Russian Oil Tanker Fleet Severely Hobbled by Last Month’s US Sanctions

February 13, 2025

(Vessel tracking data compiled by)

(Bloomberg) -- The latest US sanctions on Russia’s oil trade have brought a swath of tankers that deliver Moscow’s crude to a halt — reinforcing the significance of the measures in any negotiations over ending the war in Ukraine.

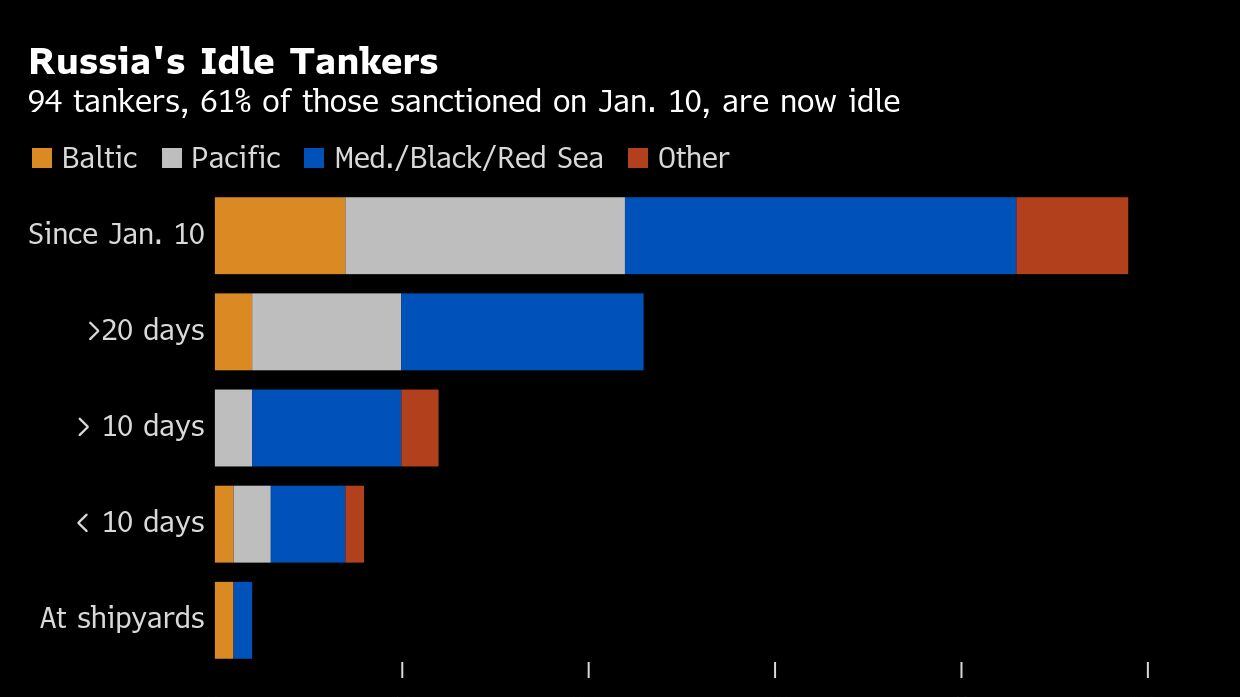

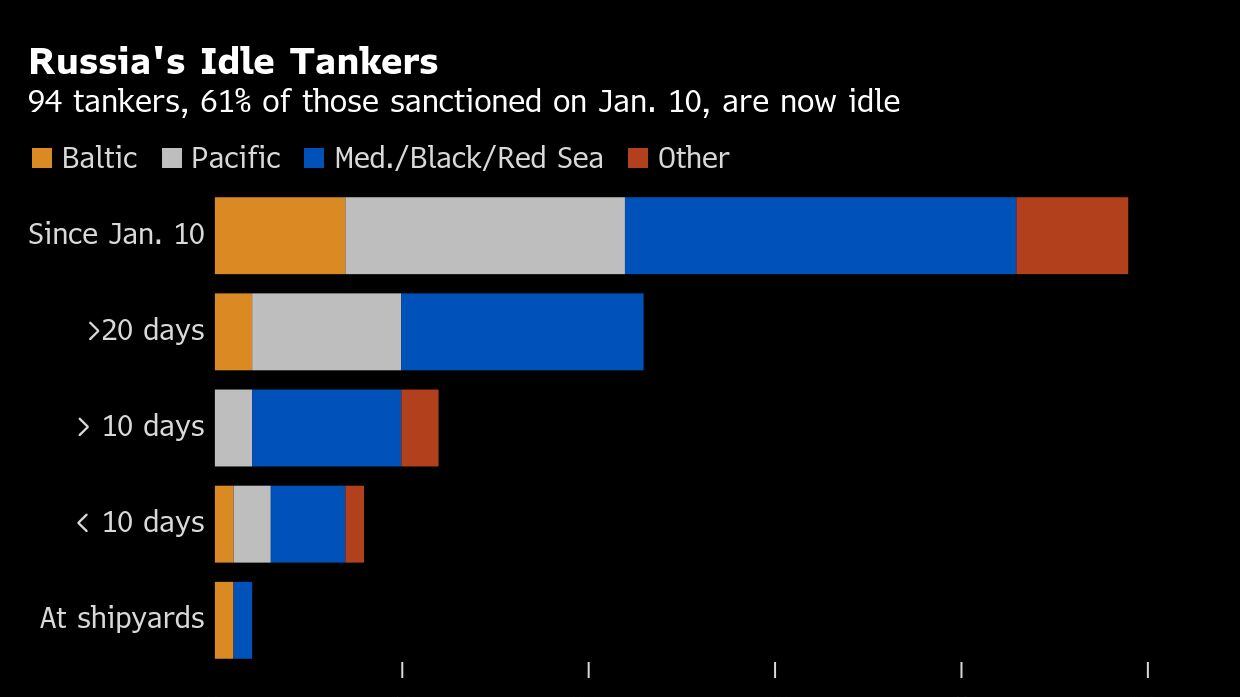

About 60% — 94 out 154 — of the active tankers blacklisted by the outgoing Biden administration last month for their involvement in the Russian oil trade have stopped hauling barrels for Moscow or anyone else, ship-tracking data compiled by Bloomberg show. Another seven were under construction or undergoing sea trials.

On Wednesday, US President Donald Trump said he’d spoken to Vladimir Putin about ending the war in Ukraine. The discussions touched on energy but, according to Kremlin spokesman Dmitry Peskov, not sanctions.

However, the Jan. 10 measures are forcing Russia to rewire its oil supply chain to find alternative ships — and pay high freight costs for them. It’s also delivering cargoes in unusual ways. At stake is the country’s capacity to keep supplying increasingly cautious customers and, ultimately, Russia’s own production of hydrocarbons.

While there’s no sign yet that output is being hurt by the measures, Russia’s tanker fleet clearly is being disrupted. Around half of the idled vessels observed by Bloomberg became inactive as soon as they were blacklisted.

To be clear, it’s too soon to say what will happen to the remaining tankers that were sanctioned on Jan. 10 and are still operating for now. If history is any guide some will also be forced to stop trading.

Of 44 that have taken on cargoes since being blacklisted, 20 are operating solely within Russia. Another nine are specialized shuttle ships used by two projects on Sakhalin Island in Russia’s Far East, most of which are struggling to offload their consignments.

However, some buyers and buyer countries have balked at dealing with sanctioned shipments in the wake of the US Treasury’s measures.

The Indian government has said it won’t allow sanctioned ships to dock at its ports after Feb. 27 and before then only if they are carrying cargoes loaded prior to Jan. 10. Many ports in China’s Shandong province, a hub for independent refiners, are wary of handling sanctioned tankers after a warning from a major terminal operator. Likewise, the biggest refiner in Turkey, Russia’s other major customer, is also restricting purchases to avoid falling foul of US sanctions.

