NUKE NEWZ

European SMR Industrial Alliance launched

07 February 2024

The European Commission has launched an Industrial Alliance dedicated to small modular reactors (SMRs), aiming to facilitate the development of SMRs in Europe by the early 2030s. The announcement came as the commission presented its assessment for a 2040 climate target for the EU.

.jpg?ext=.jpg) The European Commission (Image: Pixabay)

The European Commission (Image: Pixabay)

The European Commission set up a European SMR pre-Partnership in June last year with the overall objective of identifying enabling conditions and constraints, including financial ones, towards safe design, construction and operation of SMRs in Europe in the next decade and beyond, in compliance with the EU legislative framework in general and to the Euratom legislative framework in particular.

In early November, it announced that it would establish an Industrial Alliance for SMRs early this year. Industrial alliances are a tool to facilitate stronger cooperation and joint action between all interested partners. Industrial alliances can play a role in achieving key EU policy objectives through joint action by all the interested partners.

"The cxommission is also launching an Industrial Alliance to facilitate stakeholder's cooperation at EU level and to accelerate the deployment of SMRs and ensure a strong EU supply chain, including a skilled workforce," the commission said in a statement on 6 February. "This will leverage EU's manufacturing and innovation capacities to accelerate the deployment of first SMR projects in the EU by early 2030 under the highest standards of nuclear safety, environmental sustainability, and industrial competitiveness."

According to the commission, this Industrial Alliance will elaborate a Strategic Action Plan in order to identify, for example: technically mature and commercially viable SMR technologies that could be supported under the alliance; potential gaps and solutions in the European supply chain for SMRs (including fuel and raw materials); investment barriers, funding opportunities and new financial blending options to support SMR development; and future needs for research on SMRs and advanced modular reactors (AMRs) and identify existing skills gaps along the supply chain to be addressed under the Euratom Research and Training Programme, and at national level.

A call for alliance membership will open shortly. All public and private legal entities which fulfil a set of eligibility membership criteria can apply for membership. In addition, a dissemination event covering the scope, objectives and activities of the Industrial Alliance is expected to be organised in Brussels next month.

European nuclear trade body Nucleareurope, which has been instrumental in the creation of the SMR Alliance, said: "Thanks to the work undertaken as Chair of the European SMR pre-Partnership Steering Committee and our outreach to Members of the European Parliament that culminated in the overwhelming adoption of an Own Initiative Report on SMRs."

"The deployment of SMRs will bring significant benefits to Europe, including greater energy sovereignty, lower CO2 emissions, new jobs and economic growth," said Nucleareurope Director General Yves Desbazeille. "The European nuclear industry has been at the forefront of innovation and industrial excellence for decades and this Industrial Alliance will help maintain our industry's world class position.

"However, there are several challenges which need to be tackled to ensure the smooth deployment of SMRs. Therefore, we are delighted that the commission is moving ahead with this alliance in order to work on viable solutions to overcome these challenges."

Urenco - which was actively engaged in the European SMR Pre-Partnership - welcomed the launch of the Industrial Alliance. "The increased global demand to reduce emissions and strengthen energy security is increasing the focus on new nuclear technologies such as SMRs and AMRs, as well as the fuels needed to power them," it said. "The alliance will help to further increase confidence in the sector by facilitating the necessary conditions across the supply chain to accelerate the development of these new technologies in a safe, efficient, and secure manner, and Urenco looks forward to supporting the Alliance through the relevant working groups."

2040 climate target announced

The announcement of the launch of the Industrial Alliance for SMRs came as the Commission published a detailed impact assessment on possible pathways to reach the agreed goal of making the European Union climate neutral by 2050. The EU's 2030 climate target is to reduce net greenhouse gas emissions by at least 55% relative to 1990. Based on the latest impact assessment, the European Commission recommends a 90% net greenhouse gas emissions reduction by 2040 compared with 1990 levels, launching a discussion with all stakeholders; a legislative proposal will be made by the next Commission, after the European elections, and agreed with the European Parliament and Member States as required under the EU Climate Law.

"Today's communication also sets out a number of enabling policy conditions which are necessary to achieve the 90% target," the commission said. "They include the full implementation of the agreed 2030 framework, ensuring the competitiveness of the European industry, a greater focus on a just transition that leaves no one behind, a level playing field with international partners, and a strategic dialogue on the post-2030 framework, including with industry and the agricultural sector."

