, BNN Bloomberg

This story was last updated on Nov. 29 to reflect recent developments.

Panama’s government plans to shut down a giant copper mine owned by Canada’s First Quantum Minerals Ltd., after a Supreme Court ruling found the mine’s contract was unconstitutional.

The recent developments follow weeks of anti-mining protests that have rocked the country and forced First Quantum to halt operations.

Here is a look at how we got here.

WHAT IS FIRST QUANTUM? WHAT IS ITS PRESENCE IN PANAMA?

First Quantum is a Canadian copper company that operates globally, with offices in Toronto and Vancouver. The company says it operates long-life mines in several countries. It is listed on the Toronto Stock Exchange.

First Quantum’s Panama presence includes its newest operation, the Cobre Panama mine, considered its most lucrative asset. The company describes this mine as one of the largest new copper mines opened globally over the past decade, with three billion tons of “proven and probable” copper reserves. Commercial production started in 2019.

In November 2017, First Quantum increased its ownership interest in the Panamanian company that holds the Cobre Panama concession, Minera Panamá S.A., to 90 per cent.

WHAT IS THE LATEST ON THE SITUATION IN PANAMA?

His statement posted on X came after a unanimous Supreme Court ruling that found the Cobre Panama’s mining contract license was unconstitutional. Cortizo did not say how long the process of closing the mine would take.

The court ruling followed weeks of protests from environmentalists concerned about Cobre Panama’s impact.

First Quantum didn’t immediately comment on the court decision, Bloomberg News reported.

But days earlier, the company took the first steps in an arbitration process with Panama over the mining contract at the heart of the mass protests.

The company said it issued an arbitration notice on Sunday to the administration of Panama’s president, Laurentino Cortizo.

Last month, Panama extended the company’s mining license but later reversed its position and proposed to put First Quantum’s future operation in the region to a vote.

The proposed referendum, as well as a push for the country’s congress to repeal the contract, were set aside as the government awaited the Supreme Court’s ruling on whether to end the agreement.

Last week, the company ceased commercial production as a port blockade of small boats prevented the delivery of key supplies.

Earlier this month, First Quantum reduced operations at its flagship copper mine in Panama as a result of protests, local opposition and the blockade, the company said.

Thousands of protesters have taken to the streets in Panama over a government decision to extend First Quantum’s mining license.

The protests stem from a 20-year extension to First Quantum’s assets. Panama’s government also received a larger share of revenue, according to Bloomberg News.

Environmentalists and student groups began blocking highways in October in opposition to the mining contract extension. The protests have seen clashes with police and the unrest has resulted in rising food prices in the capital city, Panama City, as farms were cut off.

On Sunday a group of protestors attacked workers that were leaving the mine, according to a union leader. The Associated Press reported earlier this month that two people had died while participating in the third week of protests.

WHY ARE PEOPLE PROTESTING THE MINING CONTRACT?

Demonstrators have demanded the Panamanian government annul its contract that allows First Quantum to continue operation of its open-pit copper mine in a biodiverse jungle area.

Indigenous groups have said the mine threatens the area's delicate ecosystem.

Panama’s government, meanwhile, has said the mine is an important source of employment.

HOW HAS THE COMPANY BEEN AFFECTED?

Since Cortizo changed his posture on First Quantum’s operations in late October, First Quantum has lost about half of its market value.

Last week the company ceased commercial operations amid a port blockade that restricted incoming supplies.

That followed an earlier reduction in operations at Cobre Panama this month, when First Quantum said in a press release it was “ramping down one ore processing train while two remain operational” due to an “illegal blockade.”

Investment expert Lyle Stein, president of Forvest Global Wealth Management, said in an interview with BNN Bloomberg earlier this month that the situation shows how problems can arise when large amounts of capital are committed to smaller areas.