The reluctance of Moscow’s biggest buyers to accept vessels sanctioned by Washington is starting to cause logistics headaches for exporters.

Emerging Clusters

While the idled ships are dotted across the globe, there are places where some have clustered.

Those locations include Ust-Luga in the Baltic Sea, the Black Sea — although most disappear from automated tracking systems on entering that body of water — and the Sea of Marmara. In Asia, groups of vessels are anchored near the Russian port of Kozmino and China’s Zhoushan.

More have gathered in the Riau archipelago, east of Singapore, which is better known in the market for the clandestine transfer of Iranian cargoes.

About 2 million barrels of Sokol crude from the Sakhalin 1 project have been transferred onto a very large crude carrier for onward shipment to China from specialized shuttle tankers that were blacklisted. Two more shuttle ships are idling near China with cargoes on board.

The Sakhalin 2 project is also experiencing delays in offloading cargoes. All three of the shuttle tankers it normally uses are idling, while a fourth pulled in to carry its oil has come to a near halt in the Sea of Japan.

Elsewhere, only crude from the Arctic port of Murmansk is still being exported on sanctioned tankers in any significant quantity. That oil is already hauled to the port and stored there on blacklisted vessels.

The first of the ships carrying Arctic crude from Murmansk are still at least a week away from their destinations.

Several previously identified as heading to India are now signaling North China or possible storage locations off Oman.

©2025 Bloomberg L.P.

(Bloomberg) -- The latest US sanctions on Russia’s oil trade have brought a swath of tankers that deliver Moscow’s crude to a halt — reinforcing the significance of the measures in any negotiations over ending the war in Ukraine.

About 60% — 94 out 154 — of the active tankers blacklisted by the outgoing Biden administration last month for their involvement in the Russian oil trade have stopped hauling barrels for Moscow or anyone else, ship-tracking data compiled by Bloomberg show. Another seven were under construction or undergoing sea trials.

On Wednesday, US President Donald Trump said he’d spoken to Vladimir Putin about ending the war in Ukraine. The discussions touched on energy but, according to Kremlin spokesman Dmitry Peskov, not sanctions.

