UK has no immediate plans for critical minerals price floor, minister says

Britain has no plans to match the United States in supporting domestic rare earth companies with a price floor to cut reliance on dominant producer China, Industry Minister Chris McDonald said.

So far Britain is attracting adequate investment in the critical minerals sector to develop home-grown supply, but it will monitor the situation in case other mechanisms are needed, he told Reuters.

Group of Seven (G7) members and the European Union are considering price floors to promote rare earth production, as well as taxes on some Chinese exports to incentivize investment, sources told Reuters in September.

The US provided a guaranteed minimum price to rare earths group MP Materials in July as part of a multibillion-dollar investment by the Pentagon and sources told Reuters the mechanism would likely be extended to other firms.

On Monday, McDonald met with US Pentagon officials in London, who outlined their support policies for critical minerals, including the price floor, he said.

“We’re doing most of them but we’re not doing all of them, and a price floor is one of them that’s currently not on our list. But maybe I’ll keep an eye on how that goes,” he said in an interview.

“Ultimately for me it’s about can we attract this investment, and at the moment we are attracting the investment.”

Britain launched its critical minerals strategy last month, which set targets to meet 10% of domestic demand from UK mining and 20% from recycling by 2035, backed by up to 50 million pounds in funding.

China accounts for about 70% of rare earth mining and 90% of refining.

Britain, which currently produces 6% of its critical mineral needs domestically, is focusing its strategy on lithium, nickel, tungsten and rare earths.

Britain expects lithium processing projects in northern England to break ground within the next few years and aims to produce at least 50,000 metric tons of lithium by 2035.

The country also plans to include stockpiling of critical minerals in its defence procurement plan.

(By Eric Onstad; Editing by Louise Heavens)

Trump pressure fuels Latin America’s critical minerals push

Latin America is stepping up efforts to build critical mineral supply chains as the Inter-American Development Bank (IDB) says governments want to add more value at home while the Trump administration pushes for production closer to the US.

IDB president Ilan Goldfajn said countries across the region are working on increasing their refining and processing capabilities for lithium, copper and other key minerals instead of exporting raw material to Asia.

Together with the European Union, the IBD launched last year a joint initiative to boost responsible investment and develop value chains for critical minerals in Latin America and the Caribbean. Under this program the EU provided a grant of nearly €6.3 million ($7.3m), which is expected to unlock about €120 ($140m) million in IDB funding for mineral-related projects in countries including Argentina, Bolivia, Brazil, Chile and Ecuador.

The funding is especially aimed at supporting downstream activities like processing, refining, and building value chains.

Through a project called Mining for the Energy Transition (MET), the IDB is also providing technical assistance to Latin American nations, with the objective of Strengthening regulatory and investment frameworks, improving geological knowledge and data, supporting low-carbon, sustainable mining and production practices, and enhancing infrastructure.

In an interview with the Financial Times, Goldfajn said Washington has signalled it prefers sourcing and processing within the hemisphere and that governments across the political spectrum see a rare opening to capture more value.

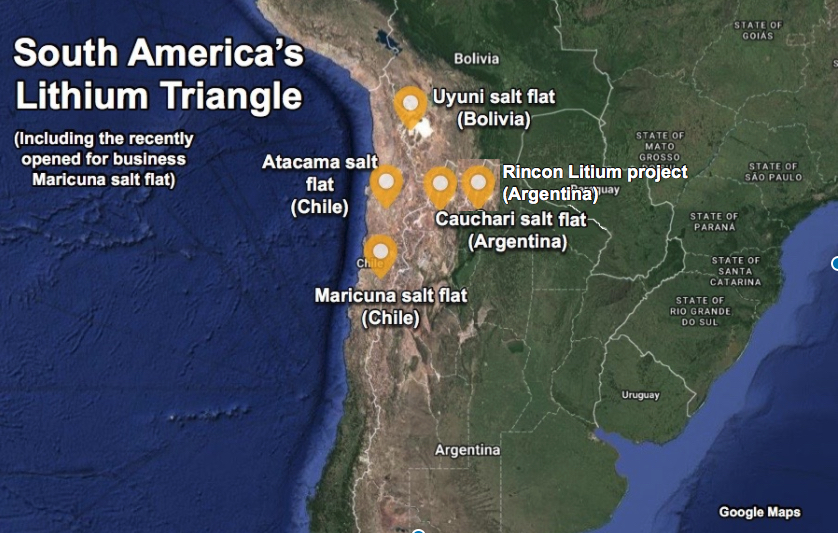

Latin America holds about 60% of the world’s identified lithium reserves and produces roughly 46% of its copper, leading production of the red metal alongside Peru.

Brazil has the world’s second largest rare earths reserves, though its output remains modest because of technical and commercial hurdles. China dominates global processing and its low prices have long undercut efforts by resource countries to move beyond extraction.

Argentina exports 70% of its lithium to China, only to import it back at prices eight or nine times higher after processing.

Long-term supply contracts are key to closing the cost gap with Asia, Goldfajn said, pointing to a 20-year deal for Chile to sell green hydrogen to Germany that helped unlock IDB financing for the sector.

Extraction too

The bank is also backing extraction and processing projects directly. In Argentina, it is making a $100-million loan toward Rio Tinto’s (ASX: RIO) $2.5 billion plan to produce battery-grade lithium in Salta province.

Goldfajn noted the political divides between the Trump administration and major leftwing governments in Brazil, Mexico and Colombia, but said Washington’s renewed focus on the region was constructive.

Rising demand for financing tied to critical minerals is part of why the IDB group expects to mobilize more than $30 billion this year, up from $23 billion last year. Nearly $20 billion will come from its public-sector arm, while IDB Invest and IDB Lab will finance more than $11 billion for companies.

Appian talking to US, Australia on critical minerals after IFC deal

Appian Capital Advisory said it is in talks with the US and Australia about replicating the critical minerals investment partnership it recently agreed with a World Bank division.

The private equity firm and the International Finance Corporation (IFC) launched a $1 billion fund in October to invest in projects in Africa and Latin America.

Major economies are stepping up efforts to secure access to critical minerals, which are essential to advanced defence systems, communications equipment and next-generation industrial technologies, including electric vehicles.

“We think that the IFC formula is very attractive,” said Dominic Raab, head of global affairs at Appian, on Tuesday, adding: “We’ve had a lot of interest off the back of the announcement and we’re talking with the US and Australians”.

“We’ve had conversations around Ukraine and things as well about this,” added Raab, a former UK deputy prime minister and foreign minister who joined Appian, which has about $5 billion in assets under management, in February 2024.

Washington and Kyiv signed an agreement in late April that gives the US preferential access to new Ukrainian minerals deals. In October, US President Donald Trump and Australian Prime Minister Anthony Albanese sealed a pact aimed at countering China’s dominance of critical minerals.

Raab said the IFC could rely on Appian’s in-house team of geologists and finance experts, while having more control over project delivery by virtue of owning equity.

Governments want assurances that the mineral offtake they are trying to secure and the mining asset itself will not be “snaffled up by China”, Raab said at the Resourcing Tomorrow conference in London. “Equity control gives you that.”

(By Tom Daly; Editing by Alexander Smith)

No comments:

Post a Comment