Renewable Energy Target Faces Challenges in Australia

- Australia's 2025 federal election will be a referendum on nuclear energy versus a high renewable energy target, with the outcome significantly impacting the country's long-term energy strategy.

- Immediate energy security concerns, including gas shortages and grid instability, necessitate reliance on gas and LNG to bridge the gap during Australia's energy transition.

- Despite ambitious renewable energy targets, challenges such as infrastructure bottlenecks and the retirement of coal plants threaten to create power shortfalls, making dispatchable generation critically important.

Energy policy is set to take center stage at Australia’s upcoming federal election, which will be held on or before 17 May 2025. The election will serve as a referendum on nuclear energy, aiming to address the country’s long-term energy needs while tackling rising energy prices and the high cost of living. However, grid instability, power shortfalls, a looming gas shortage and infrastructure bottlenecks have created a perfect storm that could derail the country’s more immediate energy transition as energy security issues come to light.

Australian voters will face a crucial decision: an 82% renewable energy target under the incumbent Labor government or the Liberal-National Party's (LNP) proposal to build 13 gigawatts (GW) of nuclear power by 2051 to replace coal generation. Rystad Energy’s research forecasts that achieving the 82% target will be challenging, with more realistic projections under Labor estimating a renewable share of around 65%: a shortfall of 17%, even under the most optimistic scenarios. If the LNP wins, the country’s renewable energy share is expected to be lower due to the party's focus on nuclear power, making the 82% target a distant goal and highlighting the underlying challenges affecting Australia's energy transition, regardless of which party emerges victorious.

As clean energy reliability becomes a priority ahead of the election, further research from Rystad Energy points to an urgent need for gas and liquefied natural gas (LNG) in Australia. By 2028, New South Wales (NSW), South Australia and Victoria (VIC) are projected to face capacity shortfalls due to the retirement of coal and gas plants like Yallourn West and Eraring. To mitigate this loss, gas generators and gas-peaking facilities—used during peak demand—will be essential. Batteries and pumped hydro are also expected to play a crucial role, with 3 GW projected to be energized by year-end, addressing grid instability in one of the world’s most unpredictable electricity markets. However, infrastructure bottlenecks and longer supply wait times may hinder the timely development of renewables and energy storage, significantly affecting energy security for Australians.