However, the Jan. 10 measures are forcing Russia to rewire its oil supply chain to find alternative ships — and pay high freight costs for them. It’s also delivering cargoes in unusual ways. At stake is the country’s capacity to keep supplying increasingly cautious customers and, ultimately, Russia’s own production of hydrocarbons.

While there’s no sign yet that output is being hurt by the measures, Russia’s tanker fleet clearly is being disrupted. Around half of the idled vessels observed by Bloomberg became inactive as soon as they were blacklisted.

To be clear, it’s too soon to say what will happen to the remaining tankers that were sanctioned on Jan. 10 and are still operating for now. If history is any guide some will also be forced to stop trading.

Of 44 that have taken on cargoes since being blacklisted, 20 are operating solely within Russia. Another nine are specialized shuttle ships used by two projects on Sakhalin Island in Russia’s Far East, most of which are struggling to offload their consignments.

However, some buyers and buyer countries have balked at dealing with sanctioned shipments in the wake of the US Treasury’s measures.

The Indian government has said it won’t allow sanctioned ships to dock at its ports after Feb. 27 and before then only if they are carrying cargoes loaded prior to Jan. 10. Many ports in China’s Shandong province, a hub for independent refiners, are wary of handling sanctioned tankers after a warning from a major terminal operator. Likewise, the biggest refiner in Turkey, Russia’s other major customer, is also restricting purchases to avoid falling foul of US sanctions.

The reluctance of Moscow’s biggest buyers to accept vessels sanctioned by Washington is starting to cause logistics headaches for exporters.

Emerging Clusters

While the idled ships are dotted across the globe, there are places where some have clustered.

Those locations include Ust-Luga in the Baltic Sea, the Black Sea — although most disappear from automated tracking systems on entering that body of water — and the Sea of Marmara. In Asia, groups of vessels are anchored near the Russian port of Kozmino and China’s Zhoushan.

More have gathered in the Riau archipelago, east of Singapore, which is better known in the market for the clandestine transfer of Iranian cargoes.

About 2 million barrels of Sokol crude from the Sakhalin 1 project have been transferred onto a very large crude carrier for onward shipment to China from specialized shuttle tankers that were blacklisted. Two more shuttle ships are idling near China with cargoes on board.

The Sakhalin 2 project is also experiencing delays in offloading cargoes. All three of the shuttle tankers it normally uses are idling, while a fourth pulled in to carry its oil has come to a near halt in the Sea of Japan.

Elsewhere, only crude from the Arctic port of Murmansk is still being exported on sanctioned tankers in any significant quantity. That oil is already hauled to the port and stored there on blacklisted vessels.

The first of the ships carrying Arctic crude from Murmansk are still at least a week away from their destinations.

Several previously identified as heading to India are now signaling North China or possible storage locations off Oman.

©2025 Bloomberg L.P.

By Julianne Geiger - Feb 13, 2025

Russia has increased oil production despite facing Western sanctions, highlighting the effectiveness of its workarounds to circumvent restrictions.

The IEA has revised its forecasts, acknowledging Russia's ability to maintain oil output despite sanctions.

The global oil market faces uncertainty, with rising supply, potential plateauing of Chinese demand, and the ongoing impact of the Ukraine conflict.

If you thought Russia’s oil industry would finally take a hit from Washington’s latest round of sanctions, think again. According to the International Energy Agency (IEA), Moscow is already crafting new workarounds, keeping its oil flowing despite restrictions that were supposed to tighten the screws. The IEA, which has had to revise its Russian supply forecasts more times than it cares to admit, now says the country’s crude output actually rose by 100,000 barrels per day (bpd) in January, hitting 9.2 million bpd.

Sanctions, it turns out, are just another puzzle for Moscow to solve. This time, Russia is hunting for smaller tankers to supplement its so-called shadow fleet, ensuring its crude keeps moving—mostly to India and China, which have happily stepped in to buy discounted barrels. And the IEA is already hedging its bets, admitting that “workarounds may well appear in the coming weeks.”

They know Russia will find a way.

Meanwhile, the broader oil market is dealing with its own surprises. The IEA nudged up its 2025 global oil demand forecast by 50,000 bpd to 1.1 million bpd, but supply is still expected to outpace demand, thanks to a surge in production from the Americas. Even if OPEC+ keeps its production cuts in place, global supply is set to rise by 1.6 million bpd this year—a number that doesn’t exactly scream tight markets.

Then there’s China, long the engine of oil demand growth. The IEA now believes China’s fuel consumption may have peaked, with gasoline, jet fuel, and diesel demand barely above 2019 levels. If true, that’s a significant shift. The big wildcard? Petrochemicals, which could still keep China’s crude intake steady—but the days of roaring Chinese fuel demand might be numbered.

Despite all this, oil prices are a rollercoaster. Brent spiked over $82 a barrel in mid-January, only to slide back to the mid-$70s on talk of a possible Russia-Ukraine peace deal and fears of an economic slowdown.

So, where does that leave us? Russia keeps dodging sanctions, oil supply keeps growing, and China’s demand might be plateauing.

By Julianne Geiger for Oilprice.com

No comments:

Post a Comment