Trump's 50% Copper Tariff Rocks U.S. Automakers

- President Trump's new 50% tariff on imported copper is set to significantly increase production costs for U.S. automotive manufacturers, particularly for electric vehicles.

- The tariff is further straining U.S. supply chains, which are already grappling with existing tariffs on steel, aluminum, and other auto parts.

- Ongoing EU-U.S. trade talks are exploring potential exemptions for autos, steel, and possibly copper, which could impact future market dynamics and prices for metal buyers.

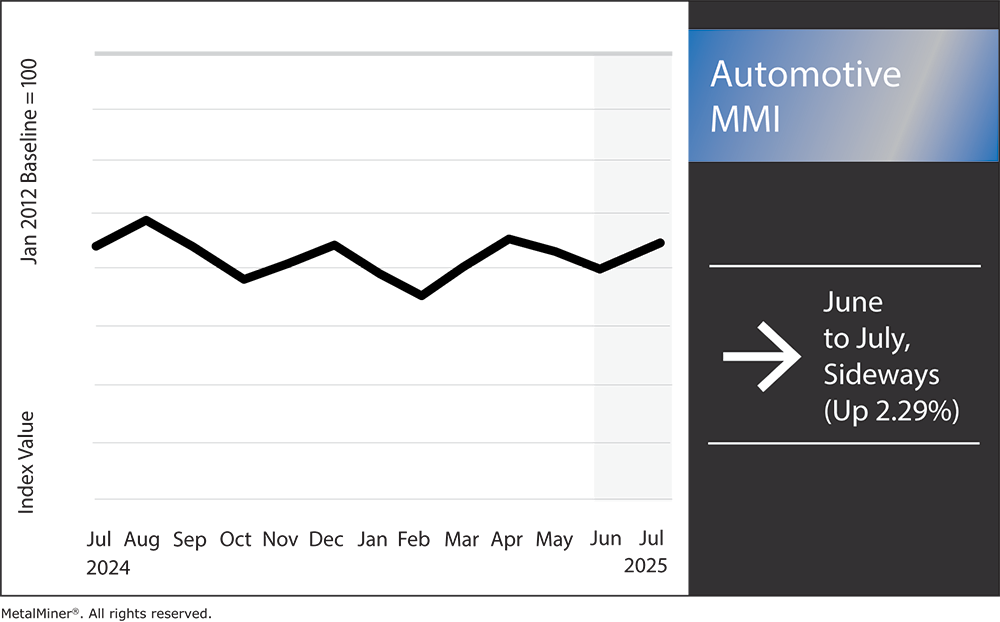

The Automotive MMI (Monthly Metals Index) moved sideways, inching up by 2.29%. While the index has maintained a mostly sideways trend over the past year, short-term volatility may be on the way. President Trump recently announced a 50% tariff on imported copper, a move expected to impact U.S. automotive manufacturing firms that source the red metal.

Trump’s 50% Copper Tariff Stuns Automotive Manufacturing Supply Chain

President Trump’s surprise July 8–9, 2025 announcement of a 50% tariff on imported copper (which will come into effect late July/early August) jolted U.S. automakers. Copper futures leaped roughly 15–17% to record highs as buyers scrambled ahead of the deadline, reflecting a new price premium. Copper is vital for EV motors, batteries and wiring harnesses, so the tariff will boost automotive manufacturing costs by hundreds of dollars per vehicle, especially in the case of electric cars.

The sudden move came with little warning. President Trump said the goal is to “bring copper production back home to America,” citing its key industrial role. Meanwhile, traders had already been rushing imports. Bloomberg noted that, in the short term, “the price is going to rise significantly” because markets had expected a lower rate.

In the meantime, procurement teams should brace for higher metal costs and act quickly. We recommend subscribing to MetalMiner’s free newsletter for real-time updates and checking our premium, monthly forecasts for detailed supply-risk analysis.

Auto Supply Chain Are Already Stretched Thin

25% tariffs on steel, aluminum, automobiles and parts have already strained U.S. supply chains. Automakers warn these levies “increase costs on consumers” in North America’s integrated market. Now, copper is being added to the mix. Meanwhile, U.S. buyers already pay approximately $1,250 per ton above average world prices for aluminum due to past tariffs.

