Frik Els | August 2, 2024 |

Stock image.

The promise of electric cars has occupied the mining industry (and these pages) going on seven years now.

Recall when Glencore heralded a new dawn for mining thanks to EVs – telling the audience at its 2017 investors day that “as early as 2020, when electric vehicles would still make up only 2% of new vehicle sales, related metal demand already becomes significant.”

That prediction proved conservative – global penetration reached over 5% in 2020. The data is still trickling in, but the second quarter of this year is on course to set a new record for the electrification of the global car parc with 26% of passenger vehicle sales either full electric, plug-in or conventional hybrids.

Traditional hybrids remain a meaningful source of battery metals demand (thanks to large volumes and the widespread use of nickel metal hydride batteries) and even when stripping out Priuses (Pria?) with new owners, nearly one in five vehicles sold worldwide in Q2 was electrified.

Yet, when pairing robust metals demand with often volatile prices in the EV battery supply chain the picture looks very different.

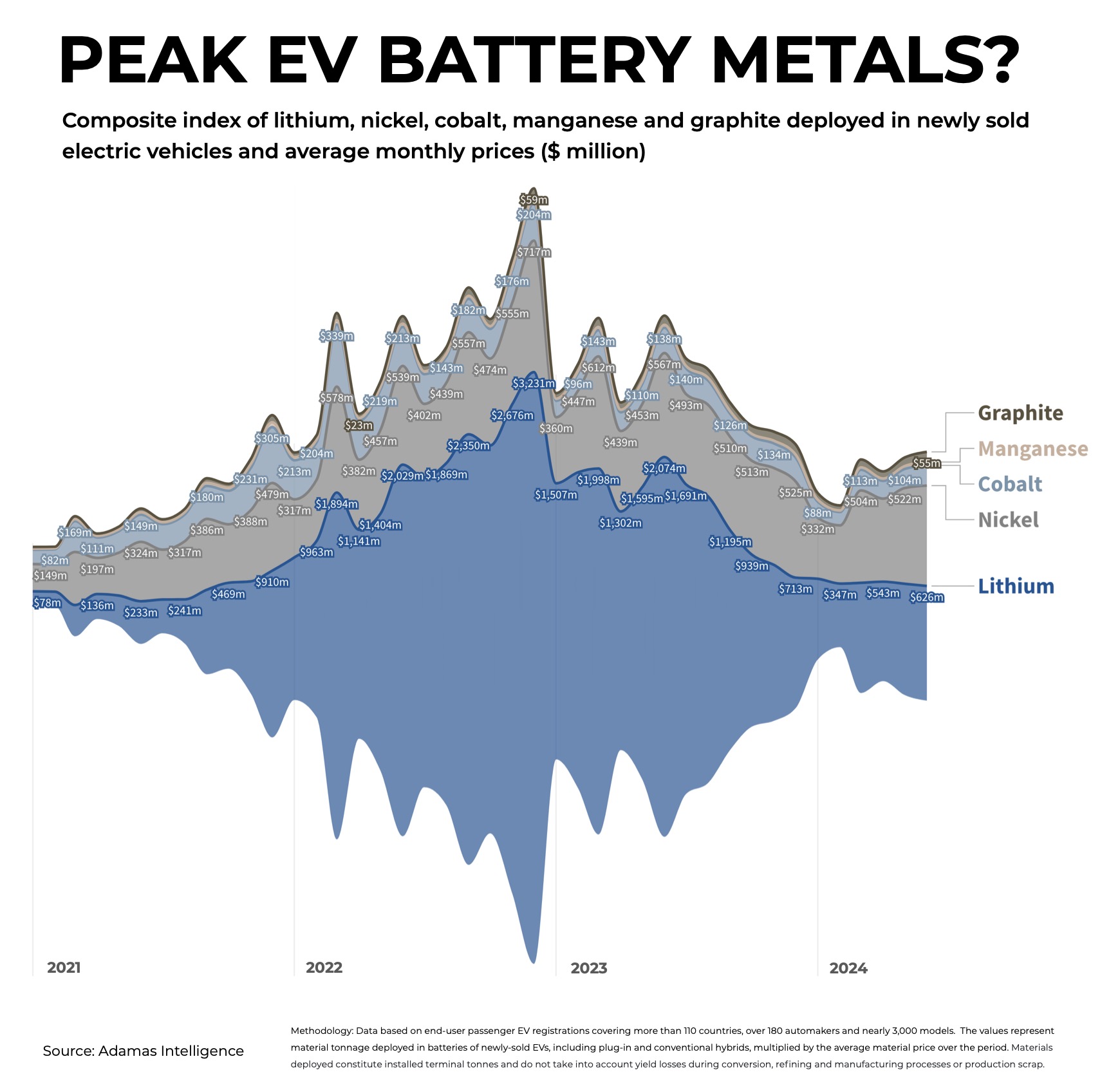

The graph from Adamas Intelligence below shows the monthly dollar value of lithium, nickel, cobalt, manganese and graphite contained in the batteries of EVs based on global end-user EV registrations, battery capacity and chemistries.

When looking at a streamgraph you don’t want the bulge to be at the start, but a chart that looks like an ink blot Rorschach test like the one below is hardly better.

December 2022 saw a record $4.2 billion worth of battery metals business done.

December is usually a blowout month for the global EV industry and the final month of 2023 was no exception. During December 2023 battery metals consumption was up another 20% year-over-year to a combined 140,000 tonnes on the back of a 23% increase in total giga-watt hours of battery capacity hitting the world’s roads that month.

However, more than $2.8 billion had disappeared from the value chain as metal prices capitulated.

During calendar 2022, the monthly value of combined battery metals deployment averaged $2.6 billion. In 2023, that number was $2.1 billion. So far this year? Down to $1.5 billion.

In the analysis below, materials deployed constitute installed terminal tonnes and do not take into account yield losses during conversion, refining and manufacturing processes, or production scrap.

This means that at the mine mouth the required tonnes (and values) to feed the supply chain are considerably higher.

Also, with 2023’s slump still in the rearview mirror, there is growing consensus that battery metals prices have bottomed out.

And combined with still healthy, albeit slowing EV sales growth should provide battery metals miners some comfort. But right now, that’s mostly cold comfort.

No comments:

Post a Comment