Sell-off as investors take fright at prospect of surge in government borrowing to cover huge tax cuts

Sterling was down by two cents agains the dollar to a fresh 37-year low.

Photograph: Dado Ruvić/Reuters

Fri 23 Sep 2022

The pound has fallen below $1.10 for the first time since 1985 as investors took fright at the prospect of a surge in government borrowing to pay for Kwasi Kwarteng’s sweeping tax cuts.

Issuing a punishing verdict on the chancellor’s “dash for growth”, traders sent sterling tumbling on Friday in a broad-based sell-off in response to the huge rise in public borrowing required to finance his plans.

Analysts at the US investment bank JPMorgan said the market reaction demonstrated “a broader loss of investor confidence in the government’s approach”, reflecting the damage to Britain’s standing in global markets.

Citi analysts said the chancellor’s tax giveaway, the biggest since 1972 , “risks a confidence crisis in sterling”.

The pound was down two and a half cents against the dollar to a fresh 37-year low of $1.0993 as fears over the future path for the public finances also triggered a surge in government borrowing costs. The fall below the symbolic $1.10 mark came after the chancellor announced £45bn of tax cuts directed at higher earners.

The FTSE 100 fell more than 2% to trade below 7,000 for the first time since early March, after Russia’s invasion of Ukraine, while the cost of borrowing for the UK government on international markets rose by the most in a single day for more than a decade.

Two-year UK government bond yields – which are inversely related to the value of bonds and rise as they fall – jumped by as much as 0.4 percentage points to come close to 4%, reaching the highest level since the 2008 financial crisis.

Borrowing costs on 10-year bonds rose by more than 0.2 percentage points to trade close to 3.8%, continuing a dramatic climb under way since Liz Truss took over as prime minister earlier this month. At the start of September, yields on benchmark UK sovereign debt have risen by almost one percentage point, significantly more than for comparable advanced economies.

“[It’s] really hard to overstate the degree to which the Kwarteng budget has just wrecked the gilt market,” said Toby Nangle, a former fund manager at Columbia Threadneedle. Illustrating the scale of the turmoil, he said five-year gilt yields had moved by the most in a single day since 1993 - surpassing the Covid pandemic, the 2008 financial crisis, and 9/11.

Investors warned Britain’s experiment with Trussonomics comes at a challenging moment with a soaring US dollar, rising interest rates from global central banks, and with higher borrowing costs across advanced economies amid weaker economic growth and soaring inflation.

However, they said Britain was being singled out after years of the government damaging its reputation for sound economic management, compounded by the steps being taken by the new prime minister.

Gabriele Foa, a portfolio manager at Algebris Investments, said: “We are in a situation in which the UK government has lost a lot of credibility in the past three to four years and pushed the market’s patience in a lot of ways.

“[It’s about] Covid management, government instability, the management of Brexit. It is just a big, let’s say, series of concerns. The UK was in the first league, [but] it’s moving from first, to second to third. If you give some signs that you’re not reliable you move leagues.”

It comes after the Treasury said it would finance the chancellor’s tax cuts and the energy price guarantee for consumers and businesses with £72.4bn in additional UK government debt sales than planned for the current financial year.

Instead of the £161.7bn planned by the Debt Management Office in April, the Treasury said it would now sell £234.1bn of government bonds to international investors in 2022-23.

The change will mean investors are being approached to buy significantly more government debt than previously expected, and comes in addition to the Bank of England preparing to sell £80bn of gilts held on its balance sheet thanks to its quantitative easing programme.

Markets bet the Bank would be forced by Kwarteng’s support schemes to ramp interest rates above 5% by May next year – more than double the current rate of 2.25% – on the expectation they would add significantly to inflationary pressures.

Vivek Paul, a senior portfolio strategist at BlackRock, said: “The credibility of the UK is what markets are reacting to.

“Over time we will know if there will be a fundamental change. The jury is out, [but] the initial reaction from markets is not a ringing endorsement. Let’s put it that way.”

The moves come as the Bank responds to soaring inflation by raising interest rates, despite warning that Britain’s economy is already in recession.

Antoine Bouvet, a senior rates strategist, and Chris Turner, the global head of markets at the Dutch bank ING, said the conditions amounted to a “perfect storm” for the UK as global markets shun sterling and gilts.

