to be well above ten billion dollars, and the fallout should be long-lasting even though former FTX CEO Sam Bankman-Fried continues to tweet about potential next steps forward.

Here are the craziest details from the chapter 11 bankruptcy filings this week.

FTX's balance sheet was a nightmare

After FTX imploded, Bankman-Fried claimed on Twitter that FTX held about $5.5 billion in "less liquid" crypto tokens.

In reality, according to the bankruptcy filing, FTX's crypto holdings have a fair value of just $659,000 as of September 30. That number could also be lower given the volatility that has wracked the market since then.

Clues were building that the internal numbers were going to be awful, given that FTX founder Sam Bankman-Fried caveated multiple tweet storms about the finances of FTX as "approximate" and "to the best of my knowledge" and "treat all of these numbers as rough."

Bankman-Fried and Co. received $3.3 billion in loans from Alameda Research

The bankruptcy filing of FTX revealed that Alameda Research, the crypto hedge fund sister-company of FTX, directly lent $1 billion to Sam Bankman-Fried. Additionally, Alameda lent another $2.3 billion to Paper Bird Inc., which Bankman-Fried owns a majority stake in.

Other employees at FTX also received loans from Alameda, including $543 million to head of engineering Nishad Singh and $55 million to head of FTX digital markets Ryan Salame. It seems unlikely those loans will be paid back anytime soon.

FTX didn't have an accounting department

Ray said in the bankruptcy filing that FTX had compromised internal systems, faulty regulatory oversight, and inexperienced and unsophisticated people in charge of the company's finances. That includes the company not having an accountant in charge of its finances, which is astonishing for a company once valued at $32 billion.

"The debtors are locating and securing all available materials but expect it will be some time before reliable historical financial statements can be prepared for the FTX Group with which I am comfortable as Chief Executive Officer," Ray said. "The debtors do not have an accounting department and outsource this function." Ray added that any previous financial statments could not be relied on.

Auditing company financials was a firm with offices in the metaverse.

FTX could have more than a million creditors

FTX had initially warned it had more than 100,000 creditors it owed money to following the implosion of the crypto exchange. For a more accurate figure, try multiplying that number by 10.

"In fact, there could be more than one million creditors in these Chapter 11 Cases," the bankruptcy filing said.

FTX may have used corporate funds to buy homes for employees

"In the Bahamas, I understand that corporate funds of the FTX Group were used to purchase homes and other personal items for employees and advisors," Ray said in the bankruptcy filing.

What's worse is there does not appear to be proper documentation for some of these transactions, and certain real estate assets were recorded in the personal name of FTX employees and advisors on the records of the Bahamas, even though it was purchased with money from FTX.

SBF's biggest regret is filing for bankruptcy in the first place

To top it all off, Bankman-Fried's biggest "mistake" amid the implosion of FTX, according to him, is the fact that he filed for chapter 11 bankruptcy in the first place.

Bankman-Fried said in Twitter direct messages to a Vox reporter that those now in charge of FTX were "trying to burn it all to the ground."

"You know what was maybe my single biggest fuckup?" Bankman-Fried said. "The one thing *everyone* told me to do." He said later he was referring to Chapter 11.

Darrell Etherington

Sun, November 20, 2022

At our TC Sessions: Crypto event last week in Miami, I sat down with Bitwise Asset Management General Counsel and Chief Compliance Officer Katherine Dowling, Perkins Coie Partner Sarah Shtylman and Paradigm Policy Director Justin Slaughter to talk about the crypto regulation landscape, with a specific focus on the U.S. What we didn't know heading into the panel was just how much would change about the industry owing to the fallout from FTX's collapse the week prior.

Slaughter in particular felt the impacts of the FTX fiasco firsthand: Paradigm wrote down a $278 million investment in the exchange following its declaration of bankruptcy. We talked about that up front, but mostly as a jumping-off point to discuss the knock-on effects for the state of regulation, which was itself already a contentious mess, particularly when it comes to U.S. lawmakers and the various federal regulators involved in the market, including the SEC and the CFTC.

The key takeaways that all three panelists essentially agreed upon is that the benefit of the FTX situation is that there's now more impetus than ever to arrive at some kind of regulatory framework specific to crypto in the U.S., and that there's now ample demand from the industry side, as well as an opportunity to further educate regulators since they're looking for illumination coming out of the FTX collapse. On the incentive side, there's harm reduction, since regulators and lawmakers don't want more FTX scenarios to continue to unfold, as well as FOMO on the business being done abroad in markets where they've raced ahead to encourage crypto adoption.

Bibhu Pattnaik

Sat, November 19, 2022

The beleaguered cryptocurrency exchange FTX, which recently filed for bankruptcy, has fired some of Sam Bankman-Fried's top deputies. There were close to 300 staff members at FTX, many of which have resigned over the past few weeks. Only a few are based at the Bahamas headquarters.

According to a Wall Street Journal report, Caroline Ellison, Gary Wang, and Nishad Singh have been terminated from their positions at FTX.

All three of them were fired after FTX appointed John J. Ray III as the new CEO of the company to oversee the bankruptcy, the report says.

Earlier, Ray said that Bankman-Fried utilized business cash from the FTX Group to buy homes and other personal assets for staff and consultants.

"Never in my career have I seen such a complete failure of corporate controls and a complete absence of trustworthy financial information as occurred here," Ray said.

Also Read: Marathon Digital CEO Fred Thiel Says FTX Bankruptcy 'Has Increased The Fear Factor'

Earlier last week, FTX said in an emergency court filing that Bahamian regulators ordered Bankman-Fried to gain "unauthorized access" and obtain the company's digital assets following its bankruptcy filing.

Public Remarks By Bankman-Fried Pose A Problem

Meanwhile, legal experts have said that Bankman-Fried's remarks on public platforms may have harmed his defense.

Bankman-Fried has been speaking with reporters and posting tweets regarding the FTX collapse. However, legal experts have said that such public statements will likely make life more difficult for his defense lawyers seeking to manage the fallout from the exchange's demise.

A defense lawyer at Saul Ewing Arnstein & Lehr says, "There's this old saying that a lawyer who represents himself has a fool for a client. The reverse is also true. An individual who is the subject of an investigation and tries to defend themselves in the court of public opinion has a fool for a lawyer."

