THE 'STANS

How Central Asia came to love the Chinese electric vehicle invasion

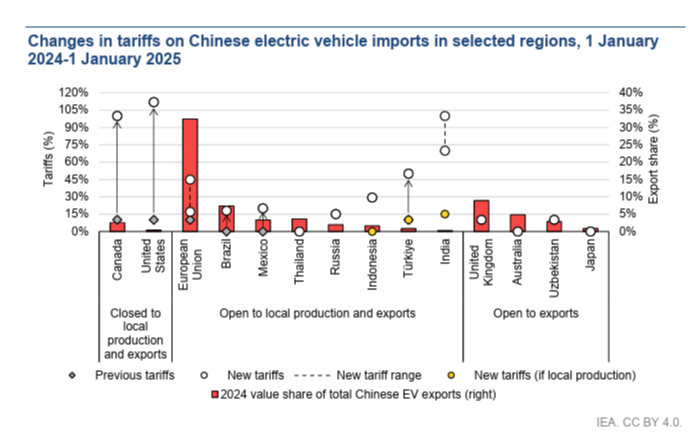

Western countries may have introduced tariffs to shield their auto industries from the huge Chinese electric vehicle (EV) production surge, but Central Asia stands out for having done precisely the opposite, flinging open its doors.

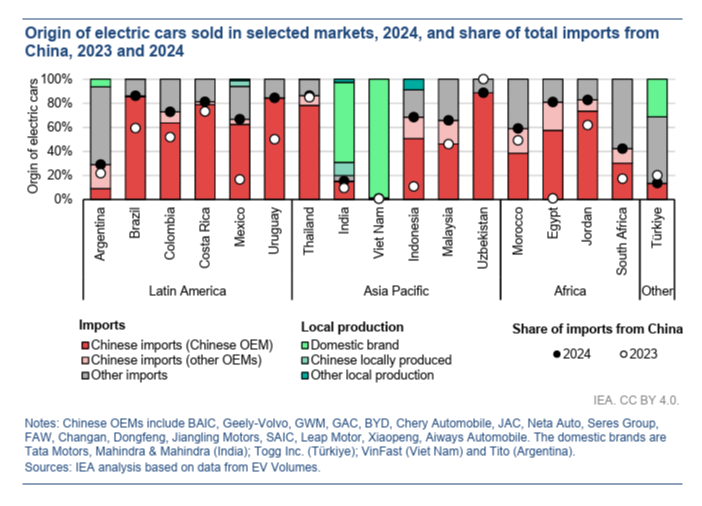

In 2024, every 10th car on China’s roads was electric. What’s more, Chinese automakers accounted for four in 10 EVs shipped to export markets worldwide.

Some dramatic statistics on Chinese EVs in Central Asia (as gathered by a recent commentary published by Carnegie politika, titled “China has flooded Central Asia with electric cars – the impact will be long-lasting”) catch the eye.

As recently as 2020, the annual value of China’s car exports to the five countries of Central Asia stood at just $750mn. The shipments were largely composed of used internal combustion engine (ICE) cars.

In 2024, cars exported by China to Central Asia boasted a value of nearly $10bn. And shipped EVs accounted for $1.1bn of that figure.

Tenth of all exports

Another eyecatching reality is that, as things stand, automobiles now represent about a 10th of all Chinese exports to the five-state region.

According to the analysis – penned by Temur Umarov, a fellow at Carnegie Russia Eurasia Center, and Roman Vakulchuk, head of the Climate and Energy Group at the Norwegian Institute of International Affairs, or NUPI, and co-founder of the Central Asian Development Institute – the “uptick came about because of a fortunate combination of circumstances… the region is experiencing a demographic boom, and both purchasing power and demand for cars are growing.”

Uzbekistan out in front

Nowhere is that more evident than in Uzbekistan. In Central Asia, the country is leading the way in the switch from ICE-cars to EVs. An International Energy Agency (IEA) report, Global EV Outlook 2025, observes that between 2023 and 2024, EV sales in Uzbekistan, Central Asia’s most populous country with 38mn people, doubled in share, while the average import price fell almost threefold.

Official trade data show that Uzbekistan imported nearly 29,000 EVs in the first eight months of 2025, more than double the 12,900 brought in during the same period in 2024. Spending on EV imports expanded to $358.9mn from $166.7mn. As of July, the total EV fleet in the country amounted to 73,600 vehicles, up by 8,400 units since April.

The rate of EV adoption in Uzbekistan can be seen in the expansion of the country’s charging network. By May, Uzbekistan had 1,399 charging stations in place, more than double the figure of a year earlier. The capital Tashkent hosted 820 of them.

