Nippon Steel revises closing date for US Steel acquisition

Reuters | December 26, 2024 |

Credit: U.S. Steel

Japan’s Nippon Steel said on Thursday it revised the closing date for its purchase of US Steel, expressing confidence that the acquisition will protect and grow the American company.

The estimated closing date was revised to the first quarter of 2025 from the third or fourth quarter of 2024 previously.

(By Rocky Swift; Editing by Himani Sarkar)

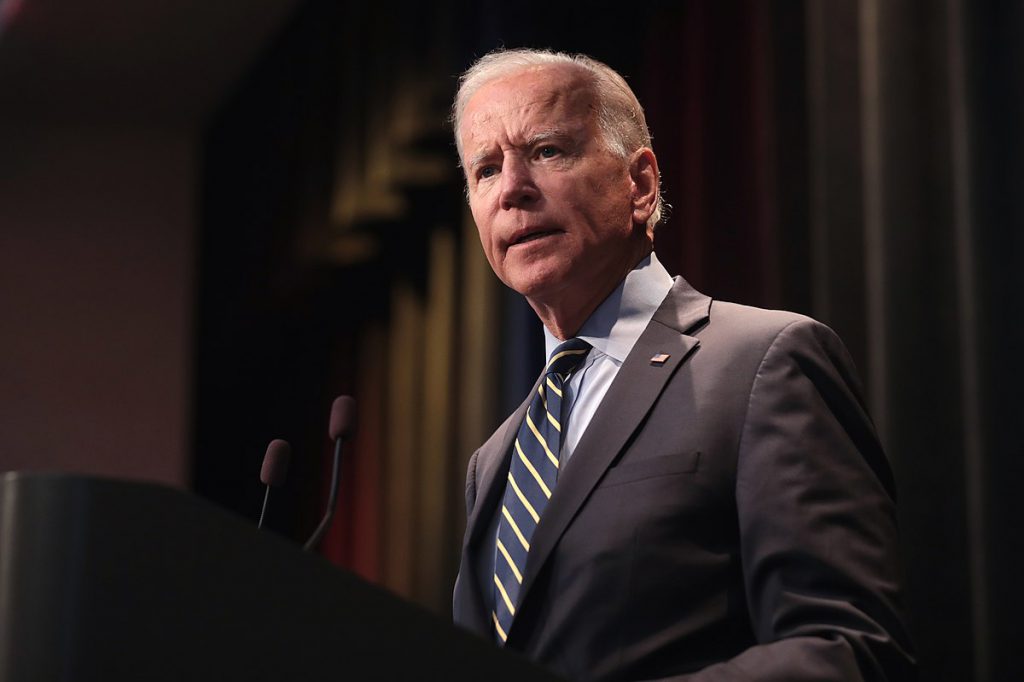

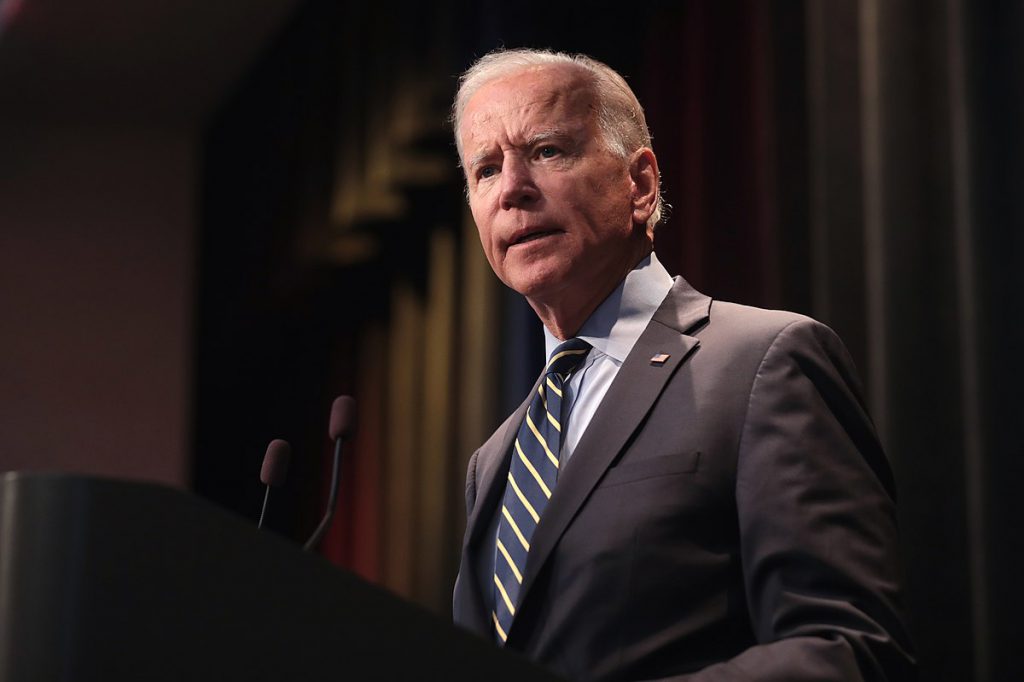

President Biden to decide fate of Nippon Steel’s $15bn bid for US Steel

Reuters | December 23, 2024 |

Credit: Wikimedia Commons

Nippon Steel’s $15 billion bid for US Steel has been referred to US President Joe Biden, a White House spokesman said, giving the president 15 days to decide on a tie up he has previously said he opposes.

The Committee on Foreign Investment in the United States (CFIUS), which reviews foreign investments in the US for national security risks, referred the deal to Biden after it was unable to reach a consensus, the companies and two sources said.

That gives Biden, who has long opposed the tie-up, 15 days to block the deal. If he takes no action in that time, the merger would get an unexpected greenlight.

“We received the CFIUS evaluation and the President will review it,” White House spokeswoman Saloni Sharma said.

The referral to Biden paves the way for the deal to be killed before President-elect Donald Trump takes office.

Trump, who will be inaugurated on Jan. 20, has also opposed the deal, which was first announced last December.

Nippon Steel and US Steel said on Tuesday they were informed of the referral. Both companies have previously said they had planned to close the deal before the end of 2024.

“We urge him (Biden) to reflect on the great lengths that we have gone to address any national security concerns that have been raised and the significant commitments we have made to grow US Steel,” Nippon Steel said in a statement.