“Price action in UK gilts is going from bad to worse. A daunting list of challenges has arisen for sterling-denominated bond investors, and the Treasury’s mini-budget has done little to shore up confidence.”

The pound has fallen below $1.10 for the first time since 1985 as investors took fright at the prospect of a surge in government borrowing to pay for Kwasi Kwarteng’s sweeping tax cuts.

Issuing a punishing verdict on the chancellor’s “dash for growth”, traders sent sterling tumbling on Friday in a broad-based sell-off in response to the huge rise in public borrowing required to finance his plans.

Analysts at the US investment bank JPMorgan said the market reaction demonstrated “a broader loss of investor confidence in the government’s approach”, reflecting the damage to Britain’s standing in global markets.

Citi analysts said the chancellor’s tax giveaway, the biggest since 1972 , “risks a confidence crisis in sterling”.

The pound was down two and a half cents against the dollar to a fresh 37-year low of $1.0993 as fears over the future path for the public finances also triggered a surge in government borrowing costs. The fall below the symbolic $1.10 mark came after the chancellor announced £45bn of tax cuts directed at higher earners.

The FTSE 100 fell more than 2% to trade below 7,000 for the first time since early March, after Russia’s invasion of Ukraine, while the cost of borrowing for the UK government on international markets rose by the most in a single day for more than a decade.

Two-year UK government bond yields – which are inversely related to the value of bonds and rise as they fall – jumped by as much as 0.4 percentage points to come close to 4%, reaching the highest level since the 2008 financial crisis.

Borrowing costs on 10-year bonds rose by more than 0.2 percentage points to trade close to 3.8%, continuing a dramatic climb under way since Liz Truss took over as prime minister earlier this month. At the start of September, yields on benchmark UK sovereign debt have risen by almost one percentage point, significantly more than for comparable advanced economies.

“[It’s] really hard to overstate the degree to which the Kwarteng budget has just wrecked the gilt market,” said Toby Nangle, a former fund manager at Columbia Threadneedle. Illustrating the scale of the turmoil, he said five-year gilt yields had moved by the most in a single day since 1993 - surpassing the Covid pandemic, the 2008 financial crisis, and 9/11.

Investors warned Britain’s experiment with Trussonomics comes at a challenging moment with a soaring US dollar, rising interest rates from global central banks, and with higher borrowing costs across advanced economies amid weaker economic growth and soaring inflation.

However, they said Britain was being singled out after years of the government damaging its reputation for sound economic management, compounded by the steps being taken by the new prime minister.

Gabriele Foa, a portfolio manager at Algebris Investments, said: “We are in a situation in which the UK government has lost a lot of credibility in the past three to four years and pushed the market’s patience in a lot of ways.

“[It’s about] Covid management, government instability, the management of Brexit. It is just a big, let’s say, series of concerns. The UK was in the first league, [but] it’s moving from first, to second to third. If you give some signs that you’re not reliable you move leagues.”

It comes after the Treasury said it would finance the chancellor’s tax cuts and the energy price guarantee for consumers and businesses with £72.4bn in additional UK government debt sales than planned for the current financial year.

Instead of the £161.7bn planned by the Debt Management Office in April, the Treasury said it would now sell £234.1bn of government bonds to international investors in 2022-23.

The change will mean investors are being approached to buy significantly more government debt than previously expected, and comes in addition to the Bank of England preparing to sell £80bn of gilts held on its balance sheet thanks to its quantitative easing programme.

Markets bet the Bank would be forced by Kwarteng’s support schemes to ramp interest rates above 5% by May next year – more than double the current rate of 2.25% – on the expectation they would add significantly to inflationary pressures.

Vivek Paul, a senior portfolio strategist at BlackRock, said: “The credibility of the UK is what markets are reacting to.

“Over time we will know if there will be a fundamental change. The jury is out, [but] the initial reaction from markets is not a ringing endorsement. Let’s put it that way.”

The moves come as the Bank responds to soaring inflation by raising interest rates, despite warning that Britain’s economy is already in recession.

Antoine Bouvet, a senior rates strategist, and Chris Turner, the global head of markets at the Dutch bank ING, said the conditions amounted to a “perfect storm” for the UK as global markets shun sterling and gilts.

“Price action in UK gilts is going from bad to worse. A daunting list of challenges has arisen for sterling-denominated bond investors, and the Treasury’s mini-budget has done little to shore up confidence.”

