Zacks Equity Research

Mon, August 28, 2023

BP plc BP is pressing energy companies to invest more in hydrocarbon production to prevent a sharp surge in prices, while accelerating the transition to a carbon-neutral economy, per a Reuters report.

In 2022, about 3% of global gas supplies were affected by Russia’s aggressive invasion of Ukraine. Gas prices increased significantly, which led to countries switching to the next cheaper energy source, coal. As a result, coal use escalated to record highs last year.

Per BP CEO, Bernard Looney, oil and gas will continue to be a significant energy source globally for many decades to come. Oil and gas, used to power vehicles, airplanes and in several industries, constitute 55% of the world’s energy needs. Per International Energy Agency projections, global oil demand is set to rise to new high in 2023.

Energy transition should be orderly to maintain its pace as emission levels have risen since the Paris Accord in 2015 despite global efforts. Orderly transition will allow us to continue investing in existing fossil fuels and in transition projects at the same time. BP cited that it would spend 40% of its capital on energy transition projects by the middle of this decade and 50% by the end of the decade.

BP has been expanding other fuel options in India, the world’s third-largest energy consumer. The company has established about 3,000 electric vehicle charging points to date, which increased from 750 in January 2023. BP also invested in India’s gas sector and its venture arm acquired a stake in electric ride-hailing company BluSmart.

With big oil profits reaching record highs in 2022, BP wants to increase investments in fossil fuel production for the rest of the current decade. BP’s plan could indicate a major change in direction for other European oil majors.

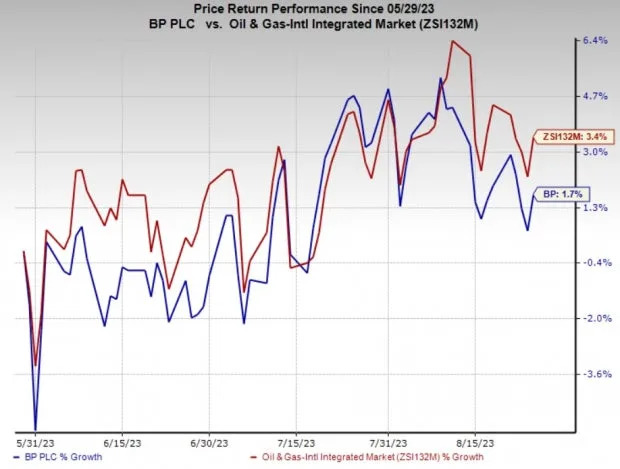

Price Performance

Shares of BP have underperformed the industry in the past three months. The stock has gained 1.7% compared with the industry’s 3.4% growth.

Zacks Investment Research

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

BP currently carries a Zack Rank #5 (Strong Sell).

Some better-ranked players in the energy sector are USA Compression Partners, LP USAC, currently sporting a Zacks Rank of 1 (Strong Buy), and Global Partners GLP and Evolution Petroleum Corporation EPM, carrying a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

USA Compression Partners is one of the largest independent natural gas compression services providers across the United States in terms of fleet horsepower.

USA Compression Partners has witnessed upward earnings estimate revisions for 2023 and 2024 in the past 30 days. The consensus estimate for USAC’s 2023 and 2024 earnings per share is pegged at 30 cents and 55 cents, respectively.

Global Partners is a leading operator of gasoline stations and convenience stores. Over the past 60 days, GLP has witnessed upward earnings estimate revisions for 2023 and 2024, respectively.

The Zacks Consensus Estimate for Global Partners’ 2023 and 2024 earnings per share is pegged at $3.46 and $3.69, respectively. GLP currently has a Zacks Style Score of A for Value and Growth.

Evolution Petroleum is an independent energy company. EPM has a Zacks Style Score of A for Growth and B for Value.

Evolution Petroleum has witnessed upward earnings estimate revisions for 2023 and 2024 in the past 60 days. The consensus estimate for EPM’s 2023 and 2024 earnings per share is pegged at $1.11 and $1.08, respectively.

No comments:

Post a Comment