Bolivia’s Uyuni salt flat. (Image by Diego Delso, Wikimedia Commons).

Reuters | June 19, 2023 |

Chinese battery giant CATL confirmed a $1.4 billion investment to help develop Bolivia’s huge but largely untapped reserves of lithium, cementing on Sunday a partnership with the government made in January.

The agreement connects CATL, the world’s largest manufacturer of electric vehicle batteries, with Bolivia’s salt flats that are home to the world’s largest lithium resources.

Following a meeting with CATL executives on Sunday, Bolivian President Luis Arce confirmed the commitment to build two lithium plants to extract minerals from the country’s Uyuni and Oruro salt flats.

“We met with Burton Roy (Yu Bo), CEO of the Investment Committee of CATL to confirm the investment of $1.4 billion,” the president said via Twitter, adding that as partners they would “evaluate the possibility” of increasing investments to 2028.

Construction of both plants could begin as soon as July, according to the country’s energy ministry, with overall investment climbing to around $9.9 billion during the project’s industrial process.

Sunday’s announcement follows a partnership deal signed on January 20 between Bolivia’s state-run lithium company, Yacimientos del Litio Bolivianos (YLB), and a Chinese consortium, in which CATL would invest over $1 billion in the project’s first stage in exchange for rights to develop the two lithium plants, which could each produce up to 25,000 metric tons of battery-grade lithium carbonate per year.

CATL does not currently produce any lithium, although it has invested in a number of Chinese projects.

Lithium resources in Bolivia’s iconic salt flats are estimated at 21 million metric tons, according to the US Geological Survey, but as yet has almost no industrial production or commercially viable reserves.

(By Daniel Ramos and Lucinda Elliott; Editing by Chizu Nomiyama)

Australia cautious on Chinese investment in vital lithium sector

Bloomberg News | June 20, 2023

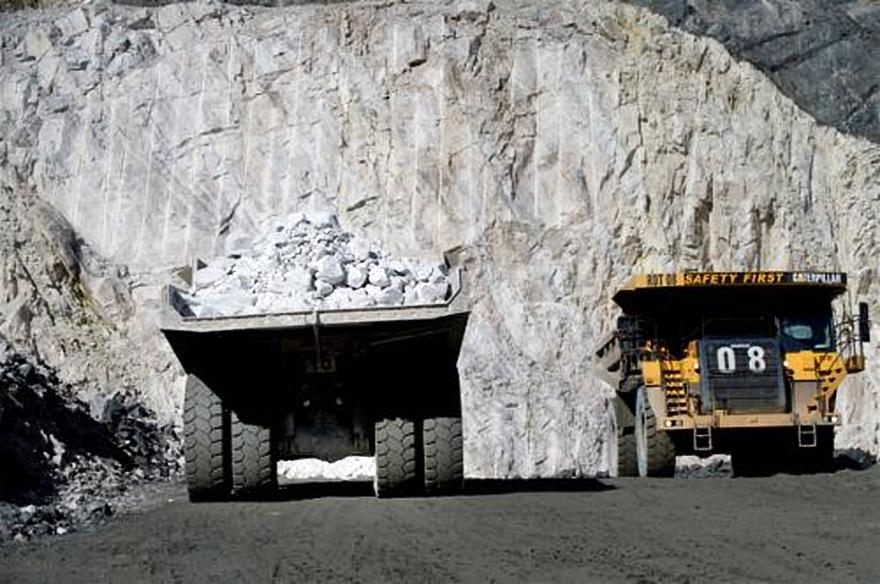

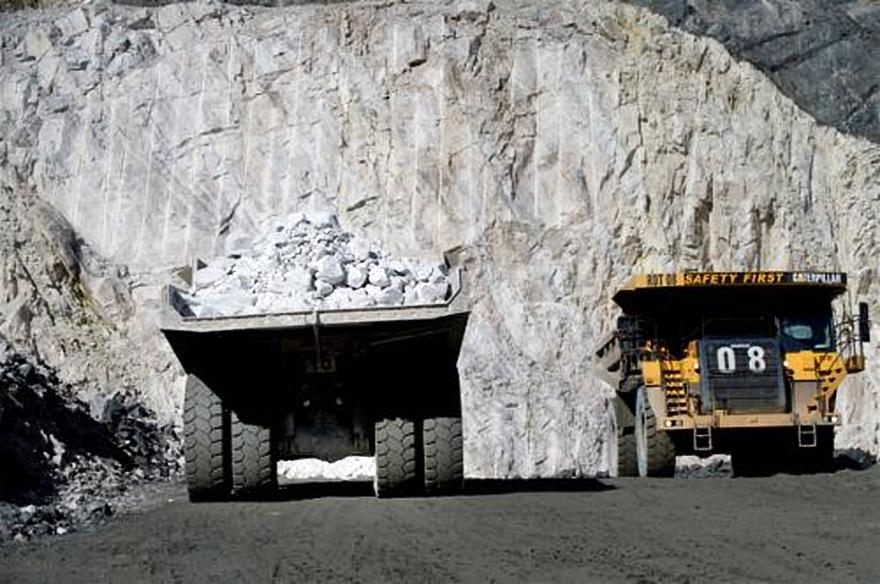

Greenbushes spodumene mine in Western Australia. Image: Talison Lithium.