It added: "Setting a 2040 climate target will help European industry, investors, citizens and governments to make decisions in this decade that will keep the EU on track to meet its climate neutrality objective in 2050. It will send important signals on how to invest and plan effectively for the longer term, minimising the risks of stranded assets ... It will also boost Europe's resilience against future crises, and notably strengthen the EU's energy independence from fossil fuel imports, which accounted for over 4% of GDP in 2022 as we faced the consequences of Russia's war of aggression against Ukraine. The costs and human impacts of climate change are increasingly large, and visible."

The European Commission noted that the energy sector is projected to achieve full decarbonisation shortly after 2040, "based on all zero and low-carbon energy solutions, including renewables, nuclear, energy efficiency, storage, CCS, CCU, carbon removals, geothermal and hydro".

Outer dome installed on Chinese small modular nuclear reactor

07 February 2024

The outer containment dome has been successfully hoisted into place at the ACP100 small modular reactor demonstration project at the Changjiang site on China's island province of Hainan, China National Nuclear Corporation (CNNC) has announced.

(Image: CNNC)

(Image: CNNC)

The reactor building for the ACP100 - also referred to as the Linglong One - consists of three parts: the internal structure, the steel containment shell and the outer concrete shielding shell. The inner steel containment dome was installed in November.

The operation to lift and place in position the outer shell, which weighs about 550 tonnes, took one hour and thirty eight minutes on 6 February, in time for Chinese New Year and the Spring Festival holidays. CNNC said that 6000 workers at the Linglong One project site will stay at their jobs "and go all out to ensure that the project is completed on time".

Chen Weimin, deputy director of the Hainan Nuclear Power Engineering Management Office, said: "The hoisting of the outer dome into place means the main structure of the reactor building has been completed and laid the foundation for the subsequent capping of the reactor building." He said that there had been valuable experience for subsequent modular development of new nuclear.

The weather conditions had to be suitable for the operation (Image: CNNC)

The weather conditions had to be suitable for the operation (Image: CNNC)

CNNC announced in July 2019 the launch of a project to construct an ACP100 reactor at Changjiang in Hainan Province. The site is already home to two operating CNP600 PWRs, while the construction of the two Hualong One units began in March and December 2021. Both those units are due to enter commercial operation by the end of 2026.

First concrete for the ACP100 was poured on 13 July 2021, with a planned total construction period of 58 months. Equipment installation work commenced in December 2022 and the main internal structure of the reactor building was completed in March 2023.

Under development since 2010, the 125 MWe ACP100 integrated pressurised water reactor's (PWR's) preliminary design was completed in 2014. In 2016, the design became the first SMR to pass a safety review by the International Atomic Energy Agency.

Once completed, the Changjiang ACP100 reactor - which CNNC describes as "the world's first commercial land-based small modular PWR" - will be capable of producing 1 billion kilowatt-hours of electricity annually, enough to meet the needs of 526,000 households. The reactor is designed for electricity production, heating, steam production or seawater desalination.

The project at Changjiang involves a joint venture of three main companies: CNNC subsidiary China National Nuclear Power as owner and operator; the Nuclear Power Institute of China as the reactor designer; and China Nuclear Power Engineering Group being responsible for plant construction. For the demonstration plant, the reactor vessel is being supplied by Shanghai Boiler Works Limited, the steam generators by a CNNC subsidiary and other reactor internals by Dongfang Electric Corporation.

Construction starts on French lead-212 production facility

06 February 2024

Orano subsidiary Orano Med has laid the foundation stone for its Alpha Therapy Laboratory (ATLab) in Onnaing in northern France. This will be Europe's first industrial-scale pharmaceutical facility dedicated to the production of lead-212 (Pb-212) based radioligand therapies.

.jpg?ext=.jpg) The ground-breaking ceremony for the ATLab Valenciennes facility (Image: Orano Med)

The ground-breaking ceremony for the ATLab Valenciennes facility (Image: Orano Med)

The isotope is used in an emerging medical treatment called targeted alpha therapy, in which an alpha-emitting isotope is combined with a protein or antibody that specifically targets and destroy cancer cells while minimising damage to healthy tissue. However the use of these therapies has been constrained by global radioisotope supply shortages.

Orano said the construction of ATLab Valenciennes is a step towards making these promising new treatments available to cancer patients with high unmet needs.

