Chernobyl's protective shelter damaged 'by drone strike'

International Atomic Energy Agency staff at the Chernobyl site say "radiation levels inside and outside remain normal and stable" after a drone was reported to have struck the roof of the shelter built over the remains of the reactor destroyed in the 1986 accident.

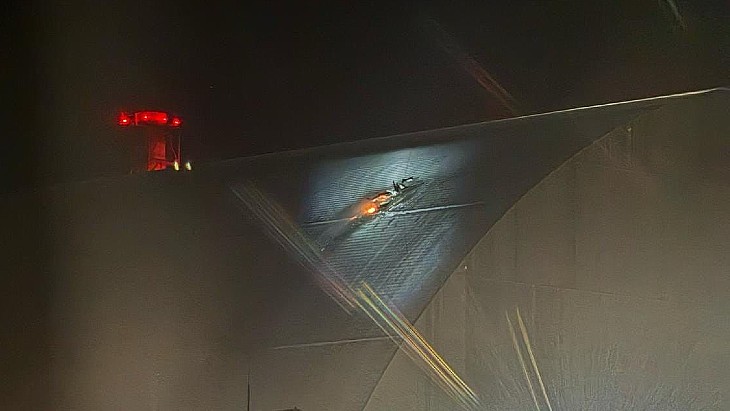

The IAEA, posting on the social media site X, said their team at the site heard an explosion at around 01:50 local time coming from the New Safe Confinement (NSC) shelter, with photos showing flames from the apparent impact point towards the top of the structure.

They were told that the damage had been caused by a drone and added: "Fire safety personnel and vehicles responded within minutes. At this moment, there is no indication of a breach in the NSC’s inner containment. Radiation levels inside and outside remain normal and stable. No casualties reported. IAEA continues monitoring the situation."

IAEA Director General Rafael Mariano Grossi said the incident at Chernobyl and recent military activity in the Zaporizhzhia nuclear power plant area showed "there is no room for complacency, and the IAEA remains on high alert".

The two shelters covering the accident site

Chernobyl Nuclear Power Plant's unit 4 was destroyed in the April 1986 accident (you can read more about it in the World Nuclear Association's Chernobyl Accident information paper) with a shelter constructed in a matter of months to encase the damaged unit, which allowed the other units at the plant to continue operating. It still contains the molten core of the reactor and an estimated 200 tonnes of highly radioactive material.

However it was not designed for the very long-term, and so the New Safe Confinement - the largest moveable land-based structure ever built - was constructed to cover a much larger area including the original shelter. The New Safe Confinement has a span of 257 metres, a length of 162 metres, a height of 108 metres and a total weight of 36,000 tonnes and was designed for a lifetime of about 100 years. It was built nearby in two halves which were moved on specially constructed rail tracks to the current position, where it was completed in 2019.

The original shelter is now within the New Safe Confinement (File Picture, Image: EBRD)

It has two layers of internal and external cladding around the main steel structure - about 12 metres apart - with the IAEA reference to the inner containment not being breached thought to refer to the inner section. The NSC was designed to allow for the eventual dismantling of the ageing makeshift shelter from 1986 and the management of radioactive waste. It is also designed to withstand temperatures ranging from -43°C to +45°C, a class-three tornado, and an earthquake with a magnitude of 6 on the Richter scale.

According to World Nuclear Association, the hermetically-sealed New Safe Confinement allows "engineers to remotely dismantle the 1986 structure that has shielded the remains of the reactor from the weather since the weeks after the accident. It will enable the eventual removal of the fuel-containing materials in the bottom of the reactor building and accommodate their characterisation, compaction, and packing for disposal. This task represents the most important step in eliminating nuclear hazard at the site - and the real start of dismantling".

What do we know about the damage to the shelter?

According to the operators of the Chernobyl Nuclear Power Plant (ChNPP) site, the arch-shaped New Safe Containment was struck at a height of 87 metres and "the impact occurred above the premises housing technological equipment that ensures the remote operation of the Confinement. As a result, both the external and internal cladding of the NSC Arch were damaged, along with equipment from the Main Cranes System. Additionally, local fire was detected on the external and internal cladding of the NSC Arch".

