MONOPOLY CAPITALI$M

Rio Tinto’s bid for Glencore piles pressure on BHP

Rio Tinto’s talks to buy Glencore and create a new global industry leader could spur consolidation efforts across the copper-hungry mining sector and heap pressure on BHP, currently the world’s biggest miner, to respond.

If the bid succeeds, and depending on any final value, it could rank among the biggest 10 M&A deals yet and it reflects an appetite for scale that bankers have said could drive mega-deals in 2026.

“This is yet another example that the mining space is consolidating and the big firms are being forced to do corporate action to create value,” Mark Kelly, CEO at advisory firm MKI Global, said.

Last September, London-listed miner Anglo American announced what was then the sector’s second biggest M&A deal, with a plan to merge with Canada’s Teck Resources and forge a new global copper-focused heavyweight. The deal awaits regulatory clearance.

BHP under pressure to act

Half a dozen analysts, investors and bankers told Reuters that BHP, which has a market capitalization of $161 billion, is the most likely spoiler of Rio’s bid talks with Glencore, which could create a company worth almost $207 billion.

If BHP keeps out of the current talks, it may consider another deal to retain its leadership.

One banking source, who spoke on condition of anonymity, said that was the most likely outcome, given the company views Glencore’s portfolio is too diverse and would benefit from asset sales. Regulatory authorities would almost certainly require some disposals to ease competition concerns.

BHP declined to comment.

“The most likely interloper to this deal is BHP,” said Richard Hatch, analyst at Berenberg. “Essentially, with the deal driven by copper, we think that BHP could look to acquire Glencore with a rival bid, keep copper, and likely divest the balance.”

Talks between Rio and Glencore are at a preliminary stage and Rio has until February 5 to make a formal offer, a deadline that could be extended.

The two sides have held talks in the past that have led nowhere and again they may fail to reach agreement.

George Cheveley, natural resources portfolio manager of Ninety One, which is a shareholder of Glencore, said BHP may feel the need to intervene, but also that it may find it “difficult emotionally” given its repeated failure to buy Anglo American.

To try to reinforce its dwindling dominance in copper, BHP tried to acquire Anglo American in a months-long pursuit in 2024. It briefly revived the effort in November last year.

Adding to the pressure on BHP, sources say the company is preparing to appoint a new CEO, most likely an internal candidate who will be expected to deliver change.

BHP declined to comment on its CEO succession.

Size matters and so does copper

Apart from the quest for scale to increase margins and contain costs, copper is a major reason for tie-ups in the mining sector.

