IEA: Fossil Fuel Demand to Peak by 2030; But Demand ‘Far Too High’ to Keep 1.5°C Alive

The International Energy Agency (IEA) has projected that global demand for oil, coal, and gas will peak by 2030, but demand for fossil fuels before and after that will still remain “far too high” to keep the Paris Agreement Target of 1.5°C average global warming within reach.

On the brighter side, the transition to clean energy is happening worldwide and is “unstoppable”, according to the IEA World Energy Outlook report, released on Tuesday. It credits the record growth of key clean energy technologies, such as solar PV and electric cars, for this shift.

“It’s not a question of ‘if’, it’s just a matter of ‘how soon’ – and the sooner the better for all of us,” said IEA Executive Director Fatih Birol, at the launch of the report. “Taking into account the ongoing strains and volatility in traditional energy markets today, claims that oil and gas represent safe or secure choices for the world’s energy and climate future look weaker than ever.”

The IEA report predicts that a continuing surge in renewable technologies will underpin green transformation of the global economy. By 2030, renewable energies such as solar, wind, and hydropower could provide nearly 50% of the global electricity mix, up from around 30% today, the report states. The number of electric cars on roads worldwide is projected to increase 10-fold.

“Peak” does not mean “decline”

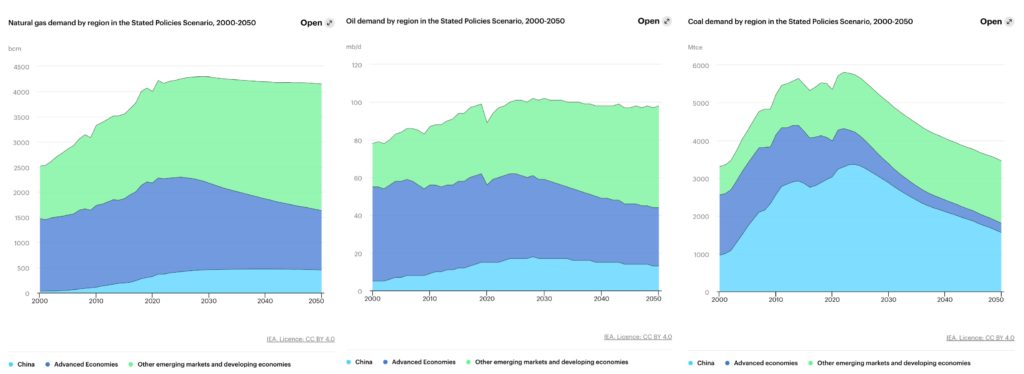

At the same time, IEA report underlines that a “peak” in demand for the first time in 150 years does not mean “decline”. On the contrary, oil and natural gas consumption is forecast to remain close to ‘peak’ levels until 2050.

The IEA projects oil and gas demand will be buoyed by increases in consumption in developing economies which will offset expected decreases in advanced economies.

Conversely, demand for coal – the dirtiest fossil fuel of which 55% is already sold at below market rates globally – will drop off sharply after 2030, the report finds.