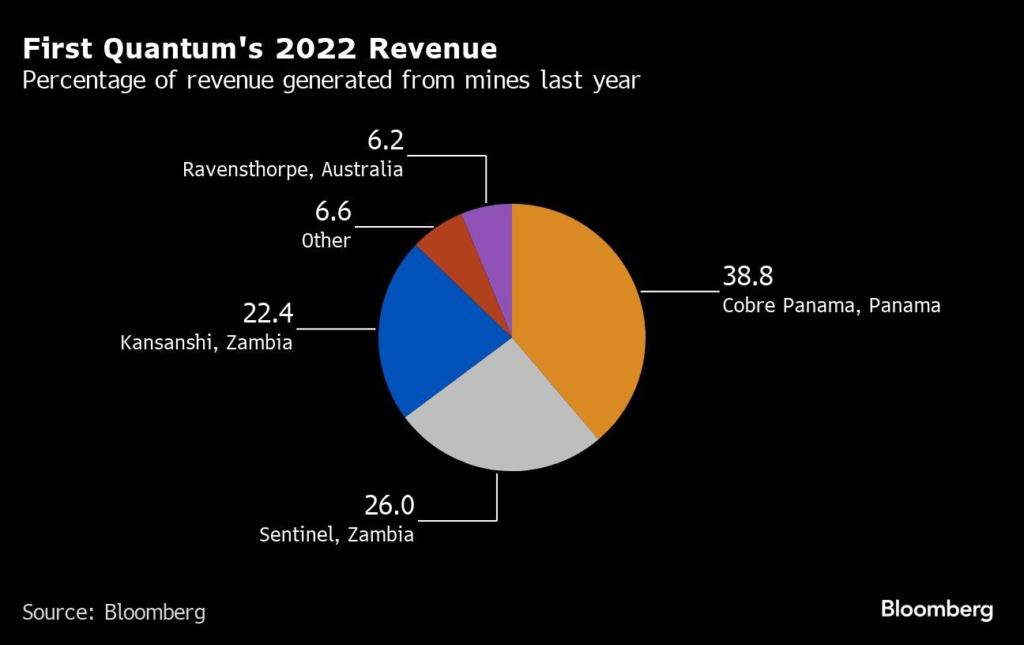

“Once it's all spent, you really are at the mercy of governments and now the populations that surround the mine. It is a big risk in mining investment, it's a big risk in global investment anywhere,” he said. “Diversification is big and in the case of First Quantum, Cobra Panama is a very big asset relative to its entire operation.”

With files from Holly McKenzie-Sutter, The Canadian Press, The Associated Press and Bloomberg News.

Cobre Panama mine is First Quantum Minerals’ largest copper operation. (Image courtesy of Cobre Panama.)

A plan to close a major mine in Panama is threatening to upend the global copper market by whipsawing the industry back into a period of tighter supply.

Until recently, the broad consensus among forecasters was that copper would enjoy a comfortable surplus for the next few years, before tightening sharply later in the decade as supply struggles to keep up with surging demand for the energy transition.

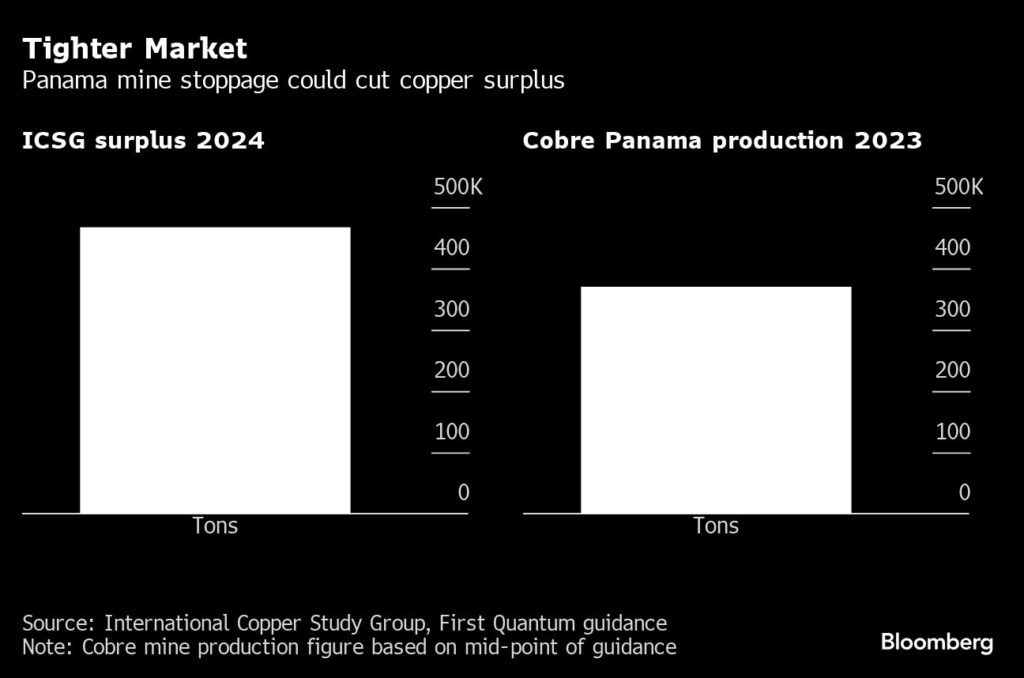

The expectation for a looser market in the near term has been reflected in copper prices, which drifted sideways for most of this year, while inventory levels on the London Metal Exchange bounced back from perilously low levels to hit a two-year high last month. In early October, the International Copper Study Group said it expects a surplus of 467,000 tons next year — its largest forecast for a glut since 2014.

Now, the news that Panama intends to shut down one of the world’s biggest and newest copper mines threatens to disrupt that trajectory. Copper prices have risen about 6% since the protests erupted in Panama, and touched a 10-week high earlier on Wednesday before retreating.

Shrinking surplus

First Quantum Minerals Ltd.’s $10 billion Cobre Panama operation produces about 1.5% of the world’s copper supply, and boasts estimated copper resources worth more than $100 billion at current prices, according to Bloomberg calculations.

The project has been the target of protests across the central American country over the past six weeks, culminating in Tuesday’s announcement by President Laurentino Cortizo that authorities will start a process to close the mine after a supreme court ruling against it.