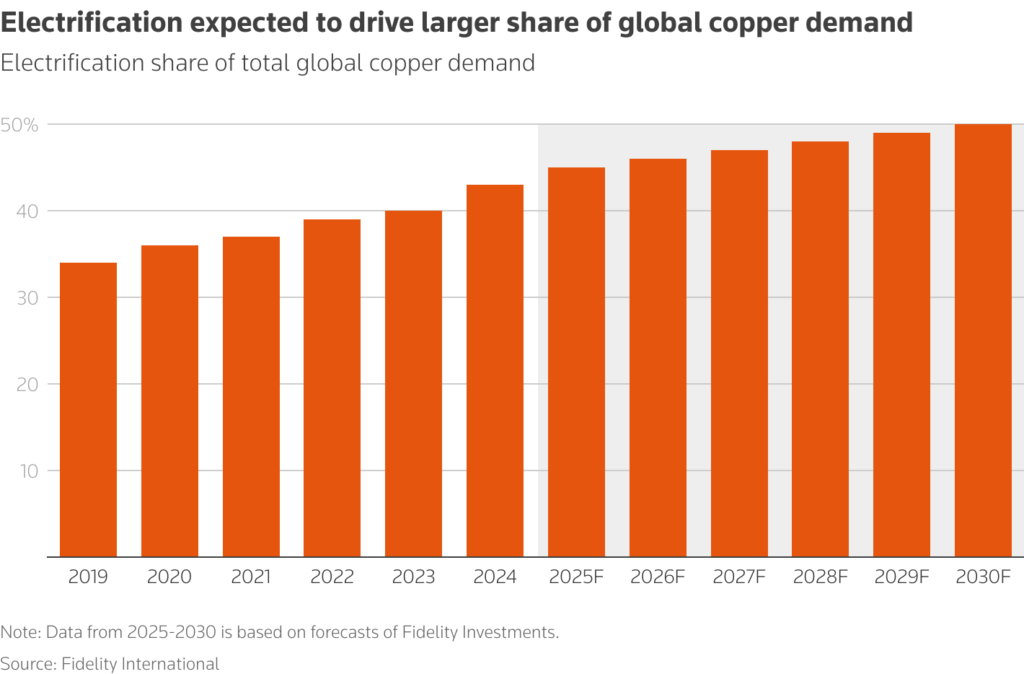

The mass adoption of artificial intelligence and the transition across the world to cleaner energy have driven demand for copper as the most cost-effective metal to conduct electricity.

The advantage of mergers is that they can provide access to producing assets, avoiding the lengthy, costly and uncertain process of hunting for new reserves.

“The real read across from both this and the Anglo-Teck deal is in copper – we know that copper is attractive and that’s what buyers want access to,” said Kelly. If it does not bid successfully for Glencore, there are other possible targets to consider.

“Vale and Freeport are both going to be in focus – but it’s unlikely they’re for sale,” Kelly added.

Equally, BHP may decide it is better to do nothing, some analysts say.

“BHP has a cleaner growth profile in copper than a merged Rio/Glencore so I don’t think they need to do anything,” said Kaan Peker, an analyst at RBC.

“That said, if the transaction is successful, you might get some pressure with shareholders saying: ‘How come Rio pulled this off and you couldn’t with Anglo?’.”

(By Anousha Sakoui, Clara Denina, Melanie Burton and Charlie Conchie; Editing by Veronica Brown and Barbara Lewis)

Rio Tinto and Glencore hold buyout talks to create $207 billion mega-miner

Glencore and Rio Tinto said late on Thursday they were in early buyout talks that could potentially create the world’s largest mining company with a combined market value of nearly $207 billion.

Global miners are racing to bulk up in metals like copper, set to benefit from the global energy transition, and that has sparked a wave of project expansions and takeover attempts.

London-listed Anglo American and Canada’s Teck Resources are nearing the finish line on a merger to create a $53 billion copper-focused heavyweight.

The discussions between Rio Tinto and Glencore about combining some or all of their businesses are the second round of talks in just over a year between the two companies, after Glencore approached Rio Tinto in late 2024 but a deal did not proceed.

The two companies said one option would include an all-share buyout of Glencore by Rio Tinto. There was no certainty that the terms of any deal or offer would be agreed upon, the miners said after the Financial Times first reported the revived talks.

US-listed shares of Glencore were up 6% after the talks were confirmed. But Rio Tinto’s Australian-listed shares fell as much as 6.4%, the biggest intraday fall since July 2022, against a broader positive market.

“There is a risk (Rio) could overpay. It comes down to price, but if they have to pay a big premium there is a risk that a transaction could destroy some value for shareholders, said Tim Hillier, an analyst at fund manager Allan Gray, which is a Rio Tinto investor.

“Rio has a strong pipeline of internal high-growth projects. It’s not clear why they need to look externally for things to do,” he added.

Under UK takeover rules, Rio Tinto has until February 5 to make a formal offer for Glencore or say it will not proceed.

Rio Tinto, the world’s biggest iron ore miner, has a market capitalization of about $142 billion. Glencore, one of the world’s largest base metal producers, is valued at $65 billion as of its last close.

The transaction would be the world’s largest-ever mining deal if completed, according to LSEG data, and the market value of the combined company would top Australia’s BHP Group at $161 billion. BHP shares were up 0.6% in early Australian trade on Friday.

