How can Sri Lanka recover from economic collapse?

A bailout from the International Monetary Fund will be critical in stabilizing Sri Lanka's finances, but critics say the Indian Ocean island needs to tackle food insecurity and political instability first.

Sri Lanka's economic crisis has caused fuel shortages that sparked long lines at gas stations

Sri Lanka's President Ranil Wickremesinghe, who was picked to continue in the role by parliament on Wednesday, now has a mammoth task in guiding the country out of its economic crisis. The Indian Ocean island's debt-laden economy collapsed after it ran out of money to pay for food, fuel and medicine — sparking months of protests.

The government owes $51 billion (€50 billion) and is struggling to make interest payments on those loans, let alone pay down the principal.

Many analysts have blamed years of mismanagement and corruption for the meltdown, including reckless borrowing from China, which was used to fund infrastructure projects that turned into white elephants.

The debt crisis was exacerbated by several other policy blunders, including deep tax cuts introduced just months before COVID-19 hit and an abrupt transition to organic farming that saw crop yields plummet.

A massive drop in tourism revenue — a vital source of foreign exchange — following the 2019 Easter terrorist attacks and during the pandemic, made matters far worse.

The economy is on course to contract by as much as 8% this year, while the cost of many food products and fuel has tripled and currency has collapsed by 80%.

Can IMF bailout be secured?

The first priority for the new government will be to restructure Sri Lanka's huge debts. Negotiations for a bailout from the International Monetary Fund (IMF) are already underway but they will require further restructuring of existing IMF loans as well as to others from China, India and Japan.

Any rescue package is likely to come with strings attached, including the privatization of state-owned enterprises and deeper austerity measures.

"The reality is that people can't take any more austerity," Ahilan Kadirgamar, a political economist at the University of Jaffna, told DW. "Many people have no cushion whatsoever," he said, adding that nearly two-thirds of Sri Lankans work in the informal economy.

Kadirgamar is skeptical about an IMF bailout, saying that Colombo will struggle to boost its external debt going forward as the cost of capital will be too high for a country that has just defaulted.

More relief needed to 'avert famine'

The economist has called on Wickremesinghe to use Sri Lanka's foreign exchange income — which he said amounted to $1.3-$1.5 billion per month — to prioritize the import of essentials like food, fuel and medicine that are still in short supply. The government must also increase deficit spending to fund further relief for the public, amid the rising threat of famine, he added.

The previous government of President Gotabaya Rajapaksa — who fled to Singapore and resigned from exile — has already undone some of the policy errors that fueled the crisis. But many of them could take years to help fuel the recovery.

Sri Lanka's new president (left) faces a deep political, economic and humanitarian crisis

that toppled the previous leader

Tax cuts reversed

For example, sweeping tax cuts announced in 2019 to spur growth were reversed last month to help meet the conditions of the proposed IMF bailout.

The original decision saw revenues fall by as much as 800 billion rupees ($2.2 billion, €2.1 billion) a year, according to Bloomberg. The reversal means sales tax (VAT) and corporate taxes are being hiked at the worst possible time and may fail to boost tax revenues enough while the economy is on its knees.

"I would say that the benefits [of the tax hikes] are going to be negligible," Soumya Bhowmick, associate fellow at the India-based Center for New Economic Diplomacy, Observer Research Foundation, told DW. "The additional tax revenue won't go to strengthen the economy but to tackle food shortages and other measures."

Kadirgamar, from the University of Jaffna, noted there was, "no appetite from the political class for a wealth tax," despite the urgent need for new streams of tax revenue.

Farming stimulus needed after organic crops debacle

In November, the government also U-turned on a major experiment with organic farming, just months after announcing a nationwide ban on synthetic fertilizers and pesticides. As a result of the ban, domestic rice production fell by a third and tea production — the country's primary export and source of foreign currency — dropped by 16%.

"In a short period of time, they destroyed the productivity gains achieved by farmers over many years, so rebuilding will take quite a lot of time, and that's after they have dealt with the crisis at hand," Bhowmick said.

