Teck-Anglo deal could boost Canadian critical mineral output: experts

By The Canadian Press

September 11, 2025

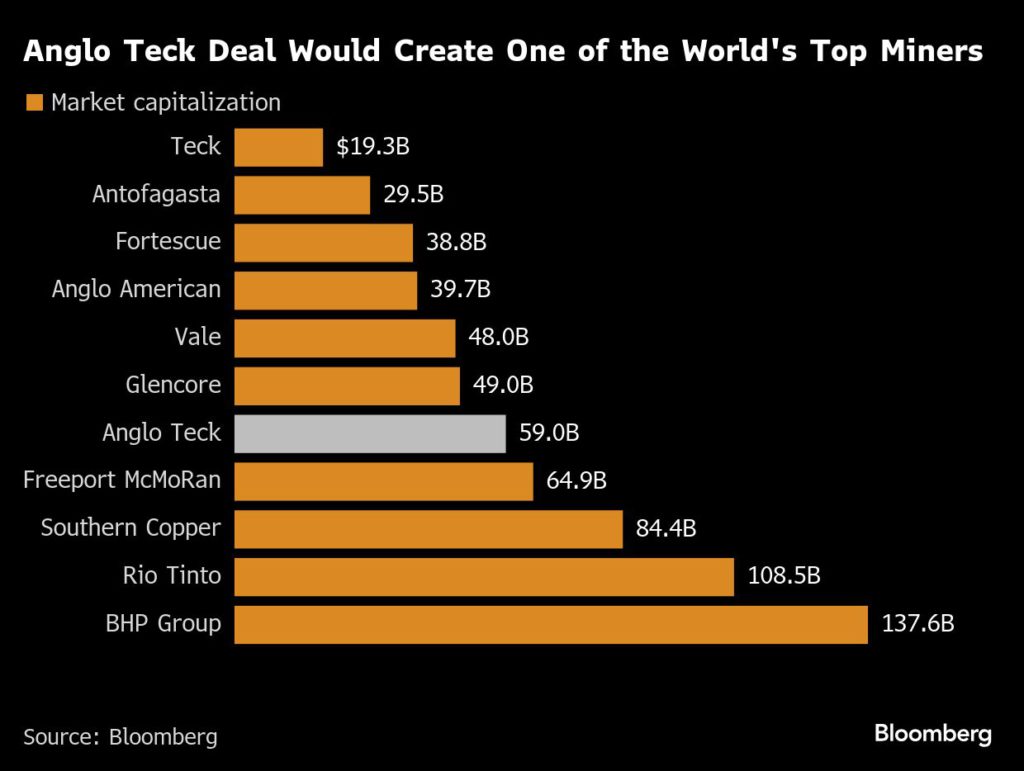

TORONTO — Experts say the proposed merger between Teck Resources Ltd. and Anglo American PLC to create a $70 billion, critical minerals-focused giant could help Canada’s efforts to boost production of the metals that are key to the energy transition.

John Steen, director of the Bradshaw Research Institute for Minerals and Mining at UBC, says the size of the combined company could help it move faster to develop mines than Teck could alone.

Teck and U.K.-based Anglo American have also committed to spend $4.5 billion in Canada over five years as part of its pitch to regulators for the deal, with a focus on the critical minerals space that the federal government has made a priority.

A good chunk of that spending is already committed by Teck, including upwards of $2.4 billion to extend the life of its Highland Valley Copper mine, but the companies say they will also spend on exploration as well as development in areas like B.C.’s Golden Triangle.

Steen says having what would be the world’s fifth-biggest copper producer be based in Vancouver would especially help efforts to produce more of the metal that will “make or break” the energy transition.

He says the potential for the combined company to add to copper processing capacity at Teck’s smelter in Trail, B.C., is notable as Canada has a shortage of critical minerals processing capacity, but that the company’s talk of supporting new processing facilities seems like a longer-term prospect given the difficulty of building them.

This report by The Canadian Press was first published Sept. 11, 2025.

Anglo’s go-to banker drives Teck deal after seeing off BHP

Centerview Partners LLC banker James Hartop has his own badge to get into Anglo American Plc’s headquarters near London’s diamond district. Rival advisers wait to be called in. It’s a symbol of the dealmaker’s bond with the century-old miner, and his crucial role in protecting it – most recently just last year when BHP Group made a $49 billion bid for its smaller rival.

