AU

Caledonia secures $150M for Zimbabwe gold mine in rare international capital raise

Caledonia Mining Corporation on Wednesday said it raised $150 million via a seven-year convertible bond offering to fund its Bilboes project which, once operational, will be Zimbabwe’s largest gold mine.

Zimbabwe-focused Caledonia’s debt issuance is the biggest international capital raising in over a decade for the country, which had been shunned by global investors due to economic and policy volatility.

Spot gold prices surged to more than $4,800 per ounce on Wednesday, driven by investors seeking havens who are backing miners like Caledonia to lift output.

In a statement, Caledonia – which operates the 80,000-ounce-per-year Blanket mine in Zimbabwe – said demand for the offering from US institutional investors exceeded $600 million.

“Receiving more than $600 million of demand from high-quality North American investors is a tremendous endorsement of our strategy, the quality of our assets, our operational track record and the long-term prospects of the company,” Caledonia CEO Mark Learmonth said.

Caledonia said the bond issue is part of a broader strategy it is pursuing to fund Bilboes, which is expected to start production in late 2028. The mine is expected to reach annual output of 200,000 ounces from 2029 for an initial period of 10 years.

The company is also arranging a $150 million funding facility with a consortium of Zimbabwean and South African banks and will also engage regional and global lenders for Bilboes financing.

The Bilboes project has an expected total cost of $584 million and peak funding requirements of $484 million.

Zimbabwe’s gold output plunged to 3 metric tons during the height of its economic and political crisis in 2008. It has more than doubled production over the past decade to an all-time high of 47 metric tons in 2025.

(By Chris Takudzwa Muronzi; Editing by Nelson Banya and Thomas Derpinghaus)

Russia gains $216 billion in gold rally, replacing lost assets

Russia has reaped a windfall from a surge in gold prices since the start of its war in Ukraine, generating gains on a scale comparable to the sovereign reserves frozen in Europe over President Vladimir Putin’s invasion.

The value of the Bank of Russia’s gold holdings has increased by more than $216 billion since February 2022, according to Bloomberg calculations. At the same time, the central bank has largely refrained from both major purchases of the metal and using its gold reserves during that period, despite the loss of access to foreign securities and currencies blocked under sanctions.

In December, European Union countries approved extending a freeze on around €210 billion ($244 billion) of Russian sovereign assets held in the bloc.

The increase in the value of bullion restores most of Russia’s lost financial capacity, even if it doesn’t return the blocked reserves. While securities and cash immobilized in Europe cannot be sold or pledged, gold can still be monetized if needed.

Russia, the world’s second-largest gold producer, mines more than 300 tons of the metal a year. Since 2022, however, Russian bullion has been shut out of Western markets and is no longer accepted by the London Bullion Market Association, effectively barring it from the world’s biggest over-the-counter gold-trading hub. That complicates any potential large-scale sales by the central bank to Asian buyers, where it would also face competition from newly mined gold produced by sanctioned Russian producers that cannot currently be sold elsewhere.

