The NTSB has released its investigative report on the deadly blaze aboard the aging boxship Stride, which sustained an engine room fire at Port of Houston early last year. The fire was caused by the installation of the wrong kind of valve, which led to an overflow of fuel into the engine room.

On January 8, 2024, Stride was alongside at the Barbours Cut Marine Terminal and taking on bunkers. The chief engineer and third engineer were in the engine room to monitor the transfer, and they began the bunkering sequence by lining up valves to put diesel into the port and starboard diesel oil tanks simultaneously. Transfer began at 0305 at a slow speed, then - at the chief's request - ramped up to maximum pressure and flow rate.

All was normal until 0325, when the wiper - who was on the 3rd deck of the engine room - saw diesel dripping down from the upper levels. He ran to the engine control room and alerted the chief and the third engineer, who began yelling on the radio. The tankerman on the bunker barge and the captain on the bunkering tug both heard "excited chatter" on VHF, and the tug master ordered the tankerman to shut down transfer immediately. The tankerman shut down the pump right away and valved off the discharge. At about this point, the crewmember stationed at Stride's bunker manifold said the pressure gauge spiked to about 30 PSI, up from zero earlier in the evolution.

Minutes later, at about 0330, a fire and explosion occurred in the engine room, sending flames up to six feet out of the open engine room hatch. The captain heard the blast and ran to the bridge to shut down all emergency stops, including the ventilation fans, the boiler and the oil pumps, and he sounded the general alarm.

On the captain's orders, the crew sealed the hatch and the ventilation ducts to the engine room, with three crewmembers still inside. The crew ran out fire hoses and began boundary cooling on the outside of the engine room.

At 0336, the chief engineer reported by radio that he, the wiper and the third engineer were still trapped. Two minutes later, a fire team suited up and attempted to enter the engine room through a scuttle, but could not because of heavy smoke. They tried again at 0345 through an entrance on the upper deck, but were repelled by the fire. At 0350, one member of the fire team made it inside, but could not locate the missing crewmembers before he had to retreat.

Shoreside fire teams began arriving at 0343, along with a fireboat, which provided boundary cooling. A local fire department leader recommended discharging CO2 in the engine room, but the master refused, since he still had people inside.

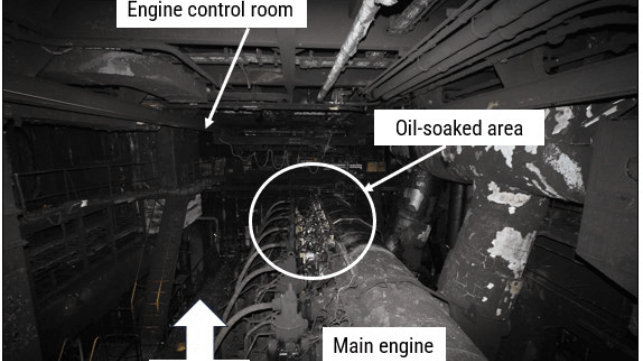

At 0415, the fire team finally managed to reach the engine control room. The blaze was out, but the space was filled with thick smoke. They found the victims; only the wiper was still breathing, and paramedics pronounced the chief engineer and third engineer dead on scene.

At the fire department's request, the engine room was sealed and filled with CO2 for 24 hours to ensure that the blaze was out.

After the fire, diesel fuel was found on all decks of the engine room, dripping out of the funnel casing and coating the interior of the funnel. It was pooled in large quantities around the base of the main engine. The fire damage throughout the engine room was so extensive that the 27-year-old ship was declared a constructive total loss and scrapped.

Investigators found that the starboard side diesel tank had overfilled, and the pressure pushed fuel through the vent pipe, eight decks up into the funnel. The fuel then flooded out of cracks in a badly-repaired cutout section of the vent and dripped back down the funnel casing. (Class found that three of the owner's other vessels had the same cutout in the vent.)

Weeks prior, the Stride's offgoing chief engineer had ordered the wrong valve as a replacement for the angle stop valve on the port side diesel tank. The new valve was a one-way check valve, not a stop valve, and it was installed in an orientation that prevented any diesel from going into the tank - even when the valve was nominally open.

When the oncoming chief engineer lined up the valves to fill both port and starboard tanks at the same time, he was actually filling only the starboard tank, since no fuel could get past the check valve on the port side. The starboard tank rapidly overfilled, then sent the excess diesel up the vent pipe, causing the casualty.

"Vessel drawings contain piping symbols for equipment such as valve types, sizes, and functions. Owners, operators, and crews should carefully note all components of a vessel’s drawings and diagrams to ensure that proper spare or replacement parts are ordered to maintain functionality," noted NTSB. "Crews should ensure adequate personnel are available to take frequent soundings, establish fuel tank filling rates, and communicate to the person in charge, so tanks are monitored and do not overflow."