Copper price climbs on tight supply outlook after best year since 2009

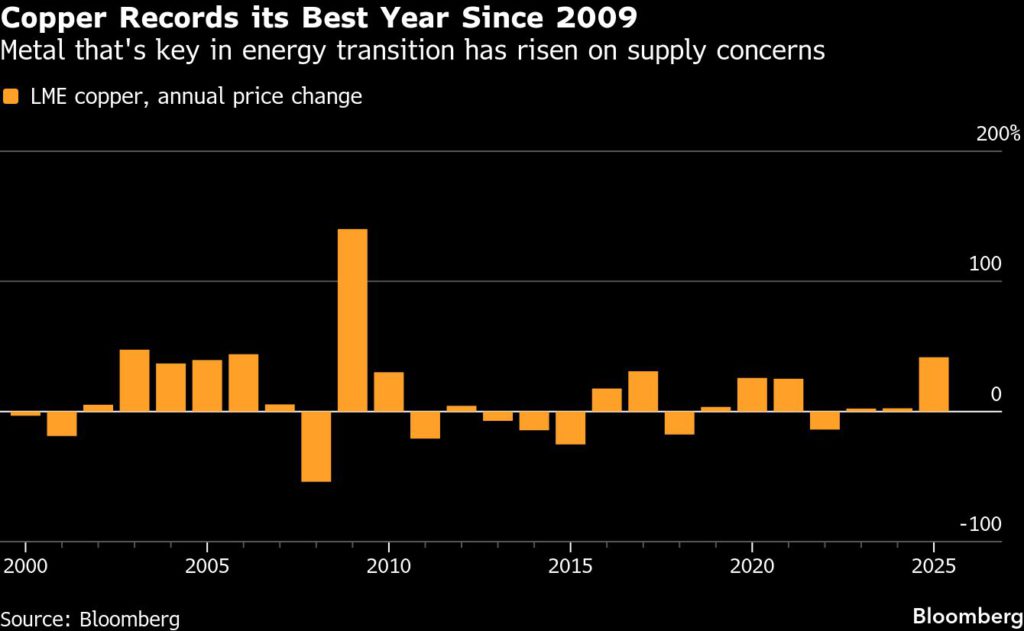

Copper rose on the first trading day of 2026, after capping the biggest annual gain since 2009 on prospects for a tighter market.

The red metal resumed its advance on Friday after losing 1.1% in the previous session. Copper rallied 42% on the London Metal Exchange in 2025, underpinned by mine disruptions and concerns around tariffs, which have led traders to ramp up shipments to the US, creating tightness elsewhere.

Copper notched a series of all-time highs during an end-of-year surge, making it the best performer of the six industrial metals on the LME. Beyond the tariff-driven flows, mines in Indonesia to Chile and the Democratic Republic of the Congo suffered accidents in 2025, crimping output.

The red metal was 1% higher at $12,543.00 a ton at 3:39 p.m. Singapore time, after hitting a record of $12,960 on Monday. Aluminum was little changed at $2,997.50.

Nickel climbed 1.1% to $16,840.00, with PT Vale Indonesia suspending operations at its mines after not receiving approval for an annual work plan from the authorities. Delays in mining-quota approvals are not unusual in the Southeast Asian nation, but traders are honing in on supply after Indonesia said it planned to cut output this year.

Iron ore futures in Singapore rose 0.2% to $105.55 a ton. Chinese markets are closed for public holiday.

(By Annie Lee)

Ivanhoe Mines begins copper anode production at new Congo smelter

Ivanhoe Mines (TSX: IVN) has officially begun copper anode production at Kamoa-Kakula’s direct-to-blister smelter in the Democratic Republic of the Congo.

First production occurred on Dec. 29, 2025, approximately five weeks after the commencement of smelter’s heat-up and one week after the first feed of concentrate, the company said in a statement Friday. The facility, with a steady-state capacity of 500,000 tonnes per annum, would be the largest in Africa once ramped up.

“The first production of copper anodes from our world-class smelter is a defining moment for Kamoa-Kakula,” Ivanhoe’s founder and executive co-chairman Robert Friedland said in a news release. He added that the facility will “deliver the highest-quality Congolese copper anodes to the international markets, setting a new global benchmark for scale, efficiency, and sustainability.”

Analysts at BMO Capital Markets, in a note published Friday, said Ivanhoe’s announcement of first anode production from the Kamoa-Kakula smelter falls in line with guidance and the bank’s expectations.

Shares of Ivanhoe Mines jumped as much as 5% on the announcement, before paring some gains. By midday in Toronto, it traded at around C$16 apiece with a market capitalization of C$23.2 billion ($16.9 billion).

Ramp-up continues

Ivanhoe said Friday that it is now ramping up the Kamoa-Kakula copper smelter to its annualized rate of 500,000 tonnes of 99.7%-pure copper anode, with completion expected by year-end.

As announced by the company last month, Kamoa-Kakula’s copper production is estimated at between 380,000 and 420,000 tonnes in 2026, with the mid-point of 400,000 tonnes representing approximately 80% of the smelter’s total capacity.

According to the Canadian miner, the Kamoa-Kakula management team is expected to prioritize the processing of concentrates produced by the Phase 1, 2, and 3 concentrators through the on-site smelter, with any excess concentrate toll-treated at the Lualaba smelter near Kolwezi.

Prior to the first feed of concentrate into the smelter, Kamoa-Kakula’s on-site concentrate inventory contained approximately 37,000 tonnes of copper. Total unsold copper in concentrate at the smelter, held in stockpiles and the smelting circuit, is expected to be reduced to approximately 17,000 tonnes during 2026 as the smelter ramps up.

As such, 2026 copper sales are expected to be approximately 20,000 tonnes higher than copper production as the on-site inventory of unsold copper concentrate is destocked, predominantly during the first half of 2026, Ivanhoe said. As destocking occurs, Kamoa-Kakula’s management aims to capitalize on near-record-high copper prices, it added.

Stage 2 dewatering done

Ivanhoe also noted that it has completed the Stage 2 dewatering of the Kakula mine, which became flooded following an earthquake last May. The incident impacted mining operations on the eastern side of the mine, putting a dent in the company’s 2025 copper production.

Following months of dewatering activities, selective mining began on the impacted areas in late December, which Ivanhoe said was ahead of schedule. Stage 3 dewatering will now take over, consisting of re-commissioning the existing, water-damaged underground horizontal pump stations, which are used for steady-state operations.

Three dewatering activities are expected to continue into Q2 2026 and will not be on the critical path for Kakula’s mining operations, Ivanhoe said.

No comments:

Post a Comment