Powerful investors are demanding climate action from oil and gas giants for the sake of their bottom lines as well as the planet.

Oil industry giants like Exxon and Shell are coming under increasing pressure to adopt energy transition measures

It was an earthquake for the oil industry and its financiers.

Shareholders of ExxonMobil, the world's second largest oil and gas giant, elected three candidates from the hedge fund Engine No. 1 to the company's 12-member board of directors in a crucial vote at the end of May.

The fund holds just 0.02% of the shares in ExxonMobil and had campaigned to accelerate the group's transition from polluting fossil fuels to clean energy. In doing so, it hoped to secure Exxon's profitability in the long term.

"Shareholders have spoken and the message is clear. It's time for board accountability," said Anne Simpson of Californian pension fund CalPERS. "We need climate competent directors willing and able to drive the energy transition."

The three largest pension funds in the US — CalPERs, the Californian Teachers' Pension Fund CalSTR and the New York State Common — supported the initiative, as did Black Rock, the world's largest asset manager and Exxon's second largest shareholder. "The votes at Exxon mark a new era in financial markets, with investors behaving like owners," said Simpson.

Companies without a climate strategy need to change, CalSTR said in a statement to DW. "Shareholders have the power to effect change at even the most resistant companies... to contribute to the sustainable value of their investments. "

Chevron is among a number of big oil and gas companies whose shareholders are pushing it to pollute less

The power of shareholders in large corporations

Other corporations have also felt the pressure from so-called impact investors, who advocate for a more sustainable corporate strategy. At the end of May, 61% of the shareholders of US oil giant Chevron also voted in favor of drastically reducing the company's emissions. Although the vote is not binding, it was a clear signal to the company's management that shareholders are increasingly demanding climate protection.