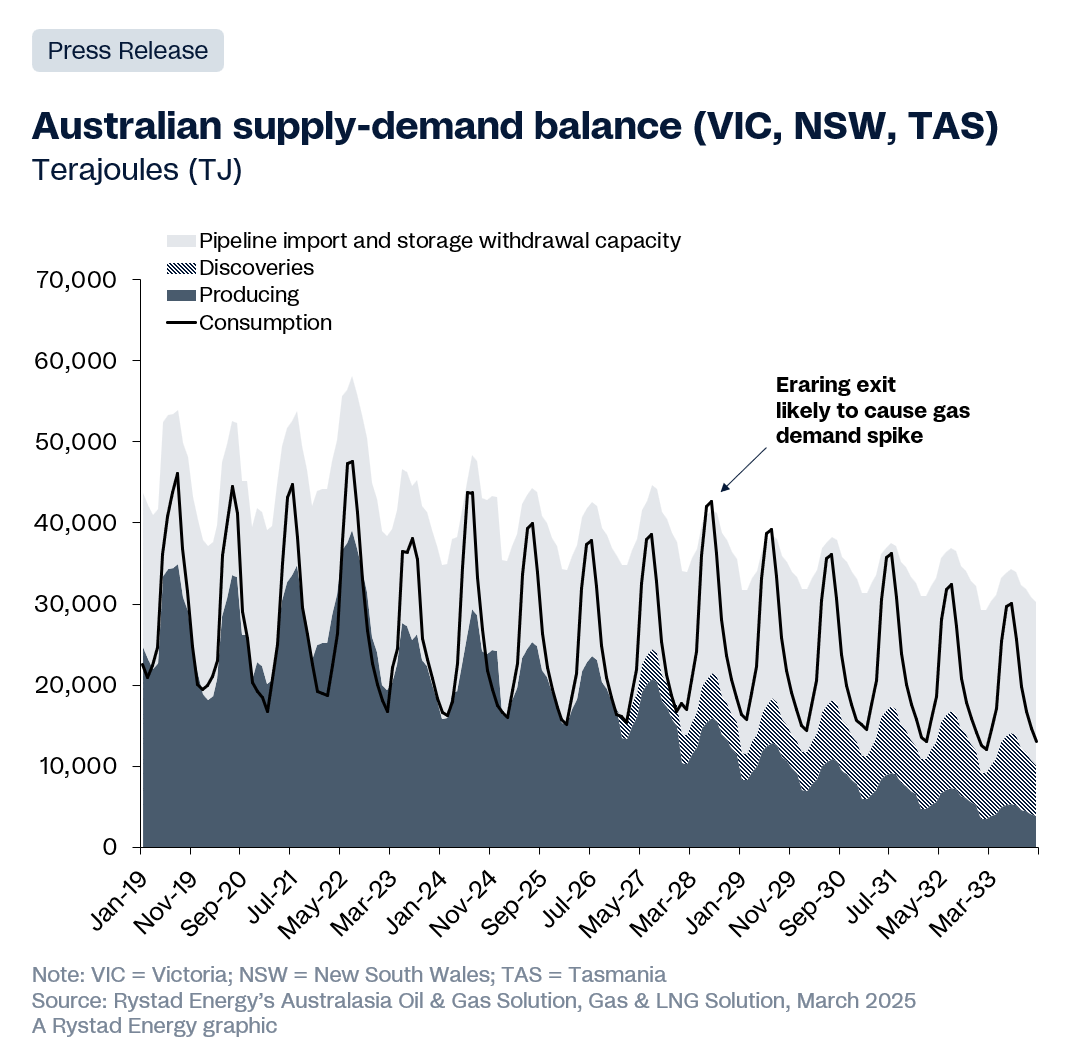

NSW, VIC and Tasmania (TAS) are already testing their gas supply security for winter with steeply declining production from legacy offshore Victorian fields increasing their reliance on Queensland. Compared to the crisis year of 2022, these states now have severely diminished buffer capacity, which could trigger another price surge if multiple supply and demand shocks occur. Even in our most optimistic scenario, LNG imports to Australia are looking like an inevitability,

Kaushal Ramesh, Vice President, Gas & LNG Research, Rystad Energy

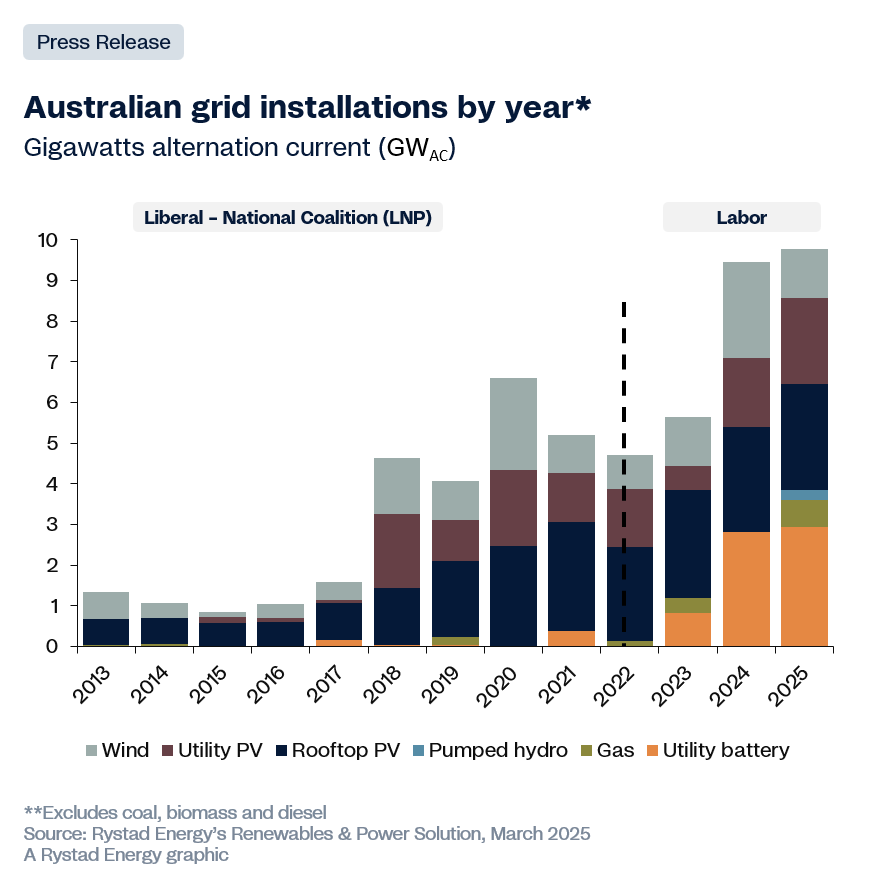

If Labor wins the upcoming federal election, Rystad Energy estimates that Australia will add a record 7.2 GW to its grid annually of both renewable energy and gas, primarily in Queensland, Victoria and New South Wales—the highest annual increase in Australia’s history. Conversely, an LNP victory would likely lead to a reduction in solar and wind power deployment, but by how much is the key unknown.