100 cars per 1,000 people

Umarov and Vakulchuk point to data showing that there are by now more than 100 cars per 1,000 people in all of the Central Asian states except for the poorest state of the region Tajikistan. Largest Central Asian economy Kazakhstan is even nearly level with Russia at 308 cars per 1,000 people compared to Russia’s 331.

The analysis also takes note of how “Central Asia also plays a role as a re-exporter of cars to the Russian market, which saw an exodus of Western companies after Russia’s invasion of Ukraine in 2022. It’s more expensive for Chinese exporters to supply cars directly to Russia than Central Asia, since customs duties are three times lower in Kyrgyzstan, for example. As a result, Kyrgyzstan, which has no automobile industry of its own, has since 2022 become the second-largest supplier of cars to Russia after China.”

The growth in Central Asia’s auto demand is progressing in a form of symbiosis with auto supply surge from China. “Beijing,” say the analysts, “is using subsidies and tax breaks to encourage its manufacturers to sell more electric cars both domestically and abroad. Chinese automakers are so keen to increase sales that they are willing to resort to some outlandish schemes, such as selling new cars as used ones with zero mileage.”

Riding on state support, China’s BYD Auto has overtaken Tesla to become the world’s number one EV market player.

In Uzbekistan, 99% of all imported EVs come from China, and in Kazakhstan, sales of Chinese brands are growing at a clip of 50% a year, displacing traditional market leaders such as Hyundai, Kia, and Chevrolet, say the analysts.

Smog-weary buyers

The growing popularity of EVs in smog-ridden Central Asian cities such as Tashkent, Bishkek, Almaty and Dushanbe is also down to the environmental plus they bring in terms of cutting emissions.

Such is their popularity that in Tajikistan, EVs are exempt from taxes and import duties through 2032, say Umarov and Vakulchuk.

* For footnotes to above IEA graph, visit the source report.

An interesting episode in the development of EV manufacturing within Central Asia saw BYD Auto play its cards exactly right. A year after its Uzbekistan plant (its first outside China) was opened in a collaboration with Uzbek automaker ADM Jizzakh, BYD lobbied for a fourfold hike (to around $6,000) in the “recycling fee” (a future scrappage fee) paid on imported EVs. “Since BYD is the only company producing electric cars inside the country, it is exempt from the recycling fee and effectively has a monopoly on Uzbekistan’s electric car market,” says the Carnegie report.

Telling how the Central Asian countries have given up on expensive attempts to diversify supplies of electronics away from Chinese brands, the two authors of the report conclude: “China’s technology monopoly is rapidly making it a necessity for the Central Asian countries to integrate into their giant neighbor’s tech ecosystem. Electric cars are not just an alternative to cars with internal combustion engines; they are also the next stage of the industry’s development, which will bring new technologies.

“Accordingly, by entering this new stage of development of the automotive industry via Chinese electric cars, Central Asia will eventually be forced to adopt Chinese standards for the industry’s development: the entire infrastructure of electric charging stations, servicing, the replacement and disposal of batteries, and in due course, standards for driverless cars. That will ultimately spread to the level of management: first of municipal infrastructure, and then the nationwide transport system, leaving no room for competitors.”

Turkey heading for surrender?

Central Asia is unlikely to be the last region to surrender to the Chinese EV behemoth.

Recent years saw Turkey, for instance, lavish much attention and capital on developing a homegrown electric car, the Togg. But the fast-growing Turkish EV market – over 100,000 fully electric vehicles were sold in the country in the first seven months of 2025, marking a 147% y/y increase – has whetted the appetite of Chinese EV makers.

Are the Togg's days numbered? (Credit: Metuboy, cc-by-sa 4.0).

To balance foreign investment with protectionism, Ankara has raised tariffs on imported Chinese EVs to 50%, but granted exemptions to firms like BYD that commit to production in Turkey. Sales of imported BYD cars have since soared. The prospect of 150,000 BYD cars per year rolling of the production lines at BYD’s Turkish plant in Manisa when it is ready to roll now poses possible trouble for the Togg.

“They [Togg] may not survive in such a market,” Cagdas Ungor of Marmara University was cited as saying by The Economist in September.

Rise of the "electro-yuan"

But back to Central Asia where the Chinese EV phenomenon combined with Beijing’s plans to roll out a proliferation of artificial intelligence (AI) projects in the region have economists working overtime staring into the crystal ball.

One consideration is that the combination could drive up Central Asian power demand to such an extent that it could help make yuan-based settlements in cross-border trade and investment more common.