Data confirms this strain. For instance, a recent ISM report said tariffs have caused “bottlenecks in the supply chain,” slowing U.S. factories. Many automakers and are now accelerating orders and hedging where possible. MetalMiner provides instant alerts on price spikes. Our advice? Lock in key metal contracts while prices climb using, and update cost models to include the new copper duty.

EU–U.S. Trade Talks, Auto Exemptions in Play

These events also coincide with high-stakes EU-U.S. trade talks. Both sides are racing for a deal by August 1, and EU sources say autos, steel and possibly copper exemptions are being discussed. According to The Guardian, German Chancellor Friedrich Merz says he’s “cautiously optimistic” that an agreement on cars and steel will be struck by month’s end.

Germany has proposed a specific automotive manufacturing deal that allows U.S. cars to be tariff-free in return for more European production on American soil. Reuters reports BMW, Mercedes and VW could earn import credits for vehicles built in the U.S., effectively offsetting duties. This would primarily benefit German brands with large U.S. plants. As such, some EU officials are wary, fearing it could favor only a few exporters.

For U.S. metal buyers, the lesson is clear: stay informed. Any trade outcome will affect both demand and prices.

What Should Automotive Companies in the U.S. Do to Prepare?

The 50% copper tariff has jolted America’s automotive manufacturing sector with price shocks. Copper futures surged as importers rushed to meet the deadline, and production-cost models now indicate significantly higher vehicle costs. For automakers, which often run on tight single-digit margins, even a few hundred dollars of extra cost per vehicle can make a big difference.

By The MetalMiner Team

Trump’s 50% copper tariff set to include products for power grids, data centers

US consumers to bear brunt of copper tariffs,

US President Donald Trump’s plans to impose 50% import tariffs on copper imports are set to include the kinds of materials used for power grids, the military and data centers.

Plans involve including semi-finished products, according to people familiar with the matter who asked not to be named as discussions are private. That comes as few details of Trump’s plans for copper tariffs have been revealed so far. The tariff measures haven’t yet been formalized and they could change.

It has been widely expected that refined copper would be tariffed, but it was unclear what would happen with semi-finished products — a category that includes wires, sheets, tubes and plates. Including semi-fabricated goods would ramp up the impact of the levies. Copper on Comex in New York rose as much as 1.3% in early Asia trading on Friday.

The levies, which Trump said will come Aug. 1, will have far-reaching impacts for the US. The move is expected to raise costs across a swath of the US economy due to the myriad of industries and applications reliant on the metal. Copper is used in everything from consumer electronics and automobiles to construction and the military.

Trump is pursuing the tariffs as part of his effort to bolster America’s copper supply chain, which encompasses mining, refining and processing, recycling and making semi-finished goods and end products.

The biggest category imported by the US is refined copper, which has a metal content of more than 99.993%. The US imported 908,000 metric tons last year, with that raw material consumed by fabricators to make rods, cables and alloys.

North America’s biggest fabricator is Southwire Co., which supplies wires for US military installations and naval vessels. Southwire didn’t immediately respond to a request for comment.

The Copper Development Association describes copper semi-products as the key link in the US military-industrial supply chain in its March 31 submission to the US Commerce Department for this year’s copper investigation under Section 232 of the Trade Expansion Act. The industry group presented its comments on behalf of 90% of US copper semi-producers.

Domestic copper production isn’t enough for the US — forcing the country to source a significant amount of semi-finished copper from abroad. An estimated 800,000 tons of copper and copper alloy semi-fabricated products were imported last year, on top of refined copper, according to MM Markets, a consultancy working with American fabricators and recyclers.

Krisztina Kalman, the co-founder of the firm, expects the 50% tariff to extend to semi-products for security reasons. Any disturbance in foreign supply of copper and semi-finished products could expose the US to significant issues in delivering electricity, she said.

Imposing tariffs on semi-finished copper could also bring disruption to fabricators, since wire rod mills rely on primary imports and levies would drive up their costs.

“The local fabricators will not be able to produce 800,000 tons more semi-products with current capacity, and it could take up to seven years to install new capacity,” Kalman said.

(By Julian Luk, Joe Deaux and Catherine Lucey)

Third of chip production could face copper supply disruptions by 2035, PwC report says

Some 32% of global semiconductor production could face climate change related copper supply disruptions by 2035, quadrupling from today’s levels, advisory firm PricewaterhouseCoopers (PwC) said in a report for business leaders on Tuesday.

