Two SMR projects selected for US federal funding

_82983.jpg)

In October 2024, the US Department of Energy (DOE) - under the Joe Biden administration - opened applications for funding to support the initial domestic deployment of Generation III+ small modular reactor (SMR) technologies, with up to USD800 million to go to two "first-mover" teams, with an additional USD100 million to address so-called gaps that have hindered plant deployments. According to the solicitation documentation, a Gen III+ SMR is defined as a nuclear fission reactor that uses light water as a coolant and low-enriched uranium fuel, with a single-unit net electrical power output of 50-350 MWe, that maximises factory fabrication approaches, and the same or improved safety, security, and environmental benefits compared with current large nuclear power plant designs.

The solicitation was re-issued by the DOE in March this year to better align with President Donald Trump's agenda on unleashing American energy and AI dominance.

The DOE has now announced the selection of Tennessee Valley Authority (TVA) and Holtec as the first-mover recipients of funding to advance initial Gen III+ SMR projects.

"The selections announced today will help deliver new nuclear generation in the early 2030s, strengthen domestic supply chains, and advance President Trump's Executive Orders to usher in a nuclear renaissance and expand America's Energy Dominance agenda," the DOE said.

"President Trump has made clear that America is going to build more energy, not less, and nuclear is central to that mission," said US Secretary of Energy Chris Wright. "Advanced light-water SMRs will give our nation the reliable, round-the-clock power we need to fuel the President's manufacturing boom, support data centres and AI growth, and reinforce a stronger, more secure electric grid. These awards ensure we can deploy these reactors as soon as possible."

The projects

TVA's application was selected for funding to accelerate the deployment of the USA's first Gen III+ SMR at its Clinch River site in East Tennessee. TVA - which applied for the grant with a coalition of partners in April - plans to advance deployment of a GE Vernova Hitachi BWRX-300 at the site, as well as accelerate the deployment of additional units with Indiana Michigan Power and Elementl. Additionally, TVA plans to work with the domestic nuclear supply chain partners Scot Forge, North American Forgemasters, BWX Technologies, and Aecon. Other partners supporting the project include Duke Energy, Oak Ridge Associated Universities, and the Electric Power Research Institute. TVA says the Clinch River project will serve "as a national model for how to deploy SMRs safely, efficiently, and affordably".

In May, TVA submitted a construction permit application to the US Nuclear Regulatory Commission (NRC) to build the first BWRX-300 at Clinch River. The NRC is currently reviewing the application.

"This award affirms TVA's continued leadership in shaping the nation's nuclear energy future," said TVA President and CEO Don Moul. "With DOE's support and the strength of our partners, we're accelerating the deployment of next-generation nuclear – reducing financial risk to consumers and strengthening US energy security. This is how we deliver reliable, affordable energy and real opportunity for American families."

As the lead applicant, TVA and DOE will now enter further discussion around project milestones and co-applicant awards.

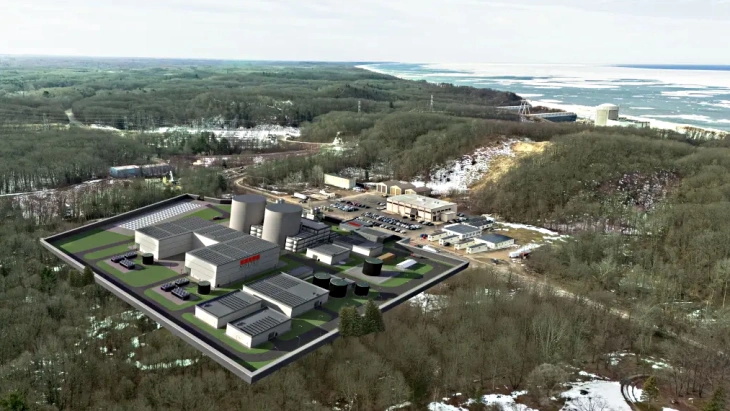

The planned Palisades SMR project (Image: Holtec)