Bankman-Fried's statements have already been cited in FTX's bankruptcy proceedings.

FTX is facing investigations from the Justice Department, Securities and Exchange Commission, and Commodity Futures Trading Commission.

A group of cryptocurrency investors has also filed a class action against Bankman-Fried and others who promoted FTX.

Zuckerberg Says He Was More Thoughtful About Meta Layoffs Than Musk's Job Cuts At Twitter

Musk Thought There Were Ghost Employees At Twitter, Demanded Audit To Confirm They Were 'Real Humans'

© 2022 Benzinga.com

Bethany Biron

Sun, November 20, 2022

Sam Bankman-Fried.FTX

Sam Bankman-Fried and FTX execs donated a total of $70 million to political campaigns in 18 months, according to OpenSecrets.

Bankman-Fried himself donated $40 million to mostly liberal efforts, while fellow exec Ryan Salame gave $23 million primarily to Republicans.

Critics are now scrutinizing the role of cryptocurrency in politics after FTX's dramatic demise.

FTX founder Sam Bankman-Fried and fellow company executives donated more than $70 million to political campaigns ahead of the 2022 midterm elections, according to OpenSecrets data.

Bankman-Fried himself donated nearly $40 million to Democratic candidates and political action committees, according to OpenSecrets, a nonpartisan organization that tracks campaign spending in US politics. He was the second highest donor for liberal efforts behind George Soros and the sixth highest donor overall.

Meanwhile, Ryan Salame, a fellow FTX senior executive, donated more than $23 million primarily to Republican candidates and efforts. Remaining donations came from FTX engineering director Nishad Singh, who contributed $8 million to liberal efforts.

Their collective contributions cemented FTX as the third largest contributor to political efforts this election cycle, and helped propel cryptocurrency to one of the top spending industries in Washington.

Now, in the wake of FTX's dramatic implosion and bankruptcy — which led Bankman-Fried to step down from his position while simultaneously losing $16 billion of his net worth earlier this month — the donations are prompting increased scrutiny of the cryptocurrency industry's influence on politics.

FTX's swift demise also led many to criticize "effective altruism," a world view held by Bankman-Fried and some of his colleagues which led to the formation of the Future Fund, an effort to make socially impactful investments.

During an interview on NBC's Meet the Press in September, Bankman-Fried discussed his political donations, and acknowledged the influence such sizeable contributions may have over lawmakers.

"Frankly, everyone should always be skeptical of things like this," Bankman-Fried said of political donations. "I'm not going to tell people that they should give anyone a free pass on it. What I'd say is look at the evidence, try to trace out what's happening."

Bankman-Fried's FTX Was a Wild West Show And a Personal Bank

It was the Wild West.

A place where everything was acceptable.

Everything was allowed and there was no control to call to order those who went too far. There was no red line.

The CEO reportedly considered the funds of one of his companies to be his personal bank. Employees allegedly dipped into company money to buy homes in the Bahamas and none of these transactions were recorded anywhere.

There may even have been fictitious employees. The board of directors, which is supposed to rein in everyone's instincts, reportedly never met.

Welcome to the cryptocurrency empire of Sam Bankman-Fried, 30, the fallen king of the crypto sphere, who filed for Chapter 11 bankruptcy on Nov. 11. This empire mainly includes the FTX cryptocurrency exchange and Alameda Trading, a crypto hedge fund.

'Potentially Compromised Individuals'

John Ray, the new CEO in charge of restructuring this empire, gave this scathing description in a 30-page document filed with the United States Bankruptcy Court for the District of Delaware. The document was made public on Nov. 17.

Page after page, Ray described a company whose practices seem surreal. What dominates here are lawless cowboys.

"Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here," Ray wrote. "From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented."

Ray isn't a rookie. He was the liquidator of Enron, the broker whose collapse remains one of the biggest financial fiascos of modern times.

Each page is a bombshell, an indictment of the Bankman-Fried regime. For Ray, the former trader and his two associates -- Zixiao "Gary" Wang and Nishad Singh -- failed on several levels.

"Many of the companies in the FTX Group, especially those organized in Antigua and the Bahamas, did not have appropriate corporate governance. I understand that many entities, for example, never had board meetings," the new chief executive officer blasted.

He added that there was "the use of software to conceal the misuse of customer funds."

Ray didn't provide further details. But his statement clearly undermines Backman-Fried's denial that there was a back door, allowing him to alter the records without third parties, including auditors and investors, noticing.

FTX's financials showed that there was a "back door" in the books, created with "bespoke software," Reuters reported last week. It was described as a way that Bankman-Fried could cook the books without raising any alerts.

$1 Billion in Personal Loans

"Unacceptable management practices included the use of an unsecured group email account as the root user to access confidential private keys and critically sensitive data for the FTX Group companies around the world," the seasoned restructuring veteran wrote.

The insolvency of FTX was due to a liquidity shortfall when clients attempted to withdraw funds from the platform. The liquidity shortfall appears to have been the result of FTX’s founder reportedly transferring $10 billion of customer funds from FTX to Alameda Research.

FTX faces a shortfall of $1 billion to $2 billion.

As a crypto exchange, FTX executed orders for their clients, taking their cash and buying cryptocurrencies on their behalf. FTX acted as a custodian, holding the clients’ crypto currencies.

FTX then used its clients’ crypto assets, through its sister company’s Alameda Research trading arm, to generate cash through borrowing or market making. The cash FTX borrowed was used to bail out other crypto institutions in the summer of 2022.

At the same time, FTX was using the cryptocurrency it was issuing, FTT, as collateral on its balance sheet. This represented a significant exposure, due to the concentration risk and the volatility of FTT.

Bankman-Fried received a personal loan of $1 billion from Alameda, according to Ray,. The firm also gave a $543 million personal loan to Singh, and $55 million to Ryan Salame, the co-CEO of FTX Digital Markets, one of FTX's affiliates.

Buying Homes

"In the Bahamas, I understand that corporate funds of the FTX group were used to purchase homes and other personal items for employees and advisors," Ray said.

"I understand that there does not appear to be documentation for certain of these transactions as loans, and that certain real estate was recorded in the personal name of these employees and advisors on the records of the Bahamas."

