"The time for climate justice is now, and that means ending fossil fuel investment at its source and holding banks and financial institutions accountable," said one Native American environmental activist.

A protester holds a placard which states "Stop financing fossil fuels" during the demonstration outside JP Morgan on October 19, 2023 in London.

(Photo: Vuk Valcic/SOPA Images/LightRocket via Getty Images)

Eloise Goldsmith

Jun 17, 2025

COMMON DREAMS

The 16th annual Banking on Climate Chaos report, which was released Tuesday, found that dozens of the world's biggest banks committed $869 billion to firms engaged in fossil fuels in 2024—a "tremendous" increase from the overall fossil fuel financing that was recorded the year prior, according to the authors of the study.

The report comes a few months after the World Meteorological Organization announced a new milestone in the climate crisis: Not only was 2024 the warmest year in a 175-year observational period, reaching a global surface temperature of roughly 1.55°C above the preindustrial average for the first time, but each of the past 10 years was also individually the 10 warmest on record.

The new report analyzed the globe's 65 largest banks by assets according to S&P Global's annual rankings and was authored by several climate-focused groups, including Rainforest Action Network (RAN), Sierra Club, Indigenous Environmental Network (IEN), and others.

The report has been endorsed by hundreds of organizations in dozens of countries, according to a statement from RAN, and all banks in the report were given the opportunity to review the financing attributed to them prior to the report's release.

Big picture, the report shows that Wall Street investment banks and other financial institutions are "complicit in the climate crisis," according to Tom BK Goldtooth, executive director of the Indigenous Environmental Network and study co-author.

"The time for climate justice is now, and that means ending fossil fuel investment at its source and holding banks and financial institutions accountable," Goldtooth added.

The bank financing compiled in the report includes things such as the role banks play in facilitating bond issuances or their lending of money, according to the methodology section. Banks play a crucial role in enabling fossil fuel production because, as senior research strategist at RAN Caleb Schwarz explained, fossil fuel companies are quite rich but they don't have enough capital to finance their projects solely on their own.

Fossil fuel financing had been in on the decline between 2021 and 2023, dropping by $215 billion during that time period to $707 billion—meaning the rise in 2024 is a turnaround of over $162 billion.

"This growth in fossil fuel finance is troubling because new fossil fuel infrastructure locks in more decades of fossil fuel dependence," according to the report. "While various macroeconomic and political factors likely influenced specific decisions, at the end of the day, what matters is the outcome: Banks poured even more money into the expansion of the fossil fuel industry, despite the clear societal need for them to do the opposite."

Other topline findings include that the 65 banks featured in the report have committed $7.9 trillion in fossil fuel financing since 2016, and over two-thirds of the banks upped their fossil fuel financing between 2023 and 2024.

The world's biggest offender when it comes to fossil fuel financing in 2024 was JPMorgan Chase, which tallied $53.5 billion in fossil fuel financing, per the report. Bank of America came in second place.

"This should be a wake-up call to national governments and regional supervisory bodies that they need to step in," said Allison Fajans-Turner, bank engagement and policy lead at RAN and one of the co-authors of the report, on Tuesday. "Banks are not policing themselves. Regulators need to set rules to manage the financial risk that banks are putting into the system."

The authors of the report lay out several demands for banks, including that they drop all finance for fossil fuel expansion, adopt "binding and mandatory emissions reduction targets for upstream, midstream, and downstream fossil fuels," and increase financing for a "just transition," among others.

'Planet Wreckers': 4 Rich Nations Plotting Nearly 70% of New Oil and Gas Over Next Decade

"This is not just hypocrisy," said one climate campaigner. "It is a death sentence for communities on the frontlines of the climate crisis."

Climate defenders march in Houston on March 10, 2025.

(Photo: Kirk Sides/Houston Chronicle via Getty Images)