ATLab Valenciennes, with more than 3000 square-metres of floor space, will represent an investment of EUR29 million (USD31 million) and will create 25 direct jobs. It will focus on the production of Pb-212 therapies developed by Orano Med and their distribution in Europe. Orano Med is due to inaugurate a similar facility this year in Indianapolis to serve the US market.

This combined capacity will enable Orano Med to manufacture 10,000 doses a year as of 2025, with the aim of producing ten times that number by the end of the decade. Given the short half-life of Pb-212 (10.6 hours), the drugs need to be produced close to hospitals. The construction of further ATLabs is therefore envisaged to meet patients' needs worldwide.

"The ATLab in Onnaing is a very important step in our development strategy and is situated at the very heart of the industrial fabric of the Valenciennes metropolitan area and the Hauts-de-France region," said Guillaume Dureau, the Orano Group's Senior Executive Vice-President Projects & Innovation R&D and Nuclear Medicine. "The expansion of our production capacity in the radiopharmaceutical field is part of a drive to revitalise our country's industrial and economic fabric."

"We are convinced that radioligand therapies will soon become an essential tool in the fight against cancer," said Orano Med CEO Julien Dodet. "As the Phase II clinical trial of our most advanced drug AlphaMedix nears completion, we are building a global industrial platform to ensure the large-scale production and distribution of these potential treatments."

The construction of ATLab Valenciennes is supported by the Hauts de France region and the Valenciennes metropolitan area. The project has also been selected under the France 2030 plan following the call for "Industrialisation and health capacities 2030" projects and will receive public support of almost EUR3.8 million.

US lab reviews low-pressure microreactor design

06 February 2024

Idaho National Laboratory (INL) has completed a pre-conceptual design review of NANO Nuclear Energy Inc's ODIN low-pressure coolant microreactor design. The company's ZEUS microreactor design is also to be reviewed by the lab.

.jpg?ext=.jpg) A rendering of the ODIN microreactor (Image: NANO Nuclear)

A rendering of the ODIN microreactor (Image: NANO Nuclear)

The microreactor company announced its Strategic Partnership Project Agreement with INL in April 2023, and requested the review to provide an external audit of the technical work completed to date on the ODIN design. "The review served to ensure that NANO Nuclear has thoroughly considered the necessary aspects of its design and the applicable regulations for advancing the technology towards a commercial product," the company said.

NANO Nuclear founder and Executive Chairman Jay Jiang Yu said the laboratory's evaluation of ODIN had provided "enormously useful and valuable insights" to assist the company's technological development. "This collaboration has equipped our world-class team with essential guidance and utilised national laboratory expertise to maintain our progress in the field of advanced nuclear reactors," he said.

According to company information, ODIN will use "conventional" uranium fuel with up to 20% enrichment, with a low-pressure coolant to minimise the stress on structural components and improve their reliability and service life. It will also use a unique reactivity control system design, aiming to have high reliability and robustness by minimising the number of moving parts. The reactor will operate at higher than conventional water-cooled reactor temperatures, and take maximum advantage of natural convection of coolant for heat transfer to the power conversion cycle at full power and for decay heat removal during reactor shutdown, operational transients, and off-normal conditions.

INL reviewed the technical information provided by NANO Nuclear on the reactor design, siting, fuel and decommissioning strategy, culminating in a panel review workshop to discuss every applicable area of the design and the future work required to successfully deliver an optimised and market-driven product. "The review panel provided recommendations and outlined a path forward for NANO Nuclear to advance and build on the work completed by its world-class scientific team to date," the company said.

INL is to carry out a similar review of NANO Nuclear's ZEUS microreactor, which features a fully solid core and is designed to fit within a standard ISO shipping container. Heat removal is through thermal conduction, eliminating the need for coolant and pumps.

"Idaho National Laboratory is a great resource to help the development and evolution of our advanced nuclear reactors," said James Walker, NANO Nuclear's CEO and head of nuclear reactor development. "Their recommendations will serve to both optimise our reactor designs, and ensure these developments simultaneously align with national standards and licensing requirements."

"The panel delivered tremendous value to us and our ODIN project," he added. "The planned review of the ZEUS reactor design is expected to provide that project with the same external input and direction which has so significantly benefitted ODIN."

MoltexFLEX publishes research on graphite interaction with molten salt

06 February 2024

MoltexFLEX scientists worked with the University of Manchester's Nuclear Graphite Research Group to use X-ray micro CT scanners to investigate how molten salt infiltrates pores within standard industrial grades of graphite.