Holtec plans to deploy two SMR-300 reactors - named Pioneer 1 and 2 - at the Palisades Nuclear Generating Station site in Michigan, demonstrating viability for additional orders both domestically and abroad. Holtec is pursuing an innovative one-stop-shop approach to SMR deployment by fulfilling the roles of technology vendor, supply chain vendor, nuclear plant constructor in partnership with Hyundai Engineering & Construction, plant operator, and electricity merchant selling the power to nearby utilities and end-users. Holtec's proposal includes a multi-site deployment pathway that establishes a repeatable, fleet-scale model - a core requirement of the Tier 1 programme intended to drive down costs and shorten construction durations through standardisation and manufacturing efficiency. The Pioneer reactors are planned to be brought online in the early 2030s.

"Holtec realises the future of nuclear energy as a source of reliable baseload electricity to power the economy of the future is realised only if we, in the industry, make the reactors predictably cost competitive," said Kris Singh, CEO and Executive Chairman of Holtec International.

"With a well-exercised and proven supply chain, a world-class alliance partner, Hyundai E&C, and the plant design marinated with four decades of practical corporate experience, we consider it our duty to lead the industry in building, owning, and operating the first SMR-300 plant in the United States. We are energised by DOE's confidence in our SMR-300 reactor, which we view as validation of our 14-year quest to develop a walk-away-safe and cost-competitive nuclear reactor. This grant positions Holtec to accelerate deployment of a standardised SMR-300 fleet that strengthens US energy security and grid resilience and will further bolster Holtec as one of the largest US exporters of nuclear equipment."

DOE said the remaining USD100 million in funding under the programme will be awarded later this year to support additional deployments and address key barriers in design, licensing, supply chain, and site readiness.

Utility consortium looks to Nebraska new build

_56328.jpg)

Four public power utilities - Lincoln Electric System, Nebraska Public Power District, Omaha Public Power District and Grand River Dam Authority - have signed a Memorandum of Understanding to form the consortium, which will be coordinated by a steering committee led by Nebraska Public Power District. It will focus on feasibility studies, site evaluations and technology assessments for between 1,000 and 2,000 MW of new nuclear capacity including small modular reactors (SMRs). All four utilities are members of the Southwest Power Pool, a regional transmission organisation covering 14 states which are part of the USA's Eastern Interconnection grid.

Each utility will fund its own early-stage work. Any future steps, such as investment, permitting or construction, would follow public engagement and each utility's independent board approval process, the consortium said.

Nebraska Public Power District - a publicly owned utility and a political subdivision of the State of Nebraska - already operates the single-unit Cooper, Nebraska's only currently operating nuclear power plant, and is working on a nuclear feasibility siting study funded through the Nebraska Legislature and the Nebraska Department of Economic Development to identify sites that have the potential to host SMRs. The consortium is not connected to that study, but said it will utilise the results during the evaluation and planning process.

"Nuclear technology has long proven to be a dependable and resilient energy source," said Nebraska Public Power District President and CEO Tom Kent. "Public power utilities have a strong tradition of collaboration, and this consortium strengthens that legacy as we work together to meet the region's growing energy demands." The ongoing siting feasibility study "positions us proactively as the consortium begins exploring opportunities to deploy this technology within Nebraska", he added.

Omaha Public Power District is the licensee of the Fort Calhoun nuclear power plant which ceased operations in 2016 and is in decommissioning. President and CEO Javier Fernandez described the formation of the consortium as a "smart, forward-looking step for public power", adding: "We're exploring all viable options to ensure we can continue to deliver reliable, affordable energy and we're doing it in a way that's transparent, collaborative and grounded in data."

Each utility will fund its own early-stage work. Any future steps, such as investment, permitting or construction, would follow public engagement and each utility's independent boad approval process, and no construction or investment decisions have been made as yet.

Reactor vessel completed for Hinkley Point C's second unit

_49382.jpg)

The vessel - measuring 13 metres in length and weighing 500 tonnes - was fabricated by Framatome at its Saint-Marcel plant in Chalon-sur-Saône, eastern France.

