Baltimore Port Shutdown Sends Shockwaves Through Auto Industry

- Baltimore port closure disrupted auto supply chain, potentially leading to higher car prices.

- Logistical challenges and rerouting of shipments add to the complexity and cost of importing vehicles.

- Consumers may feel the impact of increased dealership sticker prices due to additional expenses incurred by automakers.

Month-over-month, the Automotive MMI (Monthly Metals Index) exhibited little movement. The index trended sideways, only moving up a slight 0.28%. However, recent events continue to raise questions about the future of the industry, especially where automotive imports are concerned.

Despite the index itself not witnessing much movement, individual components of the index saw much more price movement than last month. This includes palladium, copper, and shredded scrap steel. Despite this, firm sideways movements from other components like lead and hot dipped galvanized steel kept the overall index flat. However, the real talk of the town is the shutdown of the Baltimore port in the aftermath of the Francis Scott Key bridge collapse. With Baltimore being one of the top ports in the U.S. or automobile imports, how will this impact the U.S. automotive industry?

- Baltimore port closure disrupted auto supply chain, potentially leading to higher car prices.

- Logistical challenges and rerouting of shipments add to the complexity and cost of importing vehicles.

- Consumers may feel the impact of increased dealership sticker prices due to additional expenses incurred by automakers.

Month-over-month, the Automotive MMI (Monthly Metals Index) exhibited little movement. The index trended sideways, only moving up a slight 0.28%. However, recent events continue to raise questions about the future of the industry, especially where automotive imports are concerned.

Despite the index itself not witnessing much movement, individual components of the index saw much more price movement than last month. This includes palladium, copper, and shredded scrap steel. Despite this, firm sideways movements from other components like lead and hot dipped galvanized steel kept the overall index flat. However, the real talk of the town is the shutdown of the Baltimore port in the aftermath of the Francis Scott Key bridge collapse. With Baltimore being one of the top ports in the U.S. or automobile imports, how will this impact the U.S. automotive industry?

How the Baltimore Port Shutdown Could Affect U.S. Automotive Imports

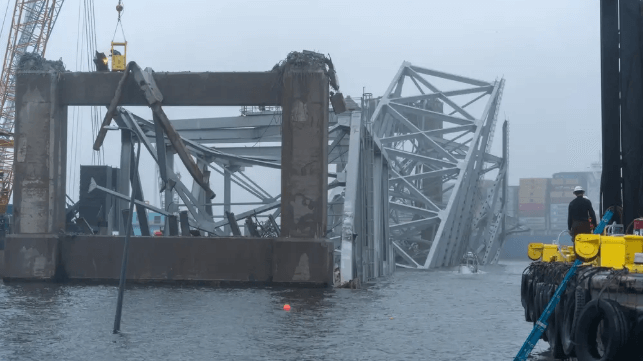

The recent collapse of the Francis Scott Key Bridge in Baltimore has rocked the U.S. car sector. Experts worry that car prices may increase due to supply chain disruptions brought on by the shutdown of this crucial port.

As a vital component in the U.S. car supply chain, the Port of Baltimore is one of the top sites for automotive imports, especially from Asia and Europe. Karl Brauer, executive analyst at iSeeCars.com, recently commented, “There are a number of considerations, but two important ones are the duration of the port’s shutdown and the capacity of other ports. The degree to which a particular brand depends on Baltimore for supply chain and vehicle shipping is one of the additional considerations.”

The recent collapse of the Francis Scott Key Bridge in Baltimore has rocked the U.S. car sector. Experts worry that car prices may increase due to supply chain disruptions brought on by the shutdown of this crucial port.

As a vital component in the U.S. car supply chain, the Port of Baltimore is one of the top sites for automotive imports, especially from Asia and Europe. Karl Brauer, executive analyst at iSeeCars.com, recently commented, “There are a number of considerations, but two important ones are the duration of the port’s shutdown and the capacity of other ports. The degree to which a particular brand depends on Baltimore for supply chain and vehicle shipping is one of the additional considerations.”

A Logistics Nightmare for Automotive Imports

Automobile makers are rushing to find alternate routes for their automobiles due to the port’s partial paralysis. For this reason, experts anticipate a cascading impact, with heightened activity in other ports on the East Coast, such as Philadelphia, Virginia, and New York.

The logistical difficulties involved in rerouting supplies continue to exacerbate the problem. Certain parts of the port are still open, but those that handle European imports (like BMW and Volkswagen), could see massive slowdowns.

According to the University at Buffalo, the situation calls for extra transportation like trucks and trains to help circumvent the impact. However, this may raise expenses and put more pressure on the already burdened transportation industry.

Automobile makers are rushing to find alternate routes for their automobiles due to the port’s partial paralysis. For this reason, experts anticipate a cascading impact, with heightened activity in other ports on the East Coast, such as Philadelphia, Virginia, and New York.

The logistical difficulties involved in rerouting supplies continue to exacerbate the problem. Certain parts of the port are still open, but those that handle European imports (like BMW and Volkswagen), could see massive slowdowns.

According to the University at Buffalo, the situation calls for extra transportation like trucks and trains to help circumvent the impact. However, this may raise expenses and put more pressure on the already burdened transportation industry.

Consumers Expected to Feel the Blow the Most

All of these factors mean that car could climb for consumers. Dealership sticker prices may rise due to additional expenses incurred from rerouting shipments, delays and shortages of available new cars. Although the entire effect on prices remains unknown, consumers who are already concerned about inflation and potential supply chain problems should take note.