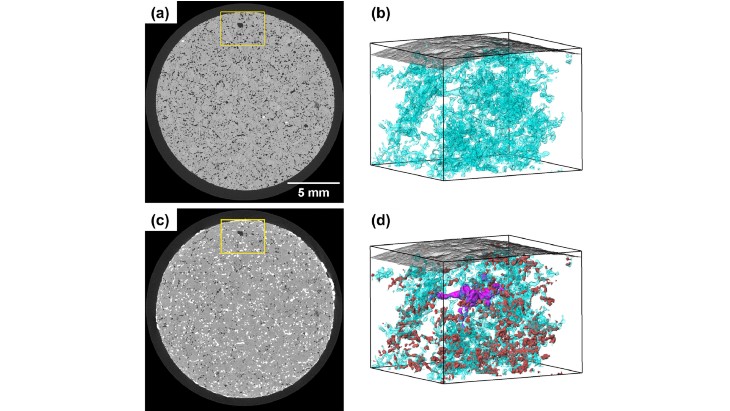

Before (a) and after (c) 2D virtual slices of a sample of graphite exposed to the molten salt. Images (b) and (d) show 3D sections of the region highlighted by the yellow rectangle in (a) and (c). Image (b) shows the structure of pores within the graphite sample, and image (d) shows pores containing salt after exposure highlighted in red. The purple area is the large void visible within the highlighted area in (a) and (c) (Image: MoltexFLEX)

Before (a) and after (c) 2D virtual slices of a sample of graphite exposed to the molten salt. Images (b) and (d) show 3D sections of the region highlighted by the yellow rectangle in (a) and (c). Image (b) shows the structure of pores within the graphite sample, and image (d) shows pores containing salt after exposure highlighted in red. The purple area is the large void visible within the highlighted area in (a) and (c) (Image: MoltexFLEX)

The research was conducted at MoltexFLEX's laboratory in Warrington and at Manchester University, which are both in northwest England. It involved immersing standard industrial grades of graphite in the molten salt, within stainless steel containers for 30 days at temperatures above 750 degrees Celsius.

The company's FLEX molten salt reactor is designed to operate at that temperature and the aim is to use commercially available graphite, which would make mass production of FLEX reactors easier, while keeping costs lower.

The research paper says: "For thermal spectrum Molten Salt Reactors (MSRs), graphite is typically utilised as moderator, reflector, and part of the core support structures. The inherent porosity within the graphite means that it is prone to infiltration by the molten salt, resulting in changes in its properties. Such property changes must be taken into consideration during reactor design and a good understanding of interaction between molten salt and the graphite microstructure is therefore important in selecting graphite grades for applications in MSRs.

"The graphite/molten salt interaction has traditionally been investigated using the weight gain after salt infiltration, followed by mercury intrusion porosimetry and post-mortem microstructure characterisations using, for example, Scanning Electron Microscopy. The results provided an overall description to the infiltration of molten salt into the graphite porosity. However, a more fundamental understanding of the graphite/molten salt interaction is still needed. How the pore size, shape, connectivity, and location with respect to the molten salt affect the detailed salt infiltration process remains to be understood."

It adds that the system used in the research, a non-destructive 3D microstructure characterisation technique, "can potentially deliver more detailed information for understanding the graphite/molten salt interaction" with the work aiming to observe the microstructure change due to the salt infiltration.

It says that the research was able to provide "a direct comparison of the graphite's microstructure before and after molten salt infiltration, enabling the relative volume of pores that have been filled by the salt to be quantified ... [and] delivered detailed information about the spatial distribution of the infiltrated salt and the 3D structures of the infiltrated salt. All of this provides valuable information for the understanding of the kinetics that control the molten salt infiltration into the porous graphite."

Ciara Fox, MoltexFLEX senior metallurgist, said: "The results were very much as we predicted. This research is a very promising first stage on the path to predicting and controlling the behaviour of molten salt infiltration within the graphite. It’s an important stepping stone in developing a technique that will allow us to do that."

MoltexFLEX has been working with the Nuclear Graphite Research Group team led by Professor Abbie Jones on graphite-related research for three years.

MoltexFLEX, a subsidiary of Moltex Energy Limited, is developing the FLEX reactor - the thermal neutron (moderated) version of Moltex Energy's stable salt reactor technology. The aim for the 60 MWt/24 MWe reactors is for them to be small and modular, passively safe, have no moving parts and, using 5% low-enriched uranium, have a five-year refuelling cycle. The target is to have the first reactor operational by 2029.