Chile, the world’s largest copper producer, already grapples with water shortages that are slowing down production. By 2035, most of the 17 countries supplying the chip industry will be at risk of drought, PwC said.

The last global chip shortage, fueled by a pandemic-driven demand spike that coincided with factory shutdowns, crippled the automotive industry and halted production lines across other chip-dependent sectors.

“It cost the US economy a full percentage point in GDP growth and Germany 2.4%,” PwC project lead Glenn Burm said in the report, citing the US Department of Commerce.

Copper miners from China, Australia, Peru, Brazil, the US, Democratic Republic of Congo, Mexico, Zambia and Mongolia will also be affected, sparing none of the world’s chipmaking regions from risk, PwC said.

Copper is used to make the billions of tiny wires inside every chip’s circuit. Even if alternatives are being researched, there is currently no match for its price and performance.

The risk will only increase over time if innovation on materials does not adapt to climate change, and a more secure water supply is not developed in the affected countries, PwC said.

“Around half of every country’s copper supply is at risk by 2050 – no matter how fast the world reduces carbon emissions,” the report says.

Chile and Peru have taken steps to secure their water supply by increasing mining efficiency and building desalination plants. This is exemplary, PwC says, but may not be a solution for countries with no access to large bodies of sea water.

PwC estimates that 25% of Chile’s copper production is at risk of disruptions today, rising to 75% within a decade and to between 90% and 100% by 2050.

(By Nathan Vifflin; Editing by Milla Nissi-Prussak)

Copper’s positive, long-term trajectory unchanged despite US tariff, Barrick CEO says

Copper miners remain bullish on the metal’s future prospects even as a looming 50% US tariff creates short-term price volatility, Barrick Mining Corp CEO Mark Bristow said in Zambia, where the company is expanding its operations.

US President Donald Trump said on Wednesday he would impose the new copper tariff from August 1 to promote domestic development of an industry critical to defence, electronics and automobiles.

The announcement propelled US Comex copper futures to an all-time high.

But analysts predict prices outside the US could be dragged down as countries like Chile, the world’s top copper producer and the United States’ biggest supplier, shift supplies elsewhere in response to the tariffs.

“The copper price is going to be unstable just like everything else in the world, and we will have to get out of this instability,” Bristow told journalists in Zambia’s capital, Lusaka, late on Thursday.

However, he said that, despite the fallout from US tariff policy decisions, copper’s long-term trajectory remained unchanged.

“We are seeing a shortage in supply, and growing demand particularly with the data centres, the movement to cleaner energy, and just generally as the emerging markets start investing in industrialization, which is a big consumer of copper,” Bristow said.

“So, everyone is in agreement that the copper demand is outgrowing the supply side,” he said.

Barrick, the world’s second-largest gold producing company by output after Newmont, is currently investing in boosting its copper production.

It is carrying out a $2 billion plan to double annual output from its Lumwana copper mine in Zambia to 240,000 metric tons by 2028. Barrick will also extend the mine’s life to 2057.

“Most of the copper industry today is only looking at marginal expansion,” Bristow said. “We are very excited that we made this commitment to invest ahead of this tightening.”

(By Chris Mfula and Nelson Banya; Editing by Joe Bavier)

Friedland backs Trump’s copper tariff as wake-up call

Ivanhoe Mines (TSX: IVN) founder and billionaire Robert Friedland has backed US President Donald Trump’s plans to impose a new copper tariff starting August 1, calling it essential for building a domestic copper industry.

Once known mainly for its role in construction and wiring, copper has become a critical mineral due to its importance in defence, electronics, and electric vehicles. Friedland said the tariff will “wake people up” to America’s vulnerability in key supply chains.

“There’s a new list of critical raw materials and without it, you can’t do anything about global warming or greening the world economy and you have a critical vulnerability in national security,” Friedland told the Financial Times. “I commend the Trump administration for doing what’s obvious and intelligent — America needs to produce the metal”.

In anticipation of the tariffs, US importers have rushed to stockpile copper. Between January and April 2025, they imported 461,000 tonnes of copper, or 232,000 and 148,000 tonnes more than the same periods in 2024 and 2023, respectively.

Copper prices soared this week on the tariff announcement, but analysts expect prices outside the US to drop as major exporters like Chile, the world’s top copper producer and the largest copper supplier to the US, redirect shipments to other markets.