Chinese investment in Australia’s minerals sector must be considered “strategically” as the countries compete directly in lithium refining, said Resources Minister Madeleine King.

She made the comments in an interview following the release of Australia’s long-awaited Critical Minerals Strategy, which includes a target to lure A$500 million ($340 million) of funds for projects that are vital to the energy transition.

The strategy calls for foreign investment from “like-minded partners” to boost domestic mining and refining of battery metals like lithium and cobalt. When asked if Chinese involvement would be welcomed, King said Australia had to take a strategic approach.

“We’re competing with China here,” she told Bloomberg. “We also want to be a producer of lithium hydroxide. It’s only natural that we would want to advance our ambitions in that space.”

Australia is the world’s biggest lithium producer, mining more than half of the metal used in electric vehicles, smartphones and grid-scale batteries, with the government forecasting output will double by 2028. But the vast majority of that is still shipped to China, which dominates downstream processing into battery-grade chemicals.

Canberra and Washington are trying to work with diplomatic and economic partners to build their critical minerals industries and break China’s monopoly in certain areas that produce materials vital to high-tech manufacturing in the defense, aerospace and green economy sectors.

Chinese firms have already invested in lithium hydroxide refineries in Western Australia and future decisions would be made by the Foreign Investment Review Board, King said. But Beijing had spent 30 years investing and building its critical minerals industry, and Australia was “behind the game” and needed to catch up, she said.

Australia’s gross domestic product could grow A$133 billion by 2040 and more than 260,000 jobs might be created if it builds more downstream processing capacity in critical minerals and secures a greater share of trade and investment, according to the strategy.

However, Canberra’s target for more investment is well below the billions of dollars the US will spend to boost its critical minerals industry under the Inflation Reduction Act. King said that while she understood calls for even greater funding, A$500 million was “nothing to sneeze at.”

“We can’t outspend the US,” she said. “Its investment in the Inflation Reduction Act is really important, but we don’t have an economy of that magnitude to spend that much money.”

(By Ben Westcott and James Fernyhough)

Bloomberg News | June 20, 2023

Greenbushes spodumene mine in Western Australia. Image: Talison Lithium.

Chinese investment in Australia’s minerals sector must be considered “strategically” as the countries compete directly in lithium refining, said Resources Minister Madeleine King.

She made the comments in an interview following the release of Australia’s long-awaited Critical Minerals Strategy, which includes a target to lure A$500 million ($340 million) of funds for projects that are vital to the energy transition.

The strategy calls for foreign investment from “like-minded partners” to boost domestic mining and refining of battery metals like lithium and cobalt. When asked if Chinese involvement would be welcomed, King said Australia had to take a strategic approach.

“We’re competing with China here,” she told Bloomberg. “We also want to be a producer of lithium hydroxide. It’s only natural that we would want to advance our ambitions in that space.”

Australia is the world’s biggest lithium producer, mining more than half of the metal used in electric vehicles, smartphones and grid-scale batteries, with the government forecasting output will double by 2028. But the vast majority of that is still shipped to China, which dominates downstream processing into battery-grade chemicals.

Canberra and Washington are trying to work with diplomatic and economic partners to build their critical minerals industries and break China’s monopoly in certain areas that produce materials vital to high-tech manufacturing in the defense, aerospace and green economy sectors.

Chinese firms have already invested in lithium hydroxide refineries in Western Australia and future decisions would be made by the Foreign Investment Review Board, King said. But Beijing had spent 30 years investing and building its critical minerals industry, and Australia was “behind the game” and needed to catch up, she said.

Australia’s gross domestic product could grow A$133 billion by 2040 and more than 260,000 jobs might be created if it builds more downstream processing capacity in critical minerals and secures a greater share of trade and investment, according to the strategy.

However, Canberra’s target for more investment is well below the billions of dollars the US will spend to boost its critical minerals industry under the Inflation Reduction Act. King said that while she understood calls for even greater funding, A$500 million was “nothing to sneeze at.”

“We can’t outspend the US,” she said. “Its investment in the Inflation Reduction Act is really important, but we don’t have an economy of that magnitude to spend that much money.”

(By Ben Westcott and James Fernyhough)

No comments:

Post a Comment