In May 2021, the Canadian Nuclear Safety Commission completed the first phase of the pre-licensing vendor design review for Moltex Energy's 300 MWe Stable Salt Reactor - Wasteburner (SSR-W 300) small modular reactor. The SSR-W is a molten salt reactor that uses nuclear waste as fuel. The company aims to deploy its first such reactor at the Point Lepreau site in New Brunswick by the early 2030s.

Preliminary design R&D completed for Russian molten salt research reactor

05 February 2024

The Mining and Chemical Combine (MCC), part of Rosatom, says that research and development work on the molten salt research reactor project has been completed, with a preliminary design developed.

(Image: MCC)

(Image: MCC)

The MCC said the creation of the preliminary design was the "next step" towards creating the molten salt research reactor (IZhSR), which is intended to "allow us to develop key technological solutions for the transmutation of minor actinides, master molten salt technology and subsequently create a full-scale molten salt reactor, which will allow us to utilise minor actinides - the most dangerous component of nuclear waste from used fuel reprocessing, as they are highly radioactive and toxic, emit a large amount of heat and have a long half-life".

It added: "If you learn how to burn them (minor actinides), the period of danger will be significantly shortened and will provide a multiple reduction in waste to be buried in deep geological formations, and in the medium term will make it possible to implement the option of a less complex near-surface disposal of waste that no longer contains minor actinides."

The project, which involves a range of different organisations within Rosatom, is targeting a licence for construction in 2027 and a launch in 2031. The research and development work is due to be reviewed at a meeting within the first three months of this year.

The IZhSR project plans to use circulating molten salt fuel. It is part of the wider Russian federal project to develop "new materials and technologies for advanced energy systems" and part of the country's goal of closing the fuel cycle. Rosatom says that the period of potential danger from minor actinides can be reduced from 10,000 years to 300 as a result of the process.

Evgeniy Vlasenko, chief specialist of the development project management group, said: "With every problem solved our level of competence grows. A large amount of research work has been carried out and continues to be carried out, to justify all the decisions included in the preliminary design. MCC performs many of them on its own. The MCC's International Center for Engineering Competence develops technologies for the preparation of fluoride salts and fuel additives, verifies and certifies analytical methods for controlling their quality, and studies the physicochemical properties of salts. In the chief mechanic’s department, they are developing technologies for welding structural material - chromium-nickel alloy, which has not yet been used in the manufacture of reactors in Russia."

Environmental permitting of Polish SMR plant progresses

05 February 2024

Orlen Synthos Green Energy (OSGE) can now begin environmental and siting research for its planned small modular reactor (SMR) project in Stawy Monowskie, in Małopolska, Poland, after the country's General Director for Environmental Protection (GDOŚ) issued the scope of the environmental report for the project.

.jpg?ext=.jpg) The planned site of the SMR power plant in Stawy Monowskie (Image: OSGE)

The planned site of the SMR power plant in Stawy Monowskie (Image: OSGE)

In mid-April 2023, OSGE announced it had shortlisted seven locations in Poland for further geological surveys to host SMR plants based on GE Hitachi Nuclear Energy's BWRX-300, for which it holds the exclusive right in Poland. The locations were: Ostrołęka, Włocławek, Stawy Monowskie, Dąbrowa Górnicza, Nowa Huta, Tarnobrzeg Special Economic Zone and Warsaw.

OSGE submitted applications in late-April to the Ministry of Climate and Environment for decisions-in-principle on the construction of power plants at six locations, omitting Warsaw from the list. The ministry issued decisions-in-principle for the six plants on 7 December. The decision-in-principle is the first decision in the process of administrative permits for investments in nuclear power facilities in Poland that an investor may apply for. Obtaining it entitles OSGE to apply for a number of further administrative arrangements, such as a siting decision or construction licence.

OSGE submitted an application to GDOŚ in May 2023 to determine the scope of the report on the environmental impact of the construction of the Stawy Monowskie plant. Last year it also submitted applications for the planned plants in Ostrołęka and Włocławek.

GDOŚ has now issued a decision specifying the requirements for the project in Stawy Monowskie. It indicated the main areas that the report will cover, including: conducting a natural inventory, identifying possible sources of cooling water, technological solutions that affect nuclear safety and radiological protection, and indicating how the power plant will be integrated with the energy transmission network.