Kadirgamar told DW that many of Sri Lanka's 2 million farmers had "lost confidence" after the organic blunder and that an "active stimulus" would be required by the government to encourage them to recultivate their land.

"Even if agriculture is low in GDP terms, in terms of our food security and people's livelihoods, it's a really huge sector," Kadirgamar told DW.

Tourism, too, could take a long time to recover. Sri Lanka's tourist revenues reached $4.3 billion in 2018 but slumped almost 80% during the pandemic.

While most Asian countries have seen an increase in international travelers recently, the widespread civil unrest and the severe disruption in Sri Lanka have again put off many holidaymakers.

Russians — the country's top source of tourism revenue — and Ukrainian

have stayed away due to the war

Remittances vital for foreign exchange

Rising foreign remittances from the estimated 3 million Sri Lankans working abroad could be a growing source of revenue but that too has been hit by both the pandemic and currency controls introduced last year.

Expatriates in total send home between $500-600 million per month, but when the government set the rupee's exchange rate at an uncompetitive price, the use of the informal "hawala" transfer system increased while official remittances dropped by up to 52%.

"Hawala" allows migrant workers to remit cash in the currency they earn to a middleman who ensures the worker's family receives the equivalent amount in rupees.

"Unless the government figures out a way to incentivize remittances through formal channels, the figure won't return to its previous level," Kadirgamar said.

Bhowmick, however, was more optimistic, as a result of an increase in Sri Lankans seeking employment abroad as their work at home has dried up.

"I'm quite hopeful that remittances will return to their normal level within a year or so as post-pandemic recoveries happen," he told DW.

Edited by: Uwe Hessler

INTER-IMPERIALI$T RIVALRIES

China, India vie for influence in Sri Lanka amid economic turmoilSri Lanka — with its strategic location at the crossroads of busy shipping routes — has become an arena of geopolitical rivalry and maritime competition between India and China.

In 2017, Colombo had to hand over the Hambantota port and thousands of acres

of surrounding land to Beijing for 99 years

Sri Lanka is currently experiencing the worst economic turmoil in its independent history, staring at surging inflation, staggering levels of debt and empty foreign exchange reserves, which have resulted in crippling shortages of essential items such as food and medicine.

Regional heavyweights India and China, both vying for influence in the island nation, have been quick to offer help.

New Delhi has so far given about $1.5 billion (€1.47 billion) to Colombo for funding imports of food, fuel, medicines and fertilizers. It has also provided another $3.8 billion in assistance in the form of currency swaps and credit lines.

Beijing, for its part, is providing some 500 million yuan ($75 million, €73.35 million) in humanitarian aid and has promised to "play a positive role" in Sri Lanka's talks with the International Monetary Fund (IMF).

But China has yet to respond to Colombo's appeal for debt relief.