At the time of Anthony Barber’s ‘dash for growth’ budget, a pint of milk cost 6p, Nilsson was top of the charts and Brian Clough was in his heyday at Derby County

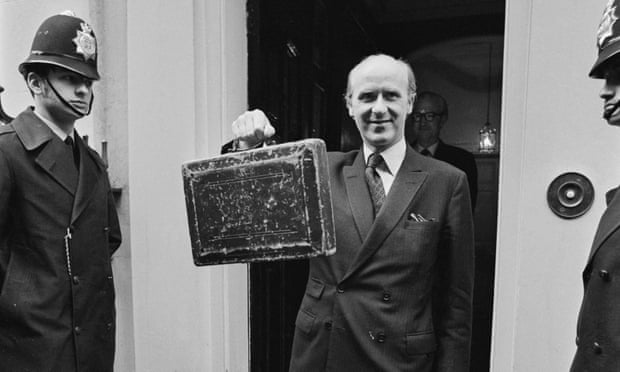

Chancellor Anthony Barber outside 11 Downing Street in 1971.

Photograph: William Lovelace/Getty Images

Martin Belam

Cost of living crisis, 1972 style

Barber’s budget was called the “dash for growth”, but the prices of everyday items seem laughably cheap by today’s standards. A pint of milk cost 6p in March 1972, butter was around 13p and a gallon of four-star petrol – leaded, naturally – would have set you back 35p or about 8p per litre. If you’d just bought a brand new Ford Cortina to fill up, the car would have cost you £963. The land registry suggests the average house price was £5,158. If you still couldn’t afford a car or a house, you could always drown your sorrows with a 14p pint of beer while smoking the packet of 20 cigarettes that had set you back around 25p inside the pub. Just 13 months after decimalisation, though, people could still be forgiven for getting confused about prices in “new money”.

Television, when it was actually on

In an era when both BBC channels still had periods of “closedown” scattered through the day and parliament was not televised, on BBC One Brian Widlake presented an afternoon budget special entitled Budget Special 1972: Confidence or Crisis? with contributors including Brian Walden and Robin Day.

That meant children’s programmes were shifted over to BBC Two, where you could catch Tony Hart on Vision On and there was a Jackanory story to enjoy. Later that night on BBC One, Robert Hardy narrated a documentary about the British Empire and Barry Norman was reviewing movies in Film 72. Of course, to have enjoyed all that, you would have had to pay for your television licence, which was £7 for a black-and-white set and £12 if you wanted to watch in colour.

The sounds of the 70s

The No 1 single in the UK that week was Without You by Nilsson, a track that was also a No 1 in Ireland, Australia and the US. Also in the top ten were American Pie by Don McLean and Hold Your Head Up by Argent. Lindisfarne were top of the album charts with Fog on the Tyne, an album that spent over a year in the UK chart including four weeks in the top spot.

Martin Belam

THE GUARDIAN

Fri 23 Sep 2022

The Institute for Fiscal Studies has said Kwasi Kwarteng’s announcement on Friday amounts to the biggest tax-cutting budget since Anthony Barber’s on the 21 March 1972, just over 50 years ago. Here is a roundup of some of the prices you would have been paying, and things you might have been watching and listening to at the time.

The Institute for Fiscal Studies has said Kwasi Kwarteng’s announcement on Friday amounts to the biggest tax-cutting budget since Anthony Barber’s on the 21 March 1972, just over 50 years ago. Here is a roundup of some of the prices you would have been paying, and things you might have been watching and listening to at the time.

Cost of living crisis, 1972 style

Barber’s budget was called the “dash for growth”, but the prices of everyday items seem laughably cheap by today’s standards. A pint of milk cost 6p in March 1972, butter was around 13p and a gallon of four-star petrol – leaded, naturally – would have set you back 35p or about 8p per litre. If you’d just bought a brand new Ford Cortina to fill up, the car would have cost you £963. The land registry suggests the average house price was £5,158. If you still couldn’t afford a car or a house, you could always drown your sorrows with a 14p pint of beer while smoking the packet of 20 cigarettes that had set you back around 25p inside the pub. Just 13 months after decimalisation, though, people could still be forgiven for getting confused about prices in “new money”.