"This is the first such decision in the entire European Union and another important step in the process of building BWRX-300 reactors in Poland," OSGE said. "The scope of such a document is determined for individual projects, taking into account the specificity of the location. The issuance of the decision by GDOŚ enables the company to commence environmental and location tests in the Stawy Monowskie location to the full extent necessary to prepare the Environmental Impact Assessment report. The time needed to prepare the report is estimated at up to two years."

"Preparing a report on the environmental impact of a nuclear investment is one of the most important elements of the investment process," said Rafał Kasprów, President of the Management Board of OSGE. "And also one of the most difficult. We are even more pleased with the good cooperation with the General Directorate for Environmental Protection and the regulator's professional approach to the first environmental proceedings in the entire EU regarding the construction of an SMR power plant.

"Today's decision of GDOŚ allows us to maintain the assumed project implementation schedules and gives us a chance to complete the investment when the Polish economy will be most in need of zero-emission and stable energy sources."

The BWRX-300 is a 300 MWe water-cooled, natural circulation SMR with passive safety systems that leverages the design and licensing basis of GEH's US Nuclear Regulatory Commission-certified ESBWR boiling water reactor design and its existing, licensed GNF2 fuel design, a unique combination that GEH says positions it to deliver an "innovative, carbon-free baseload power generation source" this decade.

In December 2021, GE Hitachi, BWXT Canada and Synthos Green Energy (SGE) signed a Letter of Intent to cooperate in deploying BWRX-300 SMRs in Poland. OSGE - a joint venture between chemical producers SGE and PKN Orlen - submitted an application to Poland's National Atomic Energy Agency (PAA) on 8 July 2022 for the assessment of the reactor design. PAA announced in May last year that the BWRX-300 is compliant with Polish nuclear safety and radiological protection standards.

Oklo reports progress in Idaho, Ohio

05 February 2024

A land rights agreement signed with the Southern Ohio Diversification Initiative (SODI) gives Oklo Inc the option and right of first refusal to purchase land in Southern Ohio where Oklo envisages deploying two of its Aurora 'powerhouses'. Meanwhile, the safety design strategy for a planned fuel facility in Idaho to support the deployment of its reactors has been approved by the US Department of Energy (DOE).

.jpg?ext=.jpg) Oklo envisages building its second and third power plants at the Piketon site (Image: Oklo)

Oklo envisages building its second and third power plants at the Piketon site (Image: Oklo)

The agreement with SODI - the DOE-designated community reuse organisation for the former Portsmouth gaseous diffusion uranium enrichment plant - builds on a non-binding memorandum of understanding between Oklo and SODI from May 2023, and signifies progress toward siting development and implementation, the company said. Procurement of land at SODI will be a "major next step" for deployment of the two powerhouses, it added.

"We see incredible potential in the Piketon region, both in its talent and infrastructure, and we deeply value partnering with SODI and collaborating with the local community," said Oklo co-founder and CEO Jacob DeWitte. "We are also greatly appreciative to the efforts of the DOE Office of Environmental Management in making these public-private partnerships possible."

"Oklo's land purchase agreement further brings into focus the potential for transformative impact the redevelopment of this site can have on our energy infrastructure and the reinvigoration of our community," SODI Executive Director Steven Shepherd said.

Oklo's Aurora design is a compact fast neutron reactor that uses heat pipes to transport heat from the reactor core to a supercritical carbon dioxide power conversion system to generate electricity. The Aurora 'powerhouse' uses metallic high-assay low-enriched uranium, or HALEU, fuel to produce about 15 MWe as well as producing usable heat.

Idaho fuel facility

In March 2020, Oklo submitted an application to the US Nuclear Regulatory Commission to build and operate an Aurora reactor at the Idaho National Laboratory (INL) site. The company announced on 31 January that the DOE has now reviewed and approved the safety design strategy (SDS) for the fuel facility it plans to build at INL to demonstrate the reuse of recovered nuclear material to support its advanced fission power plant demonstration there.

Oklo was previously selected through a competitive DOE-supported process to provide access to material recovered from used nuclear fuel from INL's now-decommissioned Experimental Breeder Reactor-II to produce high-assay low-enriched uranium for advanced reactors.

"The SDS approval is a major step towards a DOE approval of the Aurora Fuel Fabrication Facility as we continue towards our goal of producing fuel for our planned Aurora commercial power plant," DeWitte said.