Beijing funds Colombo's infrastructure drive

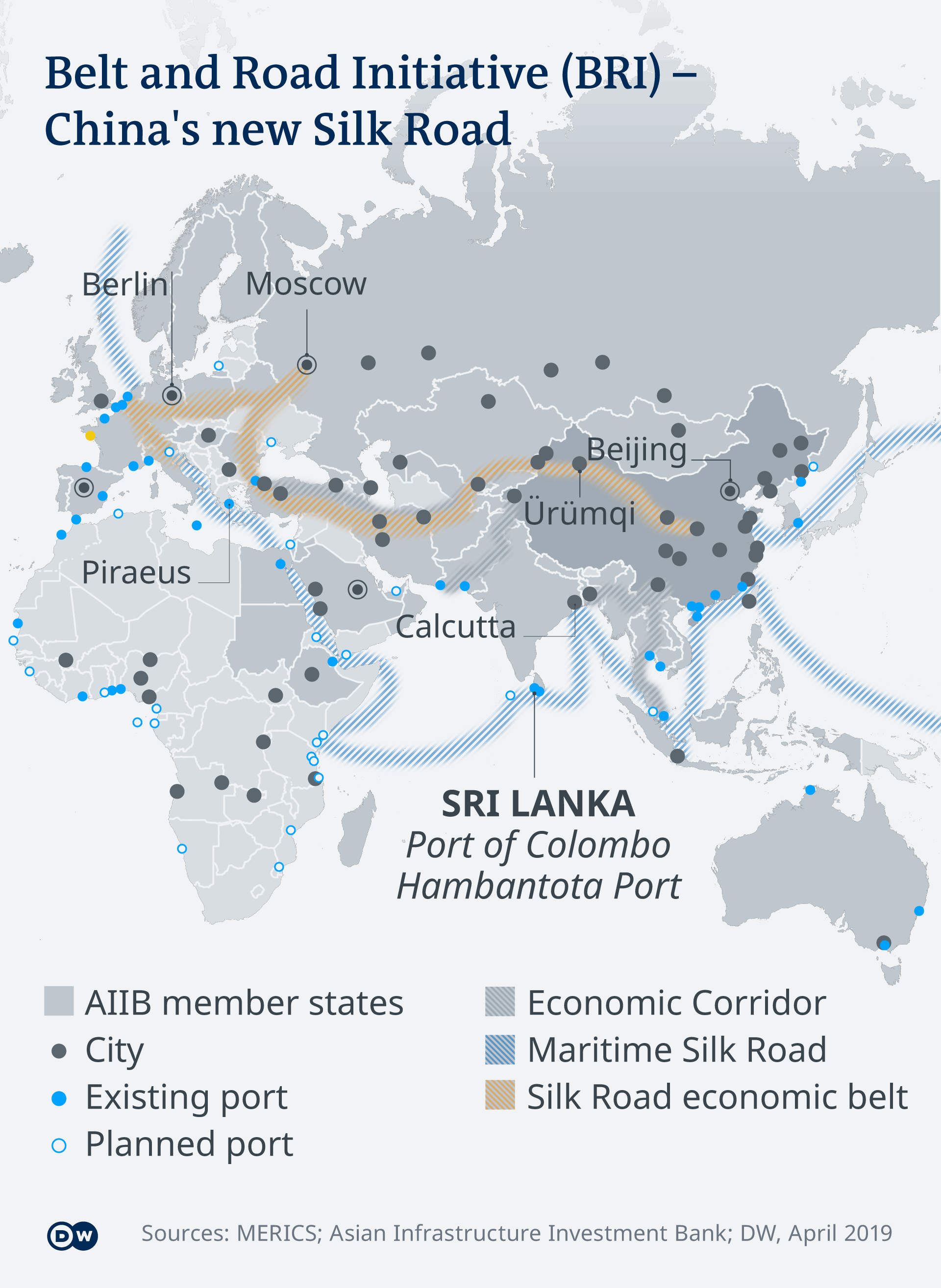

Sri Lanka — with its strategic location at the crossroads of busy shipping routes linking Asia to Africa and Europe — has become an arena of geopolitical rivalry and maritime competition between India and China in recent years.

Sri Lanka is a vital node in the Maritime Silk Road, as part of Beijing's Belt and Road Initiative

India and Sri Lanka share not only close trade relations, but also ethnic and religious ties.

But under the leadership of ousted President Gotabaya Rajapaksa and his elder brother Mahinda Rajapaksa, who served as president from 2005 to 2015, Beijing had appeared to gain sway in Colombo at the expense of New Delhi. China emerged as Sri Lanka's biggest trade partner and one of its largest creditors, accounting for about 10% of the country's entire foreign debt of about $51 billion.

When Sri Lanka embarked on a massive infrastructure drive after the end of a decades-long civil war in 2009, China pumped money into the country, funding roads, ports and airports for example.

Sri Lanka also emerged as a vital node in the Maritime Silk Road, under Beijing's Belt and Road Initiative.

Accusations of 'debt trap' diplomacy

China's closer ties with Sri Lanka have unsettled India, traditionally Colombo's closest economic and political partner.

But not all the collaboration has turned out to be financially viable, particularly the debt-financed mega projects like the Hambantota port and the Mattala Rajapaksa International Airport.