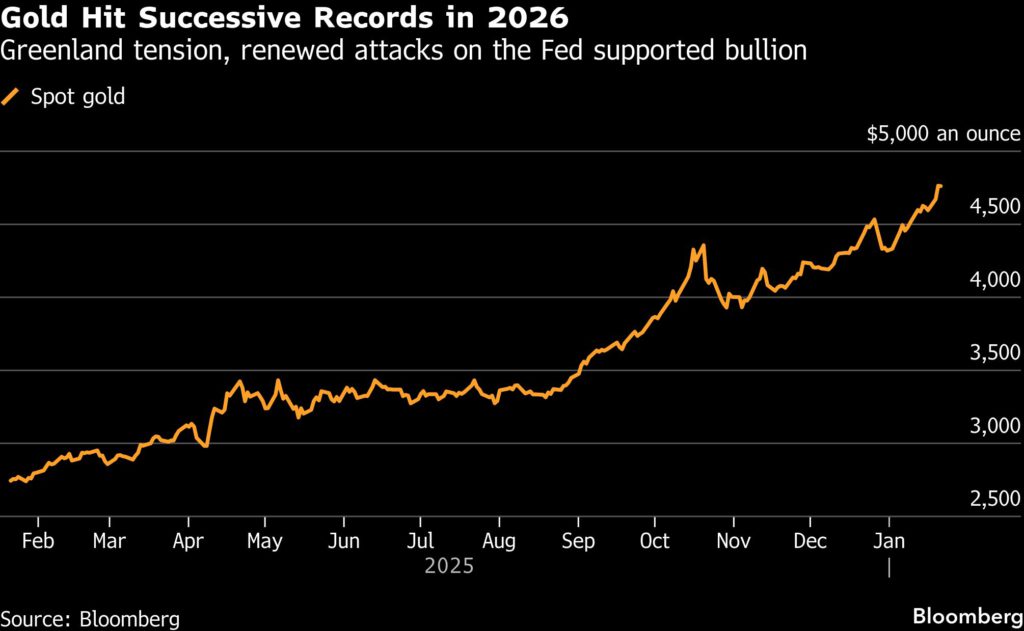

Gold prices have rallied sharply over the past four years, supported by strong demand from central banks, persistent inflation concerns, heightened geopolitical risks and investors seeking safe havens from uncertainty caused by trade wars.

In 2025, gold gained around 65%, its strongest annual performance since 1979. This has significantly lifted the valuation of official holdings worldwide even without additional purchases.

Russia’s international reserves reached $755 billion at the end of last year, including $326.5 billion held in gold, according to central bank data published on Friday. Gold prices have risen by more than 8% since then, surpassing $4,700 per ounce.

The Finance Ministry expects gold prices to keep climbing over the long term to $5,000 an ounce and higher. The current rally reflects a loss of confidence in global reserve currencies, while attempts to expropriate Russian assets are only increasing demand, Deputy Finance Minister Aleksey Moiseev said in an interview with RBC in late December.

The Bank of Russia only began drawing on its bullion toward the end of last year, with holdings falling by 0.2 million troy ounces to 74.8 million troy ounces. The decline reflected operations linked to the Finance Ministry’s sales of National Wellbeing Fund assets to finance the budget deficit.

From February 2022 through December 2025, the value of the country’s gold reserves more than doubled, while reserves held in foreign assets and currencies declined by about 14%, Bank of Russia data show. Gold accounted for 43% of total reserves compared with only 21% before the war.

Russia has stopped disclosing detailed information on its foreign currency reserves since the start of the war. As of Jan. 1, foreign currency and other non-gold assets totaled $399 billion, according to the data.

Russia’s Finance Ministry said in 2022 that roughly $300 billion of its overseas sovereign assets had been immobilized abroad.

The fate of those funds is poised to remain a subject of negotiation as talks over a potential peace settlement of the war in Ukraine continue under US leadership. EU countries have debated ways to use frozen Russian assets to provide a loan to Ukraine, but efforts to reach an agreement ultimately failed.

The Bank of Russia in response filed a lawsuit in Moscow seeking 18.2 trillion rubles ($227 billion) from Euroclear. Governor Elvira Nabiullina said the central bank doesn’t intend to drop its claim and is considering legal action in international courts.

Gold price extends record run, with $4,900 in sight

Gold extended its record rally to almost $4,900 per ounce on Wednesday, as geopolitical tensions surrounding Greenland and a meltdown in Japanese government debt kept safe-haven demand elevated.

Spot gold spiked as much as 2% to a record $4,887.19 per ounce before paring some gains. This marks the first time ever that gold has crossed the $4,800 threshold, and it comes a day after prices first broke past the $4,700-an-ounce level.

Gold is coming off its best annual performance since 1979, as mounting geopolitical risks and a global shift away from fiat currencies lifted the metal’s appeal, driving prices to record highs on more than 50 occasions through 2025 and into the new year.

This record-breaking rally in gold, which has risen by 75% over the past 12 months, reignited in recent days amid growing tensions between the US and its NATO allies. On Saturday, US President Donald Trump threatened tariffs on eight European nations that opposed his plan to take over Greenland, raising the specter of a damaging trade war.

