LI

Brazil shuts down Sigma Lithium waste piles over safety concerns

Sigma Lithium is constructing the Grota do Cirilo project in a phased approach. (Image courtesy of Sigma Lithium.)

Sigma Lithium is constructing the Grota do Cirilo project in a phased approach. (Image courtesy of Sigma Lithium.)Brazil’s Labor Ministry has shut down three waste piles at Sigma Lithium’s flagship mine in the state of Minas Gerais, citing a “grave and imminent” risk to workers and the local community, according to documents seen by Reuters.

The order adds to Sigma’s ongoing struggle to restart the lithium mine, Brazil’s largest, with annual capacity of 270,000 metric tons of lithium concentrate. It has been inactive since October, the documents show.

The restrictions do not affect Sigma’s ability to operate or compromise its schedule for resuming production, the firm said in a statement. The miner denied any safety hazards, adding that the piles only contain soil, with no contaminants.

The piles remain a concern despite the shutdown, the ministry said in a statement, adding that a collapsed waste pile could cover nearby houses or spill into the Piaui River.

Brazil’s Labor Ministry has shut down three waste piles at Sigma Lithium’s flagship mine in the state of Minas Gerais, citing a “grave and imminent” risk to workers and the local community, according to documents seen by Reuters.

The order adds to Sigma’s ongoing struggle to restart the lithium mine, Brazil’s largest, with annual capacity of 270,000 metric tons of lithium concentrate. It has been inactive since October, the documents show.

The restrictions do not affect Sigma’s ability to operate or compromise its schedule for resuming production, the firm said in a statement. The miner denied any safety hazards, adding that the piles only contain soil, with no contaminants.

The piles remain a concern despite the shutdown, the ministry said in a statement, adding that a collapsed waste pile could cover nearby houses or spill into the Piaui River.

Shares plunge after downgrade

In November, the firm said during an earnings call that the mine would resume production in two to three weeks.

Last week, with the mine still non-operational, Bank of America downgraded the firm’s shares, citing a lack of clarity on when production would resume. Their assessment sent shares tumbling 15% in a single day.

On Tuesday, the Toronto-listed firm said it was advancing its plan to resume production.

Labor officials issued the decision to close access to the piles on December 5, and on Tuesday, they dismissed the company’s appeal to lift the order.

It is unclear if Sigma could produce lithium at the Grota do Cirilo mine, its only productive asset, without using the three prohibited piles, where the miner stacks waste after processing.

Sigma told inspectors that losing access to the piles would cause “significant operational and economic impacts, in addition to jeopardizing the continuity of mining activity,” documents show.

In November, the firm said during an earnings call that the mine would resume production in two to three weeks.

Last week, with the mine still non-operational, Bank of America downgraded the firm’s shares, citing a lack of clarity on when production would resume. Their assessment sent shares tumbling 15% in a single day.

On Tuesday, the Toronto-listed firm said it was advancing its plan to resume production.

Labor officials issued the decision to close access to the piles on December 5, and on Tuesday, they dismissed the company’s appeal to lift the order.

It is unclear if Sigma could produce lithium at the Grota do Cirilo mine, its only productive asset, without using the three prohibited piles, where the miner stacks waste after processing.

Sigma told inspectors that losing access to the piles would cause “significant operational and economic impacts, in addition to jeopardizing the continuity of mining activity,” documents show.

Industry leader now struggling

Once the biggest player in Brazil’s fledgling lithium industry, Sigma has struggled since 2023 with lower lithium prices and challenges expanding its mining operation.

The firm has also tangled with former co-CEO Calvyn Gardner, ex-husband of the current CEO Ana Cabral. Gardner is suing the company over mining rights and has voiced concerns about safety at Grota do Cirilo.

To resume using the prohibited waste piles, Sigma would have to present documents proving it has fixed issues identified by the inspectors, according to a Labor Ministry document.

A labor inspector who visited the site of the mine reported on November 12 a “partial rupture” of one of the piles near a school in the small town of Poco Dantas, which he cited as evidence of structural issues.

“The company was given ample opportunity to minimize its risks,” said a labor inspector in a January 6 report dismissing Sigma’s argument that the piles are safe.

Sigma said the piles are fully within the safety parameters established by authorities, which it is demonstrating to the ministry.

(By Fabio Teixeira; Editing by Brad Haynes and Rod Nickel)

Once the biggest player in Brazil’s fledgling lithium industry, Sigma has struggled since 2023 with lower lithium prices and challenges expanding its mining operation.

The firm has also tangled with former co-CEO Calvyn Gardner, ex-husband of the current CEO Ana Cabral. Gardner is suing the company over mining rights and has voiced concerns about safety at Grota do Cirilo.

To resume using the prohibited waste piles, Sigma would have to present documents proving it has fixed issues identified by the inspectors, according to a Labor Ministry document.

A labor inspector who visited the site of the mine reported on November 12 a “partial rupture” of one of the piles near a school in the small town of Poco Dantas, which he cited as evidence of structural issues.

“The company was given ample opportunity to minimize its risks,” said a labor inspector in a January 6 report dismissing Sigma’s argument that the piles are safe.

Sigma said the piles are fully within the safety parameters established by authorities, which it is demonstrating to the ministry.