Cultural questions

Rio Tinto and Glencore restarted deal talks at the end of 2025, according to a source with knowledge of the matter.

Rio Tinto has undergone significant changes since the 2024 approach by Glencore. New Rio Tinto CEO Simon Trott was selected after the company’s chairman expressed a preference for a leader more open to large-scale deals than his predecessor, Jakob Stausholm, who was in charge when the miner turned down Glencore’s approach in late 2024.

Under Trott, who took over in August, Rio Tinto is focused on becoming leaner with fewer non-core assets.

Andy Forster, senior investment officer at Rio Tinto shareholder Argo Investments, said the deal made sense if the terms were right for both companies.

“The biggest question mark would be the culture of the two companies as Glencore clearly has trading background, is very opportunistic and results-focused, some of those aspects of their culture could actually be good for Rio,” he said. “I hope Rio stays disciplined but it makes sense to look at deals where value can be extracted by both parties.”

Rio Tinto and Glencore are both shifting their focus towards copper, a commodity expected to be in high demand as the world adopts greener forms of energy and the take-up of power-hungry artificial intelligence gains ground.

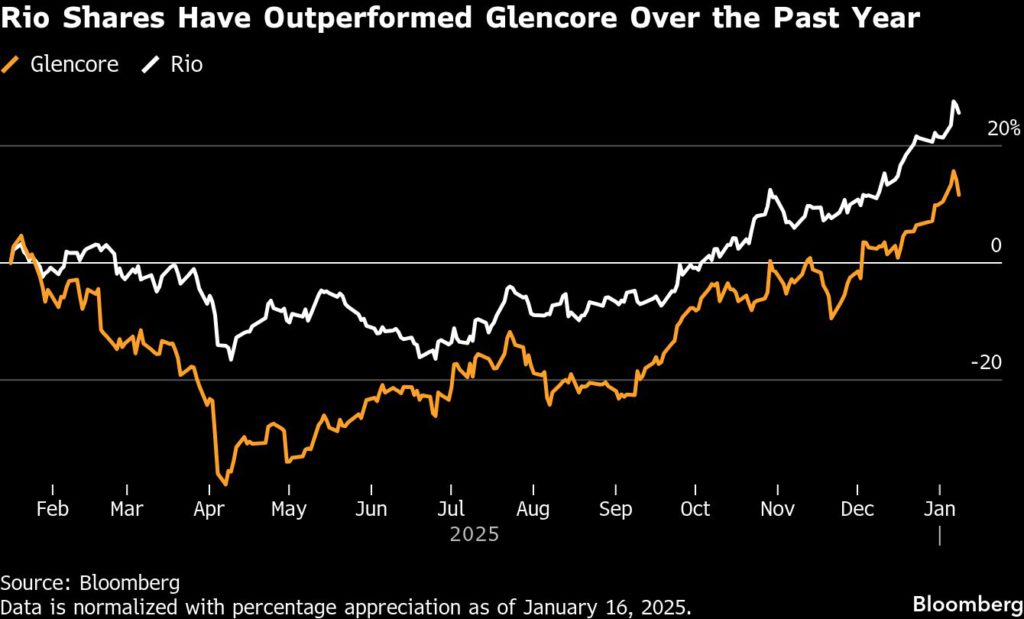

Before the deal talks were announced, Rio Tinto’s London-listed shares had risen 35% since Trott took over in August, while Glencore’s shares were up 41% over the same period in line with price increases for the materials they produce, particularly copper.

Growth in the artificial intelligence and defence sectors will boost global copper demand 50% by 2040, but supplies are expected to fall short by more than 10 million metric tons annually without more recycling and mining, consultancy S&P Global said on Thursday.

