Cecilia Jamasmie | June 26, 2024

Roughs diamonds. (Image courtesy of De Beers Group.)

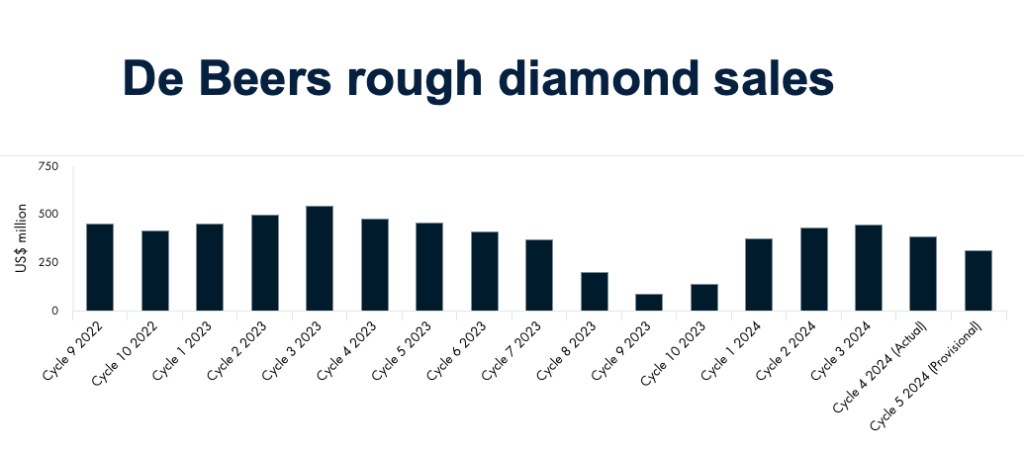

De Beers’ sales of rough diamonds fell for the second time this year, with the Anglo American’s (LON: AAL) unit recording a provisional $315 million, down from $383 million in the previous cycle and $456 million at this time last year.

The world’s largest diamond producer by value attributed the dip to the quieter summer period, but industry experts believe the results show that the diamond market remains in the doldrums.

“With the key China market struggling amid renewed graft investigations, we don’t expect to see much evidence of recovery during 2024,” BMO analyst Colin Hamilton wrote in a brief on Wednesday.

De Beers chief executive Al Cook confirmed the pessimistic outlook. “The recent annual JCK jewelry show in Las Vegas confirmed a resurgence in retailers’ interest in natural diamonds in the United States but ongoing economic growth challenges in China mean we continue to expect a protracted U-shaped recovery in demand,” he said in the statement.

Parent company Anglo American, which recently fended off a takeover by the world’s largest miner BHP (ASX:BHP), is in the midst of selling its 85% stake in De Beers.

The decision, announced in May, is part of a major company-wide restructuring and comes as the diamond sector continues to face declining sales, a sluggish global economy, and the rise of lab-created diamond alternatives.

Source: De Beers Group.

In preparation for the split from Anglo, De Beers— which coined the slogan “Diamonds are Forever”— is ditching man-made stones. This means it would end a six-year experiment to sell lab-grown diamond jewellery through its own brand, Lightbox, created in 2018.

While the miner is not halting the sale of its Lightbox stones right away, it will put the unit under review once it depletes current inventory, which will take about a year.

De Beers is targeting annual core profits of $1.5 billion by 2028. Last year, the business made just $72 million, though traditionally its profits have ranged between $500 million and $1.5 billion as the diamond industry swings from boom to bust.

The diamond miner seems ready to fly alone as it did for 124 of its 136 years of existence. Anglo American acquired a majority stake in De Beers only 13 years ago.

The government of Botswana holds the remaining shares and recently stated it would increase its stake in the company in order to play a central role in selecting a new investor to replace Anglo.

In preparation for the split from Anglo, De Beers— which coined the slogan “Diamonds are Forever”— is ditching man-made stones. This means it would end a six-year experiment to sell lab-grown diamond jewellery through its own brand, Lightbox, created in 2018.

While the miner is not halting the sale of its Lightbox stones right away, it will put the unit under review once it depletes current inventory, which will take about a year.

De Beers is targeting annual core profits of $1.5 billion by 2028. Last year, the business made just $72 million, though traditionally its profits have ranged between $500 million and $1.5 billion as the diamond industry swings from boom to bust.

The diamond miner seems ready to fly alone as it did for 124 of its 136 years of existence. Anglo American acquired a majority stake in De Beers only 13 years ago.

The government of Botswana holds the remaining shares and recently stated it would increase its stake in the company in order to play a central role in selecting a new investor to replace Anglo.

No comments:

Post a Comment