That, in turn, could fuel the rise of the "electro-yuan", akin to the petrodollar, according to a September editorial published by Reuters.

It looked at how in 2023, when a Chinese company committed to a 500-megawatt wind power project in Uzbekistan, it used the renminbi to settle power contracts.

“Rising crude-oil exports in the 1970s were settled in U.S. dollars, helping cement the greenback's dominance in global trade and finance. A yuan-denominated green electricity trade could pave the way for more usage of the Chinese currency as the world transitions to a net-zero energy system. That would arguably be [Chinese leader Xi Jinping’s] biggest win against the West,” the news agency wrote.

Central Asia to Defy Global Headwinds With Robust Economic Growth

- The EBRD forecasts Central Asia’s GDP to grow 6.1% in 2025, with Kyrgyzstan leading at 9%.

- Strong domestic demand, rising wages, and remittance inflows are powering growth across the region.

- The bank warns of vulnerabilities tied to commodity price swings and heavy reliance on Russian and Chinese markets.

A new survey published by the European Bank for Reconstruction and Development offers a strong near-term economic outlook for Central Asian states. But the bank adds that the region is prone to fluctuations in commodity prices, reliance on remittances, and dependence on Russian and Chinese markets.

The EBRD’s Regional Economic Prospects 2025 edition projects regional growth this year to reach 6.1 percent, and slow to 5.2 percent in 2026.

“Central Asia Central Asian economies continued to post solid growth in the first half of 2025, supported by robust domestic demand, rising real wages and strong remittance inflows. Industrial output remained overall resilient, but volatility in commodity prices affected mining outputs and exports of countries in this region,” the report states.

“Inflation trends diverged: while inflation eased from its peaks in Turkmenistan, Mongolia and Uzbekistan, it accelerated in Kazakhstan and the Kyrgyz Republic, driven by fiscal stimulus, rising food prices and utility tariff adjustments,” the report adds.

Kazakhstan and Uzbekistan are widely viewed as being the largest and most innovative economies in the region, but the EBRD anoints Kyrgyzstan as Central Asia’s economic “pacesetter.” Bishkek is projected to record 9 percent annual growth this year, falling to 6 percent in 2026.

“Strong public investment and buoyant domestic demand have supported growth, fueled by rising wages and continued increases in remittances,” according to the report. “The manufacturing, trade and construction sectors were the leading growth engines, while the tourism and hospitality sector maintained strong growth.”

A variety of factors, including expanded oil production from the Tengiz field, major state investments in infrastructure projects and an increase in household spending, are helping drive Kazakhstan’s economy. GDP growth is estimated to reach 5.7 percent in 2025, and ease to 4.5 percent next year. The report identifies several downside risks, in particular “an over-reliance on Russian infrastructure for oil transit, and commodity price volatility.”

Uzbekistan is expected to maintain a relatively steady growth pace, with the EBRD estimating a 6.7 percent increase in 2025 and 6 percent next year. Growth is “underpinned by robust domestic consumption and investments, as well as by sustained expansion in diversified manufacturing, bolstered by continued foreign investment,” the report states. Tashkent is also benefiting from high prices paid for its gold exports and strong growth in the volume of remittances sent home by labor migrants.

Tajikistan’s economy is heavily dependent on remittances, which have proven robust so far this year. The mining sector, along with the agricultural and transport sectors, are also performing well, according to the EBRD report, which additionally cites “strong” household consumption. Such an assertion seems at odds with reports that indicate high inflation is making it difficult to afford essential food items and other necessities. The EBRD projects Tajikistan to see GDP growth of 7.5 percent in 2025, slipping to 5.7 percent next year. “A potential decline in remittance inflows remains a downside risk,” the report notes.

The opaque nature of Turkmenistan’s political system invariably complicates efforts to estimate economic activity in the country. The EBRD report accepts official Turkmen government data as accurate, projecting economic growth over the next two years to remain at a steady 6.3 percent, propelled by “ongoing investments in energy, infrastructure, agriculture and food processing.”

The EBRD includes Mongolia in its grouping of Central Asian states, projecting Ulaanbaatar to maintain a consistent growth rate of 5.8 percent in 2025, followed by a 5.5 percent rate next year. The EBRD report states that a rebounding agricultural sector, combined with the expansion of the services sector, is offsetting “weaker mining-sector activity and a deteriorating macroeconomic environment.” Challenges over the near-term may arise from weakening Chinese demand and commodity price volatility, the report adds.