The damage to the outside (Image: IAEA/X)

The damage from the inside (Image: ChNPP)

The damage being inspected during daylight (Image: ChNPP)

Firefighters put out the fire, with ChNPP saying that "due to the breach in the cladding, the conditions and limits of safe operation established by the Technological Operation Regulations of the NSC and Shelter Object have been violated".

They added that there were no casualties and no release of radioactive substances with radiation levels at their usual levels and "the situation is under control".

The wider context

Chernobyl nuclear power plant lies about 130 kilometres north of Ukraine's capital Kyiv, and about 20 kilometres south of Belarus. A 30-kilometre exclusion zone remains around the plant, although some areas have been progressively resettled. Three other reactors at the site, which was built during Soviet times, continued to operate after the accident, with unit 3 the last one operating, until December 2000.

When Russia launched its invasion of Ukraine in February 2022 it rapidly took control of the Chernobyl plant. Its forces remained there until withdrawing on 31 March 2022 and control returned to Ukrainian personnel. The IAEA has had experts stationed at the site as the war has continued, seeking to help ensure the safety and security of the site.

IAEA teams are also in place at Ukraine's three operating nuclear power plants and the Zaporizhzhia nuclear power plant, which has been under the control of Russian forces since early March 2022.

Ukraine has blamed Russia for the drone strike, while Russia denied it was responsible and blamed Ukraine. The IAEA has not attributed blame to either side during the war, with Director General Grossi explaining in a press conference at the United Nations in April last year that this was particularly the case with drones, saying "we are not commentators. We are not political speculators or analysts, we are an international agency of inspectors. And in order to say something like that, we must have proof, indisputable evidence, that an attack, or remnants of ammunition or any other weapon, is coming from a certain place. And in this case it is simply impossible".

Modi, Trump commit to US-India partnership

The leaders of India and the USA have said their nations will work together towards the construction of large-scale US-designed nuclear reactors in India and facilitating further collaboration including the deployment small modular reactors.

_32815.jpg)

In a joint statement issued during the official visit to the USA by Prime Minister Narendra Modi, the two leaders agreed that energy security was fundamental to economic growth, social well-being and technical innovation in both countries and "re-committed to the US-India Energy Security Partnership, including in oil, gas, and civil nuclear energy".

The joint statement paid particular attention to the two countries' view of the importance of hydrocarbons, and enhancing production "to ensure better global energy prices and secure affordable and reliable energy access for their citizens" as well as the value of strategic petroleum reserves "to preserve economic stability during crises". They also said they would increase energy trade, and "establish the United States as a leading supplier of crude oil and petroleum products and liquified natural gas to India".

Turning to nuclear, they "announced their commitment to fully realise the US-India 123 Civil Nuclear Agreement by moving forward with plans to work together to build US-designed nuclear reactors in India through large scale localisation and possible technology transfer".

Bilateral nuclear cooperation agreements, specified under Section 123 of the US Atomic Energy Act, are a prerequisite for the transfer of nuclear energy-related materials and components between the USA and another country. The USA and India signed such a 123 Agreement in 2008, after India - which is not a signatory of the international Nuclear Non-proliferation Treaty - reached a safeguards agreement with the International Atomic Energy Agency. But although US-designed reactors have long been earmarked for potential construction in India - Kovvada, in Andhra Pradesh, was identified as a site for six AP1000 pressurised water reactors as long ago as 2016 - contractual arrangements remain to be finalised.

In January - in the final days of the Biden administration - National Security Advisor Jake Sullivan said the USA was getting close to removing long-standing regulations that have prevented civil nuclear cooperation between Indian nuclear entities and US companies. Since then, the Indian government has announced that it will amend both its Atomic Energy Act, which had precluded private-sector investment in India's civil nuclear industry, and the Civil Liability for Nuclear Damage Act, which has been a stumbling block for overseas nuclear power plant vendors as it gave plant operators unlimited legal recourse to the reactor supplier in the event of a nuclear accident.