In a post on LinkedIn, EDF said that a celebration was held at the Saint-Marcel plant on 28 November to mark the completion of the vessel. "The Hinkley Point C delegation watched as the reactor was prepared for shipping to Somerset," it said.

The reactor pressure vessel is the high strength steel cylinder that will house the reactor core and all associated components, including the reactor vessel internals which support and stabilise the core within the reactor vessel, as well as providing the path for coolant flow and guiding movement of the control rods.

The reactor pressure vessel for unit 1 at Hinkley Point C was completed at Framatome's Le Creusot facility in Burgundy, central France, in December 2022. It was delivered to the plant construction site in February 2023 and was kept in storage until it was installed within the unit's reactor building in December 2024.

EDF said the Hinkley Point C delegation "also formally received the first two completed steam generators for unit 2, which will be sent later, in 2026".

One of the two completed steam generators (Image: EDF)

Steam generators transfer the thermal energy generated in the reactor vessel of a pressurised water reactor from the primary (reactor) cooling system to the secondary (turbine) cooling system, producing the steam to drive the electricity generation turbine.

The first of the eight 25-metre-high, 520-tonne steam generators that the two-unit Hinkley Point C plant will feature was delivered to the site in May 2024 after a journey by sea and road. It was installed in the reactor building of unit 1 in July this year.

Construction of the first of two 1630 MWe EPR reactors at Hinkley Point C began in December 2018, with construction of unit two beginning a year later. The dome of unit 1 was put in place in December 2023. The dome was lifted into place on the second unit's containment building last week. Last year, EDF announced that the "base case" was now for unit 1 being operational in 2030, with the cost revised from GBP26 billion (USD32.8 billion) to between GBP31-34 billion, in 2015 prices. When complete, the two EPR reactors will produce enough carbon-free electricity for six million homes, and are expected to operate for as long as 80 years.

Fifth Belgian reactor is permanently shut down

_34792.jpg)

Belgium's Federal Agency for Nuclear Control (FANC) said the operation to shut down the 445 MWe (net) pressurised water reactor (PWR) was carried out under its supervision.

Doel 2 has now entered the decommissioning phase in preparation for its actual dismantling. Fuel will be unloaded from the reactor and cooled in the storage pool, so it can later be transported to temporary storage.

"As with the other shutdowns, the process began with the submission of a 'notice of cessation of activities' to the FANC," the regulator said. "This document describes in great detail the activities that will be carried out after the shutdown to prepare for decommissioning."

Belgium's federal law of 31 January 2003 required the phase-out of all seven nuclear power reactors in the country. Under that policy, Doel 1 and 2 were originally set to be taken out of service on their 40th anniversaries, in 2015. However, the law was amended in 2013 and 2015 to provide for Doel 1 and 2 to remain operational for an additional 10 years. Doel 1 was retired in February this year. Duel 3 was closed in September 2022 and Tihange 2 at the end of January 2023. Tihange 1 was disconnected from the grid on 30 September this year.

Belgium's last two reactors - Doel 4 and Tihange 3 - had also been scheduled to close last month. However, following the start of the Russia-Ukraine conflict in February 2022 the government and Electrabel began negotiating the feasibility and terms for the operation of the reactors for a further ten years, to 2035, with a final agreement reached in December, with a balanced risk allocation.

For the continued operation of Doel 4 and Tihange 3, Electrabel had to submit an extensive LTO (Long Term Operation) file with safety studies and an action plan to further increase the safety of the youngest reactors. This file was submitted in December 2024 for both units. Tihange 3 was taken offline on 5 April for a so-called 'LTO overhaul' - an extensive inspection and maintenance period with a view to safe long-term operation of the reactor. After a thorough analysis, FANC and its technical subsidiary Bel V determined that the reactor meets the conditions for a safe restart and the 1020 MWe PWR resumed operation on 10 July. Doel 4 was taken offline on 30 June for its LTO overhaul and was restarted on 8 October.

In May this year, Belgium's federal parliament voted by a large majority to repeal the 2003 law which set out a phase-out of nuclear power and ban on the construction of new nuclear generating capacity.

