Report: Green Corridors Face “Feasibility Wall” Due to Fuel Costs

A new report warns that a “feasibility wall” could jeopardize the significant progress being made for the adoption of green corridors, a key part of efforts to support sustainable shipping. The Getting to Zero Coalition and the Global Maritime Forum report that the lack of policies to bridge the cost of switching to zero-emission fuels has emerged as the number one bottleneck creating a “feasibility wall” risking the implementation of the concept.

The initiative to form green corridors as a way to support and encourage the adoption of sustainable fuels and new technologies was one of the cornerstones at the UN’s COP 26 event in Scotland in November 2021. A total of 22 nations signed the initial decree, pledging to support the launch of net-zero corridors.

The Annual Progress Report on Green Shipping Corridors 2024 released today, November 19, highlights significant growth in programs seeking to launch the corridors. It reports the number of initiatives increased by 40 percent in 2023 with a total of 62 initiatives globally.

The first demonstration took place in the Baltic this summer. Viking Line ran two of its ferries, Viking Grace and Viking Glory, fueled exclusively with liquid biogas. The Baltic emerged as one of the early proponents of the green corridor concept while there are also proposals for long-distance runs such as between Singapore and Rotterdam, which was first announced in August 2022.

The report highlights that six frontrunning initiatives are now preparing for real-world implementation. They note that these would provide a blueprint for green corridors worldwide. They highlight that a third of the proposed corridors have advanced to a new phase of exploration, including feasibility studies, implementation roadmaps, and cost assessments.

“Green shipping corridors have an essential role to play in accelerating zero-emission shipping. This year saw a handful of advanced corridors setting the pace, but continued progress is not inevitable,” said Jesse Fahnestock, Director of Decarbonisation at the Global Maritime Forum. “If industry and national governments make a concerted effort to share the costs and risks associated with new fuels, these leading corridors could together generate a breakthrough for zero-emission shipping before 2030.”

The cost of green fuels and the premium over traditional fuels is an often-cited barrier with many in the industry calling for efforts to bridge the gap. The corridor concept was to create significant demand to encourage investment in the production and distribution of new fuels. The report concludes that progress could stall without urgent action from governments to overcome the cost challenges.

The groups warn that the initiative “initiatives risks hitting a ‘feasibility wall’ if the cost of transitioning to sustainable energy sources is not urgently addressed by national policy incentives. This lack of national policy to bridge fuel costs is now the number one bottleneck and will soon limit the development of green corridors.”

The six frontrunning initiatives they believe could require over two million tonnes of hydrogen-based fuel per year by 2030.

The report calls on national governments to step up support and help unlock the business case for alternative energy, such as hydrogen-based fuels. With an increased number of governments focusing on incentivizing the adoption of hydrogen in multiple sectors, they write that providing shipping-specific support could catalyze both national hydrogen economies and the decarbonization of the maritime sector.

They are making five recommendations to ensure progress on the green corridor initiative. They believe the cost gap could be addressed by tapping into existing schemes designed to support hydrogen adoption. Furthermore, they also call for the development of innovative commercial agreements for fuel procurement and chartering within the green corridors and additional government efforts to encourage participation as well as financing policies.

Maersk as it launched its first large dual-fuel methanol containerships this year repeatedly cited the cost differential and lack of supply as major concerns for alternative fuels. At the International Maritime Organization’s MPEC committee meeting this year, member states were also called on to support a carbon pricing mechanism to support R&D and close the price gap between traditional and alternative fuels. This industry has highlighted for years the cost gap as a major impediment to the early adoption of alternative fuels.

EU Operators Brace for Cost and Complexity of FuelEU Carbon Regs

The European Union's FuelEU Maritime regulation takes effect on Jan. 1, 2025, and it is expected to give European shipping interests a big compliance challenge - or opportunity, depending on how they operate. The regulation is highly technical and is driven more by math than text, opening the door to strategization - but many owners do not like the game, believing it will make them less competitive on the global market.

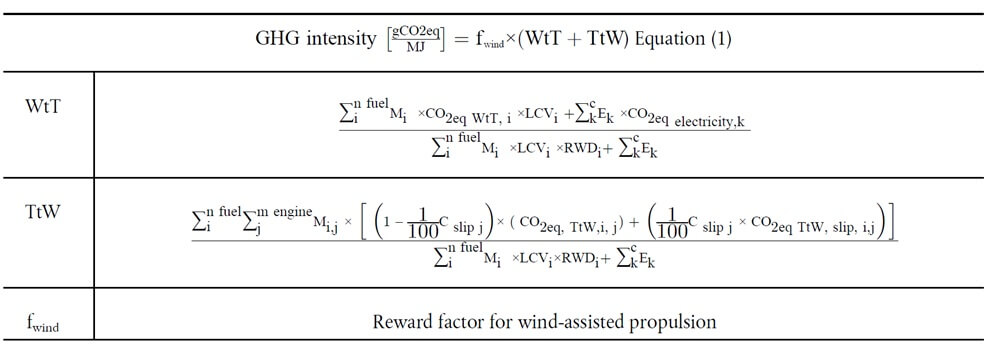

FuelEU Maritime requires operators to calculate the well-to-wake greenhouse gas intensity of each ship's fuel consumption, then reduce it over the course of a 25-year ratchet-down schedule, starting with a two percent cut next year.

Noncompliance is a law-abiding strategy for this regulation, but it is an expensive choice. The penalty for high carbon operation will be €2,400 per tonne of VLFSO energy equivalent - about triple the price of bunker fuel - for emissions over the limit. Repeat noncompliance in sequential years increases the penalty, though operators can also pool their emissions or borrow from future year compliance in order to reduce cost. The other cost-saving alternative is compliance, whether by improving vessel efficiency, adding wind propulsion or buying green fuels.

FuelEU Maritime's greenhouse gas intensity formula (EU Consilium)

At least a dozen consultants and class societies offer solutions for navigating this sophisticated ruleset, and some go further to attempt to monetize the regulation for finance-minded shipowners. Veson, NAPA, StormGeo, BV, DNV, Normec, BSM, LR, Wilhelmsen, OrbitMI, ABS, OceanScore and countless others have developed compliance assistance services for this new market.

Owners are paying close attention, and some are reprioritizing to take action, according to a recent qualitative survey by consultancy Houlder. "[The Emissions Trading System] is not a particularly big deal. It’s small penalties compared to FuelEU. What [FuelEU] has done is shocked businesses into realizing the penalties they are going to have to pay if they don’t act on energy efficiency . . . and then eventually future fuels," one industry member told Houlder. "From an R&D point of view, these have helped secure support and budget."

FuelEU Maritime is opposed by the German Shipowners' Association (VDR), whose chief executive recently called the regulation "terrible." The association is worried that it will make EU owners uncompetitive, and it wants to see international, IMO-led rules as fast as possible.

"Well-intentioned is not always well done. Shipping is international, and emissions know no borders. Regional regulations such as FuelEU Maritime create a patchwork of rules. They distort international competition and are ineffective in the fight against climate change," VDR said in a statement. "The mandate from shipping to the new European Commission is clear: the EU rules and above all FuelEU Maritime must be integrated into the IMO's international measures as quickly as possible."

No comments:

Post a Comment