Staff Writer | July 14, 2024

View from above of an open-pit copper mine in Peru. Stock image.

Electrification of the global vehicle fleet would require 55% more new copper mines coming online by 2050, the target year for net-zero emissions, according to a recent study published by the International Energy Forum.

Even factoring out energy transition, the world will need to mine at least 115% more copper than has been mined in human history pre-2018 just to meet business-as-usual trends, the report added.

Dr. Lawrence Cathles, an earth and atmospheric sciences professor at Cornell University who co-authored the study, said these findings point to a “disconnect” between the intentions behind decarbonization and the reality of the materials required.

Supply-demand disconnect

In short, the study — led by Dr. Cathles and Dr. Adam Simon, a professor of earth & environmental sciences at the University of Michigan — found that the rate at which the world is producing copper cannot keep pace with the increasing global demand for electric vehicles.

To quantify this disconnect, it gave projections of both supply and demand in a fashion that is unique to prior studies (see below).

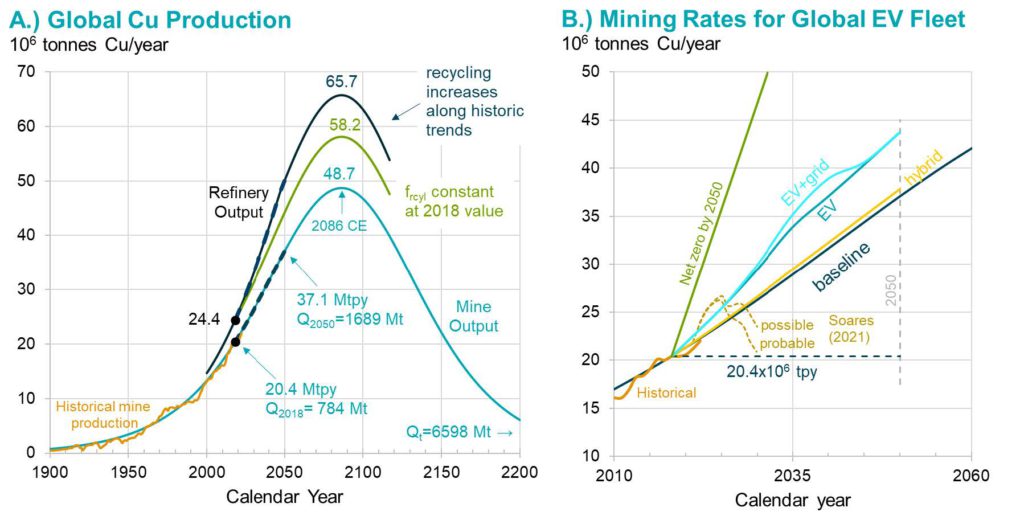

On the supply side, annual mine output is expected to increase by 82% (from 20.4Mt to 37.1Mt) by 2050, and so will the total supply, after accounting additions from copper recycling. However, all production estimates are set to peak around the year 2086 (mine output of 48.7Mt), as shown in Figure A.

On the demand side, the study investigated several decarbonization scenarios and broke down the additional copper production that will be required under each case up until year 2050 (Figure B) .

Evidently, the net-zero scenario displays the largest gap — requiring at least 194 mines or 6 new mines every year. On the other hand, the baseline scenario (business as usual) presents a more realistic challenge of 35 mines — about one per year (see chart below).

However, the authors also noted that they have been optimistic in projecting the new mine creation needs. For instance, if copper recycling remains constant at its 2018 level rather than increasing as assumed, then the number of new mines required for baseline demand would be 43.

EV manufacturing goal

Even before reaching the 2050 net-zero target, the goal of 100% EV manufacture by 2035 will still require an unprecedented departure from the copper mining baseline, the report noted.

Historically, it is estimated that excursions from mine production have been around 1 million tonnes per year (in magnitude over about 15 years), and a departure from the baseline related to EV manufacture will be five times greater and twice as long as we have experienced before (5Mt for over 30 years).

Corrected for recycling, this mining excursion is equivalent to a demand gap of 8.1 million tonnes in 2035 and 9.6 million tonnes in 2040, it added.

It is worth noting that the methods used in this study are identical to the one used by M. King Hubbert, who was famous for successfully predicting 30 years of US oil production right up to when technologies such as directional drilling and hydraulic fracturing made it possible to produce natural gas and crude oil from shale and expanded the hydrocarbon resource.

Mining takes time

With increased mining activity, there also comes the question of whether the Earth holds enough resources to support this. The short answer given by the IEF report is yes.

Under the baseline scenario, about 1.69 billion tonnes of copper will be mined by 2050, which represents 26% of the total copper resource of approximately 6.66 billion tonnes estimated by the authors. Their total resource estimate is also close to the 5.6 billion tonne figure given by the USGS.

If mining ever shifts to greater depths in Earth’s crust, the copper resource would grow further to 89 billion tonnes, and 241 billion tonnes may be recoverable from the seafloor.

Hence, there is plenty of copper available. The real concern, then, is whether these resources can be mined fast enough to support baseline global development, and then go beyond towards vehicle electrification.

The study puts that into doubt by pointing out that the new copper mines that came online between 2019 and 2022 took an average of 23 years from the time of a resource discovery for mines to be permitted, built, and put into operation.

“Within this long discovery-to-operation pipeline, we should see at least ten years of prospects (e.g. 17 prospects) with a combined production potential of 8 million tonnes per year in the pipeline to have any confidence we can meet the 1.7 major deposits per year discovery rate required for EV manufacture,” the authors wrote.