(By Clara Denina, Scott Murdoch and Shivani Tanna; Editing by Veronica Brown and Jamie Freed)

Rio-Glencore deal closer than ever with premium and CEO in focus

Glencore Plc boss Gary Nagle has called it the most obvious deal in mining. His predecessor and mentor Ivan Glasenberg has been trying to pull it off for nearly two decades. And yet the merger of Glencore with Rio Tinto Group has proven elusive – until now.

People familiar with the matter say that the current round of talks to create the world’s largest miner, which the two companies confirmed on Thursday night, are the most serious they have ever been, while emphasizing they are still at an early stage. At the heart of the shift is a concern within Rio that its iron ore-heavy portfolio could be left behind as copper M&A frenzy sweeps the sector, as well as a configuration of personalities on both sides who are better able to come to an agreement, the people said.

When the deal was last seriously discussed in late 2024, the talks foundered over Rio’s unwillingness to pay a big premium, as well as differences in the cultures fostered by Rio’s then-CEO and the Glencore leadership. At the time, Glencore pushed for Nagle to run the combined company.

Now Rio has a new boss and both sides appear more willing to compromise. Rio may ultimately consider paying a takeover premium, some of the people said, while other people suggested that the Glencore side is open to being pragmatic on the subject of management — recognizing that a larger firm paying a takeover premium would most likely seek to install its leadership in the new company.

What’s more, a shift in investors’ attitudes toward coal mining means that Rio could buy Glencore outright with less fear of a backlash. Bloomberg earlier reported that Rio was open to retaining Glencore’s vast coal business.

Still, talks are at a very early stage and the people cautioned that the two sides are still some way from reaching a deal. Even if they can, any combination would be highly complex and require the approval of numerous regulators at a time of heightened government scrutiny of natural resources.

“It does feel like these two sides want a deal,” said George Cheveley, a portfolio manager at asset manager Ninety One, who owns Glencore shares. “Glencore have a lot of brownfield and greenfield copper projects and Rio don’t, but Rio have the expertise to build them and run them.”

Representatives for Rio and Glencore both declined to comment.

In the 2024 talks, Glencore had asked for a merger ratio that would leave its shareholders with about 40% of the combined company, according to several of the people. If the same level remained a benchmark for Glencore’s negotiations, that would represent a premium of just over 25% relative to the two companies’ undisturbed share prices.

Two people familiar with Rio thinking said it may be willing to consider paying a takeover premium, although other people cautioned it was too early in the process to assess.

The idea of a combination of the two companies has been discussed several times over more than a decade. It was first floated before the global financial crisis of 2008, and then revived in 2014 – when Rio quickly rejected an informal approach from Glencore – before conversations resumed in earnest in 2024.

While those talks ended without a deal, the idea of combining the two companies never went away. Bloomberg reported last September that Glencore had continued to work behind the scenes with its bankers on the contours of a potential deal.

This time, it was Rio that re-initiated the most recent conversations, according to some of the people.

The miner had undergone a key change since the failed 2024 discussions: it had a new chief executive. Jakob Stausholm, a sober Dane with no background in the cut-and-thrust world of mining, had been asked by the board to step down, with his replacement announced as long-time Rio executive Simon Trott in July.

Equity markets have also moved in the larger miner’s favor as it mulls a possible all-share transaction, with Rio shares up about 26% between Bloomberg’s report on the 2024 talks and the close of trading on Thursday, compared with a 12% gain for Glencore. Rio closed down 3% in London on Friday, while Glencore jumped 9.6%.