President Trump and Prime Minister Modi said they welcomed the recent announcement of the amendments and "further decided to establish bilateral arrangements in accordance with CLNDA, that would address the issue of civil liability and facilitate the collaboration of Indian and US industry in the production and deployment of nuclear reactors. This path forward will unlock plans to build large US-designed reactors and enable collaboration to develop, deploy and scale up nuclear power generation with advanced small modular reactors".

They also announced a raft of technology and innovation initiatives, including the US-India TRUST (Transforming the Relationship Utilising Strategic Technology) initiative to catalyse collaboration to promote the application of critical and emerging technologies in areas including defence, artificial intelligence, semiconductors, quantum, biotechnology, energy and space, "while encouraging the use of verified technology vendors and ensuring sensitive technologies are protected".

MAGA-MIGA-MEGA

Modi also coined a new phrase to describe India's development vision as the two leaders addressed the media following their meeting in the Oval Office.

"Americans are familiar with President Trump's motto, Make America Great Again, or 'MAGA'," Modi said. "The people of India are also moving towards development at a fast pace with the determination of 'Viksit Bharat 2047' on the track of heritage and development.

"If I say in the language of America, developed India means Make India Great Again, ie "MIGA". When the United States and India work together, ie 'MAGA' plus 'MIGA', the 'MEGA' Partnership for prosperity is formed. And this mega spirit gives new scale and scope to our goals."

Modi's words were reported by the Press Trust of India.

India aims to develop at least 100 GW of nuclear energy by 2047 for its energy transition efforts and has committed to partner with the private sector on the development of the Bharat Small Modular Reactor, a compact 220 MW pressurised heavy water reactor based on India's reactor technology.

Earlier in the week, Modi and French President Emmanuel Macron agreed a Declaration of Intent for establishing a partnership on advanced modular reactors and small modular reactors.

Collaboration key to clean energy dream, India Energy Week hears

Nuclear will play a crucial part in ensuring reliable supplies of clean energy - and collaboration will be the key to make it happen, according to panelists at the Indian government's flagship energy event.

2_13901.jpg)

India Energy Week 2025, which took place in New Delhi from 11-14 February under the patronage of India's Ministry of Petroleum and Natural Gas, and was organised by the Federation of Indian Petroleum Industry, attracted more than 70,000 delegates from 50-plus countries, including more than 20 ministers. According to the host ministry, it is now the world’s second-largest energy event.

At the inaugural session - which included an address by Prime Minister Narendra Modi - India's Minister of Petroleum and Natural Gas Hardeep Singh Puri called for a balanced and inclusive energy transition that must also be "pragmatic" with a continued role for hydrocarbons alongside other energy options and must not deepen inequality by leaving developing economies behind in the transition.

Nuclear featured in India Energy Week, with a panel discussion on "Realising nuclear power’s low-carbon renaissance and future role in the clean energy mix", with panellists from World Nuclear Association, the South African Nuclear Energy Corporation (Necsa), India's NITI Aayog public policy think-tank, and the nuclear wing of Indian state-owned National Thermal Power Corporation Ltd (NTPC). The panel was moderated by the International Energy Agency's Nobuo Tanaka.

World Nuclear Association Director General Sama Bilbao y León stressed the importance of energy independence and also energy equity, with at least 100 million of the world's inhabitants lacking access to the energy they need. "We are seeing very serious interest in nuclear energy everywhere in the world," she said. "In the last two, three years we’ve seen many countries have recognised it is simply not possible to reach their goals in a sustainable, cost effective, timely and, very importantly, equitable manner, without nuclear energy."

The issue of equitable access to energy was also highlighted by Loyiso Tyabashe, Group CEO of Necsa. "The main thing that bugs us about energy is energy access - before you talk about whether it’s cheap or carbon free. So nuclear does play a very important role in ensuring that ultimate objective for the continent - it provides energy security, available 24 hours a day."

The panel session was reported by Energy Connects.

Building the supply chain

Days before India Energy Week, India's Minister of Finance Nirmala Sitharaman, in the 2025 Union Budget, said India will need to build at least 100 GW of nuclear capacity by 2047 to support its energy transition, and intends to make the necessary changes in law to clear the way for participation by private sector and overseas companies.

