Wuxi AppTec, WuXi Biologics boost lobbying spending amid rising US security concerns

기자명 Kim Ji-hye

Published 2024.07.24

SNS 기사보내기Facebook(으)로 기사보내기 Twitter(으)로 기사보내기 Kakaostory(으)로 기사보내기 Copy url(으)로 기사보내기 이메일(으)로 기사보내기 다른 공유 찾기 기사스크랩하기

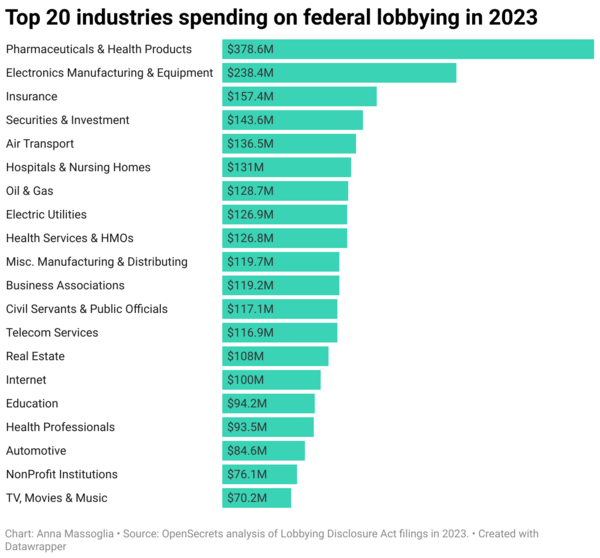

A record of $4.2 billion was funneled into influencing U.S. federal lawmakers in 2023, and the pharmaceutical and health products industries were the leading contributors, industry data showed.

On Tuesday, the Korea Biotechnology Industry Organization (KoreaBIO), a representative organization in the bioindustry field in Korea, released a report on Tuesday, citing data from the D.C.-based nonprofit OpenSecrets, which tracks money in politics.

According to the OpenSecrets analysis, “health companies spent more than any other sector in 2023 with U.S. federal lobbying spending topping $739 million for the year.”

U.S. health companies led all sectors in 2023 federal lobbying, with spending soaring to $739 million. (Source: OpenSecrets analysis of Lobbying Disclosure Act filings in 2023)

Among the key players are WuXi Biologics and its parent company, WuXi AppTec, two of China's largest contract research development and manufacturing organization (CDMO) giants. Their lobbying expenditures have soared, driven by the looming threat of the U.S. Biosecure Act.

The Biosecure Act is designed to safeguard national security by prohibiting certain U.S. government agencies from sourcing equipment or services with so-called “biotechnologies of concern,” like WuXi AppTec and WuXi Biologics, due to fears that the People's Liberation Army (PLA) could exploit their technology for military purposes.

“The legislation reflects deep-seated concerns about civilian tech advancing military capabilities and China's growing competitiveness in biotechnology,” said Oh Ki-hwan, senior managing director of the industry policy division at KoreaBIO.

However, the Biosecure Act missed its first chance at a congressional ride when the House Rules Committee omitted it from the 2025 National Defense Authorization Act (NDAA) annual spending bill. Despite its exclusion from the NDAA, House Speaker Mike Johnson (R-LA) assured that he would push the bill to the floor in the Fall. On July 8, in a speech at the Hudson Institute, a conservative think tank, Johnson emphasized the Biosecure Act among his top China-related legislative priorities.

The bill is on a fast track through U.S. Congress, with bipartisan support propelling it toward law, said Oh. "Johnson has made it clear that the bill is expected to pass, regardless of which party is in power after the 2024 U.S. Congressional and Presidential elections."

The stakes are high, the battle lines are drawn, and the pharmaceutical industry is in a frenzy to counteract the threat.

Among the key players are WuXi Biologics and its parent company, WuXi AppTec, two of China's largest contract research development and manufacturing organization (CDMO) giants. Their lobbying expenditures have soared, driven by the looming threat of the U.S. Biosecure Act.

The Biosecure Act is designed to safeguard national security by prohibiting certain U.S. government agencies from sourcing equipment or services with so-called “biotechnologies of concern,” like WuXi AppTec and WuXi Biologics, due to fears that the People's Liberation Army (PLA) could exploit their technology for military purposes.

“The legislation reflects deep-seated concerns about civilian tech advancing military capabilities and China's growing competitiveness in biotechnology,” said Oh Ki-hwan, senior managing director of the industry policy division at KoreaBIO.

However, the Biosecure Act missed its first chance at a congressional ride when the House Rules Committee omitted it from the 2025 National Defense Authorization Act (NDAA) annual spending bill. Despite its exclusion from the NDAA, House Speaker Mike Johnson (R-LA) assured that he would push the bill to the floor in the Fall. On July 8, in a speech at the Hudson Institute, a conservative think tank, Johnson emphasized the Biosecure Act among his top China-related legislative priorities.