For many, the collapse of the bridge is a sobering reminder of how interwoven the world economy remains. A single breakdown in Baltimore’s infrastructure could cause far-reaching effects for dealerships, customers, and the nation’s overall logistics industry. The car sector is left waiting for the vital port of Baltimore to reopen in order to ensure a seamless transatlantic vehicle flow as the crisis plays out.

All of these factors mean that car could climb for consumers. Dealership sticker prices may rise due to additional expenses incurred from rerouting shipments, delays and shortages of available new cars. Although the entire effect on prices remains unknown, consumers who are already concerned about inflation and potential supply chain problems should take note.

For many, the collapse of the bridge is a sobering reminder of how interwoven the world economy remains. A single breakdown in Baltimore’s infrastructure could cause far-reaching effects for dealerships, customers, and the nation’s overall logistics industry. The car sector is left waiting for the vital port of Baltimore to reopen in order to ensure a seamless transatlantic vehicle flow as the crisis plays out.

USACE Wants to Open a Deep-Draft Channel to Baltimore by End of April

The "limited access channel" would have enough water depth for ro/ros

After a week of careful analysis and surveying, the U.S. Army Corps of Engineers (USACE) has determined a working timeline for reopening a channel for merchant ships in and out of the port's inner harbor. Response officials have been careful not to predict how long the reopening might take, given the exceptional complexity of the work and the need to make a thorough assessment of the wreckage, but USACE now believes that it will be possible to clear a channel for ro/ro traffic by the end of April.

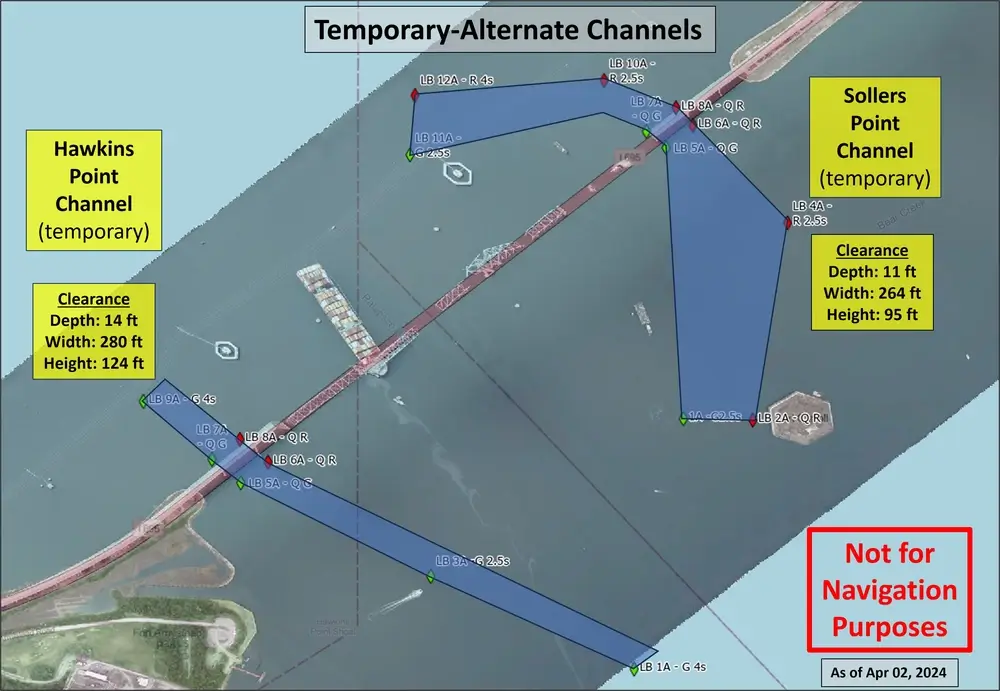

The plan calls for clearing out a 35-foot by 280-foot channel through the wreckage of the Key Bridge within four weeks. This "limited access channel" is still short of the ultimate goal - reopening the 50-foot deep draft shipping channel used by boxships - but it would be big enough to support ro/ro and container-on-barge traffic, one vessel at a time.

Up until the collapse of the bridge, Baltimore was the busiest ro/ro port in the country; while some of that traffic has been diverted to the Tradepoint Atlantic terminal, located just on the seaward side of the bridge, other ro/ro cargo will have to be offloaded at other East Coast ports. This adds cost and complexity for shipments of cars, farm equipment and construction machinery, and it also reduces port activity - and the longshore wages that go along with it.

“These are ambitious timelines that may still be impacted by significant adverse weather conditions or changes in the complexity of the wreckage,” said Lt. Gen. Scott A. Spellmon, USACE commanding general. “We are working quickly and safely to clear the channel and restore full service at this port that is so vital to the nation."

Temporary channels past the Key Bridge (Courtesy USCG)

Temporary channels past the Key Bridge (Courtesy USCG)

To date, the unified command and contracted salvors have opened up a channel to the north of the main span and a channel to the south. These temporary access lanes are 11 and 14 feet deep (respectively), which is enough for shallow barges and towboats but far from adequate for oceangoing vessels.

The complexity of the effort to open the main channel should not be underestimated, officials have repeatedly cautioned. Divers have to work in near-zero visibility on the bottom to survey the wreckage, and a tangled mat of girders from the central span has "pancaked" into the mud. Cutting this wreckage may be impossible to do safely, so the unified command is bringing in a grab bucket to pull it up piecemeal, a USACE official said Thursday.

No comments:

Post a Comment