Renewable energy adoption is accelerating at unprecedented rates, and Australia is at the forefront of a battery revolution. However, more action is urgently needed to prevent a power shortfall in the coming years. The continent’s dispatchable generation is nearing critical levels and decisions made today will be pivotal in avoiding blackouts. This challenge extends beyond Australia, as countries around the world are increasingly relying on gas to support their energy transitions. This global shift is driving a surge in demand for gas-powered generation, resulting in longer lead times for the delivery of critical heavy turbine equipment. The window of opportunity to mitigate these challenges is rapidly closing. If we do not act swiftly, we risk an inflationary bubble caused by soaring gas and power prices, resulting in a heightened cost of living for consumers.

Gero Faruggio, Head of Australia, Rystad Energy

To contact our Australian Advisory team, please reach out here.

Learn more with Rystad Energy’s Renewables & Power Solution.

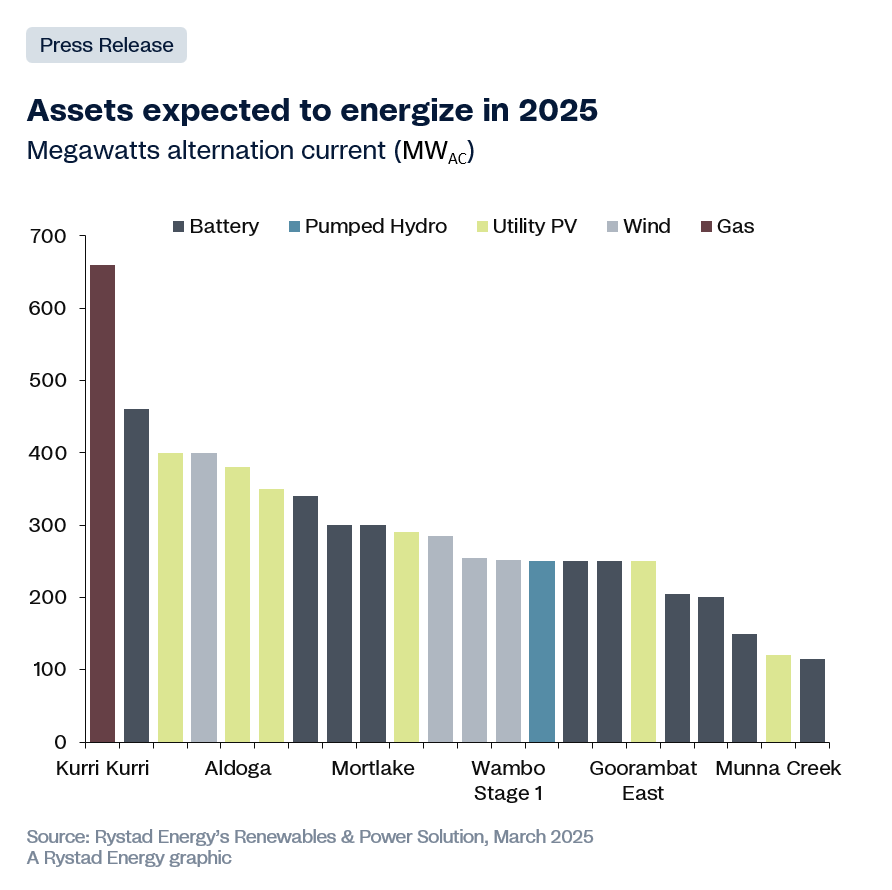

Momentum has been positive under Labor’s term for renewables investment with forecasts from Rystad Energy showing 2025 to be the highest year ever for new capacity energized. A majority of these new additions, primarily under the Labor Party’s ruling, will come from Australia’s fourth pumped hydro project, Kidston, as well as the 660-megawatt alternating current (MWAC) Kurri Kurri gas plant located in the Hunter region of New South Wales. The project from Snowy Hydro will be the largest gas plant to energize in the last 15 years, while Genex’s 250-MWAC Kidston pumped hydro project will be the first pumped hydro project to energize in 41 years.