FANC has called for "clarity to be provided in the course of this legislative term on a possible extension of the operation of Doel 4 and Tihange 3 after 2035. This will allow the necessary safety analyses and preparatory steps to be started in good time."

Laurentis, BWXT and CNPSA sign Bulgarian new nuclear contract

The contract signed by project company Kozloduy NPP-New Build EAD with Laurentis Energy Partners, its subsidiary Canadian Nuclear Partners SA (CNPSA) and BWXT Canada was announced in Sofia at an event attended by Bulgaria’s Energy Minister Zhecko Stankov and Ontario’s Energy and Minister Minister Stephen Lecce.

Bulgaria aims to get the first of the two proposed Westinghouse AP1000 units operational in 2035 and the contract, worth "hundreds of millions of euros", will provide specialised technical advisory services and project-management oversight for all the major phases of the Kozloduy New Build Project.

Bulgaria's Energy Ministry said the contract was a "decisive moment" for the new-build project and said it "ensures that the new capacity will be delivered in accordance with all international and national regulatory standards, within the agreed timeframe and budget".

It said: "The consortium will support Kozloduy NPP-New Builds as an engineering consultant, including in the initial engineering activities, management of the design, procurement, construction, and commissioning processes."

Energy Minister Stankov said that the contract was the most important one before the Engineering, Procurement and Construction contract, which he said was expected to be signed during 2026.

What was said

Stankov said: "Our country has secured leading international partners with proven experience across the full nuclear lifecycle - from design through commissioning. This project is an investment not only in our long-term energy security, but also in the strength of Bulgarian industry. Thirty percent of the specialists working on the project will be Bulgarian experts, providing our workforce with new knowledge, advanced technologies, and meaningful growth opportunities."

Petyo Ivanov, Executive Director of Kozloduy NPP New Build, said: "This is another key step in the implementation of the new nuclear capacity in Bulgaria. The companies have many years of experience in providing these services, which guarantees that the project will be completed on time, within budget, and in full compliance with regulatory standards."

Leslie McWilliams, President and CEO of Laurentis Energy Partners, said: "Laurentis's foundation is built on decades of experience supporting Candu technology, but our project-management, technical, and owner’s engineer expertise are highly transferable across reactor types and technologies. This contract reflects the confidence placed in Canadian nuclear capability for complex new-build programmes."

John MacQuarrie, BWXT’s President for Commercial Operations, said: "BWXT has significant experience successfully supporting the execution of large projects in the nuclear industry, including the refurbishments for Bruce Power and Ontario Power Generation. Our customers recognise that experience."

Giovanbattista Patalano, Managing Director, CNPSA, said: "Supporting the Kozloduy New Build and the Bulgarian nuclear programme reinforces our role as a trusted partner for complex nuclear projects, ensuring safe, efficient, and well-managed execution throughout the lifecycle of these new units."

Background

Kozloduy units 1-4 were VVER-440 models which the European Commission classified as non-upgradeable and Bulgaria agreed to close them during negotiations to join the European Union in 2007. Units 5 and 6 feature VVER-1000 reactors that were connected to the grid in 1987 and 1991, respectively. Both units have been through refurbishment and life-extension programmes to enable extension of operation from 30 to 60 years. The country's two operable reactors generate about one-third of its electricity.

Westinghouse's AP1000 has been selected as the technology for the two proposed new units and in November last year Hyundai Engineering & Construction, Westinghouse and Kozloduy NPP-New Build signed an engineering contract for the new capacity, with ministers saying that signing the contract meant that schedule and finance details would be firmed up within 12 months for the new capacity. The Ministry of Energy and the US's Citi bank agreed on a partnership in July to secure funding for the construction of the new units, and site location applications have been submitted this year.

The aim is for the first new Westinghouse AP1000 unit - unit 7 at Kozloduy - to be operational in 2035 and the second one - unit 8 - to be operational in 2037. The 2,300 MWe capacity of the two new units would exceed the 1,760 MWe capacity of the closed first four units. The Bulgarian government has also said that further units will be needed to replace units 5 and 6 by 2050. It has also been considering the deployment of small modular reactors in the country.