He further indicated that, to be reimbursed for business expenses, employees only had to submit the request by chat and a supervisor would immediately approve with a personalized emoji.

"The debtors did not have the type of disbursement controls that I believe are appropriate for a business enterprise," Ray wrote. "For example, employees of the FTX Group submitted payment requests through an on-line 'chat' platform where a disparate group of supervisors approved disbursements by responding with personalized emojis."

Finally, Ray said he still hasn't been able to locate some of the alleged employees, suggesting some either fled or didn’t exist.

"At this time, the debtors have been unable to prepare a complete list of who worked for the FTX Group," he said. "Repeated attempts to locate certain presumed employees to confirm their status have been unsuccessful to date.

Jordan Hart

Sun, November 20, 2022 at 10:45 AM·2 min read

In a 2020 FTX podcast, former Alameda Research CEO said she "took a blind leap into the unknown" when she joined Sam Bankman-Fried.

WSJ first reported on the remarks, after Ellison has drawn increased scrutiny for her role in the demise of FTX.

On Friday, bankrupt FTX-linked Alameda fired Ellison and other execs.

Caroline Ellison said she took a "blind leap into the unknown" when she left her Wall Street job to join former coworker, Sam Bankman-Fried, in the fast-paced — almost instantaneous — environment of Alameda Research.

Around 2018, Ellison left her job at Jane Street Capital to join Alameda Research, the crypto exchange company founded by Bankman-Fried the year prior. The environment of the bold young company was a bit different than her Wall Street gig, Ellison said in a 2020 FTX podcast episode, as first reported by the Wall Street Journal

"It was like, wow, the process for doing things is just someone suggests something and then someone codes it up and releases it," she said in the FTX podcast. "An hour later and it's already happened."

After nearly four years at Alameda — more than one of which the 28-year-old spent as CEO — Ellison was fired by the bankrupt cryptocurrency exchange on Friday, the Wall Street Journal reported.

Bankman-Fried's FTX Group, including Alameda, failed to secure emergency funding and filed for bankruptcy in early November. According to a Sunday report from Bloomberg, the crypto empire owes a total of $3.1 billion to its 50 biggest unsecured creditors.

Although the names and locations of the creditors weren't disclosed, the biggest unsecured creditor is owed more than $226 million alone, while the rest of the customers making up the 50 largest claims are each owed at least $21 million, Bloomberg reported.

In the FTX podcast episode, Ellison described her decision to follow Bankman-Fried on his endeavors and their shared sentiment of "effective altruism" that led to creating the Future Fund, formed to make grants to nonprofits and investments in socially impactful companies.

According to WSJ, critics of the practice say effective altruism encourages excessive risk-taking.

"The general idea of effective altruism is trying to do the most good you can and using expected value to measure that good," Ellison explained on the FTX podcast.

Ellison was asked about her plans of saving money for future retirement after explaining effective altruism in the 2020 podcast episode.

"I'm not really thinking a ton about that right now," Ellison said. "It doesn't really make sense for me to be worried about saving. I'll probably just make more money in the future."

Her April 2021 tweets about "regular amphetamine use" have drawn scrutiny in light of the collapse of FTX.

Jordan Hart

Sat, November 19, 2022

FTX-linked Caroline Ellison's past tweets about 'regular amphetamine use' have resurfaced online.

Ellison is the CEO of Alameda Research, the hedge fund FTX reportedly used to borrow money for bets.

Amphetamines are often prescribed to treat ADHD.

Old drug-related tweets posted by Caroline Ellison — the 28-year-old CEO of Alameda Research, the hedge fund linked to the downfall of FTX — are resurfacing as the cryptocurrency industry crumbles.

In a 2021 tweet posted by Ellison, who is also the reported ex-girlfriend of FTX's disgraced founder, Sam Bankman-Fried, references regularly using amphetamines and how "dumb" the "non-medicated human experience" can be.

Her initial tweet about amphetamines — often prescribed to treat ADHD — was followed up by a thread of tweets detailing the "dumbest" parts of her own non-medicated day.

It's unclear exactly what Ellison meant by her April 2021 tweets. As of Saturday morning, her account only has a total of 71 tweets since joining the platform on March 2021.

Alameda served as the trading firm through which Bankman-Fried would move crypto tokens while running FTX. As the CEO of Alameda, Ellison has garnered scrutiny for her role in FTX borrowing money from customer accounts, CNN reported.

A report from CoinDesk named Ellison as the on-again-off-again girlfriend of Bankman-Fried, according to anonymous sources.

Information on the elusive Ellison is hard to come by as her Linkedin profile, online photos, and contact information have all but disappeared in the wake of the FTX implosion.

Sun, November 20, 2022

The collapse of Sam Bankman-Fried's cryptocurrency exchange FTX has led to an increased focus on the role played by Alameda Research and its CEO Caroline Ellison in the firm's implosion.

Ellison, 28, was raised by two MIT economists and graduated from Stanford with a degree in mathematics. She met Bankman-Fried at the trading firm Jane Street Capital. Bankman-Fried, like Ellison, was raised by professors and the pair embraced the philosophy of "effective altruism," which involves making large sums of money to fund philanthropic pursuits that benefit society to the greatest extent possible. The two reportedly were involved in an on-and-off relationship, according to CoinDesk.

CEO ACCUSED OF INSTIGATING FTX COLLAPSE DETAILS SAM BANKMAN-FRIED'S ‘LIES' AND ‘STRAW THAT BROKE CAMEL’S BACK'

When Bankman-Fried left Jane Street in 2017 to found his own hedge fund known as Alameda Research, Ellison joined him shortly thereafter in what she called "a blind leap into the unknown." She became one of the lead traders at the new firm and said on an FTX-related podcast that joining Alameda was "too cool of an opportunity to pass up" but dealing with capital was "kind of daunting" when she first started at the firm in 2018.

"Mostly, sort of, it was something I wasn’t used to thinking about," she said. "So it was sort of – I don’t know, I guess I was like a trader for, I mean, not that long at Jane Street but a year and a half, which was kind of more trading experience than a lot of Alameda traders had at the time. I kind of wanted to come in and be like an expert on everything, but there was still lots of stuff in the crypto world that I knew nothing about."