US Steel said: “It is our hope that President Biden will do the right thing and adhere to the law by approving a transaction that so clearly enhances US national and economic security.”

If the deal collapses, Nippon Steel must pay a $565 million penalty to US Steel. It has earlier said it could pursue legal action against the US government if the deal falls apart.

Nippon Steel aims to raise its global steel production capacity with US Steel to 85 million metric tons per year from 65 million tons and the deal is core to its goal of lifting production to more than 100 million tons in the long-term.

The US is the only developed nation where domestic steel demand is increasing, with the highest steel prices globally due to production capacity falling short of domestic needs, SBI Securities analyst Ryunosuke Shibata said.

That makes US Steel “a once-in-a-lifetime opportunity for Nippon Steel,” Shibata added.

Lack of consensus

CFIUS said on Monday that allowing Nippon Steel to take over US Steel could result in lower domestic steel production representing “a national security risk”, according to the Washington Post, which first reported the referral to Biden.

Nippon Steel said it could eliminate that risk by appointing US citizens to top management and board of director positions at US Steel, but the committee was divided in its view of whether those remedies would be sufficient, said the newspaper.

The US Treasury Department, which leads CFIUS, and the Commerce Department, declined to comment.

The proposed tie-up has faced high-level opposition within the US since it was announced, with both Biden and Trump taking aim at it as they sought to woo union voters in the swing state of Pennsylvania, where US Steel is headquartered. The president of the United Steelworkers Union opposes the tie-up.

“The question is, what will Biden’s decision be? And I think that’s still very unpredictable,” said Nick Wall, M&A partner at Allen & Overy. “He’s got nothing really to lose.”