Speaking on the sidelines of the event, Bilbao y Léon said India had a "thriving" nuclear industry, but a secure supply chain will be necessary to underpin growth in India, and elsewhere.

"The goal of having 100 gigawatts of nuclear energy by 2047, it's a big challenge," she told CNBC. For projects in India, she said, realigning the Nuclear Energy Act and India's nuclear liability laws to incentivise public-private partnerships, bring in overseas investors and international companies "will be very important to help India accelerate their use of nuclear".

"So what we are doing right now in World Nuclear Association, together with all our members throughout the entire value chain in nuclear, we are actually trying to enhance how we invest in our infrastructure. This means industrial infrastructure, supply chain, manufacturing, but also workforce infrastructure. So we are trying to attract, retain, prepare, and educate and develop the brightest people to come to the nuclear industry.

Newcleo seeks to buy land for demonstration SMR

Innovative reactor developer Newcleo announced it has started the land acquisition process for its demonstration LFR-AS-30 small modular reactor in Indre-et-Loire in the Chinon Vienne et Loire community of municipalities in western France.

_22172.jpg)

The company has "formally initiated constructive discussions and procedures" with the Chinon Vienne et Loire community of municipalities on the siting of the reactor. "Preliminary meetings with local officials, the Chinon Vienne et Loire community of municipalities, and state authorities have allowed Newcleo to present its project while reaffirming its commitment to maintaining a constructive dialogue with all local stakeholders," it said.

"This approach, which follows the standard process for large-scale projects in France, will be accompanied by a series of preliminary studies required for administrative authorisations and subsequent decisions," Newcleo said. "The entire process is conducted in full compliance with the highest applicable regulations and standards, in close collaboration with the relevant authorities."

The company said it will soon refer the matter to the National Commission for Public Debate, in accordance with the Environmental Code. Its project will then be presented during the upcoming public debate, providing a clear overview of its ambitions and commitments. The debate allows interested parties to participate in shaping major policies or projects with significant socio-economic or environmental impact, ensuring transparent and inclusive decision-making from the outset.

According to Paris-headquartered Newcleo's delivery roadmap, the first non-nuclear pre-cursor prototype of its reactor is expected to be ready by 2026 in Italy, the first reactor operational in France by the end of 2031, while the final investment decision for the first commercial power plant is expected around 2029.

Newcleo said its first-of-a-kind 30 MWe lead-cooled fast reactor will "serve as an industrial demonstrator, a showcase for Newcleo's technology, and contribute to the development of the nuclear sector in France".

Last month, Newcleo signed framework agreements with Slovakian companies JAVYS and VUJE which could lead to up to four of its 200 MWe lead-cooled fast reactors at the Bohunice site.

Studies continue into SMR deployment in Lund

A new company is being established to further investigate the possibility of establishing a nuclear power plant based on small modular reactors in the municipality of Lund in the southern Norwegian county of Rogaland.

_57731.jpg)

In July last year, Norwegian nuclear project developer Norsk Kjernekraft - which aims to build, own and operate small modular reactor (SMR) power plants in Norway in collaboration with power-intensive industry - signed a cooperation agreement with Lund to consider the construction of such a plant in the area. Since then, thorough preliminary studies have been carried out, which show that the area has several suitable locations where a plant could be built.

The new company - named Dalane Kjernekraft AS - is being established in a partnership between Lund Municipality, Dalane Energi and Norsk Kjernekraft.

The company will operate according to the same model as Halden Kjernekraft AS. That company - founded by Norsk Kjernekraft, Østfold Energi and the municipality of Halden - is investigating the construction of a nuclear power plant based on SMRs at Halden, where a research reactor once operated.

Dalane Kjernekraft will initially continue its investigations and then select a location for an impact assessment. If the impact assessment yields positive results and shows that the benefits outweigh the disadvantages, the next step will be to prepare a licence application that can provide the basis for a possible start of construction. "If the studies yield a positive outcome, an SMR could be ready for operation around the mid-2030s," Norsk Kjernekraft said.