The Canadian company, which had already temporarily stopped production after protesters blocked supplies from reaching the mine, said on Wednesday it was still open to dialog and would seek clarification from the government, while listing a large number of concerns regarding a potential closure. Some analysts have suggested the mine could reopen under a new government after Panama’s election in May, if the company is able to renegotiate new terms.

But based on its estimated annual production of as much as 375,000 tons this year, a prolonged or permanent shutdown at Cobre Panama would erode most of the ICSG’s predicted surplus in 2024. The effect would be even more dramatic using a surplus of 355,000 tons forecast by Citigroup Inc. analysts.

Concentrates pressure

The shutdown at Cobre Panama comes at a particularly sensitive time in the market for copper concentrates, an intermediate product used to make refined metal, as Chinese smelters negotiate processing fees for next year with key mining suppliers.

In the first of such deals, Chilean miner and Antofagasta Plc and smelter Jinchuan Group agreed to copper-concentrate supply contracts for 2024 that set processing charges 9% lower than this year.

The drop is a sign of how the concentrate market has been tightening — partly because of a massive expansion of Chinese smelter capacity, which increases competition for the feedstock, and partly because of concern about the future of Cobre Panama — even before the president’s announcement on Tuesday.

“This is a significant event, adding uncertainty to the supply outlook,” said Craig Lang, principal analyst at researcher CRU Group. “This is likely to place further downwards pressure on copper concentrate market terms as smelters and traders look to cover Panama supply with alternative sources of material.”

Refined flows

Cobre Panama is a major supplier of concentrate to the Chinese market, where visible stocks of refined copper remain near multi-year lows, as robust consumption by electricity grids and the renewable energy industry counter depressed demand elsewhere.

A further tightening of the market could increase the flow of refined metal into the country, depleting stockpiles held elsewhere that have only partially recovered from the low levels seen earlier this year.

The supply disruptions also come as China is becoming increasingly aggressive in taking measures to shore up its ailing property sector, a significant pillar of global copper demand, while a slump in global bond yields makes the metal more attractive to investors.

And Cobre Panama isn’t the only mine facing disruptions. Workers at MMG Ltd.’s copper mine in Peru — another large operation — began a strike this week but will return to work on Thursday after authorities declared the action unfounded.

“For the past five years in a row, the mine disruption rate has been above the average of this century,” CRU Group’s Lang said.

(By Eddie Spence and Mark Burton)

First Quantum risks covenant breach, cost cuts if Panama shuts copper mine

Bloomberg News | November 30, 2023 |

Cobre Panama mine began producing and shipping copper concentrates in June 2019. (Image courtesy of Cobre Panama.)

First Quantum Minerals Ltd. could be forced to slow spending next year and face a potential breach of debt covenants if Panama follows through on plans to close a copper mine that generated roughly $1 billion in profit last year.

The Cobre Panama mine has been the Canadian firm’s top money maker since its 2019 opening and was expected to account for almost half of worldwide sales next year. Now, after the government announced plans to shutter the $10 billion operation, First Quantum may have to trim spending elsewhere or sell assets in order to remain in compliance with lender agreements.

The company is facing an estimated $625 million in debt maturities next year and another $1.8 billion in 2025, according to Citigroup. Without Cobre Panama’s revenue, the company appears likely to violate some debt covenants, chief financial officer Ryan MacWilliam told a conference hosted by Bank of Nova Scotia on Wednesday. First Quantum shares dropped 10% to a three-year low.

First Quantum’s $1.3 billion of 8.625% bonds due 2031 was quoted at 79.5 cents on the dollar, according to Trace bid prices Wednesday. That compared with around 86.5 cents a month earlier.

MacWilliam’s remarks capped a dramatic six weeks during which protests erupted in Panama over a decision to approve a new operating contract for the mine. President Laurentino Cortizo initially shocked investors by announcing a referendum on the project before backtracking to await a ruling by the Supreme Court. On Tuesday, the court unanimously ruled the law approving the contract was unconstitutional.

It’s as-yet unclear how serious the risk is of a permanent closure of Cobre Panama. That said, First Quantum would post negative free cash flow of about $300 million a quarter without it — at least initially, Citigroup Inc. analysts wrote in a note to clients.

First Quantum could partially salve the wound of Cobre Panama’s loss by slowing spending in other regions next year.

“There are levers they can pull in terms of non-core asset sales or capital cost reductions,” said National Bank of Canada analyst Shane Nagle. “The biggest financial hurdle will be coming close to the covenants on the revolving credit facility by this time next year without Cobre Panama in operation.”

The firm had previously planned to spend $1.8 billion on expansion projects in coming years, including $535 million in Zambia. New corporate guidance is expected to be disclosed in January, according to a Scotiabank analyst note.

(By Jacob Lorinc and James Attwood)

Bloomberg News | November 29, 2023 |

New contract awarding a 20-year extension to First Quantum’s mining license has led to relentless protests. (Image courtesy of News of the World (NOW) | YouTube.)

Staff and contractors at First Quantum Minerals Ltd.’s Panamanian copper mine staged demonstrations across the country Wednesday, demanding the government protect their jobs or ensure they receive compensation if they are laid off.