Additionally, 2.9 GW of utility battery capacity is expected to energize in 2025, with potential for further additions due to the rapid construction and energization timelines for batteries compared to other technologies. These batteries will add an estimated 1.7 to 2.0 terawatt-hours (TWh) of annual demand to the grid. This will add stability to the Australian market by shifting daytime solar output to the evening peak. However, the retirement of aging coal plants, winter heating demand when solar output is low and extreme weather events still need to be addressed. Gas peaking plants could provide backup support, but gas prices, influenced by both domestic and international markets, will impact the cost structure of gas generation facilities. While volatility is expected to subside, these wildcards remain crucial in shaping the future.

Wave Energy Poised for Major Breakthrough

- An Australian startup is pioneering open-access principles in wave energy research, aiming to accelerate development and deployment of this sustainable power source.

- Wave energy has the potential to provide consistent, baseload power, unlike solar and wind, which can stabilize energy grids and reduce the need for extensive energy storage.

- International interest and investment in wave energy are growing, with significant targets set for ocean energy production by 2050, which could be further boosted by data-sharing and technological advancements.

Wave energy could be primed for a swell of progress thanks to open data sharing. While advancements in wave energy have been piecemeal to date, an Australian startup believes that open-sharing principles can revolutionize research and development in the sector, with potentially huge ramifications for decarbonizing global energy grids.

Waves contain a huge amount of energy. According to a 2023 figure from the United States Energy Information Administration, “the theoretical annual energy potential of waves off the coasts of the United States was estimated to be as much as 2.64 trillion kilowatthours, which is equal to about 63% of total U.S. utility-scale electricity generation.” The coasts of Europe, Japan, Australia and New Zealand also offer huge potential for wave energy generation. In Europe, the potential of wave power production is estimated at a whopping 2,800 TWh per year, which is roughly 107.6% of the global nuclear power production as of 2023.

A novel wave-energy converter trial is currently taking place in Albany on the south-western coast of Australia, led by a research team from the Marine Energy Research Australia (MERA) centre at The University of Western Australia (UWA). The model being tested is a ‘Moored Multi-Mode Multibody’ (M4) wave-energy converter which features two steel frames attached to hinged floats. “As the floats rise and fall with each passing wave, the frames rotate like flapping butterfly wings,” explains a recent Nature article describing the project. “This motion drives the generators in the hinges to create electricity.”

Harvesting energy from our oceans could reshape global clean power production, as it could provide baseload energy production with zero carbon emissions. Unlike solar and wind energies, wave energy would be a constant source of power and could therefore help to stabilize energy grids as renewable energies become more prevalent. This would provide a critical complement to wind and solar power, and greatly lessen the need for energy storage technologies such as lithium-ion batteries. Ultimately, the deployment of wave energy would provide a massive boost to international energy security during the clean energy transition.

The team behind the M4 model off the shores of Albany, Australia emphasizes its model’s potential as a baseload renewable energy. “Waves reaching Albany have travelled uninterrupted for thousands of kilometres across the Southern Ocean,” MERA manager Wiebke Ebeling was recently quoted by Nature. “They’re energy-dense, highly consistent, and show little seasonal variability.”

The team also argues that their research is of particular importance to global wave energy research as they are following open-access principles and sharing their data with anyone who is interested in the project’s findings. “Previously, the wave-energy industry has experienced siloed progress,” says MERA director Christophe Gaudin. “Ours is the first fully open-access, wave-energy project, where we will share the lessons learned and the data collected — as well as the power we generate — openly with everybody.”

Accelerating research and development gains in wave energy would be critical to making it a commercial reality. So far, wave energy has simply been too expensive, too difficult to install, and too disconnected from existing grids to make commercial sense. But as technologies advance, we are getting closer to overcoming these challenges.

The International Energy Agency (IEA) is expecting 87 TWh of ocean energy to be produced by 2050. The European Union has introduced policy measures to encourage more wave energy projects, with a goal of developing 1 GW of ocean energy capacity by 2030 and 40 GW by 2050. But if MERA’s approach to data-sharing does indeed provide a boost to technological advancement, this projection could easily be adjusted to a higher rate.

This would have huge impacts on global decarbonization trajectories, provide energy security in an era of demand surges, and provide clean energy alternatives to coastal and island communities that have historically lacked reliable grid connection. Wave energy could even solve the growing problem of AI’s runaway energy footprint. “With such vast potential, wave energy could play a huge role in powering the AI boom,” Forbes recently reported. “Constructing [data centers] near coastal areas would allow them to tap directly into the ocean’s abundant clean energy, creating an efficient solution for growing demand.”

By Felicity Bradstock for Oilprice.com

No comments:

Post a Comment