In 2017, Colombo had to hand over the Hambantota port and thousands of acres of surrounding land to Beijing for 99 years, triggering accusation that China engaged in a "debt trap" diplomacy to gain influence and control over key assets in the country.

"My field research last year found that China has gained a considerable footprint on the island's foreign policy through infrastructure diplomacy," said Asanga Abeyagoonasekera, a political and security analyst from Sri Lanka.

"There are concerns regarding Chinese projects due to opaqueness, lack of transparency and high-interest rates for Chinese loans," he stressed, adding that the Chinese offered loans at considerably higher rates than other lenders.

"We have borrowed at 6.4% from China while Japanese loans were less than 1% interest rate," he said.

Sumit Ganguly, a South Asia expert and professor of political science at Indiana University Bloomington in the US, shared a similar view. "The shiny infrastructural projects that were built on the basis of Chinese loans have proven to be castles of sand," he said.

'Rumors spread by Western countries'

But Xiaoxue Liu, an associate research fellow at the National Institute of International Strategy in China, said that allegations that China's Belt and Road initiative had dragged Sri Lanka into the current hardship were "rumors spread by Western countries."

According to her, most of Sri Lanka's foreign debts were caused by the large amount of commercial loans that the country had taken out over the last few years. "These loans are the key factors that caused Sri Lanka's dire economic situation," she said.

Nevertheless, with the current economic crisis and the general perception of Beijing's culpability, as well as China's apparent reluctance to write off Sri Lanka's debt, either partly or in full, India is eyeing up the chance to regain lost ground and consolidate its position as Colombo's primary partner.

"India sees this crisis as an opportunity. It has moved quite deftly to assist Sri Lanka with supplies of fuel, medicine and loans," said Ganguly.

"There are, obviously, limits to India's generosity owing to its own needs. However, given the significance that New Delhi attaches to its neighbor and its fears of Chinese influence in the country it is acting with alacrity," he underlined.

Over the past few months, India has managed to wrest control of some Chinese projects in Sri Lanka.

In March, New Delhi inked a deal to set up hybrid power projects on islands in northern Sri Lanka, after China said in December that it was suspending its plans to build plants on three islands due to security issues. In the same month, Colombo also scrapped an agreement with a Chinese firm to build a $12 million wind farm in the country, and instead offered the project to an Indian rival.

These decisions came after Sri Lankan authorities allowed India to proceed with a long-delayed project to jointly redevelop a strategic oil terminal along the island nation's eastern coastline.

"India's policy toward Sri Lanka is not based on a reaction to China. It is historical and based on people-to-people contacts with shared culture. If you look at Indian investments in Sri Lanka, they are people-centric," said Smruti Pattanaik, a foreign policy research fellow at the Institute for Defense Studies and Analyses (IDSA) in New Delhi.

Recalibrating Sri Lanka's foreign policy

Despite India appearing to regain lost ground, all is not well as anti-Indian sentiments still persist among sections of the Sri Lankan population, given suspicions and fears about Indian hegemony.

On Wednesday, Sri Lanka's Parliament elected acting President Ranil Wickremesinghe — who has served as prime minister several times before and is seen to be pro-India — as president after Gotabaya Rajapaksa fled the country and tendered his resignation last week.

Abeyagoonasekera said that the next government should recalibrate the nation's foreign policy and make it more balanced and with less of a pro-China tilt than witnessed under Rajapaksa.

"As an island nation, we have supported international norms and values for a rules-based order in the Indian Ocean. We should keep supporting in this direction to be a partner with our like-minded partners."

Liu, meanwhile, insisted that China had no intention to compete with India in Sri Lanka, as Beijing's main goal was to develop economic programs that would benefit both China and Sri Lanka.

"It's clear to us how close Sri Lanka is to India geographically while how far away it is from China," she said. "China knows it can't compete with India for influence in Sri Lanka, but if that's how India wants to view the situation, China can't stop them from doing so."

William Yang from Taipei contributed to this article.

Edited by: Shamil Shams

No comments:

Post a Comment