That relationship meant that Hartop took the lead for Anglo as it negotiated with the Canadian miner Teck Resources Ltd., according to people with knowledge of the negotiations. The deal, which would create a $50 billion copper giant, is one of the largest in the sector in years.

Over three decades, the 51-year-old has become Anglo’s go-to banker for advice in an industry with a constant backbeat of mergers, takeovers and restructurings. This kind of connection has become rare, as the business of advising on large M&A has become increasingly commoditized. But Hartop’s long-term association with the miner has given him, and Centerview, access to a mandate that several bankers with knowledge of the situation say is one of the most lucrative jobs in the mining industry.

This story is based on conversations with current and former employees of Anglo American, and other advisers and bankers who asked not to be identified in order to discuss sensitive information.

Centerview, Hartop and Anglo American declined to comment.

Hartop’s association with Anglo American started when he joined SG Warburg — which subsequently became part of UBS Group AG — as an M&A banker in 1995, following an internship at the firm. An Oxford theology graduate, he quickly moved up the ranks as a young banker who showed enthusiasm and a level of maturity beyond his age, according to one person who worked with him during that period.

Anglo American was one of UBS’s key clients at the time, and Hartop was brought into work on the firm’s sprawling global business, which spanned multiple geographies and had copper, gold, platinum and nickel assets, among others. In 1998, he lived in Johannesburg for six months as he worked to get a deal to consolidate eight gold mining companies into AngloGold over the line.

In 2009, Hartop helped ensure that a £41 billion ($66.7 billion) merger proposal from Xstrata Plc was left – according to the company — “dead and buried.”

He advised Anglo on the spinoff of packaging business Mondi Plc in 2007, the purchase of a controlling stake in De Beers Plc in 2012, and the sale of a minority stake in Anglo American Sur SA to a consortium led by Mitsui & Co Ltd. in the same year.

One mining banker at a rival firm said the ties between Hartop and Anglo were so strong that if he saw Anglo run a sell-side process without Hartop’s involvement, he thought the company wasn’t serious about a sale.

These deals propelled Hartop’s near two-decade career at UBS. He went on to become the co-head of European investment banking at the Swiss lender and was named the head of its coverage and advisory business for Europe, Middle East and Africa before leaving to join Centerview. The boutique advisory firm was cofounded by a former UBS colleague, Blair Effron, in 2006.

UBS’s advisory work with Anglo American dropped off after Hartop’s departure, according to data compiled by Bloomberg. In 2024, The bank worked as an adviser to BHP in its approach to Anglo, along with Barclays Plc.

When that bid was made, one of the first people Anglo called in was Hartop.

Anglo had suffered a series of major setbacks. Prices for some key products had plunged and operational difficulties had forced it to cut production targets, driving down its valuation and leaving the company vulnerable to potential bidders. BHP planned to break it up.

Along with counterparts at Goldman Sachs Group Inc. and Morgan Stanley, Hartop helped devise a turnaround at Anglo, which included exiting coal, diamonds and platinum and slowing down spending on a massive UK fertilizer mine. BHP eventually walked away last May after a five-week battle.

Since then, Hartop has been heavily involved in the simplification of Anglo, working on the demerger of its platinum business and an attempt to sell its steelmaking coal business to Peabody Energy, which was scrapped in August.

Discussions between Anglo and Teck started around a year ago, according to people familiar with the matter, and gained momentum a few months ago. On Anglo’s side of the table, Hartop was ever-present, the people said.

Outside of his mining work, Hartop has worked on some of the world’s largest M&A deals globally since joining Centerview — including Anheuser-Busch InBev’s purchase of SAB Miller for about $104 billion in 2016 and AstraZeneca Plc’s acquisition of Alexion Pharmaceuticals Inc. for $39 billion. Among his key clients is DSM-Firmenich.

Centerview ranks eighth among advisers on M&A deals announced this year with an 8% market share, ahead of rival boutiques, including Lazard Ltd. and Rothschild & Co., according to data compiled by Bloomberg. They have had a role on $226 billion of transactions, the data show. Centerview were the main adviser on the recent breakup of Kraft Heinz, and Sycamore Partners’ acquisition of Walgreen Boots Alliance in March.