Lianjiang simulator ready for delivery

_44406.png)

Simulators are a vital piece of equipment for training plant operators, both at the start of their careers and for their continuing training.

The simulator for Phase I (units 1 and 2) of the Lianjiang nuclear power plant project is the first CAP1000 reactor type full-scope simulator to adopt State Power Investment Corporation's (SPIC's) proprietary virtual NuCON simulation system. Developed entirely by SPIC's technical units and built according to the latest 2021 simulator construction standards, the project team adopted a highly integrated and collaborative model.

"The owner, design institute, instrumentation and control (ADC) team, and simulator team worked closely together to solve two major challenges during the full-scope simulator development process: mismatch between design data provision and ADC progress," SPIC said. "Through technological innovation, the use of advanced productivity tools, including the integrated digital design and manufacturing (EB) tool and EB conversion tool, ensured data consistency and high quality between the simulator and the unit's ADC. The construction of a private cloud-based simulation system improved the efficiency of parallel simulator testing, significantly shortened the testing cycle, and reduced testing deviations, ultimately resulting in the delivery of the FCD+26 full-scope simulator, setting a new industry benchmark."

On 28 November, a factory acceptance meeting for the simulator was held at SPIC Automation. In accordance with the contract and testing outline requirements, all 214 test procedures were completed with a 100% pass rate. SPIC noted the deviations of Class 1 and Class 2 were cleared to zero, meeting the factory acceptance conditions and requirements.

"The successful convening of the factory acceptance meeting for the full-scope simulator of the Lianjiang Phase I project marks the imminent entry of the full-scope simulator of the Lianjiang Nuclear Power Phase I project into the on-site acceptance testing and delivery stage; it also signifies that through the implementation of the Lianjiang project, the group has built a high-level simulator management and development technology team with complete independent capabilities, laying a solid foundation for the subsequent construction of simulators for the group's CAP series reactor units," SPIC said.

The Lianjiang Phase I construction site (Image: SPIC)

The first phase of the Lianjiang nuclear power plant project - the first coastal nuclear power project developed and constructed by SPIC in Guangdong - will comprise two CAP1000 units. The site is eventually expected to house six such reactors. It is the first nuclear power plant in China to adopt seawater secondary circulation cooling technology, and is the first to develop and use a super-large cooling tower.

The construction of the first two 1250 MWe CAP1000 reactors - the Chinese version of the Westinghouse AP1000 - at the Lianjiang site was approved by China's State Council in September 2022. Excavation works for the units began in the same month. The first safety-related concrete for the nuclear island of unit 1 was poured in September 2023 and that of unit 2 in April last year. Lianjiang unit 1 is expected to be completed and put into operation in 2028.

Upgrading of third Russian uranium enrichment plant starts

It becomes the third of Rosatom’s four uranium enrichment sites to introduce the newest generation of centrifuges, following upgrade projects launched in 2018 at the Urals Electrochemical Combine and the Electrochemical Plant in Siberia.

Commissioning of the new centrifuges at the Isotope Separation Plant is scheduled to be completed in 2027. The fourth facility to be upgraded will be the Angrask electrolysis Chemical Plant in the Irkutsk region, Rosatom said.

Natalia Nikipelova, President of TVEL, said they had been "fulfilling a record-high production programme for several years in a row, but at the same time we are steadily implementing large-scale modernisation projects at all stages of the nuclear fuel cycle that our enterprises are involved in. Rosatom has already invested heavily in modernising nuclear fuel fabrication, uranium enrichment and conversion facilities, as well as manufacturing of gas centrifuges for isotope separation. This work will become the foundation for fulfilling the ambitious goals for the production of enriched uranium and nuclear fuel for operating nuclear power plants and the ones under construction in Russia and abroad".

In July TVEL said work was already progressing on a 10th-generation gas centrifuge. It said it was preparing for pilot industrial operation at one of its sites as part of the development work.