In sharp contrast to Central Asia, the EBRD is predicting a significant decline in the Caucasus region’s economic performance. Georgia, which over the past year has made a geopolitical pivot away from the European Union back towards Russia, seems to be in an economic free-fall, according to the EBRD. GDP growth in 2024 stood at 9.4 percent, but is expected to plunge to a 5 percent growth rate in 2026. Azerbaijan is projected to follow a similar trajectory, falling from a 4.1 percent growth rate in 2024 to a 2.5 percent rate in 2026. Armenia stands to see the least decline, going from a 5.9 percent growth rate in 2024 to 4.5 percent in 2026.

By Eurasianet

Kazakh Fincraft targets Canadian Tethys in strategic mining push

Kazakhstan’s Fincraft Group is seeking to acquire Tethys Petroleum (CVE: TPL), a Toronto-listed oil and mining company, as part of a broader push to integrate upstream energy production into its expanding mining portfolio.

The move, announced in a non-binding letter of intent in September, also reflects Fincraft’s strategy to secure greater control over the Central Asian region’s critical resource infrastructure.

Fincraft, which trades on the Kazakhstan Stock Exchange, operates significant assets in nickel through Kaznickel, as well as cobalt and coal via Shubarkol Premium. It has previously held controlling stakes in London-listed gold miner Petropavlovsk and Central Asia Metals, consolidating its position as one of the region’s most diversified mining groups.

Sources close to the deal say Fincraft sees in Tethys, which operates oil and gas fields across Kazakhstan, a rare opportunity to consolidate access to both mineral and energy assets within the same geography.

The group’s billionaire chairman, Kenges Rakishev, has long pursued cross-sector investments with a focus on scaling industrial ecosystems around core commodities.

A regular on the Forbes list of billionaires, Rakishev has previously launched ventures in blockchain, plant-based food production and tech start-ups, but in recent years has redirected his focus toward domestic industrial expansion, investing heavily in nickel extraction within Kazakhstan.

Through the proposed acquisition, Rakishev aims to integrate Tethys into Fincraft’s broader mining operations, securing access to energy reserves that could underpin future metals processing and export operations. The integration would also allow Fincraft to leverage Tethys’s existing oil and gas infrastructure to support logistics and industrial development across its mining network.

Kazakhstan’s resource bet

In the three decades since the collapse of the Soviet Union, Kazakhstan has built an economy heavily reliant on natural resources. Through state-owned mining firms, the country has become a leading supplier not only of oil and uranium but also of gold, copper, manganese and chromium.

For years, however, international miners steered clear of Kazakhstan, citing bureaucratic hurdles, opaque regulations and entrenched corruption. Despite its promise, the sector stagnated as new exploration opportunities dwindled.

Recognizing the problem, the government overhauled its mining code in 2018, drawing on Australia’s investment-friendly model to encourage exploration. While the reforms did not immediately trigger a wave of foreign investment, Western interest has begun to return. The number of exploration licences issued in 2024 nearly doubled the annual average of the previous six years, with known companies such as Ivanhoe Mines (TSX: IVN) stepping up prospecting efforts.

Fincraft’s move for Tethys comes at a moment when that shift in sentiment is beginning to take hold. Rakishev appears to be betting that Kazakhstan’s regulatory overhaul and renewed investor confidence have created a more stable environment for large-scale mining integration.

Investors complaint

Rakishev’s approach comes amid rising dissatisfaction among Tethys shareholders over corporate governance. One investor, Gazexport, publicly endorsed Fincraft’s proposal last week, citing what it described as weak oversight under chairman and chief executive Bill Wells. The shareholder said inadequate infrastructure at the Kul-Bas oil field, discovered in 2020, had caused frequent production interruptions and hindered growth.

Gazexport also criticized the management of Tethys’ gas assets, pointing to the lack of a formal supply agreement with the national operator QazaqGaz and to a decision to accept lower gas prices, which it said had caused losses of up to $2.5 million. The company further noted the board’s failure to pursue a potential claim before the London Court of International Arbitration to uphold gas pricing terms under a 2019 supply contract.

“As a significant shareholder of Tethys, we have spent the last few months in discussions with management but have been disappointed by the lack of willingness to engage or provide Fincraft with representation on the board,” Gazexport said.

Earlier this year, Fincraft nominated a Kazakhstan-based director with extensive local industry experience to join Tethys’ board, but the proposal was rejected. The company has since cited the suspension of natural gas supplies for more than 18 months as further evidence of mismanagement.

If completed, the acquisition would mark one of the most consequential cross-border mining-related transactions led by a Kazakh investor in recent years.

Russian President Vladimir Putin on October 8 arrived in Tajikistan for a state visit and a raft of meetings with leaders of other former Soviet states.