Workers marched through city streets, blocking roads and waving flags, a day after the Supreme Court ruled the law governing a new contract for the Cobre Panama mine was unconstitutional. Some carried signs that read “You also use 100% Panamanian copper.”

The backlash from members of the mine’s 7,000-strong workforce — as well as suppliers and contractors that account for a total of about 40,000 jobs — comes as anti-mining protesters celebrate President Laurentino Cortizo’s pledge to respect the court’s ruling and begin the process of closing the mine.

While environmentalists and some other non-mining labor unions have held protests since Oct. 20 when Congress passed the new contract, workers are fighting to keep their jobs — or at least receive proper compensation.

“This is a source of income for more than 40,000 households, and we don’t have a response as to what is going to happen to us,” union leader Michael Camacho told reporters. “We demand the government and the labor ministry respect our rights.”

Samuel Diaz, a spokesmen for suppliers of the mine, said more than 2,500 companies will be affected by the closure, and that many of those firms have already seen revenue decline over the past month amid uncertainty about the operation’s future.

Meanwhile, a construction workers union that’s against the mine vowed to stay on the streets until it’s closed. Other groups of anti-mine demonstrators, including environmentalists and civil groups, celebrated the court’s decision Tuesday night, blocking roads and setting off fireworks.

The $10 billion mine finds itself at the center of a tussle between economic development and prosperity and protecting the environment and national sovereignty. The mine accounts for more than 1% of global mined copper and delivers the government hundreds of millions of dollars a year in revenue.

First Quantum weighed in Wednesday, saying in a statement that the court’s ruling and Cortizo’s comments “do not take into account the rights of thousands of Panamanians who depend on the Cobre Panama mine and mining for their livelihood.”

(By Michael McDonald and James Attwood)

Panama orders First Quantum’s copper mine closure

Cecilia Jamasmie | November 29, 2023

President Laurentino Cortizo.

Panama has asked Canadian miner First Quantum Minerals (TSX: FM) to halt its Cobre Panama copper mine following a ruling by the Supreme Court that declared the mining contract for the operation unconstitutional.

President Laurentino Cortizo took to social media late on Tuesday to announce his government had started “the transition process for the orderly and safe closure of the mine.

The top court’s ruling capped six weeks of protests and official announcements over a contract that gave First Quantum 20 years of mining rights over the giant copper asset, with an option to extend the deal for another 20 years in return for $375 million in annual revenue to the Central American nation.

Challenges against the contract piled up in court following massive protests against the contract, which almost paralyzed the country.

Public figures including climate activist Greta Thunberg and Hollywood actor Leonardo Di Caprio backed the protests and shared a video calling for the “mega mine” to cease operations, which quickly went viral.

First Quantum’s local unit Minera Panama said in a statement on Wednesday that is interested in pursuing dialogue with the country’s government. It warned the court’s decision doesn’t touch several important points, such as how the government plans to prevent the arrival of illegal miners or what is going to happen to the more than 40,000 people directly and indirectly employed by Cobre Panama.

Workers staged demonstrations across the country later in the day, asking the government to protect their jobs or at least ensure they receive compensation if they are laid off.

Panama’s decision will have consequences for the copper market, as Cobre Panama mine accounts for about 1.5% of global production of the metal.

It will also affect the government’s coffers. The mine accounts for about 5% of its GDP and makes up 75% of Panama’s export of goods.

It is also likely to lead to international arbitration. First Quantum on Sunday sent Panamanian authorities a notification of intent to start arbitration proceedings.

It later clarified the move was not the beginning of a legal procedure, but rather “a formality required by international treaties, with the purpose of opening a dialogue period of at least 90 days between the parties.”

“Pursuing international arbitration to recoup the massive financial loss of Cobre Panama would likely take years to resolve,” Orest Wowkodaw, analyst with Scotia Capital Inc. wrote in a note to clients. “However, we believe this course of action could ultimately bear fruit.”

Cobre Panama, in production since 2019, generated 112,734 tonnes of copper in the third quarter of 2023, contributing $930 million to First Quantum’s overall third-quarter revenue of $2.02 billion.

Analysts at BMO Capital Markets believe that First Quantum is in a financial position that allows it to weather the storm in the short term.

“Under our base-case scenario which assumes Cobre Panama mine closure through 2023 year-end, First Quantum has sufficient liquidity,” BMO analyst Jackie Przybylowski wrote.

Challenges, she added, would arise if Cobre Panama remained halted for 80 days in 2024, as this would draw First Quantum’s cash down to zero at the bank’s current commodity and cash outflow assumptions.

“Tricky” spot

A closure for the first half of the year, beyond the May 2024 presidential election, would result in a $267 million cash shortfall, Przybylowski said. This estimation doesn’t including cash reserves required for working capital.

“The primary goal of the government and courts today appears to be calming the protests,” Przybylowski wrote on Tuesday. “We are optimistic that this approach will be successful, and that protests around the Cobre Panama port will subside, with mining operations likely to resume relatively quickly if protests are lifted.”