People who have worked with Hartop describe him as unassuming, easy to deal with and straight to the point. He’s developed a strong rapport with the current Anglo CEO Duncan Wanblad, just as he did with previous leaders of the firm.

New CEOs often bring with them existing relationships with key advisers, but Hartop appears to have proved himself too valuable to Anglo. He’s been a constant even as five CEOs – Julien Ogilvie Thomson, Tony Trahar, Cynthia Carroll, Mark Cutifani and now Wanblad – have gone through the top office since he started working with Anglo.

The agreement with Teck doesn’t mean that Hartop’s job is done. There is still a chance that another bidder could attempt to derail the deal by coming in with an offer for Teck. And BHP, or another large miner, could still come back to make a bid for Anglo, meaning once again it will need someone to head up its defense.

(By Dinesh Nair and Thomas Biesheuvel)

Anglo-Teck Vancouver headquarters is a ‘perpetual’ commitment

Anglo American Plc and Teck Resources Ltd.’s plan to headquarter their merged company in Canada is “a perpetual commitment,” according to Teck chief executive officer Jonathan Price.

“The commitment that we are making to Canada and the presence of the global headquarters of Anglo Tech in Canada is an enduring commitment,” Price told BNN Bloomberg Television on Wednesday.

An agreement by UK-based Anglo to acquire Canada’s Teck in one of the biggest mining deals in over a decade will need regulatory approval in countries including Canada. Last year, Canada said it would only approve foreign takeovers of large mining companies involved in critical minerals production “in the most exceptional of circumstances.”

Establishing the global headquarters in Vancouver, with the presence of most senior executives, “is a great thing for the country,” Price said.

Asked if a string of setbacks at Teck’s copper mine in Chile was a driver for the transaction, Price said “we’re fully confident that we’ll overcome those challenges.”

“The reason for doing this transaction now is that these opportunities don’t come along very often,” he said. “When you see them, you have to seize them.”

If approved by regulators, the acquisition is expected to close in 12 to 18 months.

The two companies are speaking to investors all over the world, explaining the “incredible upside” and gathering feedback, Price said. While those conversations are very preliminary, “there is real recognition here for the industrial logic of this and the quality of the business we are creating.”

(By James Attwood)

Anglo American’s £36 Billion Merger With Teck Marks Blow to UK Business

- Anglo American and Teck will merge in a $50bn deal, forming Anglo Teck with headquarters in Vancouver but retaining a London listing.

- The merger will concentrate around 70% of the company’s portfolio in copper, alongside iron ore and zinc, while issuing a $4.5bn dividend to Anglo shareholders.

- The move drew sharp criticism from UK opposition figures as a blow to London’s global business standing, though executives touted growth in critical minerals.

Anglo American will merge with Canada’s Teck Resources in a $50bn (£36bn) deal, shifting its headquarters to Canada and reducing its London presence in a move criticised by shadow business secretary Andrew Griffith. The Tory MP said it represents a blow to UK business and confidence in London.

The new entity, to be called Anglo Teck, is expected to have roughly 70 per cent exposure to copper, as well as premium iron ore and zinc. Under the terms of the deal, Anglo will own 62.4 per cent of the combined group, with Teck shareholders owning the rest.

Anglo American’s share price rocketed up 7.75 per cent in early morning trading to £24.55, in response to the news.

HQ relocates to Canada

The company will be headquartered in Vancouver, but will retain its primary London listing with secondary listings in Johannesburg, Toronto and New York.

However, as a result, Anglo American’s London office, which employs up to 700 people, will be significantly downsized.

The merged company will be led by Anglo American chief executive Duncan Wanblad, while Teck chief executive Johnathan Price will move to the role of deputy CEO. However, the CEO, deputy CEO, CFO, and a “significant majority” of the executive management team will also be based in and reside in Canada.

Andrew Griffith told City AM, “If we want the UK to be the best place in the world to do business, Labour must wake up fast.”

He said: This is a clear signal that companies and investors are losing confidence in the UK and voting with their feet.”

“Taxing and regulating businesses into submission will not bring growth; it drives them away. What businesses need instead is a government that champions wealth creation and investment, not one that undermines our competitiveness.”

The fact that a historic British mining giant is moving its headquarters to Canada is yet another signal of decline under Labour,” the shadow business secretary added.