It stressed that the 9+ generation gas centrifuges would operate for decades. The differences between the various generations was not specified beyond "the growth of their efficiency and productivity".

Background

Unenriched, or natural, uranium contains about 0.7% of the fissile uranium-235 (U-235) isotope. ("Fissile" means it's capable of undergoing the fission process by which energy is produced in a nuclear reactor). The rest is the non-fissile uranium-238 isotope. Most nuclear reactors need fuel containing between 3.5% and 5% U-235. This is also known as low-enriched uranium, or LEU. Advanced reactor designs that are now being developed - and many small modular reactors - will require higher enrichments still.

Enrichment increases the concentration of the fissile isotope by passing the gaseous uranium hexafluoride through gas centrifuges, in which a fast spinning rotor (a thousand revolutions per second) inside a vacuum casing makes use of the very slight difference in mass between the fissile and non-fissile isotopes to separate them. As the rotor spins, the concentration of molecules containing heavier, non-fissile, isotopes near the outer wall of the cylinder increases, with a corresponding increase in the concentration of molecules containing the lighter U-235 isotope towards the centre. World Nuclear Association’s information paper on uranium enrichment contains more details about the enrichment process and technology.

Podcast: Johan Svenningsson on Sweden’s ‘Nuclear 2.0’, and his World Nuclear Association role

(Click the podcast player above to listen. Scroll down this page for an edited transcript)

In this edition of the World Nuclear News Podcast Svenningsson talks about what has been an eventful few years for the nuclear energy sector in Sweden, and the current positive mood around ambitious plans for new nuclear - "it's fantastic, we're basically talking about nuclear 2.0 in Sweden", is how he puts it.

He also covers: lessons on modular construction from his previous work in the oil and gas and the pharmaceuticals industries; life-extension work; decommissioning programmes; and how the construction of a deep geological repository is progressing.

Regarding his role with World Nuclear Association, Svenningsson says nuclear is a unique global industry where people learn from each other and share knowledge: "I don't see any other industry which is that global and which is that integrated - we're all competitors, suppliers, customers but we really focus on, and want, nuclear to be a strong part of a future, greener society."

His priorities for the association include the industry's need to deliver, now that the political and financial conditions are increasingly in place. He says that on the political and regulatory front "we've come a long way - I think nuclear is starting to be more on a par with other technologies, but there is still a way to go". Other priorities are the need to attract a diverse range of talented people into the industry, and to develop supply chains in both emerging nuclear countries and in those countries restarting nuclear construction programmes after decades.

Here is an edited version of the interview:

Background:

A mechanical engineer by training, Svenningsson did his Master’s thesis at the nuclear power plant in Oskarshamn, then joined ABB’s trainee programme and was in the nuclear division which was later acquired by Westinghouse. He also worked at the Ringhals nuclear power plant before spending time outside nuclear, working in the oil and gas and pharmaceutical industries, gaining experience of building modular offshore platforms and modular pharmaceutical plants. He has been Country Chairman and CEO for Uniper Sweden, since 2016.

What lessons did you learn from modular construction?

It's quite fascinating looking at sectors like offshore oil and gas and pharmaceuticals. They are highly regulated, high-quality, big projects, with a lot of similarities to nuclear, especially if you add in the modularisation. We can learn a lot from those industries - when you get modularised production in factories the cost of manufacturing goes down tremendously, but also the quality goes up because the indoor environment means you can spread your design and manufacturing, doing the most difficult modules first, because then we just put them all together. I think that we, as an industry, could probably do more of getting that knowledge from outside, even though we're really good at getting learnings from within the industry.

On his role with Uniper

We are the second largest energy company in Sweden. We have a large nuclear portfolio, but also a large hydro portfolio with 78 hydropower plants, and thermal plants, basically for security of supply. We are the only company in Sweden which has ownership in all operating nuclear facilities. So we're the majority owner of the Oskarshamn plant and minority owner in the Ringhals and Forsmark plants. We also have a large decommissioning portfolio. We are decommissioning four plants in one common programme and that is quite fascinating - we can really take the learnings from decommissioning a fleet of plants and we see the cost curves coming down about 30% from the 1st to the 4th unit. On top of that, we also have an international decommissioning business where we're selling decommissioning services in Europe and globally for different customers.