Lawyers contacted by MINING.COM said both the Panamanian government and First Quantum are now in a “tricky spot” since Cortizo’s administration passed a bill on Nov. 2 banning all new mining concessions and extensions. That could prevent the two parties from negotiating a new deal.

Panama’s top court rules First Quantum contract unconstitutional

Cecilia Jamasmie | November 28, 2023 |

Copper shipments from Cobre Panama mine. (Image courtesy of Cobre Panama.)

Panama’s Supreme Court ruled on Tuesday that First Quantum Minerals’ (TSX: FM) contract to operate its giant Cobre Panama copper mine, the only mining operation in the Central American country, is unconstitutional.

Challenges against the contract, which would have allowed Cobre Panama to keep operating for the next 20 years, piled up in court following public protests against the deal inked in October by the government and First Quantum’s local subsidiary, Minera Panama.

The court began deliberations on Friday and continued over the weekend. It announced a 12-hour break at the end of Monday’s session, delivering its verdict in in the early hours of Tuesday morning. The announcement was streamed live and watched by almost 24,000 people just in the first hour.

The court’s president Maria Eugenia Lopez said the vote against the contract had been unanimous, adding the ruling will now be published in the country’s official government newspaper.

President Laurentino Cortizo said in a post on X Tuesday that his government was ready to start “the transition process for the orderly and safe closure of the mine.”

First Quantum said in a statement that it was reviewing the ruling and that it “continues to reserve all its local and international legal rights in regards to developments in Panama.”

The Supreme Court decision adds to a growing list of questions surrounding First Quantum’s Cobre Panama mine and its implications.

Lawyers contacted by MINING.COM agree that the most immediate effect would be a freeze of First Quantum’s operations in the country. This doesn’t mean much though, they said, as Cobre Panama has been halted since Friday.

A previous contract was ruled illegal once before, in 2017, but the mine continued to operate as usual while both parties negotiated a new deal. Unprecedented public anger against the project this time may force the government to adopt a stricter approach, local sources said.

Multi-layer earthquake

The ruling will have consequences for the copper market, as Cobre Panama mine accounts for about 1.5% of global production of the metal.

It will also affect the government’s coffers. The mine accounts for about 5% of its GDP and makes up 75% of Panama’s export of goods, supporting at least 40,000 jobs, directly and indirectly.

It is also likely to lead to international arbitration. First Quantum on Sunday sent Panamanian authorities a notification of intent to start arbitration proceedings. It later clarified the move was not the beginning of a legal procedure, but rather “a formality required by international treaties, with the purpose of opening a dialogue period of at least 90 days between the parties.”

“Pursuing international arbitration to recoup the massive financial loss of Cobre Panama would likely take years to resolve,” Orest Wowkodaw, analyst with Scotia Capital Inc. wrote in a note to clients. “However, we believe this course of action could ultimately bear fruit.”

Panama legislators had ratified the new contract between the executive and First Quantum, but reconsidered their decision after massive protests — the largest since a cost of living crisis last July — almost paralyzed the country.

The land and sea ongoing demonstrations blocked the delivery of crucial supplies to the mine, forcing First Quantum to halt operations again this week. The protests have also affected farmers, schools, emergency services and a long list of businesses unable to keep up activities due to lack of staff and supplies, stranded along the many blocked routes in and out the capital city.

Over the weekend, demonstrators received endorsements from climate activist Greta Thunberg and Hollywood actor Leonardo Di Caprio, who shared a video calling for the “mega mine” to cease operations.

Cobre Panama, in production since 2019, generated 112,734 tonnes of copper in the third quarter of 2023, contributing $930 million to First Quantum’s overall third-quarter revenue of $2.02 billion.

Analysts at BMO Capital Markets believe that First Quantum is in a financial position that allows it to weather the storm in the short term.

“Under our base-case scenario which assumes Cobre Panama mine closure through 2023 year-end, First Quantum has sufficient liquidity,” BMO analyst Jackie Przybylowski wrote.

Challenges, she added, would arise if Cobre Panama remained halted for 80 days in 2024, as this would draw First Quantum’s cash down to zero at the bank’s current commodity and cash outflow assumptions.

A closure for the first half of the year, beyond the May 2024 presidential election, would result in a $267 million cash shortfall, Przybylowski said. This estimation doesn’t including cash reserves required for working capital.

“The primary goal of the government and courts today appears to be calming the protests,” Przybylowski wrote on Tuesday. “We are optimistic that this approach will be successful, and that protests around the Cobre Panama port will subside, with mining operations likely to resume relatively quickly if protests are lifted.”

Shares in First Quantum were down 3% to A$9.07 in Toronto on the news Tuesday. Uncertainty around its flagship mine in Panama had already wiped about C$10 billion off First Quantum’s market value, almost 50% of it, since Cortizo decided to call a referendum on the contract. The popular vote was cancelled and the final decision was ultimately placed in hands of the Supreme Court.

Amid protests and the failed referendum, Panama legislators passed a bill that originally sought to revoke First Quantum’s contract, but ended up banning all future mining concessions, including exploration, extraction and transportation of minerals, as well as contract renewals in Panama.

