Offshore Services Giant Proposed in $4.7B Deal to Merge Saipem and Subsea 7

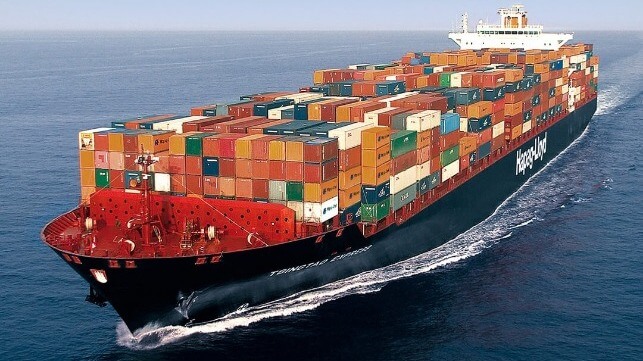

Two of the leaders in the offshore sector for energy, Saipem and Subsea 7 entered into an understanding that is designed to lead to a merger of equally to create an offshore services giant. The deal valued at nearly $4.7 billion would combine the companies to create a global presence with a fleet of more than 60 construction vessels and 45,000 employees.

The companies highlighted that they have highly complementary geographical footprints, competencies and capabilities, vessel fleets, and technologies that will benefit the global client base. They believe a combination would also unlock annual synergies of approximately €300 million to be achieved in the third year after completion, with one-off costs to achieve such synergies of approximately €270 million. The combined company would have a current backlog of €43 billion and annual revenues of nearly €20 billion.

Explaining the rationale for the combination, the companies told investors it would create a more comprehensive solution for customers, expand the expertise and experience base, and create a global and diversified operation. It would also lay the foundation for future innovation in the industry. The management of both Saipem and Subsea7 said they share the conviction that there is compelling logic in creating a global leader in energy services, particularly considering the growing size of clients’ projects.

While recognizing the potential, analysts were quick to question the logistics of completing such a combination. They cited a difficult regulatory approval in part reflected by the companies’ projection that it would be mid-2026 before the deal could be completed.

The companies reported they have completed a memorandum of understanding for the combination which calls for a merger of equals. Each company would own 50 percent of the combined entity with the new company being known as Saipem 7. Current plans call for Alessandro Puliti, CEO of Saipem, to be appointed as CEO of the combined company while John Evans, CEO of Subsea 7, would be the CEO of the offshore business which will comprise all Subsea7 and Saipem’s Offshore Engineering & Construction activities.

The companies’ large shareholders are expressing their support for the combination. Siem Industries, the largest shareholder of Subsea7, would own approximately 12 percent of the new company, while Eni and CDP Equity, the largest shareholders of Saipem, would own approximately 10.6 percent and approximately 6.4 percent of the new company.

The companies independently developed as leaders in the offshore services industry tracing their origins to the 1950s and the start of modern offshore operations. Each has been involved in the consolidation and growth of the industry. The modern Subsea 7 emerged in the early 200s and reports it is the product of over 25 different legacy companies and businesses with Kristian Siem continuing to drive the company as its chairman. Saipem was also the product of mergers and served as the service supplier for Eni until 2015 when it reduced its holding setting the stage for the modern company.

The timeline for the deal calls for completing the merger agreement by mid-year. They will require extensive antitrust approvals and shareholder approval from each company.