In August a CFIUS letter sent to the companies, seen by Reuters, which said the deal could hurt the supply of steel for critical transportation, construction and agriculture projects.

But Nippon Steel won a 90-day review by countering that its investments made by a company from an allied nation would in fact shore up US Steel’s output.

That gave CFIUS until after the November US election to make a decision, fueling hope among supporters that a calmer political climate could underpin the deal’s approval.

Those hopes were dashed last weekend when CFIUS sent a 29-page letter to the companies raising allegedly unresolved national security risks, Reuters exclusively reported.

The companies countered in a follow-up letter, exclusively reported by Reuters Friday, that Biden had “impermissible influence” over the national security review process, threatening legal action if the deal is blocked.

(By Katya Golubkova, Yuka Obayashi, Sakura Murakami, Alexandra Alper, Nandita Bose and Nilutpal Timsina; Editing by Sam Holmes and Michael Perry)

Reuters | December 26, 2024 |

Credit: U.S. Steel

Japan’s Nippon Steel said on Thursday it revised the closing date for its purchase of US Steel, expressing confidence that the acquisition will protect and grow the American company.

The estimated closing date was revised to the first quarter of 2025 from the third or fourth quarter of 2024 previously.

(By Rocky Swift; Editing by Himani Sarkar)

President Biden to decide fate of Nippon Steel’s $15bn bid for US Steel

Reuters | December 23, 2024 |

Credit: Wikimedia Commons

Nippon Steel’s $15 billion bid for US Steel has been referred to US President Joe Biden, a White House spokesman said, giving the president 15 days to decide on a tie up he has previously said he opposes.

The Committee on Foreign Investment in the United States (CFIUS), which reviews foreign investments in the US for national security risks, referred the deal to Biden after it was unable to reach a consensus, the companies and two sources said.

That gives Biden, who has long opposed the tie-up, 15 days to block the deal. If he takes no action in that time, the merger would get an unexpected greenlight.

“We received the CFIUS evaluation and the President will review it,” White House spokeswoman Saloni Sharma said.

The referral to Biden paves the way for the deal to be killed before President-elect Donald Trump takes office.

Trump, who will be inaugurated on Jan. 20, has also opposed the deal, which was first announced last December.

Nippon Steel and US Steel said on Tuesday they were informed of the referral. Both companies have previously said they had planned to close the deal before the end of 2024.

“We urge him (Biden) to reflect on the great lengths that we have gone to address any national security concerns that have been raised and the significant commitments we have made to grow US Steel,” Nippon Steel said in a statement.

US Steel said: “It is our hope that President Biden will do the right thing and adhere to the law by approving a transaction that so clearly enhances US national and economic security.”

If the deal collapses, Nippon Steel must pay a $565 million penalty to US Steel. It has earlier said it could pursue legal action against the US government if the deal falls apart.

Nippon Steel aims to raise its global steel production capacity with US Steel to 85 million metric tons per year from 65 million tons and the deal is core to its goal of lifting production to more than 100 million tons in the long-term.

The US is the only developed nation where domestic steel demand is increasing, with the highest steel prices globally due to production capacity falling short of domestic needs, SBI Securities analyst Ryunosuke Shibata said.

That makes US Steel “a once-in-a-lifetime opportunity for Nippon Steel,” Shibata added.

Lack of consensus

CFIUS said on Monday that allowing Nippon Steel to take over US Steel could result in lower domestic steel production representing “a national security risk”, according to the Washington Post, which first reported the referral to Biden.

Nippon Steel said it could eliminate that risk by appointing US citizens to top management and board of director positions at US Steel, but the committee was divided in its view of whether those remedies would be sufficient, said the newspaper.

The US Treasury Department, which leads CFIUS, and the Commerce Department, declined to comment.

The proposed tie-up has faced high-level opposition within the US since it was announced, with both Biden and Trump taking aim at it as they sought to woo union voters in the swing state of Pennsylvania, where US Steel is headquartered. The president of the United Steelworkers Union opposes the tie-up.