Panama to shut down First Quantum mine after ruling, president says

, Bloomberg

FIRST QUANTUM MINERALS LTD (FM:CT)

REAL-TIME QUOTE. Prices update every five seconds for TSX-listed stocks

Panama’s government said it will shut a giant copper mine owned by First Quantum Minerals Ltd., damping hopes that the company might be able to reach a new deal to keep operating.

Authorities will start “the transition process for the orderly and safe closure of the mine,” President Laurentino Cortizo said in a post on X Tuesday, after the nation’s supreme court ruled against the miner.

The move will deprive the government of one of its biggest sources of revenue and increases the chances of a legal battle between the Canadian miner and Panama in international arbitration. Cortizo didn’t say how long the process might take.

On Tuesday, the court ruled against a law approving a contract, sealing the doom of an operation that produces more than 1 per cent of global copper output.

Earlier, the company’s shares fell as much as 8.3 per cent in Toronto before paring most losses as copper prices on the London Metal Exchange rose. Panama’s dollar bonds dropped as the government faces the prospect of losing a large source of revenue.

The company declined to comment on Cortizo’s statement.

‘TERRIBLE’ OUTLOOK

The implications of the mine closure for Panama’s fiscal outlook are “terrible,” said Ricardo Penfold, a managing director at Seaport Global.

“The country is running a fiscal deficit of 5 per cent of GDP and this will increase it by about 0.6 per cent,” Penfold said, in a written reply to questions. “And then you have the lawsuit.”

Mass protests erupted last month after Panama’s congress approved a new contract with First Quantum, which has since been forced to suspend production due to protesters’ blockades.

Environmentalists, labor unions and others have held protests since Oct. 20 when congress passed a contract that gives First Quantum the right to produce copper for 20 years, with the option another 20-year extension.

Demonstrators argue that the contract violates national sovereignty and didn’t receive sufficient public debate prior to its approval in the legislature.

First Quantum began to wind down operations last week as small boats blocked the mine’s port, preventing the company from shipping supplies to the mine, while protesters and mining personnel clashed have clashed along the road to the site’s entrance.

Nov 28, 2023

Panama judges throw doubt on future of First Quantum mine

, Bloomberg

FIRST QUANTUM MINERALS LTD (FM:CT)

REAL-TIME QUOTE. Prices update every five seconds for TSX-listed stocks

Panama’s top court ruled against a law approving a contract with First Quantum Minerals Ltd., throwing into doubt the future of one of the world’s biggest copper operations.

The company’s shares fell as much as 8.3 per cent in Toronto before paring most losses as copper prices on the London Metal Exchange rose 1.3 per cent on upbeat economic expectations in China and tight supply. Panama’s dollar bonds dropped as the government faces the prospect of losing a large source of revenue.

The ruling raises the possibility of a long and expensive legal battle between First Quantum and Panama if the dispute moves to international arbitration. Mass protests erupted last month after Panama’s congress approved a new contract with the Canadian miner, which has since been forced to suspend production because blockades mean it can’t access the supplies it needs.

Local lawyers are split over whether the decision means First Quantum must shut its operation immediately. A previous contract was ruled unconstitutional in 2017, but the mine continued to operate. However, the outpouring of popular fury against the project may force the government to take a harder line.

First Quantum sent an arbitration notice to the government of Panama over the weekend following disruptions at its port in the country. The US$10 billion operation produces more than one per cent of global copper output.

“We want to affirm our unwavering commitment to regulatory compliance in all aspects of our operations within the country,” a First Quantum spokesman said in a written message. “We will comment further as additional details on the ruling are made public.”

The vote against the full contract was unanimous, the Supreme Court’s president Maria Eugenia Lopez told reporters on Tuesday. The ruling must now be published in the country’s official gazette, she said.

‘TERRIBLE’ IMPLICATIONS

Local attorney Victor Baker, who filed an opinion on the case with the Supreme Court, said the ruling applies to the law approved in congress, not the underlying contract. Therefore a new contract can be drafted and the mine can operate in the meantime, he said, in a written reply to questions.

But Martita Cornejo, an attorney who filed the constitutional challenge, says declaring the law unconstitutional effectively voids the contract, and that the mine must close immediately.

The country’s most liquid dollar notes due in 2036 fell as much as 0.6 cent to 95.6 cents after the ruling, according to indicative price data compiled by Bloomberg.

The implications for the nation’s fiscal outlook are “terrible,” said Ricardo Penfold, a managing director at Seaport Global.

“The country is running a fiscal deficit of 5 per cent of GDP and this will increase it by about 0.6 per cent,” Penfold said, in a written reply to questions. “And then you have the lawsuit.”

Environmentalists, labor unions and others have held protests since Oct. 20 when Congress passed a contract that gives First Quantum the right to produce copper for 20 years, with the option of another 20-year extension.

Demonstrators argue that the contract violates national sovereignty and didn’t receive sufficient public debate prior to its approval in the legislature. Anti-mining roadblocks and violent protests have caused at least $1.7 billion in losses to business, according to the country’s National Council of Private Enterprise.

First Quantum began to wind down operations last week as small boats blocked the mine’s port, preventing the company from shipping supplies to the mine, while protesters and mining personnel clashed this week along the road to the site’s entrance.