(By Fabio Teixeira; Editing by Brad Haynes and Rod Nickel)

Bill Gates’ Breakthrough, BMW and Canada back lithium refiner

Lithium refiner Mangrove Water Technologies Inc. secured $85 million from the Canada Growth Fund, BMW AG’s i Ventures and Bill Gates-backed Breakthrough Energy LLC.

The “structured financing package” will support the company’s commercial facility in Delta, which neighbors the US border south of Vancouver. It will also help the firm move toward a second, much larger plant, which could contribute to powering half a million electric vehicles per year, Canada’s Finance Department said in a statement Thursday.

The C$15 billion ($10.8 billion) arms-length government-backed Canada Growth Fund led the package with a contribution of up to $65 million, according to the statement. It has a mandate to spur investment in technologies that reduce emissions.

Industry Minister Melanie Joly said in the statement that her government is focused on “ensuring that the minerals mined in Canada are refined in Canada.”

A year ago, the firm closed a $35 million funding round with backing from Mitsubishi Corp., Asahi Kasei Corp., InBC Investment Corp., Orion Industrial Ventures, Export Development Canada and BDC Capital, as well as Breakthrough and BMW i Ventures.

At the time, founder Saad Dara said it was a critical solution to develop secure supply chains in the context of tense geopolitics between western countries and Asian markets.

(By Thomas Seal)

Lithium swings from glut to scarcity on Asia demand, Traxys says

One of the world’s biggest lithium traders is seeing a turnaround in the battery metal market as accelerating demand ends a glut that dragged down prices.

“We see a very healthy Asian demand and an under-supplied market at this point in time,” said Martim Facada, managing director for lithium trading at Luxembourg-based Traxys. “We think the market has legs to keep going up.”

Lithium is emerging from a period of oversupply after record-high prices spurred supply growth at a time of disappointing demand. The ensuing price slump prompted some projects to be idled — and they’ll take time to restart, even as prices recover on strong electric vehicle and energy storage demand.

“A lot of money was lost across different parts of the supply chain,” Facada said in an interview. “We’re turning the corner now.”

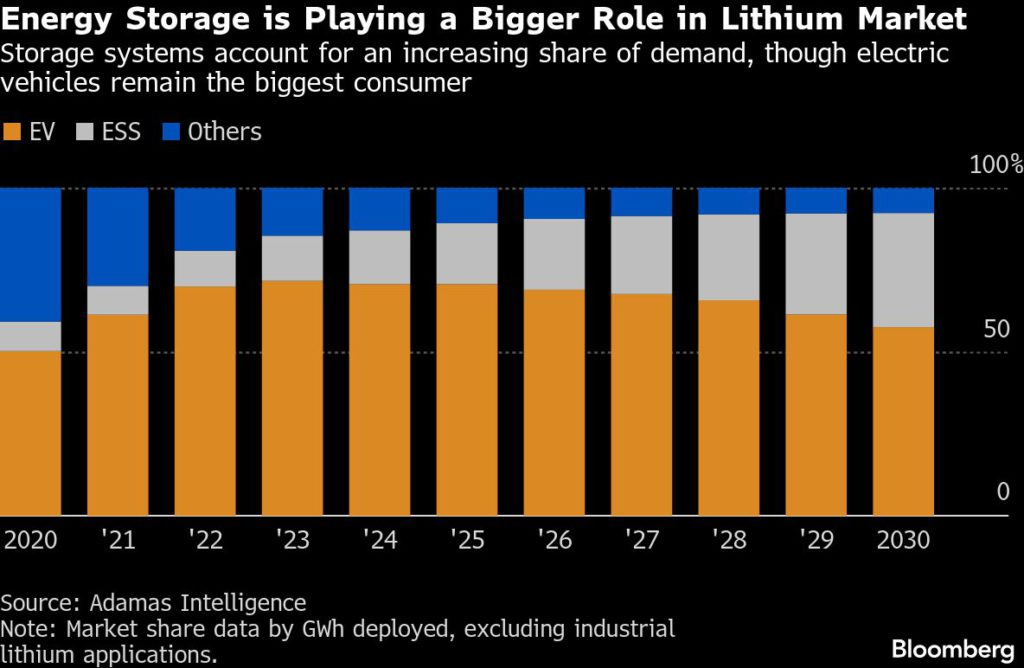

He expects EV penetration in China to climb to 60% to 70% this year, calling that a “huge” boost for demand. That compares with slightly more than 50% currently. While EVs remain the dominant consumer of lithium, energy storage that balance grids are becoming an increasingly important source of growth.

Chinese lithium prices have more than doubled from last year’s lows, though they remain more than 70% below a late-2022 peak.

Traxys recently signed an agreement to buy lithium from Lilac Solutions Inc.’s Great Salt Lake project in Utah, where production is slated to begin in early 2028. Besides offtake, the trading house may also contribute part of the roughly $300 million Lilac is seeking to raise.

Lithium carbonate from the project is earmarked for sale domestically, according to Facada and Lilac chief executive officer Raef Sully, who spoke in the same interview.

“Even though US EV subsidies have rolled off and we’re not seeing the same pace of fully electric vehicle growth domestically, the global outlook for lithium and batteries remains very strong,” Sully said.

(By James Attwood and Yvonne Yue Li)

No comments:

Post a Comment