"The Dalane region needs more clean energy to succeed with development and restructuring," said Lund's mayor Gro Helleland. "A nuclear power plant in Lund will benefit the entire region in terms of attractiveness and increased activity for both business and local communities. Consideration of natural intervention has been crucial in our choice of energy solution. A nuclear power plant can produce as much energy as Norway's largest wind farm at Fosen, but only requires an area equivalent to a football stadium. We believe the time is ripe for an open and fact-based investigation, in which Lund's residents should be closely involved in the process."

"Lund Municipality is leading the way as a good example of how Norway can meet both climate goals and nature conservation at the same time," said Norsk Kjernekraft CEO Jonny Hesthammer. "So far, we have been in dialogue with nearly 90 Norwegian municipalities, but Lund Municipality is one of the fastest and is well ahead in the queue to become a host municipality for an SMR.

"Globally, a nuclear power renaissance is now taking place, and never before has interest in this been greater in Norway. Through Dalane Kjernekraft, Lund can show Norway how municipalities can be strengthened through real sustainability in practice."

In June 2024, the Norwegian government appointed a committee to conduct a broad review and assessment of various aspects of a possible future establishment of nuclear power in the country. It must deliver its report by 1 April 2026.

Britain's energy costs are among the highest globally, and nuclear power offers a potential solution for economic improvement, energy independence, and national security.

Small modular reactors (SMRs) could provide a significant portion of the UK's energy needs at a competitive price, with a substantial return on investment despite high upfront costs.

Nuclear energy, especially from SMRs, is essential for Britain to meet its Net-Zero targets and transition away from fossil fuels, making it a crucial part of a sustainable energy future.

While France generates most of its energy from nuclear, Britain has the highest industrial electricity costs in the world. The upfront costs of small modular reactors are high, but so is the return on investment, says John Caudwell

Last month was the hottest January on record globally. It was unexpected because the natural weather phenomena known as ‘La Niña’ should have produced a cooling effect. That suggests that La Niña might be losing its ability to keep global warming in check – a terrifying reminder of the escalating climate crisis.

Countries around the world stand at a crossroads in deciding how to deal with this challenge. They can choose to create meaningful, sustainable jobs in the clean tech sector and, by doing so, stimulate economic growth and help protect our planet. Or they can choose to opt out of this race and watch others reap the rewards as they build the green infrastructure and technology of the future.

Last week, the government gave us further evidence that it is choosing the former. The prime minister is standing up for Britain’s future by pledging to reform the UK’s planning rules to make it easier to build nuclear power plants. These reforms will also make it easier to build small modular reactors (SMRs). This is good news and should be welcomed as a decision long overdue.

In 2010, the then Leader of the Liberal Democrats and soon-to-be Deputy Prime Minister Nick Clegg dismissed the tremendous opportunities offered by nuclear power because its benefits would not be apparent until 2022. Well, in 2025, such thinking appears very short sighted.

In the middle of the 20th century, Britain was the world leader in nuclear power. In fact, in 1965, the UK had more nuclear reactors than the rest of the world combined. But Britain’s nuclear engineering expertise has since disappeared as our nuclear industry atrophied, in part through our reliance on gas.

And now in Britain we look over the Channel in envy at France, who – for decades – have generated most of their energy, many times the world average, from nuclear power.

It’s because of our short-term approach that Britain now has an energy problem. We have one of the highest domestic electricity costs in Europe, and we have the highest industrial electricity cost in the world.

Nuclear would be good for the economy, energy independence and national security

There are many parts to solving this problem, such as regional energy pricing, but nuclear power also has to play a key role. That would not just be good for the economy and our energy independence and national security, it would bring electricity costs down and help tackle climate change.

Electricity from an SMR could be generated at just 5p per kilowatt hour (kWh).

Of course, there’s a substantial upfront cost. Britain will need thousands of SMRs – in addition to larger nuclear plants such as Hinkley Point C and Sizewell C, where economies of scale are greater still – and, if the build cost is roughly £500bn to provide 50 per cent of the UK needs, the total price is huge.