Brett Wilkins

Jun 16, 2025

COMMON DREAMS

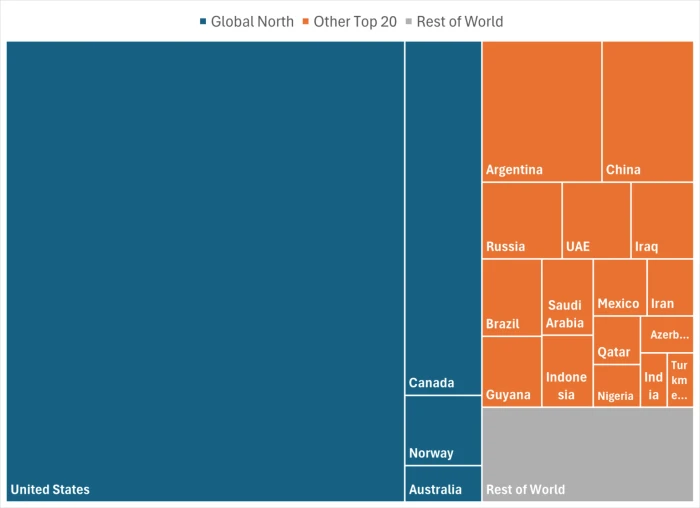

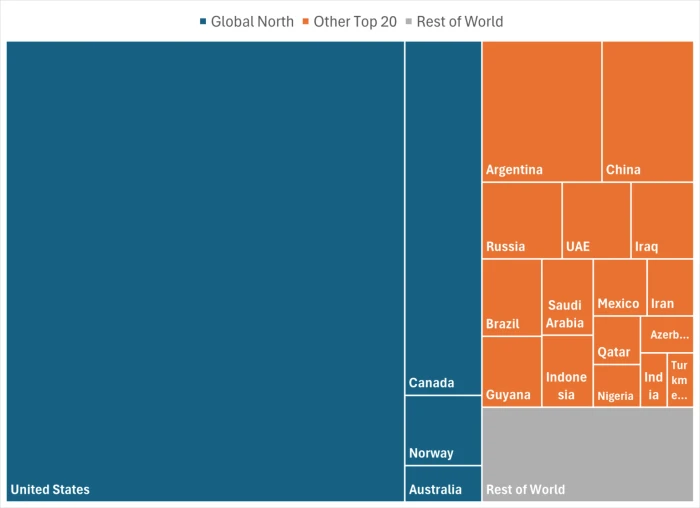

Four wealthy nations—the United States, Canada, Norway, and Australia—account for the majority of planned oil and gas expansion over the next decade, according to new data published by Oil Change International on Monday, the first day of the Bonn Climate Change Conference in Germany.

Oil Change's analysis, titled Planet Wreckers, notes that if those four Global North nations stopped their planned new oil and gas extraction, 32 billion tons of carbon pollution would stay in the ground instead of being burned and released into the atmosphere, where they fuel planetary heating. That's the equivalent of three times the annual global emissions created by burning coal.

"A handful of the world's richest nations remain intent on leading us into disaster. This is not just hypocrisy. It is a death sentence for communities on the frontlines of the climate crisis," Oil Change International global policy lead Romain Ioualalen said in a statement Monday.

"It is sickening that countries with the highest incomes and outsized historical responsibility for causing the climate crisis are planning massive oil and gas expansion with no regard for the lives and livelihoods at stake," Ioualalen added.

"This is not just hypocrisy," said one climate campaigner. "It is a death sentence for communities on the frontlines of the climate crisis."

Climate defenders march in Houston on March 10, 2025.

(Photo: Kirk Sides/Houston Chronicle via Getty Images)

Brett Wilkins

Jun 16, 2025

COMMON DREAMS

Four wealthy nations—the United States, Canada, Norway, and Australia—account for the majority of planned oil and gas expansion over the next decade, according to new data published by Oil Change International on Monday, the first day of the Bonn Climate Change Conference in Germany.

Oil Change's analysis, titled Planet Wreckers, notes that if those four Global North nations stopped their planned new oil and gas extraction, 32 billion tons of carbon pollution would stay in the ground instead of being burned and released into the atmosphere, where they fuel planetary heating. That's the equivalent of three times the annual global emissions created by burning coal.

"A handful of the world's richest nations remain intent on leading us into disaster. This is not just hypocrisy. It is a death sentence for communities on the frontlines of the climate crisis," Oil Change International global policy lead Romain Ioualalen said in a statement Monday.

"It is sickening that countries with the highest incomes and outsized historical responsibility for causing the climate crisis are planning massive oil and gas expansion with no regard for the lives and livelihoods at stake," Ioualalen added.

(Image: Oil Change International)

Nations that took part in the 2023 United Nations Climate Change Conference, or COP28, in Dubai committed to an equitable transition from fossil fuels. However, as Ioualalen noted, "this commitment is largely being ignored by some of the world's richest countries."

"Equity is not a buzzword. It is a foundational requirement to accelerate the transition," he asserted. "Until the richest countries commit to ending fossil fuel production and use and deliver adequate climate finance on fair terms, global calls for fossil fuel phaseout will ring hollow to developing countries that are struggling to meet development, energy access, and climate resilience needs."

The prospects of the U.S. making any meaningful near-term contribution to such a transition are dim given the Trump administration's "drill, baby, drill" energy policy.

The new report, and this year's Bonn conference, come between last year's COP29 in Baku, Azerbaijan and the upcoming COP30 in Belém, Brazil. Oil Change noted that Brazil ranks among the 10 largest projected expanders of oil and gas over the next decade, with plans to surpass Saudi Arabia.

"Countries have an opportunity to course correct by working together," Ioualalen stressed. "COP30 must deliver a collective roadmap for equitable phaseout dates for fossil fuel production and use, to actually deliver on commitments all countries made at COP28."

Nations that took part in the 2023 United Nations Climate Change Conference, or COP28, in Dubai committed to an equitable transition from fossil fuels. However, as Ioualalen noted, "this commitment is largely being ignored by some of the world's richest countries."

"Equity is not a buzzword. It is a foundational requirement to accelerate the transition," he asserted. "Until the richest countries commit to ending fossil fuel production and use and deliver adequate climate finance on fair terms, global calls for fossil fuel phaseout will ring hollow to developing countries that are struggling to meet development, energy access, and climate resilience needs."

The prospects of the U.S. making any meaningful near-term contribution to such a transition are dim given the Trump administration's "drill, baby, drill" energy policy.

The new report, and this year's Bonn conference, come between last year's COP29 in Baku, Azerbaijan and the upcoming COP30 in Belém, Brazil. Oil Change noted that Brazil ranks among the 10 largest projected expanders of oil and gas over the next decade, with plans to surpass Saudi Arabia.

"Countries have an opportunity to course correct by working together," Ioualalen stressed. "COP30 must deliver a collective roadmap for equitable phaseout dates for fossil fuel production and use, to actually deliver on commitments all countries made at COP28."

No comments:

Post a Comment