“The question is, what will Biden’s decision be? And I think that’s still very unpredictable,” said Nick Wall, M&A partner at Allen & Overy. “He’s got nothing really to lose.”

In August a CFIUS letter sent to the companies, seen by Reuters, which said the deal could hurt the supply of steel for critical transportation, construction and agriculture projects.

But Nippon Steel won a 90-day review by countering that its investments made by a company from an allied nation would in fact shore up US Steel’s output.

That gave CFIUS until after the November US election to make a decision, fueling hope among supporters that a calmer political climate could underpin the deal’s approval.

Those hopes were dashed last weekend when CFIUS sent a 29-page letter to the companies raising allegedly unresolved national security risks, Reuters exclusively reported.

The companies countered in a follow-up letter, exclusively reported by Reuters Friday, that Biden had “impermissible influence” over the national security review process, threatening legal action if the deal is blocked.

(By Katya Golubkova, Yuka Obayashi, Sakura Murakami, Alexandra Alper, Nandita Bose and Nilutpal Timsina; Editing by Sam Holmes and Michael Perry)

USW SHOULD BUY IT WITH LABOR PENSION FUNDS

By AFP

December 23, 2024

Nippon Steel has urged US President Joe Biden to allow its takeover of US Steel to go through after a regulatory panel failed to reach a consensus

- Copyright AFP/File Richard A. Brooks

John BIERS

A US government panel failed to reach a consensus on whether US Steel’s acquisition by Nippon Steel threatens Washington’s national security, shifting the decision to the White House, the Japanese company said late Monday.

The deadlock by the Committee on Foreign Investment in the United States (CFIUS) means the controversial $14.9 billion transaction will now be referred to President Joe Biden, who is legally required to act within a 15-day deadline.

“Nippon Steel has been informed by CFIUS that the Committee has referred this matter to President Biden after failing to reach a consensus on our transaction with US Steel,” Nippon said.

Biden has criticized the deal for months, joining a loud consensus of US power players who have slammed the transaction, including President-elect Donald Trump and the incoming vice president, JD Vance.

The deal became ensnared in the 2024 presidential campaign when Pennsylvania emerged as a critical swing state and leaders of the United Steelworkers (USW) union loudly opposed the transaction.

Nippon officials had hoped to have more success after the election, but there have been few signs of change in the dynamics.

US media have reported that the killing of the deal could prompt litigation from the steel companies. There are also questions about diplomatic fallout from derailing a transaction championed by Japan, a close US ally.

Nippon said the deal should go through.

“During the 15-day period that the President has to make a final decision, we urge him to reflect on the great lengths that we have gone to address any national security concerns that have been raised and the significant commitments we have made to grow US Steel, protect American jobs, and strengthen the entire American steel industry, which will enhance American national security,” Nippon said.

“We are confident that our transaction should and will be approved if it is fairly evaluated on its merits.”

US Steel also called on Biden to approve the deal, noting that Nippon is based in “one of the United States’ closest allies” and describing the transaction as a means to “combat the competitive threat from China.”

The Nippon deal is “the best way, by far, to ensure that US Steel, including its employees, communities, and customers, will thrive well into the future,” US Steel said.

Nippon has argued that the transaction would pump much-needed capital to update plants in Pennsylvania’s Mon Valley, the oldest of which dates to 1875.

The company has described the transaction as a lifeline to Pennsylvania’s much-diminished steel industry, vowing to keep US Steel’s headquarters in Pittsburgh.

But the USW union has characterized Nippon’s commitments as untrustworthy, while slamming US Steel executives as being motivated by the huge windfalls they would likely make from the sale.

“The proposed US Steel-Nippon transaction represents nothing more than corporate greed, selling out American workers and jeopardizing the long-term future of the domestic steel industry and our national security,” USW President David McCall said Monday as he urged Biden to block the transaction.

No comments:

Post a Comment