“The US does not have nearly enough mine, smelter or refinery capacity to be self-sufficient in copper,” Jefferies LLC analysts including Christopher LaFemina wrote this week. “Import tariffs are likely to lead to continued significant price premiums in the US relative to other regions.”

Speeding up permitting

The Trump administration has sought to streamline permitting for mining and drilling on public lands. Timelines that once stretched one to two years have reportedly been shortened to as little as up “to 28 days at most” Still, building a new mine takes an average of nearly 29 years. This positions the US as the second-longest lead time in the world after Zambia, according to S&P Global.

“The longer-term aim of the Trump administration may be for the US to be fully self-sufficient in copper, but mines take too long to develop for this to be achieved in less than a 10-year time horizon,” Jefferies analysts wrote.

Copper has become a symbol of the US struggle to bring new mining projects online. Major projects such as Rio Tinto’s Resolution in Arizona, Northern Dynasty Pebble project in Alaska and Antofagasta’s Twin Metals in Minnesota have all stalled for years in the federal permitting process.

Friedland’s US-focused Ivanhoe Electric (TSX, NYSE: IE) also plans to develop the Santa Cruz copper mine in Arizona.

Rio Tinto wants to invest more in US copper under Trump tariffs

Rio Tinto Plc says it has a “strong desire” to invest in US copper mining following President Donald Trump’s plans to levy imports of the critical metal.

“There is increasing recognition by the US government of the need for domestic sources of copper and other critical materials to support manufacturing and to power the country’s energy future,” chief executive officer Katie Jackson said in an emailed statement. “We have a strong desire to invest more in American copper and we see significant opportunities to grow our business in the United States.”

Trump’s plans to slap 50% tariffs on copper imports are expected to raise costs across a broad section of the US economy that relies on the metal for consumer electronics, automobiles, home construction and more. The levies are aimed at supporting a robust domestic supply chain for the commodity, though analysts warn that permitting obstacles and litigation still stand in the way of building mines quickly.

Rio Tinto declined to comment on the size of possible investments.

The company, one of the world’s largest mining firms, has expressed optimism over the White House’s push to boost critical mineral production domestically. Its proposed Resolution underground copper mine, owned 55% by Rio and 45% by BHP Group, has gotten a boost from a favorable Supreme Court decision that allows it to advance the long-stalled project.

The Resolution project has the potential to become the biggest copper mine in North America.

Rio also operates one of two operating copper smelters in the US from its Kennecott operations in Utah.

(By Jacob Lorinc)

Codelco in ‘wait-and-see’ mode after Trump tariff bombshell

Chile, the world’s No. 1 copper producer, is in wait-and-see mode after US President Donald Trump announced a surprise 50% tariff on imports of the red metal, with the Andean nation blindsided while its top miner held out hope of exemptions.

In a call with Reuters shortly after Trump’s remarks, the chairman of Chilean state miner Codelco Maximo Pacheco said the firm wanted to know which copper products would be included and if the tariff would hit all countries.

“What we need to do is understand what this is about. What products are affected? Because he referred to copper in general terms. But copper includes a variety of products,” Pacheco said on Tuesday in his first comments since the announcement.

“Then, we have to see whether this will apply to all countries or only some. We’ve always known that exceptions are made, and therefore, I think it’s premature to comment.”

US Comex copper futures jumped more than 12% to a record high after Trump announced the planned tariffs.

Chile is the single biggest copper supplier to the US, a market that makes up less than 7% of its refined copper exports. Chile sends much of its copper to China, which dominates global copper refining.

Still, SONAMI president Jorge Riesco said tariffs could cause market uncertainty and price volatility that could hit Chile and other supplier countries.

He said the high prices driven by US companies stockpiling copper ahead of possible tariffs were likely to be temporary, and warned that the US would struggle to expand its own supply.

“The US lacks the capacity for self-sufficiency and relies heavily on copper smelting and refining in China,” Riesco said in a statement.

Chile’s foreign ministry said the Andean nation had not received any formal official communication regarding the implementation of US copper tariffs.

“We continue to be in contact and dialogue on this and other matters with the competent authorities and technical teams,” the ministry said in a statement.

Chile, along with Canada and Peru, had previously pushed back against a probe by the Trump administration into imports of the metal and said they should not face tariffs.