The deal, revealed to its shareholders on Tuesday, follows both companies rejecting takeover approaches from larger rivals, including BHP’s failed £39bn pursuit of Anglo in 2024.

Wanblad said: “Together, we are propelling Anglo Teck to the forefront of our industry in terms of value accretive growth in responsibly produced critical minerals.”

Price added: “This transaction will create significant economic opportunity in Canada, while positioning Anglo Teck to deliver sustainable, long-term value for shareholders.”

Shareholder decisions and dividends

The companies said the shareholder vote for the deal would take place in the coming months, and if approved, antitrust approval could take an additional 12 to 18 months.

Anglo will issue 1.33 shares to existing Teck investors for each share they hold in the company.

The London company is also set to issue a special $4.5bn dividend to its own shareholders ahead of the merger.

The merger is expected to generate annual cost savings and efficiency gains of $800m by the fourth year after completion.

Commenting on the deal, AJ Bell investment director Russ Mould said: ““It now remains to be seen whether it can complete the restructuring of its own business and then whether Anglo Teck delivers on its operational and financial targets, but at least the lowly valuation means there could be upside in the newly-formed company’s share price if it does so, all other things being equal and providing commodity prices do not nose dive in the meantime.”

By CityAM

BHP seen as unlikely to pounce on Anglo or Teck

Top global miner BHP’s focus on expanding its own copper assets while it undergoes leadership change means it is unlikely to gatecrash the planned $53 billion tie-up of Anglo American and Teck Resources, investors and bankers said on Wednesday.

London-listed Anglo American and Canada’s Teck Resources announced a merger on Tuesday, marking the sector’s second-biggest tie-up ever, to forge a new global copper-focused heavyweight.

The deal came just over a year after BHP scrapped a $49 billion bid for Anglo that in one mega acquisition would have beefed up the Australian miner’s holding in the metal seen as essential to the energy transition.

After being rebuffed by Anglo three times, BHP opted instead to double down on a series of smaller projects where it sees better value, a strategy that investors said has been consistent and suggests it is unlikely to make a move on Anglo or Teck.

“Given BHP’s message, ‘We have moved on,’ any move by BHP for either of the companies would come as a surprise,” said Andy Forster, a portfolio manager at Argo Investments in Sydney, which holds BHP shares.

In the past year, BHP instead spent $2 billion for a stake with Canada’s Lundin in two Argentinian copper projects, including the Josemaria mine whose life was last month extended by six years. It has also pushed hard to eke out production gains at top copper mine Escondida in Chile.

BHP declined to comment on whether it might spoil the Anglo-Teck deal but pointed Reuters to recent comments by its chief executive saying that M&A was just one lever of many for growth.

“Frankly in current markets, it’s hard to see the right combination of the commodities that we like, the asset quality that we like, at a price where we can still unlock attractive value for BHP shareholders,” CEO Mike Henry said on a results call in August.

Despite its recent failure to offload its Australian coal assets, Anglo has worked hard to improve its share price from a year ago, one M&A banker said.

“Both miners are in play now. Anglo’s share price is up, they could probably put in a good defence like they did last time,” he said. Shares in Anglo have jumped 20% since before BHP’s bid in late April while BHP shares have dropped 8%.

The deal was smart in that several factors were favourable to Canada in a way that would be difficult to replicate for other majors who might want to buy Teck, such as relocating the new company’s headquarters to Canada, two people said.

Among the conditions for approving BHP’s merger with South Africa’s Billiton in 2001, the Australian government mandated that the holding company be headquartered in Australia.

Succession may be another stumbling block. BHP chair Ross McEwan replaced Ken MacKenzie in March, after the latter’s decade at the wheel, while CEO Henry is more than five years into a typical six-year term, meaning that BHP may be focused for now on replacing him rather than on big ticket M&A.

But bankers aren’t ruling out the possibility of BHP swooping in down the track, especially if the deal doesn’t go to plan.

“You’d have to have a serious think about it – the two most obvious targets in a nil premium deal,” said an M&A banker not directly involved in the deal, which the parties expect to take 12 to 18 months to complete.

“They have got time … A deal doesn’t have to be done tomorrow.”

(By Melanie Burton; Editing by Sonali Paul)

No comments:

Post a Comment