A Ford Cortina would have set you back £973 in 1972.

Photograph: David Newell Smith/The Observer

Television, when it was actually on

In an era when both BBC channels still had periods of “closedown” scattered through the day and parliament was not televised, on BBC One Brian Widlake presented an afternoon budget special entitled Budget Special 1972: Confidence or Crisis? with contributors including Brian Walden and Robin Day.

That meant children’s programmes were shifted over to BBC Two, where you could catch Tony Hart on Vision On and there was a Jackanory story to enjoy. Later that night on BBC One, Robert Hardy narrated a documentary about the British Empire and Barry Norman was reviewing movies in Film 72. Of course, to have enjoyed all that, you would have had to pay for your television licence, which was £7 for a black-and-white set and £12 if you wanted to watch in colour.

The sounds of the 70s

The No 1 single in the UK that week was Without You by Nilsson, a track that was also a No 1 in Ireland, Australia and the US. Also in the top ten were American Pie by Don McLean and Hold Your Head Up by Argent. Lindisfarne were top of the album charts with Fog on the Tyne, an album that spent over a year in the UK chart including four weeks in the top spot.

David Bowie performs Starman on Top of the Pops in 1972.

Photograph: YouTube/GreatGuitarHeroes

The US singer-songwriter Judee Sill was the guest musician on the Old Grey Whistle Test on the day of the budget, while Thursday’s edition of Top of the Pops is one you will not have seen repeated on BBC Four recently, as it was presented by Jimmy Savile. It included the Chiffons, Olivia Newton-John, Labi Siffre and Tom Jones.

The Radio One DJ lineup on the day of the budget was a veritable who’s who of broadcasting, including Tony Blackburn, Jimmy Young, Dave Lee Travis, Johnny Walker, Terry Wogan, Annie Nightingale and John Peel. John Timpson and Robert Robinson were presenting the Today programme on Radio 4, while Radio 2 handled the coverage of the budget in the afternoon.

Clough’s glory days with Derby County

In football, Derby County were on their way to winning their first English Division One title under the genius management of Brian Clough. Ahead of the budget they beat Leicester 3-0, while Liverpool, their rivals for the title, thrashed Newcastle 5-0 . Leeds United were busy dispensing with Tottenham 2-1 in the FA Cup on their way to eventually winning it. In Scotland, Celtic were heading to the seventh of nine consecutive titles, while Glasgow Rangers would eventually lift the now-defunct European Cup-Winners Cup that year.

The US singer-songwriter Judee Sill was the guest musician on the Old Grey Whistle Test on the day of the budget, while Thursday’s edition of Top of the Pops is one you will not have seen repeated on BBC Four recently, as it was presented by Jimmy Savile. It included the Chiffons, Olivia Newton-John, Labi Siffre and Tom Jones.

The Radio One DJ lineup on the day of the budget was a veritable who’s who of broadcasting, including Tony Blackburn, Jimmy Young, Dave Lee Travis, Johnny Walker, Terry Wogan, Annie Nightingale and John Peel. John Timpson and Robert Robinson were presenting the Today programme on Radio 4, while Radio 2 handled the coverage of the budget in the afternoon.

Clough’s glory days with Derby County

In football, Derby County were on their way to winning their first English Division One title under the genius management of Brian Clough. Ahead of the budget they beat Leicester 3-0, while Liverpool, their rivals for the title, thrashed Newcastle 5-0 . Leeds United were busy dispensing with Tottenham 2-1 in the FA Cup on their way to eventually winning it. In Scotland, Celtic were heading to the seventh of nine consecutive titles, while Glasgow Rangers would eventually lift the now-defunct European Cup-Winners Cup that year.

Brian Clough (left) and his assistant Peter Taylor show off the League Championship trophy to jubilant Derby County fans in May 1972.

Photograph: PA Photos/PA

In rugby union, Scotland had won the Calcutta Cup 23-9 against England at Murrayfield the weekend before the budget, in a Five Nations tournament truncated by the political upheaval following Bloody Sunday in Northern Ireland that January, which meant Ireland’s home fixtures against Scotland and Wales were cancelled.

Elsewhere in sport, Eddy Merckx won both the Giro D’Italia and Tour de France, Jack Nicklaus was the highest earner on the golf circuit, Alex Higgins was world snooker champion, and Emerson Fittipaldi took the F1 crown.