Codelco’s Pacheco said the US would need growing amounts of copper, which goes into electric vehicles, military hardware, the power grid and many consumer goods.

“The United States is a country that needs a lot of copper, and it will continue to need even more copper,” he said, adding it was getting harder to ramp up production. Codelco, the world’s biggest copper producer, has seen output hit a 25-year low in recent years.

Pacheco estimated global demand would increase some 3% this year, which was creating a supply gap on top of flat output.

“The global copper supply is increasingly hard to raise. In fact, I believe that this year, it will be hard to produce more copper than last year,” he said. “We also have to consider the reality of what’s happening in the market.”

(By Daina Beth Solomon and Fabian Cambero; Editing by Adam Jourdan, Veronica Brown, David Gregorio and Richard Chang)

Antofagasta CEO says context of Trump copper tariffs could help US project

Chilean copper miner Antofagasta sees opportunity for its stalled copper project in the US following President Donald Trump’s move to impose 50% import tariffs on the metal, CEO Ivan Arriagada said on Thursday.

London-listed Antofagasta operates four copper mines in Chile and aims to develop the Twin Metals copper and nickel mine in Minnesota. The project stalled after former President Joe Biden’s administration blocked permits over environmental concerns.

“We have a project and we see an opportunity in this context to develop it,” Arriagada told reporters at an event.

He said it would still take years before a final investment decision could be made on the project.

“We need to continue working with a long-term perspective.”

The miner has maintained its current mid-term and long-term sales contracts, without additional copper shipments to the US, he added.

US companies have been bulking up on copper since Trump in February opened a probe into potential tariffs on copper imports.

Chile is the world’s biggest copper producer, and also the top copper importer to the US.

Chilean Mining Minister Aurora Williams, speaking alongside Arriagada, said the government had not yet received precise information about how the copper tariffs would be implemented or which types of copper would be affected.

Later on Thursday, she and Chile’s Foreign Minister Alberto van Klaveren told reporters they are calling for a meeting next week with Chilean copper industry leaders to discuss the tariffs.

Van Klaveren said he expected to receive details from the White House on the scope of the tariffs “in a matter of days,” although he said the exact timing was hard to determine.

(By Fabian Cambero and Daina Beth Solomon; Editing by Chizu Nomiyama, Marguerita Choy and David Gregorio)

Copper traders look to Chinese buyers in post Trump-tariff world

Global copper traders are offering cargoes to Chinese buyers as they look to offload metal no longer able to reach the US before President Donald Trump’s 50% copper tariff deadline.

Trump said late on Wednesday he would impose the new tariff from August 1 to promote domestic production of everything from semiconductors to ammunition. He didn’t specify which copper products would be hit or whether exceptions would be considered.

China is the world’s largest copper consumer, and the number of offers by overseas sellers has been picking up since late June and is now at the highest in months, according to a Chinese copper trader who spoke on condition of anonymity.

A second China-based trader said they had received an offer for a 1,500 metric ton cargo from South America for delivery in late July or early August from a buyer “eager to find a home.”

The step up in offers to China reflects how traders, who have spent months shipping copper to the United States in anticipation of the tariff, must now begin to find alternative destinations for cargoes unable to cross the US border before the tariff comes into effect.

Only copper from Latin America that is being loaded or already en route is likely to make the deadline, and even then it is likely to be close, according to logistics sources.

“If Chilean material is being freed up to make its way to Europe because less is going to the US, that means it’s being freed up for everyone and you might see some of that in Asia and elsewhere,” Albert Mackenzie, a copper analyst at Benchmark Mineral Intelligence, said.

The Yangshan Copper Premium (bill of lading), a benchmark for what Chinese buyers will pay above LME for copper still outside the country, fell 5% to $62 on Thursday, reflecting the offers now on the table, according to a Singapore-based copper trader.

Major international trading houses are offering thousands of tons of cargo originally destined for the US for delivery in late July and August to Chinese buyers, they added.

The most-traded copper contract on the Shanghai Futures Exchange fell for the fifth day on Thursday, down 0.4% to 78,600 yuan ($10,952.87) per ton after touching its lowest since June 23.

(By Amy Lv, Lewis Jackson and Pratima Desai; Editing by Susan Fenton)

No comments:

Post a Comment