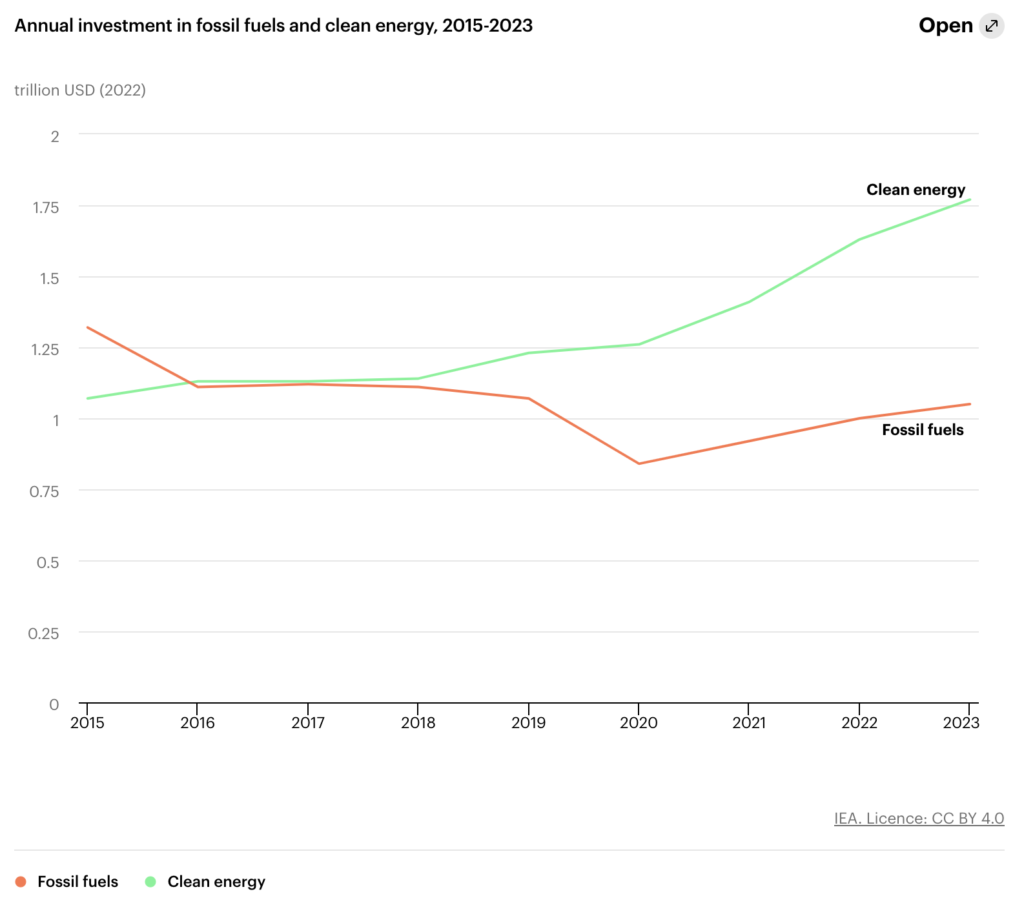

The net result, warns the IEA, is that governments still are not doing enough to support the transition to clean energy. While investments in fossil fuels will remain “essential” to keep the global energy mix balanced, investments in fossil fuels are currently too high, the IEA said. This is reflected in the record-high levels of global fossil fuels subsidies, which reached $7 trillion in 2020.

“As things stand, demand for fossil fuels is set to remain far too high to keep within reach the Paris Agreement goal of limiting the rise in average global temperatures to 1.5°C,” the report said. “This risks not only worsening climate impacts after a year of record-breaking heat, but also undermining the security of the energy system, which was built for a cooler world with less extreme weather events.”

Projections at the mercy of political shifts on green energy

The IEA assessment, based on current policies being implemented presently by governments and could change – for better or for worse – depending on whether governments backtrack or double down on major climate pledges, the report also noted.

For instance, UK Prime Minister Rishi Sunak recently backtracked on some of his country’s net-zero pledges, delaying from 2030-2035 the target date for banning petrol and diesel car sales, while pushing ahead with plans to “max out” the UK’s fossil fuel reserves. And former US President Donald Trump has already signaled that should he be re-elected in 2024, he will try to repeal the Inflation Reduction Act, the largest package of green investment in US history.

China, the world’s largest consumer of fossil fuels, is also a key player. The country accounts for one-half the world’s coal use and through its investments and development strategies, Beijing has driven two-thirds of the growth in global oil demand over the past decade. At the same time, China’s commitment to harnessing its green energy dominance to reshape its dependence on fossil fuels is essential to realization of IEA projections of a 2030 peak in fossil fuel consumption, the IEA report stresses.

The fossil fuel industry has different ideas

The IEA assessment is in stark contrast to the views of the fossil fuel industry, which has long insisted that oil and gas will continue to play a dominant role in the global energy mix. The Organization of the Petroleum Exporting Countries (OPEC), the global oil cartel that supplies 51% of the world’s oil and controls 81% of proven oil reserves, said in its annual report earlier this month that it expects oil demand to increase by 17% by 2045.

The OPEC report called for expectations of what green energy can deliver to be more “pragmatic and realistic”, reflecting language also used by the United Arab Emirates presidency ahead of the upcoming UN Climate Conference (COP28) in Dubai, 30 November – 13 December.

OPEC Secretary General and Kuwaiti oil executive Haitham Al Ghais wrote in the foreword of the OPEC report: “Calls to stop investments in new oil projects are misguided and could lead to energy and economic chaos.”

The bullish projections of OPEC are shared by American fossil fuel giants ExxonMobil and Chevron, who both announced plans to buy smaller shale producers in the United States a combined total of over $100 billion.

The International Energy Agency (IEA) has a mixed track record in forecasting fossil fuel demand. In 2016, the agency incorrectly predicted that China’s coal demand had peaked. But in previous reports, it also underestimated the rapid growth of renewable energy sources such as solar power.

No comments:

Post a Comment