Also in the news

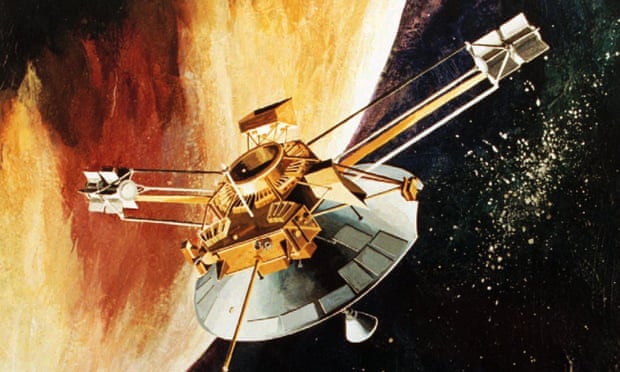

Nasa launched Pioneer 10 in March on its way to study Jupiter before becoming the first human-made object to leave the solar system, and Apollo 16 was scheduled to head to the moon in early April. The Godfather had its premiere in New York before going on to be the highest-grossing movie of the year ahead of The Poseidon Adventure.

In rugby union, Scotland had won the Calcutta Cup 23-9 against England at Murrayfield the weekend before the budget, in a Five Nations tournament truncated by the political upheaval following Bloody Sunday in Northern Ireland that January, which meant Ireland’s home fixtures against Scotland and Wales were cancelled.

Elsewhere in sport, Eddy Merckx won both the Giro D’Italia and Tour de France, Jack Nicklaus was the highest earner on the golf circuit, Alex Higgins was world snooker champion, and Emerson Fittipaldi took the F1 crown.

Also in the news

Nasa launched Pioneer 10 in March on its way to study Jupiter before becoming the first human-made object to leave the solar system, and Apollo 16 was scheduled to head to the moon in early April. The Godfather had its premiere in New York before going on to be the highest-grossing movie of the year ahead of The Poseidon Adventure.

Nasa’s Pioneer 10 spacecraft. Photograph: Associated Press

Closer to home, just a few days after the budget London would impose direct rule on Northern Ireland, and the summer of 1972 was the last time you could legally leave school at 15. The age was raised to 16 from 1 September.

The more things change …

Some things remain surprisingly constant. When Barber stood up to make his budget speech, the third Doctor Who, Jon Pertwee, was part of the way through a six-part adventure pitting him against The Sea Devils – monsters that returned to celebrate their own own 50th anniversary in this year’s Doctor Who Easter Special starring the 13th Doctor, Jodie Whittaker.

And what happened to Anthony Barber?

Within months of his budget the chancellor was forced to float the pound, which led to a sharp decrease in its value and huge inflationary pressure on the economy, which failed to grow in the way his tax-cutting measures had been intended to stimulate. After industrial unrest, Ted Heath called a general election early in 1974 and Barber lost his job as chancellor as Harold Wilson was returned to office with a minority Labour government. Barber did not stand for re-election when Wilson called the second general election of 1974 in October in a bid to secure a majority, which he narrowly achieved. Barber went off to work in the world of banking, where at one point a certain John Major was under his tutelage.

Closer to home, just a few days after the budget London would impose direct rule on Northern Ireland, and the summer of 1972 was the last time you could legally leave school at 15. The age was raised to 16 from 1 September.

The more things change …

Some things remain surprisingly constant. When Barber stood up to make his budget speech, the third Doctor Who, Jon Pertwee, was part of the way through a six-part adventure pitting him against The Sea Devils – monsters that returned to celebrate their own own 50th anniversary in this year’s Doctor Who Easter Special starring the 13th Doctor, Jodie Whittaker.

And what happened to Anthony Barber?

Within months of his budget the chancellor was forced to float the pound, which led to a sharp decrease in its value and huge inflationary pressure on the economy, which failed to grow in the way his tax-cutting measures had been intended to stimulate. After industrial unrest, Ted Heath called a general election early in 1974 and Barber lost his job as chancellor as Harold Wilson was returned to office with a minority Labour government. Barber did not stand for re-election when Wilson called the second general election of 1974 in October in a bid to secure a majority, which he narrowly achieved. Barber went off to work in the world of banking, where at one point a certain John Major was under his tutelage.

No comments:

Post a Comment