Meanwhile, a meltdown in Japanese sovereign debt spilt over into bond markets worldwide earlier this week, with long-dated Treasuries and the dollar both tumbling. As well as sparking fears of the repatriation of capital to the East Asian nation as yields rise, the ructions highlighted worries about the fiscal situations of major economies that fueled the so-called “debasement trade”, where investors avoid currencies and government bonds.

The situation in Japan is spurring “fear of market-led debasement in the rest of the world,” Daniel Ghali, a senior commodity strategist at TD Securities, wrote in a note. “Gold’s rally is about trust. For now, trust has bent, but hasn’t broken. If it breaks, momentum will persist for longer.”

Gold is poised for more support from the world’s biggest reported buyer, the National Bank of Poland. The central bank approved plans to purchase another 150 tons, while Bolivia’s central bank has resumed purchases for its foreign reserves under new regulations enacted in December 2025.

“Gold remains our highest conviction,” Daan Struyven, co-head of commodities research at Goldman Sachs Group, said at a media briefing on Wednesday, citing continued purchases by central banks. He reiterated the bank’s base case scenario is for gold to climb to $4,900 an ounce, with risks to the upside.

Silver down

Meanwhile, silver retreated by over 1% after notching its all-time best $95.89 per ounce during the Tuesday session. The metal has benefitted from the gold trade and performed even better during 2025, recording a gain of 140% for the year.

As with gold, analysts remain bullish on the white metal in 2026. “Silver’s rise to a three-digit number is looking quite possible given the price momentum we are seeing, but it will not be a one-way move. There could be some correction in prices and volatility can be higher,” ANZ commodity strategist Soni Kumari said on Wednesday.

(With files from Bloomberg and Reuters)

Gold, silver premiums in India surge on import duty hike bets

Gold premiums in India surged past $100 an ounce on Wednesday for the first time in more than a decade, with silver premiums at a record high, as traders priced in possible curbs on precious metals imports to shore up the rupee.

Bullion dealers charged a premium of up to $112 per ounce over official domestic gold prices – inclusive of 6% import and 3% sales levies – the highest since May 2014. Last week, dealers offered a discount of up to $12.

Silver premiums surged to $8 per ounce, surpassing the previous peak of $5 scaled in October.

India is the world’s second-largest consumer of gold and the largest consumer of silver. The rupee slipped to a record low of 91.7425 against the US dollar on Wednesday.

“People are speculating that the government may raise import duties on gold and silver to curb imports in the budget,” said Chanda Venkatesh, managing director of Hyderabad-based bullion merchant CapsGold.

“Anticipating the hike, traders are charging premiums over record prices.”

Finance Minister Nirmala Sitharaman is set to present the Union Budget for 2026/27 on February 1. She had slashed import duties on gold and silver to 6% from 15% in July 2024 to curb smuggling.

India meets most of its gold and silver demand through imports, which have surged in recent months, widening the trade deficit and putting pressure on the rupee.

Local gold prices soared to an all-time high of 158,339 rupees per 10 grams, while silver surged to a record 335,521 rupees per kilogram.

“Traders with short positions were squeezed as prices rose, forcing them to buy to close their positions,” said Prithviraj Kothari, president, India Bullion and Jewellers Association (IBJA).

While jewellery demand is down, investment in coins, bars, and exchange-traded funds has surged, Kothari said.

“Supply hasn’t kept up. This shortage is causing sellers to charge higher premiums,” said Chirag Thakkar, chief executive of Amrapali Group Gujarat, a leading importer.

The industry is concerned that the government may take steps to restrict bank funding currently used by jewellers for gold and silver imports, a move that is also lifting premiums on both metals, said Surendra Mehta, secretary, IBJA.

India’s Ministry of Commerce and Industry did not immediately respond to a Reuters request for comment.

(By Rajendra Jadhav and Aftab Ahmed; Editing by Harikrishnan Nair)

No comments:

Post a Comment