How can decommissioning experience inform plant design?

We're looking into how we can take the decommissioning experience and build that into new designs. Of course, you probably don't want to pay too much for that in the design because this benefit will come about 100 years from now, or 80 years from now. But if you can do that, if you design with a plan for decommissioning, you can save a lot of money and also make it much more efficient and safe. So building that experience into a new design, I think that's probably coming in a few years. Right now we need to deploy the ones that we have on the drawing board.

On the outlook for nuclear in Sweden

It's quite fantastic. We're talking about basically Nuclear 2.0 in Sweden. We're coming to the end of the life of the first cycle for some of our plants, and they're going to decommissioning. But we also see, as a nuclear nation since the 1960s, the need for nuclear in the system to have a reliable, cost-effective and clean energy system. We saw in Sweden that when we started to reduce the share of nuclear that that has an impact on the system. That's really fostered the view that ‘we need to expand, and we need to build new nuclear’ and, of course, to make sure that the current fleet we have can operate for as long as possible. As Uniper we've been working with this since 2016 to really ensure that we get the right policy development and now in recent years, the current government is really pushing ahead with policy updates, legal updates, financial schemes, risk-sharing and is committed to getting new nuclear in place with clear targets of having 2.5 GW online by 2035 and 10 GW by 2045. It seems ambitious. It is ambitious. But it's actually almost a copy of what it did in the 1970s and the 1980s. So if we did it then, why couldn't we do it now?

Sweden’s proposal to hedge against political risks

We know politics may change every 4, 5 or 6 years when you have an election, and that is right, because we're democracies. But if you invest for something that's going to be there for 80 or 100 years, you need to have some type of protection and some type of risk-sharing with the government. I think the discussion that the Swedish Government is having now (outlining compensation payable to owners if a future government decides to phase out nuclear energy) is a good way of trying to limit those risks, so the bar would be higher if politicians want to change policies in the future. It’s going to be interesting to see the final proposals.

Uniper’s involvement in Sweden’s new nuclear

We currently do not have any plans for new-build. We are currently focusing on the existing plants, and I think that's also a global issue. We really like the growth of new nuclear coming but we also need to keep the current plants operating in a safe, high-availability and cost-effective manner, so that is our focus currently. Making sure that we do the investment so we can operate these for decades to come. But then we are also following very closely all development activities, to be up-to-date with that in case something changes in the future. but also because it could impact our current fleet with technology developments and regulatory developments. We are also involved in research and development and we have this joint venture with Blykalla where they're developing the 4th generation lead-cooled advanced modular reactor. Together we are building this electrical test facility. It's not a nuclear power plant, but it's a test facility to show the processes, show that we really want to be part of this research and development.

The operating life of existing plants

Currently the Swedish fleet is upgraded to run to 2040-2045. In the last few years we've been doing the pre-studies looking for them to go from 60 to 80 years, from 2045 to 2065 or actually more, maybe taking years out of the equation, we just continue to invest, a little bit like we do with the hydro fleet, we just invest and they've been running for 100 years. So, we're doing the first pre-studies and we see that there's no technical limitations. We have as a planning assumption to run for 80 years and we're doing all the detailed pre-studies to be able to probably make the first investment decisions in the early 2030s. It's still a long way to go to when we need to be upgraded, but it's a long process and we want to be out there early, making sure that if there are any issues that we can address them.

Is 80 or 100 years the limit for operation?

The more we learn, we really see that it is more just to continue investing for continuing operations and then seeing. There will be limits at a certain point … exchanging a reactor pressure vessel, I think that today that doesn't seem to be financially viable. Then you have a concrete structure with a containment that is also going to be a limiting factor, but we see that that is very far down the road. The rest you could basically change everything. But how big is the investment? So today I don’t see an end date and I know in the US there's programmes looking for 100 years.

