INDIA

Vedanta to keep coal as base energy source amid clean energy push

Indian mining and metals conglomerate Vedanta Ltd will continue to rely on coal as its primary energy source for mining operations, while aiming to increase the share of renewable sources in its energy mix, a top executive said on Tuesday.

Coal accounts for nearly 70% of Vedanta’s energy mix, Deshnee Naidoo, chief executive officer of Vedanta Resources, said in an interview on the sidelines of FT Live Energy Transition Summit India.

“Coal will be, for us in Vedanta, the baseload contributor,” Naidoo said.

The company, however, plans to raise the share of renewable energy in its operations by reducing its dependence on coal-based power to around 50–60% over the next three to four years, Naidoo said.

Vedanta is targeting a shift towards non-fossil sources, including solar, wind and hybrid models, to support its decarbonization goals.

It is also investing in low-carbon products, including aluminum and zinc, leveraging renewable energy and hydrogen in its manufacturing processes.

The low-carbon products are less than 20% of the company’s total output, but Vedanta is scaling up their production, Naidoo said.

The company is exploring similar energy transitions in its overseas operations.

In Zambia, where Vedanta faces up to 20 hours of daily power cuts, it plans to build a 300-megawatt power facility – split equally between coal and renewables – to support its mining expansion.

Zambia copper unit, lithium mining

Vedanta Resources has restored copper production at its Zambian unit to around 180,000-200,000 metric tons, levels last seen in 2018, Naidoo said. The company aims to ramp up output to 300,000 metric tons over the next three years.

“We’re absolutely in production,” the executive said.

However, the company does not have a timeline for listing the unit, Naidoo said.

Back in India, the company has no plans to venture into lithium mining, Naidoo said, adding that the country is yet to showcase its exploration potential.

(By Sethuraman NR; Editing by Jacqueline Wong and Shinjini Ganguli)

India’s silver imports to gain momentum from strong investment demand

India’s silver imports are expected to gather momentum in the coming months, supported by stronger investment and industrial demand that has already absorbed the surplus from last year’s elevated shipments, industry officials told Reuters.

Higher imports by the world’s biggest silver consumer could give further support to global prices that are close to their highest level in 14 years.

“With prices going up, investment demand has shot up, too — nearly twice as much as before,” Chirag Thakkar, CEO of silver importer Amrapali Group Gujarat, said on the sidelines of the India Gold Conference in New Delhi.

Silver imports are set to pick up in the coming months, with the annual total likely to be between 5,500 and 6,000 metric tons, Thakkar said.

The industry had expected a sharp drop in India’s 2025 imports after shipments more than doubled in 2024 to 7,669 tons.

India’s silver imports in the first eight months of 2025 more than halved to 2,580 tons from 5,695 tons a year earlier, provisional trade ministry data showed.

However, strong demand in recent months has depleted stocks, prompting banks and dealers to step up imports, Thakkar said.

Local silver futures hit a record high of 129,878 Indian rupees ($1,474.75) per kilogram on Tuesday and are up nearly 49% this year, outpacing a 44% jump in gold prices.

Despite the price rally, silver is trading at a slight premium over official domestic rates, which include a 6% import duty and 3% sales levy, as demand remains strong from industrial users and investors, said one Mumbai-based dealer with a private bank.

“Usually, when prices shoot up, a ton of scrap hits the market because investors cash out. But this time they’re so bullish on the outlook that hardly any scrap is showing up,” he said.

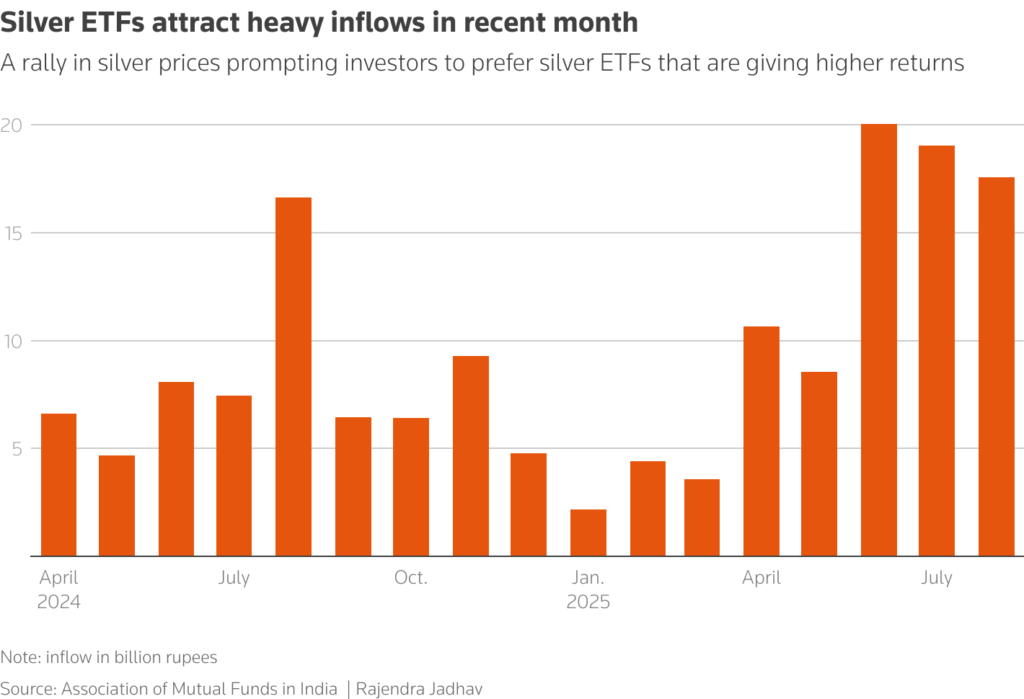

Inflows into silver exchange-traded funds reached 17.59 billion rupees in July and 19.04 billion rupees in August, well above the last fiscal year’s monthly average of 6.7 billion rupees, data from the Association of Mutual Funds in India showed.

India imports silver mainly from the United Arab Emirates, Britain and China.

($1 = 88.0680 Indian rupees)

(By Rajendra Jadhav and Brijesh Patel; Editing by Joe Bavier)

No comments:

Post a Comment