First Quantum and the government reached the new arrangement for the mine in March, extending the Vancouver-based firm’s contract and providing the government with a bigger share of profits. The deal required congressional approval before becoming law.

Truckers are stranded due to the protests that have been going on in Panama for more than a month in rejection of a mining contract, in Chiriquí, Panama, 27 November 2023. EFE/ Marcelino Rosario

Truckers stranded in Panama due to anti-mining protests denounce ‘inhumane’ conditions

David, Panama, Nov. 27 (EFE) – Freight drivers, many from Central America, denounce that they are facing “inhumane and unhygienic” conditions in the roadblocks that have been in place in Panama for more than a month to protest against a mining contract signed by Congress.

One such driver is Panamanian Ernesto Rey, who was stranded in Chiriquí, the province bordering Costa Rica, on his way back to Panama City from the neighboring country.

Like many other truckers returning from Central America, he has not seen his family in weeks, although, as he told EFE, he is fortunate to be parked near a gas station.

The prospect of being stranded in heavy traffic far from a gas station or a town would an “unhygienic and inhuman” situation, he told EFE.

“There is no bathroom (to take a shower), there is no toilet and there is nothing,” he says angrily and complains bitterly that “the truckers always pay the price” when there is a roadblock.

The line of stranded trucks can be seen along the Pan-American Highway – the country’s main highway – from Paso Canoas, the border with Costa Rica through Chiriquí, to Ojo de Agua in Veraguas, the next province over.

The roadblocks are in protest against the contract awarded to Minera Panamá, a subsidiary of the Canadian company First Quantum Minerals, for the exploitation of a large copper mine approved by the Panamanian Assembly.

The trucks carry goods coming from Asia, the United States and Europe to Central America through Panama’s Colón Free Zone, the largest on the continent, and the port system connected to the Panama Canal.

There are also trucks that bring manufactured goods of all kinds, including medicines, to Panama, where more than 80% of what is consumed is imported, including soap, cookies, beverages and other products that are now stranded in the canal, Carlos Eliécer Argueta, vice president of Panama’s National Chamber of Freight Transportation, told EFE.

Chiriquí, an important vegetable-producing area, is the area most affected by the blockades by indigenous groups and unions, which have caused shortages of basic products, gas and fuel.

Some representatives of employers’ associations have reported that drivers are victims of theft and other crimes.

Incalculable losses

The economic losses to the freight transportation sector, a neuralgic node in Panama’s powerful logistics system, are growing by the hour, Argueta said.

“There is no way to calculate the losses. Panama receives daily 250 18-wheelers from Central America,” he added.He also emphasizes that due to this situation, the Colón Free Zone “has lost the two best months of commercial sales”, the Christmas and New Year’s seasons.

The blockades, which also occurred in the Caribbean province of Colón, have almost paralyzed the free zone and affected the movement of cargo between the Atlantic and Pacific ports, as explained to EFE by businessmen of the sector, who emphasize the loss of Panama’s reputation as a safe supplier of logistics services, which represent 30% of the GDP.

Transporters ask for help

Panamanian and foreign transporters stranded on the Pan-American Highway are asking for someone to intervene to reopen the road, as they claim to feel alone.

This “kidnapping” situation, as spokesmen for the Panamanian employers have described the blockades, is keeping the north of the country in a crisis of fuel and food shortages.

“(The protesters) publish on social media when they open a road, but when the vehicles arrive at the next intersections of the closures it’s the same thing: the trucks are blocked and can’t get through,” Rey said.

On Sunday, the government of El Salvador asked Panama for a humanitarian corridor to allow the exit of heavy cargo drivers who have been stranded in Panama for “more than 30 days” due to the blockades.

Expectations are high in Panama for a possible declaration of unconstitutionality of the mining contract, which would put an end to more than a month of protests in the country. EFE

By: BNN Correspondents

Published: November 27, 2023

As the world watches in anticipation, the humanitarian crisis in Panama triggered by protests against a mining contract with Canadian company First Quantum Minerals (FQM) continues to unfold. El Salvador has now appealed to the Panama government and its civil society leaders, pleading for the formation of a humanitarian corridor to aid Salvadoran truck drivers stranded due to relentless roadblocks.

Consequences of the Blockade

The blockades, a form of dissent against FQM’s right to operate in Panama’s Caribbean zone for the next 40 years, have been in place since October 20. This prolonged disruption has led to a shortage of basic commodities and an estimated economic loss exceeding $1.7 billion, as reported by various business associations. The blockade has not only affected Panama’s economy but also stranded Salvadoran truck drivers, who have been unable to leave the country for over a month.

The Call for a Humanitarian Corridor

El Salvador’s desperate appeal for a humanitarian corridor signifies the severity of the situation. Its purpose is to ensure the safe exit of their stranded citizens, who have been receiving food and health assistance from the Salvadoran embassy in Panama for more than a month now. The plight of these drivers sheds light on the collateral damage caused by this socio-political impasse.