On Sweden’s deep geological repository

I was in a meeting recently where people said the problem that we haven't solved was the nuclear waste issue. But I said that issue is solved. We have a final repository where we developed the concept and the design in Sweden. Finland took the same concept but they've been faster than us in the approval process, much more efficient, so they have a final repository which is now in test operation. We are now breaking ground and starting to build the final repository. We have all the necessary approvals at this stage. So for us that is a solved issue. Now it's time to construct it and build it. We have good conditions with our bedrock in the Nordics, but this is a solution that can be deployed globally.

Getting involved with World Nuclear Association

I think nuclear is a global industry, a fascinating industry. We are learning from experience across the whole world, from the US, from Europe, from China, all different nations. But also to be part of driving the conditions to tackle climate change and to go to a fossil-free society. Nuclear has a really big role to play there. Without nuclear, the hurdle and the cost would be so much more. I also wanted the Nordic industry, with a long and successful history in nuclear, to be able to give that experience to World Nuclear Association. So both giving to the industry and also gaining from the knowledge.

What are the nuclear industry’s strengths?

I don't see any other industry which is as global and which is as integrated. We're all competitors, suppliers and customers and we all really focus on wanting nuclear to be a strong part of the future … we know that we're all in the same boat and that means that we need to work together to ensure both nuclear safety, but also finding the ways to be attractive and competitive.

As chairman of World Nuclear Association what will be priorities?

There's a lot of things. The first one is that we really need to deliver. All of us in the industry have been working to try to create the conditions for nuclear and now we're starting to get the conditions. We have a lot of the political support, we have the financial support, we have investors in the countries that want to invest in nuclear. So the conditions are starting to be there, so it is for us to really make sure that we are delivering on our promises (on budget and on schedule). Then, as part of that, of course, creating the financial conditions, the regulatory conditions, the political support. I think we've come a long way. I think nuclear is starting to be more on a par with other technologies, but there is still a way to go. We're still talking about renewables or nuclear or renewables and nuclear. We should look at all these technologies to be fossil-free to get us to a greener society. And another priority is the skills supply and the competence supply and the supply chain. It’s a lot of work but we know that when the business is there that will attract young talents. It will attract experienced people. As a side note, something that's also close to my heart is diversity and inclusion. We, as an industry, as is typical of these type of industries, are typically male-dominated. I think we're quite diverse, we're very diverse from a nationality perspective, but we need to work more on the diversity side to attract female students and female professionals.

Involvement with World Nuclear University

This is a bit of a side hobby. I had the opportunity to be part of the Summer Institute, which is a great event where we have all the global talents and coming leaders, 50-70 people from 40-50 different nations in the five week gathering to develop leadership. I had the opportunity to be there to talk about leadership and my leadership journey and also to be part of the evaluation of the work they're doing. For me it gives me as much as I hopefully give to them, with the energy and the knowledge that they have from all over the world. We have people from Africa, Asia, Europe, the US and Canada meeting together and we're all talking about nuclear leadership. It's a fascinating event.

On the long term outlook for nuclear and main challenges

What I have seen change in Sweden and also in the EU, and globally, is that we're starting to see nuclear as really part of the equation. We need to have a significant growth of nuclear, otherwise we will not meet the Net Zero targets on a global scale (he adds that each country can decide for itself it wants to have nuclear or not). So first of all we need to keep the current units operating safely and available for the long term, because otherwise the bar will be raised even further. In Europe, the US, Canada and the Western world, where we have built very few plants in the last years, there have been first-of-a-kind issues which we need to get through on this learning curve. Another hurdle is finance, but the finance community is really starting to appreciate and find models and ways so it's really starting to be bankable and investable with risk sharing with governments. So the need is there for new nuclear and the market is there. So I think that's a very positive outlook.

Key links to find out more:

World Nuclear News Podcast

Uniper Sweden

World Nuclear Association

Email newsletter:

Sign up to the World Nuclear News daily or weekly news round-ups

Contact info:

alex.hunt@world-nuclear.org

Episode credit: Presenter Alex Hunt. Co-produced and mixed by Pixelkisser Production

No comments:

Post a Comment