The logo of FTX is seen at the entrance of the FTX Arena in Miami, Fla,, Nov. 12, 2022.

FTX FILES FOR COURT RELIEF TO PAY VENDORS, BEGINS REVIEW OF ASSETS

Alameda was a major trader in the cryptocurrency space and traded frequently on FTX's platform, according to the Wall Street Journal. Though Bankman-Fried was the founder and majority owner of Alameda, he eventually ceded control of its operations and focused primarily on his role as CEO of crypto exchange FTX, which he founded in 2019. At its peak, FTX amassed a valuation of roughly $32 billion and was the world's third-largest cryptocurrency exchange by volume.

The fast-paced atmosphere and rapid growth of both Alameda and FTX increased the strain on those at the helm. The Wall Street Journal previously reported that the use of stimulants was commonplace among those in Bankman-Fried's upper echelon. Ellison tweeted last year, "Nothing like regular amphetamine use to make you appreciate how dumb a lot of normal, non-medicated human experience is."

Sam Bankman-Fried, founder and chief executive officer of FTX Cryptocurrency Derivatives Exchange, speaks during the Institute of International Finance (IIF) annual membership meeting in Washington, DC, US, on Thursday, Oct. 13, 2022. This year's conference theme is "The Search for Stability in an Era of Uncertainty, Realignment and Transformation."More

In October 2021, Ellison was named co-CEO of Alameda with Sam Trabucco. She became CEO in August 2022 when Trabucco announced on Twitter he was stepping down from the role. Trabucco said leading Alameda alongside Ellison had been "difficult and exhausting and consuming," but added that he would "stay on as an advisor."

Cryptocurrency prices were near all-time highs in the fall of 2021, but in early 2022, the digital currencies were plummeting and many investment and lending firms in the sector were facing financial pressure.

NEW FTX CEO HIGHLIGHTS ‘PERVASIVE FAILURES’ IN COURT FILING

By early November of this year, concerning reports about the financial health of both Alameda and FTX were mounting. Rival crypto exchange Binance scuttled a tentative plan to acquire FTX after due diligence revealed what Binance CEO Changpeng Zhao called a "chaotic" balance sheet in an interview with Fox Business's Susan Li.

The interconnected relationship between the two firms ultimately led to their collapse, as FTX lent billions of dollars of customer funds from the exchange to Alameda in an effort to shore up the firm's finances. When unnerved investors went to withdraw funds from FTX, it was unable to fulfill those requests and spiraled into insolvency.

During a video meeting earlier this month before the firm and FTX filed for bankruptcy, the Wall Street Journal reported that Ellison informed Alameda staff about FTX using customers' funds to help Alameda meet its liabilities, and added that she, Bankman-Fried, and other members of the firms' leadership were aware of the decision.

Fox Business's Kayla Bailey and Aislinn Murphy contributed to this report

Lakshmi Varanasi

Sat, November 19, 2022

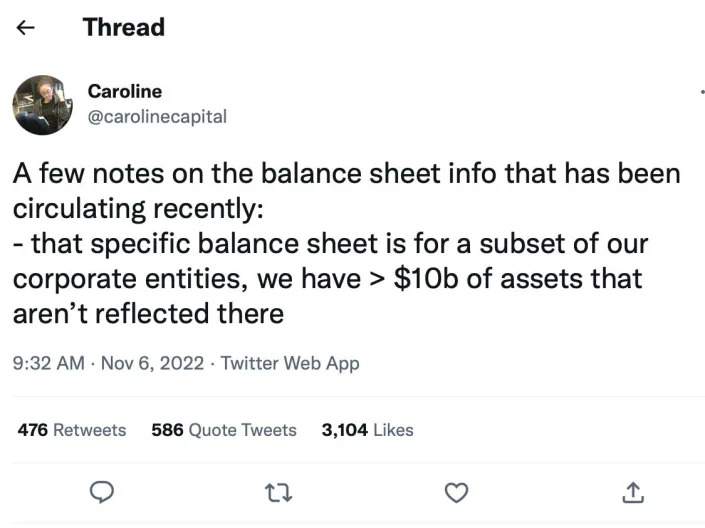

Screenshot from Caroline Ellison's Twitter, @carolinecapital

Caroline Ellison was the CEO of Alameda Research, a trading firm launched by Sam Bankman-Fried.

She oversaw many of the risky bets Alameda took with FTX customers' crypto tokens.

Here is her background story.

Over the past few weeks, a mushroom of secrets about the inner workings of Sam Bankman-Fried's crypto exchange, FTX, have come to light.

From that, the once shadowy figure of Caroline Ellison has emerged as an important character behind FTX's seeming success and surprising downfall.

Ellison was the head of Alameda Research — the trading firm through which Bankman-Fried moved crypto tokens in tandem with running FTX. Amidst the revelation that FTX borrowed money from customer accounts to fund bets via Alameda, Ellison has become a subject of online speculation.

Ellison's virtual presence, however, is dwindling by the day. Her LinkedIn, online photos, and contact information have largely disappeared over the past couple of weeks. That's left journalists, investors, and voyeurs of all types scrambling to find information about her.

The curiosity has only heightened since CoinDesk reported via anonymous sources that she was in an on-and-off relationship with SBF.

Right now, the most reliable information about Ellison has been sourced from her Tumblr account, and the handful of media interviews she's given over the years. The bones of her virtual self suggest that Ellison is extraordinarily bright and highly educated as well as a math whiz and a big reader. She speculates often about gender roles and shifts in culture and society on Tumblr.

Here's what we know about Caroline Ellison.

Ellison grew up in the suburbs of Boston.

Skyline of Boston, Massachusetts.Getty Images.

Source: Forbes

Her father, Glenn Ellison, is the department head of economics at Massachusetts Institute of Technology. He once reported directly to Gary Gensler, the current chair of the Securities and Exchange Commission. Ellison's mother Sara Fisher Ellison, is a senior lecturer in economics at MIT. "We definitely got exposed to a lot of economics," Ellison once told Forbes in an interview.

William B. Plowman/Getty Images

Source: Cryptoslate and Forbes

When she was eight years old, Ellison reportedly wrote her father an economics paper analyzing stuffed animal prices at Toys 'R' Us.