The bill is on a fast track through U.S. Congress, with bipartisan support propelling it toward law, said Oh. "Johnson has made it clear that the bill is expected to pass, regardless of which party is in power after the 2024 U.S. Congressional and Presidential elections."

The stakes are high, the battle lines are drawn, and the pharmaceutical industry is in a frenzy to counteract the threat.

A record $4.2 billion was poured into federal lobbying last year, led by the pharmaceutical and health sectors, with key players like WuXi AppTec and WuXi Biologics boosting their spending dramatically in response to the looming Biosecure Act. (Credit: Getty Images)

KoreaBIO said that based on the Lobbying Disclosure Act (LDA) Reports, WuXi AppTec’s lobbying expenditures jumped from $100,000 in the fourth quarter of 2023 to $360,000 in the second quarter of 2024.

WuXi Biologics isn’t far behind, increasing its lobbying budget from $40,000 in the third quarter of 2023 to $165,000 by the second quarter of 2024, according to KoreaBIO.

With WuXi AppTec and WuXi Biologics targeted in the Biosecure Act, U.S. companies will be rocked, and WuXi AppTec and WuXi Biologics’ revenues will likely plummet, given that a majority of its business is conducted with U.S. companies, said Oh. He said that global consulting firm L.E.K. Consulting’s survey results revealed that global life science companies’ trust in Chinese companies has significantly declined, particularly in the CDMO sector, prompting many to take precautionary measures.

After a U.S.-based Biotechnology Innovation Organization (BIO) survey suggested that switching away from Chinese CDMOs could take biopharma companies up to eight years, the bill’s new draft laid out a 2032 deadline for U.S. firms to sever ties with high-risk Chinese biotechnology companies as well as their subsidiaries, parents, affiliates, and successors. Oh said companies are now eyeing alternatives like Indian pharmaceutical CDMOs to avoid risks that could hinder their entry into the U.S. market.

Major global biologics manufacturers are fueling the surge in pharmaceutical lobbying, driven by intense scrutiny of prescription drug benefit managers (PBMs), which are seen as major obstacles to lowering drug prices. The battle to keep drug prices high and protect profit margins is fierce. “PBMs resist change, intensifying governmental pressure to lower drug prices by targeting these organizations,” Oh said.

The health sector remains a top spender at both the federal and state levels,continuing a trend that started in 2019, according to OpenSecrets. As scrutiny intensifies around prescription drug management and regulatory issues, spending is expected to soar even higher in the coming months. With the spotlight on biosafety legislation, biotech and pharmaceutical companies are poised to escalate their lobbying efforts further.

“The pharmaceutical industry is set to once again dominate lobbying expenditures this year,” said Oh.

KoreaBIO said that based on the Lobbying Disclosure Act (LDA) Reports, WuXi AppTec’s lobbying expenditures jumped from $100,000 in the fourth quarter of 2023 to $360,000 in the second quarter of 2024.

WuXi Biologics isn’t far behind, increasing its lobbying budget from $40,000 in the third quarter of 2023 to $165,000 by the second quarter of 2024, according to KoreaBIO.

With WuXi AppTec and WuXi Biologics targeted in the Biosecure Act, U.S. companies will be rocked, and WuXi AppTec and WuXi Biologics’ revenues will likely plummet, given that a majority of its business is conducted with U.S. companies, said Oh. He said that global consulting firm L.E.K. Consulting’s survey results revealed that global life science companies’ trust in Chinese companies has significantly declined, particularly in the CDMO sector, prompting many to take precautionary measures.

After a U.S.-based Biotechnology Innovation Organization (BIO) survey suggested that switching away from Chinese CDMOs could take biopharma companies up to eight years, the bill’s new draft laid out a 2032 deadline for U.S. firms to sever ties with high-risk Chinese biotechnology companies as well as their subsidiaries, parents, affiliates, and successors. Oh said companies are now eyeing alternatives like Indian pharmaceutical CDMOs to avoid risks that could hinder their entry into the U.S. market.

Major global biologics manufacturers are fueling the surge in pharmaceutical lobbying, driven by intense scrutiny of prescription drug benefit managers (PBMs), which are seen as major obstacles to lowering drug prices. The battle to keep drug prices high and protect profit margins is fierce. “PBMs resist change, intensifying governmental pressure to lower drug prices by targeting these organizations,” Oh said.

The health sector remains a top spender at both the federal and state levels,continuing a trend that started in 2019, according to OpenSecrets. As scrutiny intensifies around prescription drug management and regulatory issues, spending is expected to soar even higher in the coming months. With the spotlight on biosafety legislation, biotech and pharmaceutical companies are poised to escalate their lobbying efforts further.

“The pharmaceutical industry is set to once again dominate lobbying expenditures this year,” said Oh.

No comments:

Post a Comment