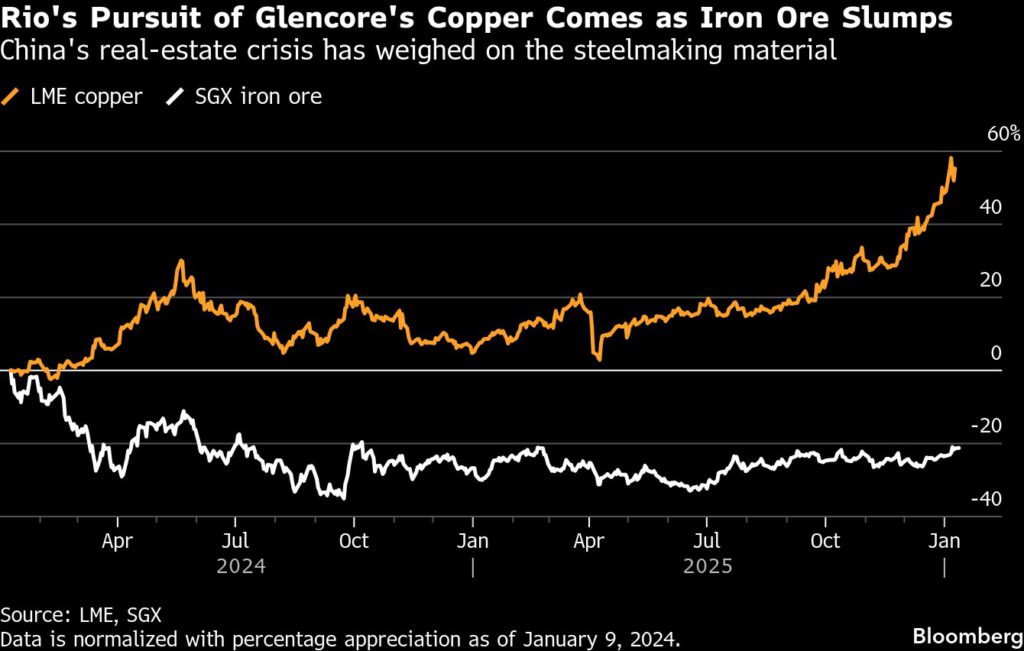

For Rio, the fundamental case for buying Glencore boils down to copper. While the miner is a significant player in markets from aluminum and copper to lithium, iron ore still accounted for more than half of its earnings in its most recent financial report.

The medium-term outlook for iron ore is downbeat, with China’s cooling property market sapping demand while Rio’s huge new project in Guinea is poised to flood the market with supply. Copper, meanwhile, has long been the most coveted metal for mining executives who see a bright future for the metal as the trend to electrification supercharges demand.

Rio has a relative dearth of copper development prospects as its vast Oyu Tolgoi mine in Mongolia reaches capacity. Glencore, on the other hand, spent an investor day last month highlighting its array of copper development options in Argentina, Peru and the Democratic Republic of Congo.

The merger deal struck by Anglo American Plc and Teck Resources Ltd. in September and the recent surge in copper prices to record highs above $13,000 a ton only heightened the pressure on Rio to act.

The company’s executives recognized that its own relative reliance on iron ore, together with Glencore’s growth plans if it is able to achieve them, meant that waiting would likely only make the deal more expensive, according to some of the people.

There remain many complexities to navigate, even if the two companies are able to agree terms. Glencore’s coal business is still problematic for some large Rio shareholders because of sustainability concerns. And other parts of its business – from its trading unit, which in 2022 admitted to widespread historical corruption, to its assets in countries like Congo and Kazakhstan – could prove unattractive to some.

The transaction structure is also likely to be complicated by Rio’s dual UK and Australian listings, while a successful deal would be scrutinized by antitrust regulators everywhere from China to Canada.

Still, speaking to Bloomberg on Friday, large shareholders of both companies were tentatively supportive of a potential deal.

“We’re not pushing for a deal, but we’re open to any and all options that create and highlight value for Glencore shareholders,” said Justin Hance, a partner at Chicago-based Harris Associates LP, which is Glencore’s 11th-largest shareholder, according to Bloomberg data. “The attractiveness of any deal would depend not only on the shareholder ratio, but also on the structure, terms, and finer details of the transaction.”

(By Thomas Biesheuvel, Dinesh Nair, Jack Farchy and Leonard Kehnscherper)

No comments:

Post a Comment