Pixavril/Shutterstock

Source: Forbes

Ellison, who attended Newton North High School, had a special aptitude for mathematics. She would flex her skills in competitions like the Math Prize for Girls, which bills itself as "the largest math prize for girls in the world."

Pixabay via Google Images

Source: Gawker and Math Prize for Girls.

In 2012, Ellison enrolled at Stanford University, where she studied mathematics. Ruth Ackerman, a math professor who taught Ellison, described Ellison to Forbes as "bright, focused, very mathy."

People walk on the Stanford University campus in Santa Clara, California.Ben Margot/AP

Source: Forbes

Like her future colleague, Bankman-Fried, Ellison began exploring effective altruism in college. It's a philosophical movement that uses calculations to understand how people can use their time, money, and resources to best help others. She eventually joined Stanford's Effective Altruism Club.

Orbon Alija/ Getty Images

Source: Forbes

After college, Ellison went to work for the trading firm Jane Street. There, she met Bankman-Fried, and the two supposedly bonded over their interest in effective altruism.

People walk by the New York Stock Exchange (NYSE) on June 14, 2022 in New York City. The Dow was up in morning trading following a drop on Monday of over 800 points, which sent the market into bear territory as fears of a possible recession loom.Spencer Platt/Getty Images

Source: Forbes

By 2018, Bankman-Fried, also known as SBF, had launched a crypto trading firm called Alameda Research, and persuaded Ellison to join him. "This was very much like, 'oh, yeah, we don't really know what we're doing,'" Ellison told Forbes of her initial impressions of Alameda.

Sam Bankman-Fried, founder of FTX and Alameda ResearchFTX

Source: Forbes

Aside from Ellison, the Alameda Research crew included SBF's close friends Nishad Singh, Gary Wang, and Sam Trabucco. They moved from Berkeley to Hong Kong in 2018 where they lived like college students and fiercely traded crypto. Ellison was the only female on the team. While the others played video games, she'd be watching the royal wedding of Prince Harry and Meghan Markle.

Meghan Markle and Prince Harry in their wedding carriage on May 19, 2018.Aaron Chown/WPA Pool/Getty Images

Source: Forbes

After SBF established FTX in 2019, Ellison began taking more responsibility at Alameda Research. She and her colleague, Sam Trabucco, were featured in Forbes' 30 Under 30 in 2022.

Screenshot of Caroline Ellison and Sam Trabucco on Forbes 30 Under 30.

Source: Forbes

Ellison maintained an active online persona. She tweeted under the handle @carolinecapital. She supposedly had two Tumblr accounts — worldoptimization and worldoptimization-lifeadvice — according to Gawker.

The Tumblr app went down.Shutterstock

Source: Gawker

Still, Ellison largely remained out of the limelight as FTX rose to fame. FTX employees told Forbes that Ellison was content staying behind the scenes.

Michael Blann/ Getty Images

Source: Forbes

In April, Trabucco stepped down as CEO. Since then, Ellison has been solely running Alameda.

Catherine McQueen/ Getty Images

Source: Forbes

Now, amid the fallout of FTX, online investigators ranging from the Twitter account, @Autismcapital, to media outlets like Gawker have rushed to unearth information on Ellison.

Boris Zhitkov/ Getty Images

Source: Gawker

CoinDesk, the crypto publication, reported through anonymous sourcing, that Ellison was among the 10-person crew of FTX and Alameda employees who all lived together in the Bahamas. CoinDesk noted that all 10 members were paired off in relationships with one another at some point. Ellison reportedly had an on-and-off relationship with SBF.

Leaf Cay, BahamasDamianos Sotheby’s International Realty

Source: Insider and CoinDesk.

On what is assumed to be her Tumblr account, Ellison likened the polyamory in the Bahamas house to an "imperial Chinese harem." She supposedly noted that there was an established hierarchy and everyone knew where they fell within it.

Dimitri Otis/ Getty Images

Source: Screenshot of the Ellison's supposed Tumblr provided by Twitter handle @OxHonky.

Ellison along with the other housemates reportedly shared a therapist named George Lerner.

Getty Images

Source: Gawker citing Sequoia Capital's profile of SBF, which was removed after the fallout.

Ellison is a reader and often posted book reviews on her Tumblr. The most recent titles she reviewed include The Golden Enclaves by Naomi Novik and Venomous Lumpsucker by Ned Beuman.

Raimund Koch/Getty Images

But her literary tastes range far and wide, from the Harry Potter series…

Amazon

Source: Ellison's worldoptimization Tumblr.

…to the Substack of Matthew Yglesias, a blogger who writes about economics and politics.

Matthew Yglesias, co-founding editor of Vox and author of "One Billion Americans."Moshe Zusman

Source: Ellison's worldoptimization Tumblr.

As of 2021, her favorite color was gray.

zhengshun tang/ Getty Images

Ellison's worldoptimization Tumblr.

She often talks about her relationship as being a "trad," which can be understood as one who adheres to conventional gender roles and traditions. Ellison contended on her Tumblr that over time, she's moved away from being a "trad" to becoming "a bit more agnostic on culture/society."

Busà Photography/ Getty Images

Ellison's worldoptimization Tumblr.

The late Supreme Court Justice Antonin Scalia reportedly lived in her former home.

AP

Source: Ellison's worldoptimization Tumblr.

It's unclear what will happen to Ellison moving forward. Her online presence— including her LinkedIn— is dwindling by the day and her physical whereabouts are unclear. She last posted online on November 6 tweeting in defense of Alameda's balance sheet.

Screenshot of Ellison's twitter, @carolinecapital.

Source: Caroline Ellison's Twitter, @carolinecapital.

Sam Tabahriti,Ryan Hogg

Sun, November 20, 2022

Sam Bankman-Fried co-founded FTX in 2019.FTX

Sam Bankman-Fried's mother, a Stanford law professor, once wrote an article titled "Beyond Blame."

Barbara Fried asked what would happen if the focus was on fixing problems and not assigning blame.

Her son Sam Bankman-Fried co-founded FTX, which last week filed for bankruptcy.

A series of essays written by Sam Bankman-Fried's mother have come to light following the collapse of FTX, the crypto exchange he cofounded.