The three-day trip will include a Russia-Central Asia summit on October 9 involving Putin, who turned 73 on October 7, and the leaders of Tajikistan, Kazakhstan, Kyrgyzstan, Turkmenistan and Uzbekistan. On October 10, the Russian and Central Asian presidents will be joined by the leaders of Armenia, Azerbaijan and Belarus for a broader meeting of countries of the Commonwealth of Independent States (CIS).

Tajikistan is a member of the International Criminal Court (ICC) that in 2023 issued an arrest warrant for Putin over alleged war crimes committed during Russia’s war in Ukraine. But like ICC member Mongolia, which received Putin for a visit in September 2024, Tajikistan, a country that hosts a Russian military base with a mission to help secure the border with Afghanistan, will certainly not act on the warrant given its strategic and economic ties with Moscow.

Human Rights Watch on October 8 called on Tajikistan to arrest Putin. It said a failure to do so would show “utter disregard for the suffering of victims of Russian forces’ crimes in Ukraine.”

On arrival in Tajik capital Dushanbe, Putin was greeted by Tajikistan’s President Emomali Rahmon, who turned 73 two days before Putin. Rahmon has been in power for nearly 33 years and is the longest serving of all the ex-Soviet leaders in power.

Earlier on October 8, Russia's Defence Ministry said Defence Minister Andrei Belousov held talks on military cooperation with his Tajik opposite number Emomali Sobirzoda.

"A lot today depends on cooperation between our two military institutions, most importantly, stability in Central Asia," the ministry quoted Belousov as saying. "The current situation remains very difficult."

Distracted by the war with Ukraine, Russia has lost economic ground in Central Asia to China and other powers and has struggled to keep up the level of political influence it has enjoyed in the region since the dissolution of the Soviet Union in 1991.

To Tajikistan, Russia is an essential source of remittances from work migrants. Russian presidential aide Yuri Ushakov told media on October 8 that Tajik citizens working in Russia transferred more than $1.8bn to their homeland in 2024, a figure that represents 17% of Tajikistan's GDP.

There is, though, much concern across Tajikistan, Uzbekistan and Kyrgyzstan—the three Central Asian countries that account for most of the migrant workforce in Russia—about an ongoing tough crackdown on migrants in Russia, which is widely seen as xenophobic.

"Although the countries of the [Central Asian] region have benefitted economically from the war in Ukraine, sharply increasing their exports to Russia, tensions between the two sides have nevertheless increased recently. These tensions are linked to the worsening situation of labour migrants from Uzbekistan and Tajikistan in Russia," Alisher Ilkhamov, founder of the UK-based research centre Central Asia Due Diligence, was quoted as saying by Azattyk.

The stagnation of the Russian economy looks set to pose a threat to the volume of remittances migrant workers can send to home countries in Central Asia.

That would make the crackdown on migrants by Russian authorities even harder to bear.

"Migrants have become one of the vulnerable groups on which the Russian state is practicing its methods of social control," Temur Umarov, a researcher at the Carnegie Berlin Center, told Azattyk, adding: "These practices can then be scaled up to cover the rest of the population.

“Furthermore, a strict migration policy allows certain political forces within Russia to score points—it's used to consolidate society, create an 'enemy', and strengthen national identity. This is the inherent contradiction: migration policy undermines Russia's strategic interests in the region, yet it is being implemented by agencies unaffiliated with the foreign policy bloc."

Umarov did not rule out the chance that one of the Central Asian leaders gathered in Dushanbe might cautiously express dissatisfaction with Russia's migration policy, but added that he believed no harsh statements should be expected.

New Ukrainian postage stamp bearing a picture of scientist and Tajik native Bezhan Sharofov, who was killed while fighting against the Russian invasion of Ukraine (Credit: Ukrposhta, social media).

Likely with an eye on Putin’s visit to Tajikistan, Ukraine on October 7 announced a postage stamp with a likeness of scientist Bezhan Sharofov, a biophysicist and native of Tajikistan, who was killed in April 2022 while defending Ukraine against the Russian invasion that started two months previously.

On October 8, AlJazeera reported on a prison interview with a Tajik work migrant from Dushanbe who was captured by Ukrainian troops as he fought for Russia. The prisoner of war, named only as Mohammed, claimed to have been roughly treated, forced into the Russian Army and fooled into military service that meant fighting on the frontline.

“Seeing Ukrainian servicemen’s normal attitude towards him, and comparing it with the Russians’ attitude, Mohammed expressed a wish to serve for the Ukrainian forces, so that he doesn’t return to Russia to experience racial and ethnic discrimination,” a Ukrainian officer was quoted as saying.

_200324_0.jpg)

No comments:

Post a Comment