But so is the return on investment. At current electricity prices, I think the initial investment could be covered in two years.

Savvy investors should happily stump up the short-term costs to, in the Prime Minister’s words, “build, baby, build” and seize the long-term opportunity this offers

Savvy investors should happily stump up the short-term costs to, in the Prime Minister’s words, “build, baby, build” and seize the long-term opportunity this offers.

The UK could become a world leader in nuclear power – and SMRs are a crucial part of that vision. We should not pretend that nuclear power is a panacea for all our energy woes, but they do have a central role to play in boosting our energy independence and resilience.

Environmentalists should welcome this too. If the UK is ever to wean ourselves off fossil fuels and meet our Net-Zero targets, then safe, clean nuclear energy – particularly from SMRs – is essential. And we need it faster than ever.

By City AM

Iran's economy is facing severe challenges, with the national currency plummeting to a record low due to US sanctions and stalled nuclear negotiations.

Supreme Leader Ayatollah Ali Khamenei's changing stance on negotiating with the US has led to public frustration and criticism, with many Iranians expressing anger on social media.

The economic hardship in Iran is causing widespread poverty and social unrest, with concerns that an "angry and hungry society" could take to the streets in protest.

Public outrage is mounting in Iran as the country's struggling economy worsens under crippling U.S. sanctions.

The national currency plunged to a record low on February 11 soon after U.S. President Donald Trump ordered the restart of a "maximum pressure" campaign on the Islamic republic.

In response, Supreme Leader Ayatollah Ali Khamenei appeared to dismiss the prospect of negotiations with the United States over Iran's disputed nuclear program.

A nuclear deal is seen as key to Washington lifting economic sanctions on Iran, which has witnessed rising unemployment and growing poverty in recent years.

Quick Turnabout

For months, Iranian officials have signaled the country was open to negotiating with Trump.

That is despite Trump withdrawing the United States from a nuclear deal between Tehran and world powers and reimposing sanctions during his first term in office. In response, Tehran significantly expanded its nuclear program, though it maintains it is not looking to weaponize it.

Khamenei on January 28 appeared to give his blessing to talks with Trump, saying it's "possible to make a deal" with someone you know and can prepare for.

But the Iranian leader changed tack on February 7, saying it would "not be intelligent, wise, or honorable" to negotiate with Washington because it cannot be trusted.

"A portion of society pinned their hopes" on reformist President Masud Pezeshkian, who was elected in 2024, said Saeed Peyvandi, a professor of sociology at Paris 13 University.

"Now they will see their lives getting worse," Peyvandi told RFE/RL's Radio Farda. "This will make the prospects of change in the [Islamic republic] impossible in the eyes of the people…. An angry and hungry society can take to the streets at any moment."

There have been violent protests in recent years over Iran's freefalling economy.

Frustration And Criticism

Khamenei's apparent rejection of negotiations with the United States has led to an outpouring of frustration and criticism on social media.

Some Iranians on X asked why an "unelected, lifelong official" gets to decide what is best for an entire nation.

Others called on Pezeshkian to resign if he was unable to deliver on his campaign pledge to ease tensions with the West.

Khamenei's comments as well as Trump's decision to resume a "maximum pressure" campaign on Iran appeared to trigger the sudden drop of the value of the rial against the U.S. dollar.

The falling value of the rial in recent years has exacerbated the cost of living in Iran. A recent report by Iran's statistical authority said that around a third of Iranians earn less than $2 a day and struggle to afford basic necessities.

Economy journalist Zohreh Irani pointed to the depreciation of the rial and declared, "You will negotiate, I promise you."

Joking about the speed with which the rial is falling, Iranian poet Morteza Lotfi wrote on X, "We worked 9 hours today but we're poorer than the morning!"

Ata Mohamed Tabriz, a political analyst based in Turkey, told Radio Farda that Iranians have expressed "serious anger" since Khamenei's comments.

"There is a chance the anger will grow…. But it doesn't look like the Islamic republic is going to do anything about it," he added.

By RFE/RL