FTX filed for bankruptcy last week and Bankman-Fried says he's scrambling to raise $8 billion to repay customers and FTX's many creditors.

His mother is Barbara Fried, a former lawyer who's taught at Stanford Law School since 1987.

She has written pieces for the Boston Review, a quarterly political and literary magazine, arguing that attributing "personal blame" in times of crisis had "ruined criminal justice and economic policy," suggesting it was "time to move past blame."

"The fact that we have gotten so little in return for our blame mongering at least opens up the possibility that people would be receptive to a new approach," she wrote in 2013.

"The next time something goes terribly wrong, suppose that instead of immediately asking who is to blame, we were to ask: How can we fix this problem?"

Fried declined to comment when contacted by Insider for this article.

In a recent Twitter DM exchange with Vox reporter Kelsey Piper, Bankman-Fried suggested his calls for crypto market regulation were publicity stunts, and that he didn't believe his own rhetoric about the need to behave ethically.

And when asked by Vox if his colleague Nishad Singh's reported guilt over losing depositors' money explained Singh's remorse, Bankman-Fried responded: "The world is never so black and white. I feel bad for those who got f***** by it."

In another 2013 essay for the Boston Review entitled "The Limits of Personal Responsibility," Fried argued that a better world was achievable "if only we could stop arguing about who is to blame for the one we are in."

The academic defended the idea of risk in a world where personal responsibility had its limitations, saying "a world in which everyone is maximally risk averse is a world none of us wants to live in."

"Instead of trying to change the public understanding of personal responsibility, we can try to change the subject to the collective benefits (in this case, economic prosperity) that could come from actually fixing the problems we face," Fried wrote.

Discussing emotional empathy, she suggested: "Gut feeling may well have a constructive role to play in the policy sphere, particularly when we think the tools of rational decision making are unreliable.

"But until people learn to think more systematically and globally about the consequences of different courses of action—even just the consequences to them—we will keep investing in the wrong policies."

Fried's writing ties into her family's belief in "effective altruism", a movement that uses calculations to understand how people can use their time, money, and resources to best help others, with a focus on the ends of an individual's actions justifying the means of getting there.

Its detractors argue that effective altruism can overlook harmful outcomes from such action.

Some have been left wondering if Bankman-Fried somehow prioritized the expansion of FTX, given his belief in the benefits of cryptocurrencies, above all other considerations.

Indeed, in his exchanges with Piper, Bankman-Fried looked through his downfall through the lens of a calculation, where his efforts added up to bring the company down: "Each individual decision seemed fine and I didn't realize how big their sum was until the end."

The Securities and Exchange Commission, Commodity Futures Trading Commission, and Department of Justice are understood to be investigating FTX for potential mishandling of client funds. The SEC is also said to be investigating Bankman-Fried himself.

Prior to FTX's collapse, the crypto exchange reportedly transferred billions of dollars' worth of client funds to Bankman-Fried's trading firm, Alameda Research.

FTX's new CEO John Ray gave a scathing assessment of the company under Bankman-Fried, describing "a complete failure of corporate controls," underlining a divergence in the former CEO's thinking that may have contributed to his downfall.

"A month ago I was one of the world's greatest fundraisers. Now I'm a fallen wreckage of one," Bankman-Fried told Vox.

"But there's a thing about being fallen — there are people who know what that's like, and who want to do for someone else what nobody did for them."

FTX Collapse: Founder and Co Used Company's Money to Buy Homes in the Bahamas

Story by Luc Olinga • Thursday

There were no expense controls for employees whose expenses were approved by chat with personalized emojis, according to the new CEO.

FTX Collapse: Founder and Co Used Company's Money to Buy Homes in the Bahamas© Provided by TheStreet

The news will cause unprecedented anger among customers of FTX, which filed for bankruptcy on November 11.

The cryptocurrency exchange, which was still valued at $32 billion in February, imploded overnight.

This debacle is spreading to other cryptocurrency exchanges. Regulators have opened investigations. FTX clients and investors began to establish their losses. It is not certain that they will recover their money.

To help them understand what happened, John Ray, the liquidator of energy broker Enron, has just painted a picture of founder Sam Bankman-Fried's empire and how it worked. This description is an indictment of the Bankman-Fried years and his two associates Zixiao "Gary" Wang and Nishad Singh.

'Personal Items'

Ray, a veteran of restructurings, believes they have failed on many levels. For example, he has just revealed that company funds were used by employees and advisors to buy houses in the Bahamas in their own name.

In other words, it is almost impossible to claim these homes back because they are not in the name of the company. Ray also indicates that there is no record of these transactions.

Related video: Impact of FTX Collapse on FintechDuration 7:55 View on Watch

"In the Bahamas, I understand that corporate funds of the FTX group were used to purchase homes and other personal items for employees and advisors," Ray wrote in a 30-page document filed with the United States Bankruptcy court for the District of Delaware.

"I understand that there does not appear to be documentation for certain of these transactions as loans, and that certain real estate was recorded in the personal name of these employees and advisors on the records of the Bahamas," he added.

Ray also said that FTX did not keep "appropriate" books and records, or security controls, with respect to its digital assets.

He further indicated that to be reimbursed for professional expenses, employees only had to submit the request by chat and a supervisor would immediately approve with a personalized emoji.

"The debtors did not have the type of disbursement controls that I believe are appropriate for a business enterprise," the new CEO wrote. "For example, employees of the FTX Group submitted payment requests through an on-line 'chat' platform where a disparate group of supervisors approved disbursements by responding with personalized emojis."

Impossible to Locate Some Employees

Finally, Ray says he still hasn't been able to locate some of the alleged employees, suggesting some either fled or don't exist.

"At this time, the debtors have been unable to prepare a complete list of who worked for the FTX Group," he said. "Repeated attempts to locate certain presumed employees to confirm their status have been unsuccessful to date."

As a crypto exchange, FTX executed orders for their clients, taking their cash and buying cryptocurrencies on their behalf. FTX acted as a custodian, holding the clients’ crypto currencies.

FTX then used its clients’ crypto assets, through its sister company’s Alameda Research trading arm, to generate cash through borrowing or market making. The cash FTX borrowed was used to bail out other crypto institutions in the summer of 2022.