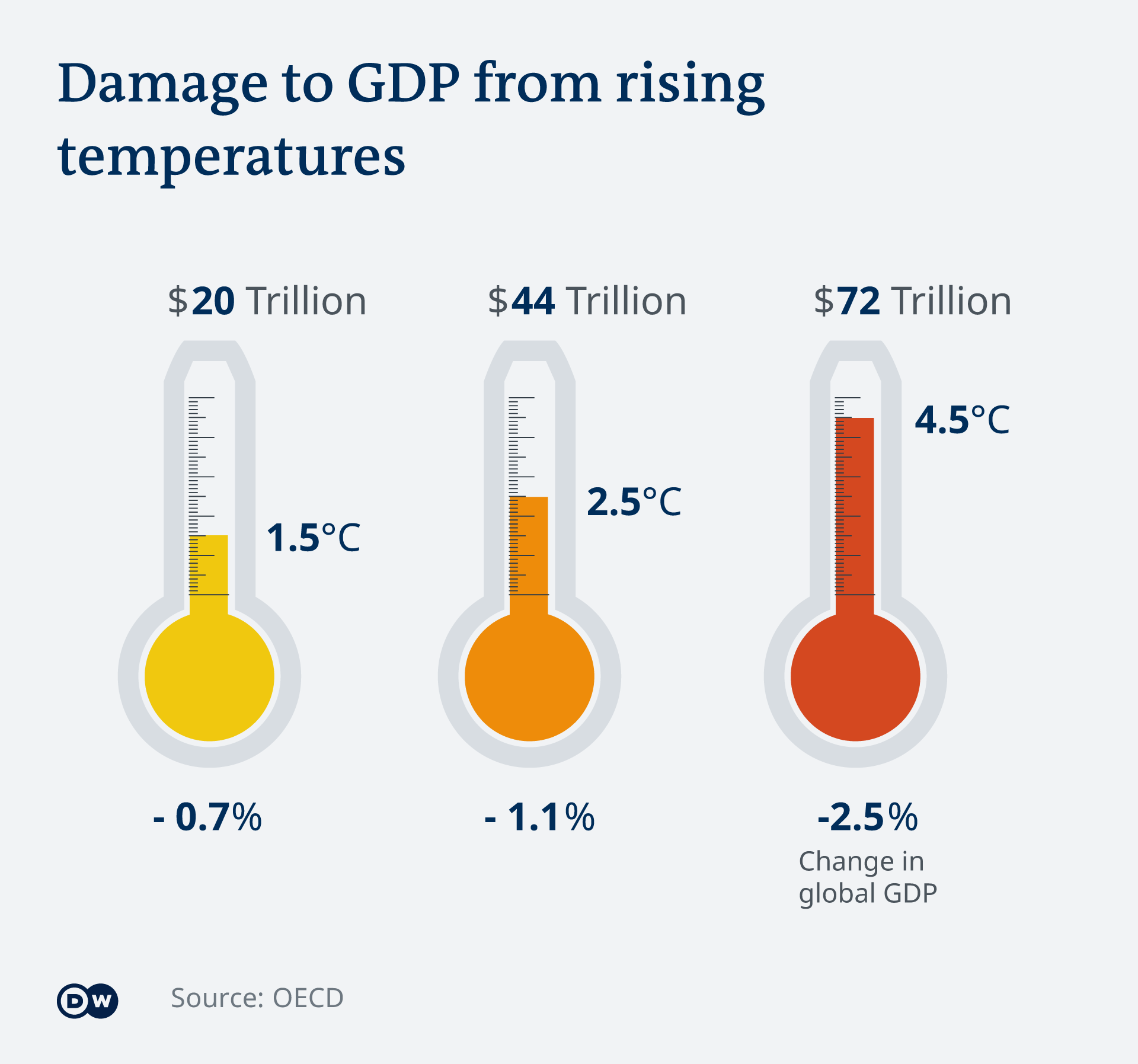

Last year, the French oil company Total set itself a zero-emissions target by 2050. This came after negotiations with investors who demanded a significant change in direction — with success. The initiators are part of ClimateAction100+, a network of over 500 investors responsible for $54 trillion (€45 trillion) in assets. They are pushing to bring emissions in large corporations in line with the goals of the Paris Climate Agreement to limit warming to well below 2 degrees Celsius above pre-industrial temperatures.

Following pressure from lobby groups, companies like BASF, Shell, General Electric, Eni, BP and Occidental Petroleum have also announced steps towards emissions cuts.

"Every large oil and gas company will need to adapt to the global energy transition — this is an unavoidable reality, even though not all management teams currently realize that fact," said Pavel Molchanov, financial analyst at consulting firm Raymond James. "That means investing less in oil and gas production, and more in low-carbon energy."

But as recently as October, Exxon CEO Daren Woods had rejected the claim that climate change poses a long-term risk to the industry. The company issued a public apology last Thursday after one of its senior lobbyists was caught in a Greenpeace sting operation admitting that Exxon worked with shadow groups against climate action and only supported a carbon tax because they did not think it politically viable.

Oil, gas and coal could soon be burning money

It's not just about the climate.

If investors are to share in profits through dividends, a company must first generate profits. But Exxon, for example, made losses of $22 billion last year. Engine No. 1's campaign focused on how the company can stay profitable by moving away from fossil fuels.

"This isn't a climate organization, this is a hedge fund driven by financial returns," said Mike Coffin, financial analyst of the London-based financial think tank Carbon Tracker. But although the financial risk of investing in oil, gas and coal is constantly growing, hundreds of billions of dollars continue to be invested annually in fossil fuel projects.

The upheavals of recent years are just the beginning, said Coffin. "The energy transition is only accelerating. It's very hard to predict what will happen over the coming years. And that's where the risk comes."

Even if drastic measures are taken today, investments of $10 trillion in the oil, gas and building sectors risk becoming "stranded assets," investments that generate losses instead of profits. About 2% of global GDP, as of 2015, would be effectively burned as a result.

Extinction Rebellion protestors are calling for an end to oil exploration and demanding governments and banks stop financing fossil fuel projects

Exxon coup also possible in Europe?

Still, a vote like the one at Exxon in the US would hardly be conceivable in Europe today, said Guillaume Prache, managing director of Better Finance, the interest group representing European shareholders.

On the one hand, this is because many investors are withdrawing their capital from climate-damaging companies instead of working to change them. As a result, investors who are less concerned about sustainability goals buy into these companies cheaply, thus losing the influence of critical investors, said Prache. "What will happen when their majority is owned by Chinese or Middle Eastern treasures? You think that are huge cash flows will be put to accelerate the energy transition? I'm really not sure about that."

What's more, it's much more difficult for private investors in the EU to get involved in the running of a company, for instance by drafting resolutions, said Prache. These procedures would have to become simpler and more digital. "Give the small investors the power to exercise their votes... and you will see things happening like what happened at Exxon."

For now, wind turbines are not replacing oil

The restructuring of global corporations takes years or even decades. In the case of Exxon, some observers doubt how serious the hedge fund Engine No. 1 is about sustainability — and whether they really live up to the title of "activist investors."

One of the new board members, Alexander Karsner, is a top manager at Google, while his colleague on the board Gregory Goff earned money in the oil and gas industry for decades. Writing in a blog post, stock market analyst Paul Sankey said: "Anyone who thinks that Greg Goff is going to storm into the Exxon Mobil boardroom and start yelling about wind farms does not know Greg Goff... We know Greg Goff, this will be orderly."

Goff would be more concerned with whipping the group into shape rather than achieving net zero, Sankey said. But the former no longer excludes the latter.

This article was translated from German.

DW

No comments:

Post a Comment