The SDS is the first stage in DOE's approval process for the fuel facility. Oklo said it is working with INL operator Battelle Energy Alliance on the next phase, focusing on the conceptual safety design report which will summarise the hazard analysis efforts and safety-in-design decisions incorporated into the conceptual design, along with any identified project risks associated with the selected strategies.

Five express interest in Kozloduy new nuclear construction

05 February 2024

The deadline to express an interest in the construction of the proposed two new units at the Kozloduy nuclear power plant in Bulgaria has passed, with five companies submitting applications.

Kozloduy supplies about one-third of Bulgaria's electricity (Image: Kozloduy NPP)

Kozloduy supplies about one-third of Bulgaria's electricity (Image: Kozloduy NPP)

In a statement issued on the Kozloduy plant's website the new build project company said that the applications will now be considered, following the passing of Friday afternoon's deadline. The new units are to be Westinghouse AP1000 reactors.

The initial part of the selection process will be to check that those expressing an interest meet the qualifying criteria. These include demonstrating construction experience and the commissioning of at least two nuclear units as well as "to have solid experience in the nuclear and turbine island of at least two units or have supplied and installed equipment for two units within the last 15 years - applicants must also demonstrate at least USD6 billion in turnover and profit for the five years period from 2018 to 2022". Candidates from the Russian Federation have been specifically excluded.

Bulgaria is aiming to have two new Westinghouse AP1000 units at Kozloduy nuclear power plant. Deputy Energy Minister Nikolay Nikolov told Bulgaria's official BTA news agency in December that the aim was to achieve a price of about EUR6 billion (USD6.5 billion) for each of the units.

Kozloduy units 1-4 were VVER-440 models which the European Commission had classified as non-upgradeable and Bulgaria agreed to close them during negotiations to join the European Union in 2007. Units 5 and 6 feature VVER-1000 reactors that were connected to the grid in 1987 and 1991, respectively. Both units have been through refurbishment and life extension programmes to enable extension of operation from 30 to 60 years.

When the decision to move ahead with AP1000 units at Kozloduy was given approval by the country's council of ministers in October, the target date for the completion of the first unit was 2033, with the second unit to follow "two or three years after the first one". The 2300 MWe capacity of the two new units would exceed the 1760 MWe capacity of the closed first four units. The Bulgarian government has also said that further units will be needed to replace units 5 and 6 by 2050.

Westinghouse will hold overall Design Authority responsibility for the AP1000 plant, the expression of interest document said, adding: "The responsibilities for the design of individual AP1000 plant systems and buildings shall be delegated by Westinghouse. The responsibility for the design of Modules, Constructions Assemblies and Platforms is aligned with the party that is responsible for the design of the building in which the item is located."

Pressure vessel in place at Indian plant

05 February 2024

The reactor vessel for Kudankulam unit 4 has been lifted into its design position at the construction site in Tamil Nadu, Rosatom announced.

.jpg?ext=.jpg) Kudankulam 4's pressure vessel is lifted into place (Image: Rosatom)

Kudankulam 4's pressure vessel is lifted into place (Image: Rosatom)

The company said the installation was carried out on 24 January using the "open top" method, first used at Kudankulam 3. This involves installing the component while the reactor dome is still open, which can significantly cut the time taken to carry out the installation. On the day of the installation, the equipment was moved to a vertical position, then lifted by crane to a height of 50 metres and lowered into the reactor shaft of the reactor building.

The pressure vessel, weighing in at over 317 tonnes, was delivered from Volgodonsk in Russia to the Kudankulam construction site in 2023 as part of an "unprecedentedly complex and large-scale" simultaneous shipment of two reactor vessels and eight steam generators for plants under construction in India and China, according to Rosatom.

After installation of the reactor vessel, installation of components for the nuclear steam system including steam generators, housings of the main circulation pump units and a pressure compensator will begin.

Kudankulam is home to two operating Russian-supplied VVER-1000 pressurised water reactors which are owned and operated by the Nuclear Power Corporation of India Ltd (NPCIL). Four further VVERs are under construction: work started on units 3 and 4 in 2017, and on units 5 and 6 in 2021. A fourth phase comprising two VVER-1200 reactors - Kudankulam 7 and 8 - has been proposed.

The general contractor is for the project is Rosatom subsidiary Atomstroyexport, the general designer is Atomenergoproekt and the general designer is OKB Gidropress.

Researched and written by World Nuclear News