At the same time, FTX was using the cryptocurrency it was issuing, FTT, as collateral on its balance sheet. This represented a significant exposure, due to the concentration risk and the volatility of FTT.

FTX's financials showed that there was a "back door" in the books, created with "bespoke software," according to Reuters. It was described as a way that Bankman-Fried could alter the firm's financial records without raising any alerts.

But Bankman-Fried denied the existence of a "back door."

LUC OLINGA

18 HOURS AGO

FTX announced on Jan. 31, 2022, that it had raised $400 million from major investors such as Softbank, Temasek, Tiger Global and others.

The funding propelled its valuation to $32 billion, more than many long-established companies. As TheStreet wrote at the time, it was a big jump of $7 billion in valuation in just three months.

Ten months later, the platform, which allows you to buy and sell cryptocurrencies like bitcoin (BTC) and ether (ETH), would be bankrupt.

The shock caused by the overnight implosion of one of the firms considered to be the most financially solid in the cryptocurrency industry, is enormous.

In addition to a who's who of investors, FTX also had the biggest names among its ambassadors: NFL legend Tom Brady and his ex-wife supermodel Gisele Bundchen, NBA legends Stephen Curry and Shaquille O'Neal, tennis star Naomi Osaka, entrepreneur star of hit TV show Shark Tank Kevin O’Leary, and "Seinfeld" creator Larry David.

It will take many months to piece together what really happened, establish full accountability and assess collateral damage, due to FTX being a central piece of the cryptocurrency industry.

What is known is that the firm ran out of cash when its customers rushed to withdraw their money by selling the cryptocurrencies they had previously purchased on the platform. FTX was using the client cryptocurrencies as collateral to borrow money which in turn had transferred to Alameda Research, a trading platform with which it shares several links. Alameda used this money to invest in crypto businesses and also for trading operations.

It is important to keep in mind that the fall of FTX is linked to that of Alameda.

FTX and Alameda were founded by former trader Sam Bankman-Fried, 30, in 2017. Bankman-Fried was the institutional face of the cryptocurrency industry. He was a regulator-whisperer and a big donor to the Democratic Party. His meteoric rise made him one of the richest men in the world with a fortune that exceeded $21 billion, but evaporated in a few days between Nov. 8 and Nov. 11.

FTX customers and investors have no certainty today that they will be able to recover their money/cryptocurrencies. Below is the timeline of the series of events which led to the brutal and rapid fall of FTX.

Nov. 2:

News outlet Coindesk publishes an article raising concerns about the financial health of FTX and Alameda Research. The article claims that the assets of Alameda Research consist of FTT, the cryptocurrency issued by FTX.

The revelations cause great concern for the following reasons: FTX was using FTT as collateral on its balance sheet. This represented a significant exposure, due to the concentration risk and the volatility of FTT. This therefore raises fears about the capital reserves of Alameda and FTX.

Nov. 6:

Billionaire Changpeng Zhao, CEO of Binance, FTX's rival exchange, announces that Binance was going to sell about $530 million of FTT, in response to Coindesk's information. That triggers a run on the bank.

The rush of investors to withdraw their money and cryptocurrencies causes a liquidity crunch. About $5 billion would be withdrawn on Nov. 6 from FTX, Bankman-Fried says.

Nov. 7:

In a now deleted tweet, Bankman-Fried assures that the assets are fine.

"A competitor is trying to go after us with false rumors. FTX is fine. Assets are fine," he says on Nov. 7. " FTX has enough to cover all client holdings. We don't invest client assets (even in treasuries). We have been processing all withdrawals, and will continue to be."

Nov. 8:

Thunderclap: Bankman-Fried and Zhao announce that they have reached an agreement for the acquisition of the empire of the former by the latter. The finalization of the deal is pending due diligence.

Bitcoin is falling. The values of cryptocurrency-related companies like Robinhood and Coinbase are plunging in the stock market.

Nov. 9:

Another blow: Binance announces that it is withdrawing its acquisition offer because the situation is more serious than the company originally thought.

"As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged US agency investigations, we have decided that we will not pursue the potential acquisition of FTX.com," Binance said.

Zhao sums up the general sentiment in the crypto industry that day: "Sad day. Tried, but 😭."

Panic has now set in. FTX is left to its fate. There is no longer any doubt that the unthinkable is now reality. In the evening, the venture capital firm Sequoia, a major investor in FTX, writes off its entire investment in the platform.

In a letter Sequoia states that it values the $210 million investment into FTX as $0 and considers it a total loss.

Bankman-Fried meets with investors and tells them that, without an injection of fresh money, his group will have to file for bankruptcy, reports Bloomberg News. The 30-year-old boss estimates he needs $8 billion to meet FTX's obligations. He would like to raise this money in the form of debt, equity, or a combination of the two.

The U.S. Securities and Exchange Commission (SEC) is deepening its investigation into FTX, Bloomberg News reports. The Commodity Futures Trading Commission (CFTC) is also investigating the cryptocurrency exchange.

In addition, the U.S. Department of Justice (DoJ) launches its own probe, according to the Wall Street Journal.

Nov. 10:

One of the Bahamian financial regulators announces that it will freeze FTX's assets. The company's headquarters are in the Bahamas, where Bankman-Fried also lives.

"The Securities Commission of The Bahamas (the Commission) took action to freeze assets of FTX Digital Markets and related parties. The Commission also suspended the registration and applied to the Supreme Court of The Bahamas for the appointment of a provisional liquidator of FTX Digital Markets Ltd," the Commission says in a statement.

Bankman-Fried apologizes: "I'm sorry," he writes on Twitter, thus breaking a 2-day silence. "That's the biggest thing." He added: "I f----- up, and should have done better."

Tongues are starting to loosen in the crypto sphere. Brian Armstrong, CEO of Coinbase (COIN) - Get Free Report, says he was surprised by the fury of Bankman-Fried acquisitions.

"I was surprised at how much cash that they seemed to have and Sam seemed to have to go out and perform various investments in the markets, both their ventures arm and, you know, buying 9% of Robinhood and other political organizations," Armstrong tells CNBC in an interview.