Hybrid: An alternative

In light of the findings, the authors of the report suggested hybrid vehicles as a better alternative for balancing the copper demands of electrification and the pressure placed on the mining industry.

“There is remarkably little difference between the amount of copper needed to manufacture hybrid electric rather than ICE vehicles,” they said, highlighting that hybrid electric vehicles require 29 kg of copper compared to 24 kg for an ICE vehicle.

“It would therefore be judicious to aim for a transition to the 100% manufacture of hybrid electric vehicles by 2035, rather than transitioning to the 100% manufacture of battery electric vehicles, which require 60 kg. The copper required for this transition is only slightly above baseline and does not require major grid improvements.”

“This is not a perfect solution, but it is a much more resource realistic one,” they emphasized.

Read the full report here.

Friedland warns of copper ‘crisis’ as mine costs soar

Henry Lazenby - The Northern Miner | July 12, 2024 |

The closing panel at the Rule Symposium. From left: Rick Rule, James Rickards, Albert Lu, Nomi Prins, and Adrian Day. Credit: Henry Lazenby

Miners and analysts gathered this week in a sweaty beach city in southeast Florida to ponder why the industry gets the cold shoulder from most investors.

Copper in particular faces a forecasted supply chasm, mining mogul Robert Friedland told the Rule Symposium via a pre-recorded video interview from Telluride, Colorado.

“The world is suffering from a shortage of copper metal,” the founder and executive co-chair of Ivanhoe Mines (TSX: IVN) said. But copper prices “fall woefully short” of supporting the development of new projects. The current price is around $4.60 per lb.

“We see a crisis coming in physical markets and a requirement for much higher prices to enable most of the copper projects that are in development to have a prayer coming in.”

Humanity would have to mine more copper in the next 20 years than we have in human history to meet surging global demand on the back of the energy transition, Friedland told the conference, organized by resource speculator and founder of Rule Investment Media, Rick Rule.

Meanwhile, the cost of new mines has soared. Friedland said recent copper mine builds in Chile and Peru, jurisdictions once credited for having among the biggest and cheapest copper mines, have seen costs soar to about $45,000 per tonne of daily installed capacity due to inflation, steadily falling grades and dropping output.

While some analysts see near-term respite for soft copper prices, developers need a sustained price gain to make long-term investment decisions. Last week, BMO Capital Markets and Citigroup analysts said copper prices may rise past the $10,000-per-tonne ($4.54 per lb.) mark again in the near term due to a Chinese smelter supply shortage and grid investments in China. Copper posted a record high of $5.11 per lb. In May.

Copper price surpasses $10,000, expected to rise further, says Citigroup

The International Energy Agency projects that copper demand will increase to 36.4 million tonnes by 2040 from 25.9 million tonnes last year, driven by its growing application in clean technology and electric grid expansion. However, analysts have warned for years that copper prices aren’t high enough to support new builds.

Friedland underlined the critical role of copper in the global economy, given its significance in electrification and renewable energy, and major new demand for modern warfare.

“The global economy needs to find five or six new Kamoa-Kakula-sized projects yearly to maintain a 3% gross domestic product growth rate over the next two decades,” Friedland estimated.

Ivanhoe is doing its part to address the copper deficit challenge with its world-class Kamoa-Kakula copper project in the Democratic Republic of Congo (DRC). The mine is ramping up, producing over 100,000 tonnes of the red metal in the June quarter. The company’s guidance for 2024 is 440,000-480,000 tonnes, with the outlook set to top 600,000 tonnes next year.

Contrarian approach

The current state of the copper market is a consequence of chronic historical underinvestment in production, compounded by increasingly scarce resources, the conference heard.

Symposium host Rule, noted that’s a repeated pattern in natural resources that will continue to lead to more boom-and-bust cycles.

Rule pointed to dramatic increases in commodity prices during the 1970s due to underinvestment: oil prices rose from $2.50 to $30 per barrel., gold from $35 to $850 per oz., and copper from $0.30 to $1.60 per pound.

Drawing parallels to the present, Rule pointed out that the US dollar lost 85% of its purchasing power in the 1970s, a situation he believes is re-emerging due to $6 trillion in quantitative easing in recent years and federal on and off-balance sheet debt of more than $100 trillion.

“Investing in underappreciated sectors presents an opportunity to invest in high-quality companies at a discount,” Rule said.

“The cure for high prices is high prices. The cure for low prices is low prices,” he said, repeating one of his favourite mantras.

Rule stressed the importance of being a contrarian investor, suggesting that attendees look for value in areas where others see risk or disinterest.

He pointed out that generally, the current sentiment around sub-$2 billion market cap mining companies is notably poor, presenting an opportunity to invest in high-quality companies at a discount.

“You can buy the serially successful companies at a small discount to the serial losers. That’s a really good deal if you think about it. The market has been completely undiscriminating with regards to the quality of leadership,” he said.

Commodities rally

The concentration in the US stock markets poses a big risk to economic stability as a small number of issuers are driving most gains, James Rickards of Paradigm said in the closing session at the conference. About 70% of the stocks in the S&P 500 are down for the year despite the index hitting new highs, driven by a handful of tech stocks.

Still, commodities have seen big gains this year, macroeconomist Nomi Prins of PrInsights Global said.

“Gold has rallied 24%, copper 27%, silver 49%, and uranium 60% — indicators of a massive transition regardless of economic ground realities,” she said.

Perhaps preaching to the converted, she noted natural resources have a critical role in future economic stability and growth. “These assets have a tremendously positive trajectory from here, driven by modern geopolitical and energy-related needs.”