Awaiting the Supreme Court’s Decision

The Supreme Court of Panama is currently reviewing the constitutionality of the mining contract with FQM. The justices are expected to remain in continuous session until a decision is reached, a verdict that could potentially lead to the shutdown of Central America’s largest open-pit copper mine. This decision holds potential implications not only for the protesters and the mining company but also for the trapped truck drivers and the overall state of Panama’s economy.

First Quantum turns to arbitration ahead of Panama court ruling

, Bloomberg

FIRST QUANTUM MINERALS LTD (FM:CT)

REAL-TIME QUOTE. Prices update every five seconds for TSX-listed stocks

First Quantum Minerals Ltd. took the first step in an arbitration process with Panama as the Canadian firm's flagship copper operation faces anti-mining protests and a Supreme Court ruling on whether its contract is constitutional.

The company said late Sunday that it issued an arbitration notice to President Laurentino Cortizo's administration. Panama extended First Quantum's mining license last month, before reacting to protests by proposing to put the mine's future to a popular vote. The referendum proposal and a push for congress to repeal the contract were subsequently shelved as the government waits to see if the Supreme Court will kill the agreement instead.

The dispute has called into question the very future of the US$10 billion Cobre Panama mine. Last week, the company halted commercial production as a port blockade chokes key supplies to an operation that accounts for more than 1 per cent of global copper supply.

“First Quantum remains committed to overcoming the current operational challenges at Cobre Panama through constructive and transparent dialogue,” it said in a statement. The company trusts in its “robust legal position” and aims to find solutions in line with stakeholder interests and with the law.

Still, the challenge facing the company in Panama was on display early Sunday when a group of protesters attacked workers leaving the mine, injuring eight, a union leader said.

First Quantum has lost about half its market value since Cortizo turned against the agreement in late October. The Supreme Court could issue a ruling anytime.

Bloomberg News | November 26, 2023 |

Protesters attacking mine workers in Panama.

Protesters attacked workers leaving the Cobre Panama mine early Sunday in an incident that left about eight people injured, a union leader said.

A group of protesters in a pickup truck threw stones at buses carrying staff from the First Quantum-operated mine, Michael Camacho, a leader of the Utramipa union, said by telephone.

After one bus was forced to stop, the passengers fled as protesters detained the driver, Camacho said. He said he was unaware of the extent of the injuries suffered by workers.

The union has called for protection of members as demonstrators pushing for the mine’s closure block key supplies from reaching it, which has forced the company to wind down operations.

Panama’s Supreme Court is considering cases filed against the mine, alleging the operating contract is unconstitutional.

(By James Attwood)

Reuters | November 22, 2023 |

Cobre Panamá operation. (Image by Minera Panama.)

Canada’s First Quantum Minerals will carry out maintenance at its Panama mine from Nov. 23 due to coal supplies being blocked by protestors opposing the government’s contract with one of the world’s biggest and newest copper mines, two sources familiar with the discussions said on Monday.

This move would effectively suspend production at the Cobre Panama mine until coal supplies resume as the mine cannot operate without power, one of the sources said. The sources declined to be identified as the information is not public.

Copper prices hit a two-month high while the company’s stock fell as much as 5.7% after Reuters reported the mine suspension. The stock ended down 3.5%, while the benchmark Canada index rose 0.4%.

Protests have escalated since the government and First Quantum signed a new contract on Oct. 20 for the Cobre Panama concession, which contributes 1% to global copper production and 5% to Panama’s gross domestic product.

A ship with supplies for the mine was unable to dock as local boats blocked off access to the key port, the company said on Friday.

An FQM spokesman on Monday declined to comment specifically on the Nov. 23 suspension.

“In terms of production we are talking about a temporary halt because of the illegal blockade. As soon as the port reopens, we will be able to ramp production back up quickly,” the company said in a statement to Reuters.

Earlier on Monday, First Quantum said it had further ramped down operations at Cobre Panama to one remaining ore processing train, adding that it expects to run out of supplies for the on-site power plant during the week commencing Nov. 20.

“The focus will be to maintain the tailings pond 24/7,” one of the sources said about the maintenance.

Tailings ponds are created to store waste generated from mining, which requires proper maintenance.

Leonardo DiCaprio backs Panamanians’ protests against First Quantum’s operation

Panama’s top court will hear the legality of the contract awarded to First Quantum from Nov. 24, the company said in the statement.

The contract has faced numerous legal challenges due to protests that claim it favors the miner too much and allege corrupt practices in its approval. Such protests have escalated into an anti-government movement, as well as demonstrations against the environmental impact of the giant operation.

Last weekend, the protests against the mine received an endorsement from Hollywood actor Leonardo Di Caprio who shared a video from an environmental group that called for the Supreme Court to cancel the contract given to First Quantum.

Cobre Panama produced 112,734 tonnes of copper in the third quarter, according to First Quantum’s financial statements. It contributed $930 million to the overall third quarter revenue of $2.02 billion.

($1 = 1.3718 Canadian dollars)

(By Divya Rajagopal and Julian Luk; Editing by Denny Thomas, Chizu Nomiyama and Marguerita Choy)

No comments:

Post a Comment