Nov. 11:

What the whole crypto sphere dreaded happens: FTX files for bankruptcy along with all its subsidiaries and all the other Bankman-Fried businesses. He is forced to resign. A new CEO is appointed to lead the restructuring of the cryptocurrency empire of the former king. John Ray, the new CEO and chief restructuring officer, was the liquidator of energy broker Enron.

"FTX Group Companies commence voluntary Chapter 11 proceedings in the United States," the firm said in a statement posted on Twitter. "Sam Bankman-Fried has resigned his role as Chief Executive Officer and will remain to assist in an orderly transition."

Nov. 12:

Bankman-Fried is questioned by the police in the Bahamas, where the authorities have opened a criminal investigation.

FTX lent customer deposits to Alameda Research to help it meet its liabilities, and top executives at Alameda Research were aware of it, the Wall Street Journal reports. This raises additional questions about the relationship between Alameda Research and FTX.

Nov. 13:

Between $1 billion and $2 billion of FTX client funds have vanished from the platform, Reuters reports. Bankman-Fried reportedly transferred $10 billion of customer funds from FTX to his cryptocurrency trading platform Alameda Research. Much of that money has disappeared. FTX's financials show there is a "back door" in the books that was created with "bespoke software," Reuters said. It is described as a way to alter the firm's financial records without alerting third parties like auditors.

But Bankman-Fried denies the existence of a "back door."

Nov. 14:

Eminent crypto lender BlockFi, which was bailed out in the summer by FTX, announces that it is suspending withdrawals from its customers.

"We determined late last week that in the current environment we could no longer operate our business as usual. Given that FTX and its affiliates are now in bankruptcy, the most prudent decision for us, in the interest of all clients, is to continue to pause many of our platform activities for now," the company says in a statement.

"At this time, withdrawals from BlockFi continue to be paused. We also continue to ask clients not to submit any deposits to BlockFi wallet or interest accounts."

FTX is under investigation by federal prosecutors in New York, ABC reported. Investigators want to determine whether the company violated securities laws when it gave customer funds to Alameda Research.

Nov. 16:

Politicians get involved, especially the Democrats who are under pressure, given that Bankman-Fried was a mega donor to the party. Members of the House are requesting testimonies from Bankman-Fried, top executives from FTX and Alameda at a hearing in December. The date has not yet been set.

"The fall of FTX has posed tremendous harm to over one million users, many of whom were everyday people who invested their hard-earned savings into the FTX cryptocurrency exchange, only to watch it all disappear within a matter of seconds," Rep. Maxine Waters, D-Calif., says in a statement.

"Unfortunately, this event is just one out of many examples of cryptocurrency platforms that have collapsed just this past year. That’s why it is with great urgency that I, along with my colleague ranking member McHenry, announce the Committee’s intention to hold a hearing to investigate the collapse of FTX."

Bankman-Fried gives regulators the middle finger in an exchange with a journalist from Vox.

"F--- regulators," the former billionaire writes. "They make everything worse. They don't protect consumers at all."

The same day in a series of tweets he indicates that he did not really know that the finances of FTX were in the red.

"Problems were brewing. Larger than I realized," he writes on Nov. 16. "[AGAIN THESE NUMBERS ARE APPROXIMATE, TO THE BEST OF MY KNOWLEDGE, ETC.] Leverage built up-- ~$5b of leverage, backed by ~$20b of assets which were....Well, they had value. FTT had value, in EV! But they had risk."

"And that risk was correlated--with the other collateral, and with the platform. And then the crash came. In a few day period, there was a historic crash--over 50% in most correlated assets, with no bid side liquidity. And at the same time there was a run on the bank."

And there he utters what appears to be unthinkable:

"Roughly 25% of customer assets were withdrawn each day--$4b. As it turned out, I was wrong: leverage wasn't ~$5b, it was ~$13b. $13b leverage, total run on the bank, total collapse in asset value, all at once. Which is why you don't want that leverage."

He says that he thought the leverage was $5 billion and later discovered that it was almost three times that amount. This admission frames two alternatives. In the first, Bankman-Fried is sincere and didn't really know what was in FTX's books, which makes him look incompetent or ignorant at best. In the second, Bankman-Fried is lying and FTX allegedly embellished its accounting.

In both cases, this revelation clearly indicates that there was a complete absence of risk management. His reference to correlated risk means that, an adverse market event would simultaneously impact multiple assets negatively, requiring more capital to withstand losses. Extreme leverage and correlated risk in a highly-volatile industry was a disaster waiting to happen.

The debacle continues to spread to other exchanges. Crypto exchange Genesis confirms on Wednesday that it has stopped customers from making withdrawals and issuing new loans. The problems at Genesis directly affect crypto exchange Gemini, founded by millionaire twins Tyler and Cameron Winklevoss. Genesis was the lending partner of Gemini.

Nov. 17:

John Ray, FTX's liquidator, paints a very damaging picture of the Bankman-Fried regime in court documents.

"Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here," Ray writes in a 30-page document filed with the United States Bankruptcy court in the District of Delaware.

"From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented."

Each page is a bombshell, an indictment of the Bankman-Fried regime. For Ray, the former trader and his two associates -- Zixiao "Gary" Wang and Nishad Singh -- failed on several levels.

"Unacceptable management practices included the use of an unsecured group email account as the root user to access confidential private keys and critically sensitive data for the FTX Group companies around the world," the seasoned restructuring veteran wrote.

According to John Ray, Bankman-Fried received a personal loan of $1 billion from Alameda. The firm also gave a $543 million personal loan to Singh, and $55 million to Ryan Salame, the co-CEO of FTX Digital Markets, one of FTX's affiliates.

"In the Bahamas, I understand that corporate funds of the FTX group were used to purchase homes and other personal items for employees and advisors," the seasoned executive said.

"I understand that there does not appear to be documentation for certain of these transactions as loans, and that certain real estate was recorded in the personal name of these employees and advisors on the records of the Bahamas."

Nov. 19:

Ray announces that he is starting a strategic review of FTX's assets and that he has recruited an investment bank to help him with this task. All options are on the table, including a sale of the assets.

"The FTX debtors have engaged Perella Weinberg Partners LP as lead investment bank and commenced preparation of certain businesses for sale or reorganization," Ray says in a statement.

No comments:

Post a Comment